North America Convertible Bond Market Size, Trends, Growth & Forecast

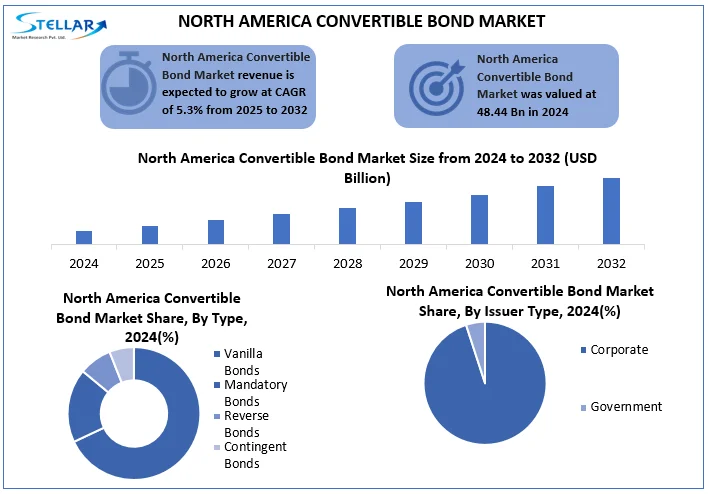

North America Convertible Bond Market size was valued at USD 48.44 Bn in 2024, and is expected to grow at a CAGR of 5.3% from 2025 to 2032, reaching nearly USD 73.22 Bn by 2032

Format : PDF | Report ID : SMR_2867

North America Convertible Bond Market Overview

Convertible bond is a fixed-income corporate debt security that yields interest payments and is converted into a predetermined number of common stock or equity shares. The conversion from the bond to stock is done at certain time during the bond's life and is usually at the discretion of the bondholder. As a hybrid security, the price of a convertible bond is especially sensitive to changes in interest rates, the price of the underlying stock, and the issuer's credit rating.

North American convertible bond market encompasses corporate-issued convertibles available in primary and secondary markets, with demand driven by issuers seeking lower coupon rates and investors attracted by upside potential. Supply originates from sectors like technology, healthcare, and finance, facilitated by a robust ecosystem of underwriters, trading platforms, and institutional investors

North America Convertible Bond Market expansion is greatly aided by the existence of sizable financial institutions and fund managers in both the US and Canada. Growing trend of ethical investing and need for hybrid investment solutions are main drivers of market expansion. Institutional investors (hedge funds, mutual funds, pension plans) dominate the market, drawn by convertible bonds hybrid risk?return profile.

To get more Insights: Request Free Sample Report

North America Convertible Bond Market Dynamics

Rising Issuance and Institutional Participation to Boost North America Convertible Bond Market Growth

North America convertible bond market is growing due to demand of companies from tech, biotech, and renewable energy sectors are seeking flexible financing solutions with reduced dilution risk. Convertible bond issuance in region rose by over 50% in 2023, as firms took advantage of favorable market conditions to secure low-cost capital while preserving equity upside for investors. Nearly 45% of U.S. convertible issuers in 2023 were pre-profit, underscoring the instrument's popularity among high-growth, cash-burning companies. Hedge funds remain key players, with convertible arbitrage strategies contributing to roughly 35% of market liquidity. According to study, convertibles in North America offer yields 1.5–2.5% lower than straight corporate bonds, making them cost-effective for issuers, while approximately 30% of convertibles end up converting to equity, providing investors with attractive returns in rising markets. The increasing participation of institutional investors, coupled with strong equity-linked demand, continues to fuel the market's expansion.

Dilution Risk and Hedge Fund Regulations to Challenge the North America Convertible Bond Market Growth

North America Convertible Bond Market faces several challenges that hinders future growth. One major issue is rising interest rates, significantly increased convertible bond yields reaching 5.7% in 2023 as thereby reducing the traditional cost advantage for issuers.

