North America Debt Recovery Services Market Size, AI-Driven Collection & Soaring Consumer Debt

North America Debt Recovery Services Market size was valued at USD 9.73 billion in 2024 and the total North America Debt Recovery Services Market size is expected to grow at a CAGR of 2.89% from 2025 to 2032, reaching nearly USD 12.23 billion by 2032.

Format : PDF | Report ID : SMR_2878

North America Debt Recovery Services Market Overview

Debt Recovery Services refer to professional solutions that help creditors, lenders, and businesses recover overdue payments from individuals or organizations. These services include negotiation, legal action, and digital collection tools (AI, chatbots) to improve repayment rates. They operate under strict regulations (GDPR, FDCPA) to ensure ethical practices while maximizing recovery efficiency.

North America debt recovery services market has been experiencing strong growth by record high consumer debt levels reaching $17.5 trillion in 2024, with credit card debt alone exceeding $1.13 trillion. The U.S. dominated this market by its massive debt volumes, advanced recovery infrastructure, and structured regulatory framework including FDCPA and TCPA compliance. Key growth drivers include rising delinquencies from inflation and economic pressures, along with opportunities in emerging sectors like BNPL defaults and healthcare debt collection. Major players like Encore Capital Group and PRA Group lead the market through their scale, technological capabilities, and expertise in managing charged off debt portfolios.

Emerging trends are reshaping the industry, particularly the adoption of AI-powered collection tools, softer digital-first recovery approaches, and regulatory technology solutions to streamline compliance. The North America debt recovery services market is also seeing innovation through Debt-as-a-Service platforms that make professional recovery accessible to smaller lenders and creditors. These developments point to continued expansion as debt burdens and recovery needs grow across the region.

To get more Insights: Request Free Sample Report

North America Debt Recovery Services Market Dynamics

US Household & Soaring Consumer Debt to Drive the North America Debt Recovery Services Market Growth

Rising Consumer Debt Levels are a major driver of North America Debt Recovery Services Market. Growing reliance on credit cards, personal loans, auto loans, and student loans is increasing overall household debt. As a more individuals face repayment challenges, delinquency rates rise. This directly boosts demand for debt collection and recovery services. U.S. alone holds trillions in consumer debt, creating a vast market. Lenders and financial institutions increasingly rely on third-party agencies to recover overdue payments efficiently.

In Q4 2024, U.S. household debt hit $17.5 trillion, with credit card debt exceeding $1.13 trillion. Rising delinquencies led banks like Capital One to increase outsourcing to recovery firms, boosting demand in the North America debt recovery services market.

Strict US-Canada Debt Laws to Restrain the North America Debt Recovery Services Market Growth

Strict regulations like Fair Debt Collection Practices Act and Telephone Consumer Protection Act impose heavy compliance burdens on debt recovery agencies, increasing operational costs. In Evolving state level laws like New York’s licensing rules, California’s consumer protections, create a fragmented legal landscape, complicating nationwide debt collection efforts.

These regulations restrict traditional recovery tactics, like a frequent calling or aggressive pressure, forcing agencies to adopt costlier, tech-driven alternatives. Non-compliance risks fines, lawsuits, and reputational damage, deterring smaller players. Also, rising consumer awareness and legal challenges further limit collection efficiency, slowing market growth. While regulations ensure ethical practices, they remain a key restraint for North America debt recovery services industry scalability.

Cloud Tools Revolutionizing to Create Opportunities in North America Debt Recovery Services Market Growth

Digital debt collection platforms including self-service portals, AI chatbots, and cloud-based tools, are revolutionizing debt recovery by enabling convenient, 24/7 consumer interactions and personalized repayment options. These technologies improve customer experience, reduce operational costs, and enhance recovery rates through analytics integration. Post-COVID, their adoption is accelerating as businesses seek compliance and efficiency in North America debt recovery services.

Riverty (powered by Parloa) deployed an AI voice assistant in late 2024 to handle over 30% of inbound debt collection calls, autonomously resolving 15% of them, reducing wait times by 50%, and cutting call-handling duration by 10%.

