Energy Trading and Risk Management Market: Size, Share, Trends, by Type, Application, Operations and Forecast 2025-2032

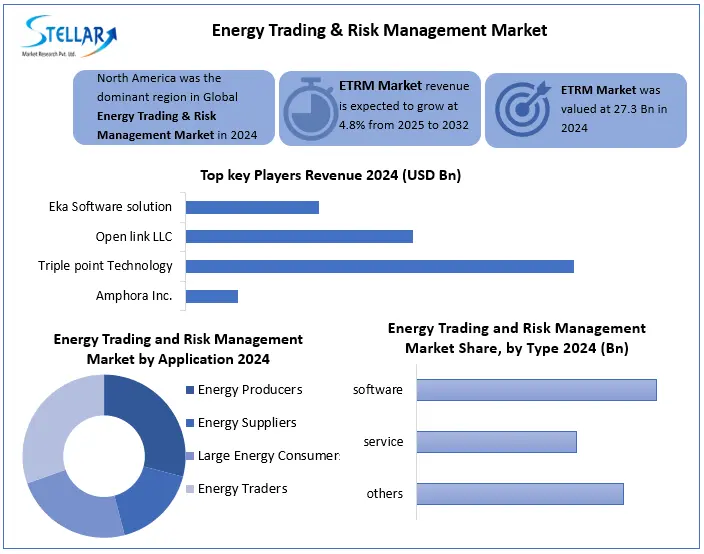

The Energy Trading and Risk Management Market was valued at USD 27.3 Bn in 2024 and is expected to grow at a CAGR of 4.8% from 2025 to 2032, reaching nearly USD 39.7 Bn by 2032.

Format : PDF | Report ID : SMR_2830

Energy Trading and Risk Management Market Overview

Energy trading and risk management means energy items such as electricity, natural gas, oil, or renewable energy and related financial instruments such as purchasing, selling and managing energy items, as well as control the risks involved.

Energy trade and risk management market systems are mainly used by energy firms, utilities, traders and financial institutions to track, evaluate and adapt energy business activities. Energy trade and risk management market system is inspired by the growing requirement to control price volatility and financial risks associated with energy business. To increase risk management capabilities, the industry is taking advantage of rapid advanced technologies, including machine learning and artificial intelligence. Integration of these technologies enables automated decision making, future modeling and real -time risk monitoring.

In addition, regulatory changes and rising attention on risk awareness among energy traders are contributing to the development of the market. The energy sector uses energy trade and risk management systems to fulfill many objectives, including regulatory compliance, risk mitigation and acceleration of business activities.

The increasing demand for solutions is powered by the energy trade and risk management process-the enterprise is powered by the resource plan services for businesses, as well as trading and collateral management platforms for large sales-side firms. Energy trade and risk management system helps reduce the risks inherent in energy business.

To get more Insights: Request Free Sample Report

Energy Trading and Risk Management Market Dynamics:

Growing Volatility of Energy Prices to fuel the Energy Trading and Risk Management Market

Geophysical stress, natural disasters, and changes in supply and demand pattern are leading to value instability in energy, forcing energy companies to force energy trade and risk management market solutions. These solutions enable organizations to analyze market conditions more effectively, predict ups and downs in value and prepare effective hedging strategies. With increasing uncertainty in energy markets, the need for end-to-end risk management solutions increases. The growth energy and risk management of advanced technologies, including artificial intelligence, machine learning and blockchain, is turning into the market.

The Pet Grooming and Accessories Market Faces Challenges Related to Market Volatility and Uncertainty

The energy sector is fundamentally unstable due to the prices of unstable objects, geo -political stress and changing regulatory guidelines. Volatility risk evaluation and management affects management in such a way that it is challenging with effective trading strategies. If the market's unexpectedness causes tremendous financial damage, there may be a lack of strong risk management systems in organizations. The energy sector is widely regulated with regulatory changes, for this reason it is difficult and expensive for energy traders.

The Rising demand for digital transformation and advanced analytics is an opportunity for the Pet Grooming and Accessories Market

Increasing the move toward digitalization across the energy industry creates important prospects for ETRM solutions. The trend toward employing cloud-based solutions, artificial intelligence (AI), and machine learning to increase real-time decision-making, streamline processes, and drive improved trading methods is being favored by businesses worldwide. With the shift towards digitization, organizations can quickly make informed decisions using sophisticated software at faster paces with enhanced precision, placing powerful demands on updated, adaptive ETRM systems.