Volatile equity market compressed conversion of premiums, exposing companies to greater dilution risk and making convertibles less attractive for both issuers and investors. Regulations like stricter hedge fund reporting rules, have further dampened arbitrage activity that provides crucial market liquidity. Liquidity constraints also persist, especially in the secondary market, where a large portion of buyers adopt buy-and-hold strategies, limiting active trading. Besides, regulatory pressures, such as enhanced hedge fund reporting rules, have dampened convertible arbitrage activity, which historically accounted for a key portion of market liquidity.

North America Convertible Bond Market Segmentation

Based on Type, the North America Convertible Bond Market is segmented into vanilla convertible bonds, mandatory convertible bonds, reverse convertible bonds, and contingent convertible bonds, with vanilla convertible bonds as a dominant type in 2024 and is expected to hold largest market share during forecast period. Vanilla bond accounts for roughly 70% of total issuance volume and are popular due to greater flexibility compared to other types of issuers benefit from lower coupon payments (typically 1-3%) while retaining control over conversion timing, unlike mandatory convertibles which force equity conversion at maturity. Investors favor vanilla structures as they offer unlimited equity upside through standard conversion options while maintaining bond like protection when stock underperforms.

Based on Maturity Profile, the North America Convertible Bond Market is segmented into corporate, and government, with corporate as dominant Maturity Profile in 2024 and is expected to hold largest market share during forecast period. Corporate convertible bonds account for approximately 95% of total issuance volume in North America, reflecting region strong reliance on private sector financing. High growth sectors such as technology, which represents around 40% of U.S. convertible issuance, followed by healthcare (20–25%) and consumer discretionary (15–20%) are key factor for dominance. Corporations in these industries leverage convertibles as strategic tool to access growth capital while minimizing immediate equity dilution. The appeal lies in their hybrid structure, offering significantly lower coupon rates (typically 3%) compared to straight corporate bonds (5–7%) while retaining equity upside, aligning well with the financial strategies of innovation driven firms in the region.

North America Convertible Bond Market Country Insight:

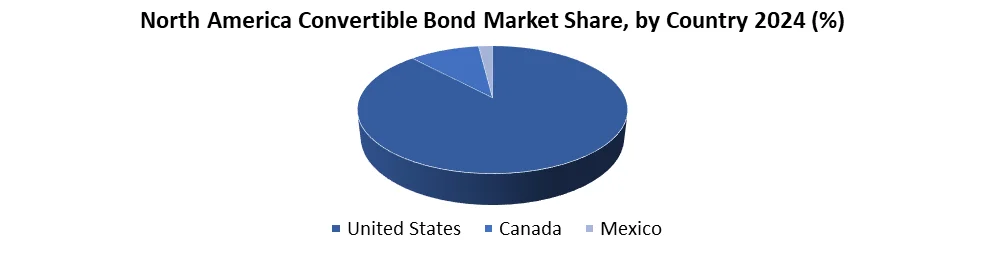

United States dominated the North American convertible bond market in 2024, accounting for over 90% of regional issuance volume, due to its deep capital markets, strong investor appetite, and high concentration of growth-oriented tech and biotech firms that frequently use convertible debt as a financing tool.

Key Growth Driving Factors in the United States

- Liquid & Mature Capital Markets – The U.S. has the world largest bond market, with institutional investors (hedge funds, asset managers) actively trading convertibles for equity upside and downside protection.

- Tech & Biotech Sector Growth – Silicon Valley and biotech hubs (Boston, San Diego) drive demand, as startups and high growth firms favor convertibles over traditional debt to minimize dilution risk.

- Favorable Regulatory Environment – The SEC’s well-defined rules on convertible securities provide clarity, encouraging issuance.

- Strong Secondary Market – High liquidity in U.S. convertible bonds (vs. Canada/Mexico) attracts global investors.

Canada, while active, remains a distant second due to its smaller economy and fewer high growth issuers. Mexico market is nascent, with minimal issuance.