North America Debt Recovery Services Market Segment Analysis

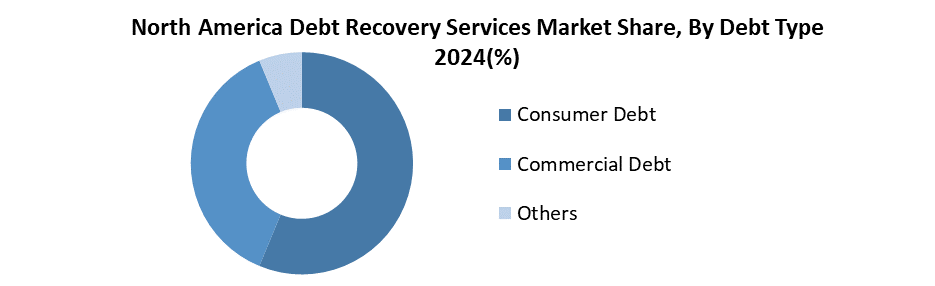

Based on debt type, North America Debt Recovery Services market is segmented in consumer debt, Commercial debt, Others. Consumer debt segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. Driven by high credit card debt ($1.13T), rising personal loans, and BNPL (Buy Now, Pay Later) adoption. Stagnant wages and inflation increase defaults, fueling demand for recovery services.

Unlike commercial debt, consumer debt is more widespread, with easier credit access and financial stress on households making it the key focus for collection agencies. The U.S. leads due to strict regulations (FDCPA) and advanced recovery systems.

Based on service type, North America Debt Recovery Services market is segmented into First-Party Collections, Third-Party Collections, Legal Collections, and Others. Third-party collections segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. Dominate the debt recovery market due to their scalability and cost-efficiency for lenders. Banks, fintechs, and creditors outsource delinquent accounts to specialized agencies, which recover 20-30% more than in-house efforts. The North American third-party collections market is driven by rising defaults, especially in unsecured consumer debt (e.g., credit cards, BNPL). Legal collections, while critical, are slower and more expensive, making outsourcing the preferred choice.

North America Debt Recovery Services Market Country Insights

U.S.-Led North America Debt Recovery Services Market with High Debt Levels & Robust Enforcement

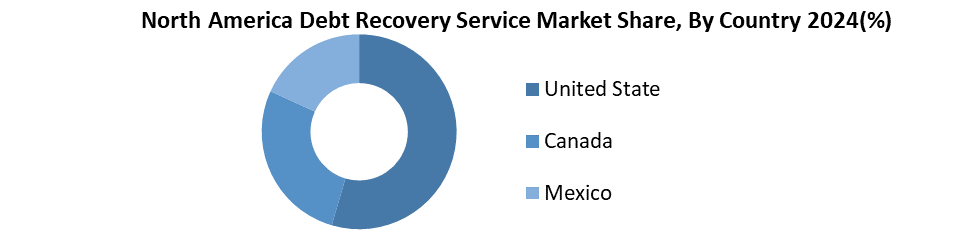

The United States dominated the North America Debt Recovery Services due to high consumer debt ($1.13T credit card, $1.7T student loans), strict regulations (FDCPA), and advanced collection tech. Strong financial infrastructure and legal enforcement further drive its lead in debt recovery. Factors contributing to its dominance include a high volume of credit card and student loan debts.

Also, presence of major debt recovery agencies and a well-established legal system for debt enforcement further strengthens its position. The U.S. also experiences consistent demand for debt recovery services due to widespread borrowing and financial instability among consumers, making it the leading North America debt recovery services market in the region.

North America Debt Recovery Services Market Competitive Landscape

North America Debt Recovery Services market is a highly competitive landscape dominated by established players like Encore Capital Group and PRA Group, which lead through large-scale debt purchasing and advanced analytics. Mid-sized firms like Transworld Systems Inc. (TSI) and IC System compete on compliance expertise and omnichannel engagement, while CBE Group and ConServe differentiate with customer-centric approaches and ethical collections.

GC Services and Prestige Services Inc. (PSI) focus on niche segments like telecom and healthcare receivables. The market is consolidating through M&A (e.g., Encore’s Cabot acquisition) and tech adoption (AI, blockchain), with regional players like Aurora National Financial serving specialized portfolios. Rising consumer debt and regulatory complexity further intensify competition.