Energy Trading and Risk Management Market Segment Analysis

Based on Types, the market is segmented into software, services, and others. The service segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). For businesses that deal in commodities and frequently need services before and after a transaction, the market offers specialized trading and risk management software. ETRM services include consultation, implementation, support and managed services that help organizations adopt, adopt and maintain their trading systems. With the energy markets growing in complexity, companies often rely on specialist service providers to customize ETRM platforms according to regulatory requirements and specific business requirements. These services also support cloud migration, cyber security and continuous upgradation, which are necessary to maintain competitive advantage and compliance in rapidly changing markets.

Based on Application, the Energy Trading and Risk Management market is segmented into power, natural gas, oil and goods, and others based on their respective applications. The power application segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). The primary driver of market expansion is the trade of energy items including energy, natural gas, minerals, crude oil, and other, which is made possible by the energy trade and risk management network of equipment, applications and systems. It contains tools and software designed especially to address procedures and possible issues. Also, energy trading and risk management are very active in a variety of fields, including data collecting, resource optimization, and timely energy delivery.

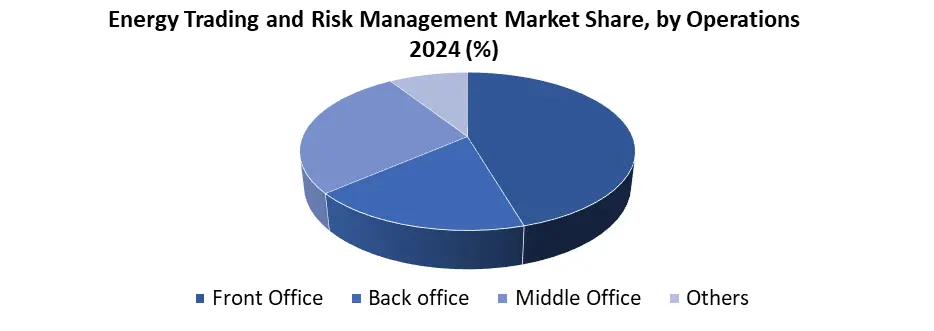

Based on Operations, the Energy Trading and Risk Management market is segmented into front office, back office, and middle office. The front office segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). The front office handles tasks related to price discovery, position management, deal appraisal, and deal capture. which directly affect a company's revenue generation. As the energy market becomes more complex and volatile, the front office has taken center stage in driving profitability, innovation, and efficiency. The primary roles of the front office are making high-risk decisions and maximizing trading strategy for the highest return on finances.

Energy Trading and Risk Management Market Regional Analysis

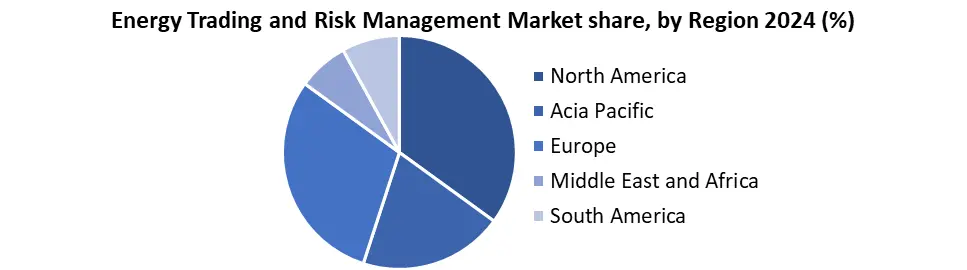

North America held the highest share in the Energy Trading and Risk Management market. In addition, it is also estimated that the U.S. shale gas success and energy market volatility in these areas will fuel the growth of the Energy Trading and Risk Management Market sector. The market would be growing at a high rate in Asia Pacific. The increasing demand for Energy Trading and Risk Management solutions, evolving regulatory mandates, and volatile energy prices are a few of the key factors that are analysed to provide the market with lucrative growth opportunities over the forecast period. The economic prosperity of nations such as China and India is also responsible for the growth of the region.

|

Energy Trading and Risk Management Market Scope |

|

|

Market Size in 2024 |

USD 27.3 Bn. |

|

Market Size in 2032 |

USD 39.7 Bn. |

|

CAGR (2025-2032) |

4.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Software Services Others |

|

By Application Energy Producers Energy Suppliers Large Energy Consumers Energy Traders Others |

|

|

By Operations Front office Back office Middle office Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Energy Trading and Risk Management Market

