North America Multi-Line Insurance Market Size, Share and Forecast (2025-2032)

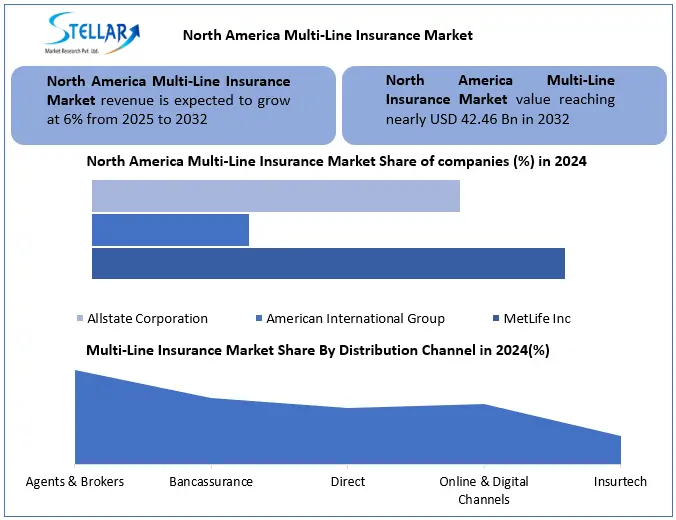

The North America Multi-Line Insurance Market Size was valued at over USD 26.64 Bn in 2024 and is expected to grow to USD 42.46 Bn in 2032 at a CAGR of 6%.

Format : PDF | Report ID : SMR_2889

North America Multi-Line Insurance Market Overview

Multi-Line Insurance is a type of policy that covers multiple types of risk under a single policy or agreement. It is cost-saving and provides convenience to people. It is customizable according to human needs It is a very broad insurance that covers all the classes of insurance, such as life insurance, property insurance, casualty insurance, health insurance, automobile insurance, liability insurance, and commercial insurance.

The North America multi-line insurance market has been growing due to a combination of economic stability and high insurance saturation. With a healthy financial foundation, the region benefits from strong capital reserves, striking $1 trillion in policyholder surplus, and consumers wants complete coverage. This stability allows insurers to offer bundled products like auto, home, and life insurance under single policies, which appeal to customers seeking convenience and cost savings. Technology and embedded insurance are reshaping the market, creating new opportunities for growth. Over 60% of insurers are now investing in AI and digital tools to streamline underwriting

Additionally, the U.S. dominated this market, holding over 80% of the regional share due to its large population and high disposable income. The demand for multi-line policies is further influenced by rising risks, such as climate-related disasters and cyber threats, which push businesses and individuals to seek broader protection.

The competitive landscape features major players like MetLife, American International Group, and Prudential, which leverage diversified portfolios and strategic partnerships to maintain dominance. For example, American International Group annual premium growth has rushed by 27.7%, showing its focus on tech-driven solutions and customer-centric products.

To get more Insights: Request Free Sample Report

North America Multi-Line Insurance Market Dynamics

Economic Stability to Drive the North America Multi-Line Insurance Market Growth

North America, particularly the United States has a mature and stable economy up to with a well-established insurance culture. High levels of disposable income and asset ownership (homes, cars, businesses) encourage individuals and corporations to invest in comprehensive multi-line policies that bundle life, health, property, and casualty coverage up to. In North America 2 out of 4 people spend 5-10% of their income in Multi-Line Insurance. In addition, Canada also features compulsory insurance regulations in sectors like auto and health, further supporting the habit of purchasing and maintaining coverage.

Technology & Embedded Insurance to boost the North America Multi-Line Insurance Market

North America being the foremost personal-lines market in the world, the region has seen a huge premium growth, especially within the automobile and home lines, with consumers' appreciation in bundling of policies for convenience and cost savings. A major opportunity lies in the E&S market that is growing quickly to furnish tailor-made coverage in high-risk places like California and Florida, wherein standard lines players are pulling back.

Pricing Wars and Competition to Restrain the North America Multi-Line Insurance Market

The North America multi-line insurance, Old Insurance companies and new tech-based startups are making the Multi-Line Insurance Market highly competitive. The new tech-based startup uses smart technologies to provide customers with their personalised insurance, and this has increased their market by 40%. Whereas many old insurance companies lower their prices by 25-20% to attract customers. Therefore, it somehow decreases the North America multi-line insurance market share in the global insurance market.

North America Multi-Line Insurance Market Segment Analysis

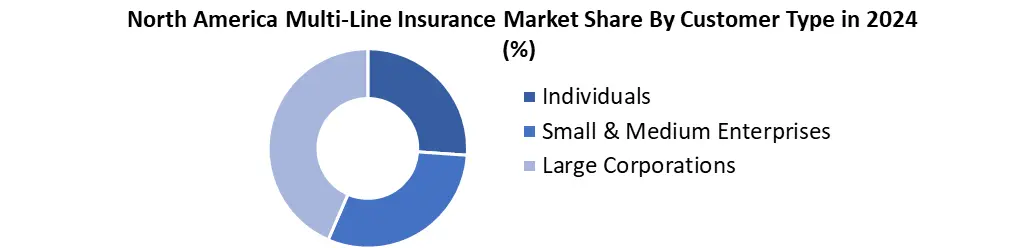

Based on Customer Type, the North America Multi-Line Insurance Market is segmented into Individuals, Small & Medium Enterprises and Large Corporations. In these segmentations, Large Corporations dominated the North America market in 2024 and are expected to dominate the market in the forecast period as well. The large corporation usually requires insurance in a bundle form, and the multi-line insurance provides such insurance; therefore, it dominates with 30% also corporate policies often spend multiple years, giving insurers stable income, and they build long-term client relationships.