North America Convertible Bond Market Competitive Landscape

North America Convertible bond market features fierce competition among major players, each fighting for dominance in their niche. Goldman Sachs continues to dominate the tech and biotech convertible space, leveraging its strong ECM franchise to win lead roles on 60% of large-cap US convertible deals. Morgan Stanley is aggressively challenging this position by offering more innovative structures and competitive pricing, particularly for healthcare issuers. On the buy side, BlackRock maintains its position as the largest convertible bond investor globally, using its scale to negotiate better terms. PIMCO focuses on value opportunities in distressed and crossover situations. Among trading firms, Citadel remains the market maker of choice for complex convertible arbitrage strategies, controlling an estimated 25% of secondary market liquidity.

Recent Development

- 03-May-2025, Goldman Sachs, led $500M convertible bond deal for Anthropic with a 2.5% coupon and 25% conversion premium to support cloud infrastructure expansion.

- 12-February-2025, Morgan Stanley, Biotech: Structured a contingent convertible (CoCo) bond for Moderna with a 3% yield, tied to FDA approval milestones.

|

North America Convertible Bond Market Scope |

|

|

Market Size in 2024 |

USD 48.44 Bn. |

|

Market Size in 2032 |

USD 73.22 Bn. |

|

CAGR (2025-2032) |

5.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments

|

By Type Vanilla Convertible Bonds Mandatory Convertible Bonds Reverse Convertible Bonds Contingent Convertible Bonds |

|

By Maturity Profile Short Term (1-5 Years) Mid Term (5-10 Years) Long-Term (10+ Years) |

|

|

By Credit Quality Investment Grade High Yield Sub-Investment Grade |

|

|

By Maturity Profile Corporate Government |

|

|

By Industry Sector Technology Healthcare Energy Consumer Goods Telecommunications |

|

|

Regional Scope

|

North America- United States, Canada, and Mexico |

North America Convertible Bond Market Key Players

United States

- Goldman Sachs

- Morgan Stanley

- J.P. Morgan

- Bank of America

- Citigroup

- BlackRock

- PIMCO

- Fidelity

- T. Rowe Price

- Citadel

- Millennium

- Point72

- Jane Street

- Susquehanna SIG

Canada

- Shopify Inc.

- Lundin Mining Corporation

Mexico

- América Móvil

- Cemex S.A.B. de C.V.

Frequently Asked Questions

It rose by over 50% as tech and biotech firms used them for flexible financing with reduced dilution risk amid favorable market conditions.

Vanilla convertible bonds dominate with around 70% share due to their flexibility and appeal to both issuers and investors

The U.S. has deep capital markets, a concentration of high-growth issuers, and a favorable regulatory framework that boosts convertible bond activity.

1. North America Convertible Bond Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Convertible Bond Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Convertible Bond Market: Dynamics

3.1. North America Convertible Bond Market Trends

3.2. North America Convertible Bond Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Convertible Bond Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. North America Convertible Bond Market Size and Forecast, By Type (2024-2032)