North America

- Allegro Development Corporation (USA)

- Amphora Inc. (USA)

- Triple Point Technology Inc. (USA)

- Openlink LLC (USA)

- Sapient (USA)

- Ventyx (USA)

- FIS (USA)

- MCG Energy Solutions, LLC (USA)

- Enuit LLC (USA)

- Contigo (USA)

- IGNITE CTRM (USA)

- Molecule Software (USA)

Europe

- Trayport (United Kingdom)

- Brady Technologies (United Kingdom)

- Calvus (Germany)

- ComFin Software (Germany)

- SAP (Germany)

- ABB (Switzerland)

- Accenture (Dublin, Ireland)

Asia -Pacific

- Eka Software Solutions (India)

Frequently Asked Questions

The Global market is growing at a CAGR of 4.5% during the forecasting period 2025-2032.

The key players in the Global Energy Trading and Risk Management Market are Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, and others.

Growing Volatility of Energy Prices is a major factor to drive the market.

The service segment type dominates the market.

1. Energy Trading and Risk Management Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Energy Trading and Risk Management Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Energy Trading and Risk Management Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Energy Trading and Risk Management Market: Dynamics

3.1. Energy Trading and Risk Management Market Trends by Region

3.1.1. North America Energy Trading and Risk Management Market Trends

3.1.2. Europe Energy Trading and Risk Management Market Trends

3.1.3. Asia Pacific Energy Trading and Risk Management Market Trends

3.1.4. Middle East & Africa Energy Trading and Risk Management Market rends

3.1.5. South America Energy Trading and Risk Management Market Marke Trends

3.2. Energy Trading and Risk Management Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

3.7. Analysis of Government Schemes and Initiatives for the Energy Trading and Risk Management Market Industry

4. Energy Trading and Risk Management Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032)

4.1. Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

4.1.1. Software

4.1.2. Services

4.1.3. Others

4.2. Energy Trading and Risk Management Market Size and Forecast, By Application (2025-2032)

4.2.1. Energy Producers

4.2.2. Energy Suppliers

4.2.3. Large Energy Consumers

4.2.4. Others

4.3. Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

4.3.1. Front Office

4.3.2. Back Office

4.3.3. Middle Office

4.3.4. Others

4.4. Energy Trading and Risk Management Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Energy Trading and Risk Management Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2025-2032)

5.1. North America Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

5.1.1. Software

5.1.2. Services

5.1.3. Others

5.2. North America Energy Trading and Risk Management Market Size and Forecast, By Application (2025-2032)

5.2.1. Energy Producers

5.2.2. Energy Suppliers

5.2.3. Large Energy Consumers

5.2.4. Energy Traders

5.2.5. Others

5.3. North America Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

5.3.1. Front Office

5.3.2. Back Office

5.3.3. Middle Office

5.3.4. Others

5.4. North America Energy Trading and Risk Management Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

5.4.1.1.1. Software

5.4.1.1.2. Services

5.4.1.1.3. Others

5.4.1.2. United States United States Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

5.4.1.2.1. Energy Producers

5.4.1.2.2. Energy Suppliers

5.4.1.2.3. Large Energy Consumers

5.4.1.2.4. Others

5.4.1.3. United States Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

5.4.1.3.1. Front Office

5.4.1.3.2. Back Office

5.4.1.3.3. Middle Office

5.4.1.3.4. Others

5.4.2. Canada

5.4.2.1. Canada Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

5.4.2.1.1. Software

5.4.2.1.2. Services

5.4.2.1.3. Others

5.4.2.2. Canada Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

5.4.2.2.1. Energy Producers

5.4.2.2.2. Energy Suppliers

5.4.2.2.3. Large Energy Consumers

5.4.2.2.4. Others

5.4.2.3. Canada Climate Adaptation Market Size and Forecast, By Operations (2025-2032)

5.4.2.3.1. Front Office

5.4.2.3.2. Back Office

5.4.2.3.3. Middle Office

5.4.2.3.4. Others

5.4.3. Mexico

5.4.3.1. Mexico Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

5.4.3.1.1. Software

5.4.3.1.2. Services

5.4.3.1.3. Others

5.4.3.2. Mexico Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

5.4.3.2.1. Energy Producers

5.4.3.2.2. Energy Suppliers

5.4.3.2.3. Large Energy Consumers

5.4.3.2.4. Others

5.4.3.3. Mexico Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

5.4.3.3.1. Front Office

5.4.3.3.2. Back Office

5.4.3.3.3. Middle Office

5.4.3.3.4. Others

6. Europe Energy Trading and Risk Management Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2025-2032)

6.1. Europe Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.2. Europe Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.3. Europe Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4. Europe Energy Trading and Risk Management Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.1.2. United Kingdom Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.1.3. United Kingdom Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4.2. France