Based on Distribution Channel, the North America Multi-Line Insurance market is segmented into Agents & Brokers, Bancassurance (through banks), Direct (Company-Owned Platforms), Online & Digital Channels and Insurtech Platforms. In these segmentations, Agents & Brokers dominated the North America market in 2024 and are expected to dominate the market in the forecast period also. As Agents and brokers offer personalised advice as it is especially valued for complex multi-line policies, and it helps them up to 60% to find out their needs. And customised consultation is much needed for customers.

North America Multi-Line Insurance Market Regional Insights

The United States dominated the North America Multi-Line Insurance Market due to the Advanced Insurance Ecosystem

In 2024, the United States had the major share of the North America Multi-Line Insurance Market due to a mature insurance infrastructure high consumer awareness, and demand for expanded insurance across personal, commercial, and specialty insurance lines. A strong regulatory framework joined with near-universal digital adoption insurers offer bundled policies seamlessly across property, casualty, life, and health lines of insurance. Meanwhile, growing geopolitical risks and climate change are also creating demand for holistic multi-line coverage solutions at both the individual and corporate levels. Moreover, the presence of top multi-national insurers in the U.S. helps it in gaining a competing edge in innovations and reach to potential customers.

North America Multi-Line Insurance Market Competitive Landscape

Topmost companies in the North America Multi-Line Insurance Market are MetLife Inc. and American International Group (AIG). They both have different services and competitive edges, which make them unique in the Multi-Line Insurance Market. MetLife offers a diverse range in Multi-Line Insurance products in North America, including life insurance, health insurance, auto insurance, home insurance, and annuities. It also provides employee benefits solutions and retirement planning services. They also have a global presence and innovative digital solutions that enhance customer experience. Also, the company has focused on mergers and acquisitions to expand its market reach. Whereas American International Group (AIG) provide a Multi-Line Insurance Market and it caters to both individuals and businesses in North America, offering risk management solutions, the company has also stood out due to its strong underwriting capabilities, global operations, and diversified portfolio. The company has also leveraged technology and data analytics to improve efficiency and customer engagement.

Key Developments in North America the Multi-Line Insurance Market

- March 5 2024; Allstate Corporation- Reported consolidated revenues of $64.1 billion, a 12.3% increase from 2023. Sold its Group Health business to Nationwide for $1.25 billion.

- December 19 2024; Liberty Mutual- Achieved a record-low combined ratio of 91.5%, its best in 20 years, and reported net income of $4.38 billion, up from $213 million in 2023.

- November 8 2023; MetLife- The platform integrates insurance products into digital platforms like e-wallets, retailers, and financial services, making coverage more accessible

North America Multi-Line Insurance Market Scope:

|

North America Multi-Line Insurance Market |

|

|

Market Size in 2024 |

USD 26.64 Bn |

|

Market Size in 2032 |

USD 42.46 Bn |

|

CAGR (2025-2032) |

6.0 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Customer Type Individuals, Small & Medium Enterprises Large Corporations |

|

By Distribution Channel Agents & Brokers Bancassurance (through banks) Direct (Company-Owned Platforms) Online & Digital Channels Insurtech Platforms. |

|

Key Players in the North America Multi-Line Insurance Market

United States

- MetLife Inc. (New York, United States)

- American International Group (AIG)(New York, United States)

- Allstate Corporation (United States)

- Liberty Mutual (United States)

- Chubb Limited (United States)

- The Hartford (United States)

- Berkshire Hathaway (United States)

- Prudential Financial (United States)

Canada

- Intact Financial Corporation (Canada)

- Desjardins Group (Canada)

- Sun Life Financial (Canada)

Mexico

- Qualitas (Mexico)

- Grupo Nacional Provincia (Mexico)

Frequently Asked Questions

The segmentation of the North America Multi-Line Insurance Market is By Customer Type and By Distribution Channel.

The North America Multi-Line Insurance Market is expected to grow steadily, fuelled by heightened commodity price volatility, increased demand for risk management tools, and the expansion of digital trading platforms.

The United States is leading in the North America Multi-Line Insurance Market.

1. North America Multi-Line Insurance Market: Research Methodology

2. North America Multi-Line Insurance Market Introduction

2.1. Study Assumptions and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. North America Multi-Line Insurance Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2023)

3.3.5. Company Headquarters

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. North America Multi-Line Insurance Market: Dynamics

4.1. North America Multi-Line Insurance Market Trends

4.2. North America Multi-Line Insurance Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

4.7. Advancements in Renewable Energy Cables

5. North America Multi-Line Insurance Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. North America Multi-Line Insurance Market: Size and Forecast, By Customer Type (2024-2032)

5.1.1. Individuals

5.1.2. Small & Medium Enterprises

5.1.3. Large Corporations

5.2. North America Multi-Line Insurance Market: Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. Agents & Brokers

5.2.2. Bancassurance (through banks)

5.2.3. Direct (Company-Owned Platforms)

5.2.4. Online & Digital Channels

5.2.5. Insurtech Platforms.

5.3. North America Multi-Line Insurance Market: Size and Forecast, by Country (2024-2030)

5.3.1. United States

5.3.2. Canada

5.3.3. Mexico

6. Company Profile: Key Players

6.1. MetLife Inc

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. American International Group

6.3. Allstate Corporation

6.4. Liberty Mutual

6.5. Chubb Limited

6.6. The Hartford

6.7. Berkshire Hathaway

6.8. Prudential Financial

6.9. Intact Financial Corporation

6.10. Desjardins Group

6.11. Sun Life Financial

6.12. Qualitas

6.13. Grupo Nacional Provincia

7. Key Findings

8. Industry Recommendations