4.1.1. Vanilla Convertible Bonds

4.1.2. Mandatory Convertible Bonds

4.1.3. Reverse Convertible Bonds

4.1.4. Contingent Convertible Bonds

4.2. North America Convertible Bond Market Size and Forecast, By Maturity Profile (2024-2032)

4.2.1. Short Term (1-5 Years)

4.2.2. Mid Term (5-10 Years)

4.2.3. Long-Term (10+ Years)

4.3. North America Convertible Bond Market Size and Forecast, By Credit Quality (2024-2032)

4.3.1. Investment Grade

4.3.2. High Yield

4.3.3. Sub-Investment Grade

4.4. North America Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

4.4.1. Corporate

4.4.2. Government

4.5. North America Convertible Bond Market Size and Forecast, By Industry User (2024-2032)

4.5.1. Technology

4.5.2. Healthcare

4.5.3. Energy

4.5.4. Consumer Goods

4.5.5. Telecommunications

4.6. North America Convertible Bond Market Size and Forecast, by Country (2024-2032)

4.6.1. United States

4.6.1.1. United States Aesthetic Medical Devices Market Size and Forecast, By Type (2024-2032)

4.6.1.1.1. Vanilla Convertible Bonds

4.6.1.1.2. Mandatory Convertible Bonds

4.6.1.1.3. Reverse Convertible Bonds

4.6.1.1.4. Contingent Convertible Bonds

4.6.1.2. United States Aesthetic Medical Devices Market Size and Forecast, By Maturity Profile (2024-2032)

4.6.1.2.1. Corporate

4.6.1.2.2. Government

4.6.1.3. United States Aesthetic Medical Devices Market Size and Forecast, By Credit Quality (2024-2032)

4.6.1.3.1. Corporate

4.6.1.3.2. Government

4.6.1.4. United States Aesthetic Medical Devices Market Size and Forecast, By Issuer Type (2024-2032)

4.6.1.4.1. Corporate

4.6.1.4.2. Government

4.6.1.5. United States Aesthetic Medical Devices Market Size and Forecast, By Industry User (2024-2032)

4.6.1.5.1. Corporate

4.6.1.5.2. Government

4.6.2. Canada

4.6.2.1. Canada Aesthetic Medical Devices Market Size and Forecast, By Type (2024-2032)

4.6.2.1.1. Vanilla Convertible Bonds

4.6.2.1.2. Mandatory Convertible Bonds

4.6.2.1.3. Reverse Convertible Bonds

4.6.2.1.4. Contingent Convertible Bonds

4.6.2.2. Canada Aesthetic Medical Devices Market Size and Forecast, By Maturity Profile (2024-2032)

4.6.2.2.1. Corporate

4.6.2.2.2. Government

4.6.2.3. Canada Aesthetic Medical Devices Market Size and Forecast, By Credit Quality (2024-2032)

4.6.2.3.1. Corporate

4.6.2.3.2. Government

4.6.2.4. Canada Aesthetic Medical Devices Market Size and Forecast By Issuer Type (2024-2032)

4.6.2.4.1. Corporate

4.6.2.4.2. Government

4.6.2.5. Canada Aesthetic Medical Devices Market Size and Forecast, By Industry User (2024-2032)

4.6.2.5.1. Corporate

4.6.2.5.2. Government

4.6.2.5.3.

4.6.3. Mexico

4.6.3.1. Mexico Aesthetic Medical Devices Market Size and Forecast, By Type (2024-2032)

4.6.3.1.1. Vanilla Convertible Bonds

4.6.3.1.2. Mandatory Convertible Bonds

4.6.3.1.3. Reverse Convertible Bonds

4.6.3.1.4. Contingent Convertible Bonds

4.6.3.2. Mexico Aesthetic Medical Devices Market Size and Forecast, By Maturity Profile (2024-2032)

4.6.3.2.1. Corporate

4.6.3.2.2. Government

4.6.3.3. Mexico Aesthetic Medical Devices Market Size and Forecast, By Credit Quality (2024-2032)

4.6.3.3.1. Corporate

4.6.3.3.2. Government

4.6.3.4. Mexico Aesthetic Medical Devices Market Size and Forecast, By Issuer Type (2024-2032)

4.6.3.4.1. Corporate

4.6.3.4.2. Government

4.6.3.5. Mexico Aesthetic Medical Devices Market Size and Forecast, Industry User (2024-2032)

4.6.3.5.1. Corporate

4.6.3.5.2. Government

5. Company Profile: Key Players

5.1. Goldman Sachs

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. Morgan Stanley

5.3. J.P. Morgan

5.4. Bank of America

5.5. Citigroup

5.6. BlackRock

5.7. PIMCO

5.8. Fidelity

5.9. T. Rowe Price

5.10. Citadel

5.11. Millennium

5.12. Point72

5.13. Jane Street

5.14. Susquehanna SIG

5.15. Shopify Inc.

5.16. Lundin Mining Corporation

5.17. América Móvil

5.18. Cemex S.A.B. de C.V.

6. Key Findings & Industry Recommendations

7. North America Convertible Bond Market: Research Methodology