6.4.2.1. France Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.2.2. France Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.2.3. France Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.3.2. Germany Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.3.3. Germany Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.4.2. Italy Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.4.3. Italy Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.5.2. Spain Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.5.3. Spain Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.6.2. Sweden Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.6.3. Sweden Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.7.2. Austria Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.7.3. Austria Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

6.4.8.2. Rest of Europe Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

6.4.8.3. Rest of Europe Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7. Asia Pacific Energy Trading and Risk Management Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

7.1. Asia Pacific Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.2. Asia Pacific Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.3. Asia Pacific Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4. Asia Pacific Energy Trading and Risk Management Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.1.2. China Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.1.3. China Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.2.2. S Korea Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.2.3. S Korea Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.3.2. Japan Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.3.3. Japan Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.4. India

7.4.4.1. India Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.4.2. India Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.4.3. India Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.5.2. Australia Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.5.3. Australia Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.6.2. Indonesia Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.6.3. Indonesia Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.7. Philippines

7.4.7.1. Philippines Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.7.2. Philippines Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.7.3. Philippines Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.8.2. Malaysia Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.8.3. Malaysia Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.9.2. Vietnam Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.9.3. Vietnam Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.10. Thailand

7.4.10.1. Thailand Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.10.2. Thailand Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.10.3. Thailand Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.11.2. ASEAN Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.11.3. ASEAN Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

7.4.12.2. Rest of Asia Pacific Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

7.4.12.3. Rest of Asia Pacific Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

8. Middle East and Africa Energy Trading and Risk Management Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2025-2032)

8.1. Middle East and Africa Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

8.2. Middle East and Africa Energy Trading and Risk Management Market Size and Forecast, By Applications Model (2025-2032)

8.3. Middle East and Africa Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

8.4. Middle East and Africa Energy Trading and Risk Management Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

8.4.1.2. South Africa Energy Trading and Risk Management Market Size and Forecast, By Applications Model (2025-2032)

8.4.1.3. South Africa Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

8.4.2.2. GCC Energy Trading and Risk Management Market Size and Forecast, By Applications Model (2025-2032)

8.4.2.3. GCC Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

8.4.3.2. Nigeria Energy Trading and Risk Management Market Size and Forecast, By Applications Model (2025-2032)

8.4.3.3. Nigeria Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

8.4.4.2. Rest of ME&A Energy Trading and Risk Management Market Size and Forecast, By Applications Model (2025-2032)

8.4.4.3. Rest of ME&A Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

9. South America Energy Trading and Risk Management Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn.) (2025-2032)

9.1. South America Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

9.2. South America Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

9.3. South America Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

9.4. South America Energy Trading and Risk Management Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

9.4.1.2. Brazil Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

9.4.1.3. Brazil Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

9.4.2.2. Argentina Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

9.4.2.3. Argentina Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Energy Trading and Risk Management Market Size and Forecast, By Type (2025-2032)

9.4.3.2. Rest Of South America Energy Trading and Risk Management Market Size and Forecast, By Applications (2025-2032)

9.4.3.3. Rest Of South America Energy Trading and Risk Management Market Size and Forecast, By Operations (2025-2032)

10. Company Profile: Key Players

10.1 Allegro Development Corporation (USA)

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Developments

10.2 Amphora Inc. (USA)

10.3 Triple Point Technology Inc. (USA)

10.4 Openlink LLC (USA)

10.5 Sapient (USA)

10.6 Ventyx (USA)

10.7 FIS (USA)

10.8 MCG Energy Solutions, LLC (USA)

10.9 Enuit LLC (USA)

10.10 Contigo (USA)

10.11 IGNITE CTRM (USA)

10.12 Molecule Software (USA)

10.13 Trayport (United Kingdom)

10.14 Brady Technologies (United Kingdom)

10.15 Calvus (Germany)

10.16 ComFin Software (Germany)

10.17 SAP (Germany)

10.18 ABB (Switzerland)

10.19 Accenture (Dublin, Ireland)

10.20 Eka Software Solutions (India)

10 Key Findings & Analyst Recommendations

11 Energy Trading and Risk Management Markets: Research Methodology