Recent Developments in the North America Debt Recovery Services Market

|

Company Name |

Date |

Key Development |

|

Encore Capital Group (USA) |

Feb 26, 2025 |

Reported strong Q4 & FY 2024 results: Portfolio purchases ↑26% (US?$1.35B), collections ↑16% (US?$2.16B); earnings affected by Cabot losses. |

|

PRA Group (USA) |

May 5, 2025 |

Q1 2025 results: ERC US?$7.8B (↑20%), purchases US?$291.7M (↑19%), collections US?$497.4M (↑10.7%). |

|

June 5, 2025 |

Fitch downgraded long-term issuer and debt ratings from BB+ to BB due to increased secured debt ratio. |

|

|

CBE Group (USA) |

May 1, 2025 |

Renewed U.S. Treasury PCA contract; remains active through mid-2026. |

|

Allied Interstate LLC (USA) |

Feb 19, 2025 |

Credit-repair sites spotlight ongoing consumer dispute issues with collection reporting/removal practices. |

|

North America Debt Recovery Services Market Scope |

|

|

Market Size in 2024 |

USD 9.73 billion. |

|

Market Size in 2032 |

USD 12.23 billion. |

|

CAGR (2024-2032) |

2.89 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Debt Type Commercial Debt Consumer Debt Others |

|

By Service Type First-Party Collections Third-Party Collections Legal Collections Others |

|

|

|

By End-User Healthcare Financial Services Government Retail Others |

|

Regional Scope |

North America- United States, Canada, and Mexico |

North America Debt Recovery Services Market Key Players:

- Encore Capital Group (San Diego, USA)

- PRA Group (Norfolk, USA)

- Transworld Systems Inc. (TSI) (Lake Forest, USA)

- GC Services LP (Houston, USA)

- CBE Group (Cedar Falls, USA)

- IQOR Holdings Inc. (St. Petersburg, USA)

- Allied Interstate LLC (Minnetonka, USA)

- Credit Bureau of Canada Collections Ltd. (Toronto, Canada)

- CBV Collection Services Ltd. (Vancouver, Canada)EOS North America (Montreal, Canada)

Frequently Asked Questions

Third-party collections, due to better recovery rates and cost-efficiency for lenders.

Encore Capital Group and PRA Group are two major players in this market.

1. North America Debt Recovery Services Market: Research Methodology

2. North America Debt Recovery Services Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. North America Debt Recovery Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. North America Debt Recovery Services Market: Dynamics

4.1. Debt Recovery Services Market Trends

4.2. Debt Recovery Services Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

4.7. Advancements in Renewable Energy Cables

5. North America Debt Recovery Services Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. North America Debt Recovery Services Market Size and Forecast, By Debt Type (2024-2032)

5.1.1. Commercial Debt

5.1.2. Consumer Debt

5.1.3. Others

5.2. North America Debt Recovery Services Market Size and Forecast, By Service Type (2024-2032)

5.2.1. First-Party Collections

5.2.2. Third-Party Collections

5.2.3. Legal Collections

5.2.4. Others

5.3. North America Debt Recovery Services Market Size and Forecast, By End-User (2024-2032)

5.3.1. Healthcare

5.3.2. Financial Services

5.3.3. Government

5.3.4. Retail

5.3.5. Others

5.4. North America Debt Recovery Services Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. North America Debt Recovery Services Market Size and Forecast, by Country (2024-2032)

6.1.1. United States

6.1.1.1. United States Debt Recovery Services Market Size and Forecast, By Debt Type (2024-2032)

6.1.1.1.1. Commercial Debt

6.1.1.1.2. Consumer Debt

6.1.1.1.3. Others

6.1.1.2. United States Debt Recovery Services Market Size and Forecast, By Service Type (2024-2032)

6.1.1.2.1. First-Party Collections

6.1.1.2.2. Third-Party Collections

6.1.1.2.3. Legal Collections

6.1.1.2.4. Others

6.1.1.3. United States Debt Recovery Services Market Size and Forecast, By End-User (2024-2032)

6.1.1.3.1. Healthcare

6.1.1.3.2. Financial Services

6.1.1.3.3. Government

6.1.1.3.4. Retail

6.1.1.3.5. Others

6.1.2. Canada

6.1.2.1. Canada Debt Recovery Services Market Size and Forecast, By Debt Type (2024-2032)

6.1.2.1.1. Commercial Debt

6.1.2.1.2. Consumer Debt

6.1.2.1.3. Others

6.1.2.2. Canada Debt Recovery Services Market Size and Forecast, By Service Type (2024-2032)

6.1.2.2.1. First-Party Collections

6.1.2.2.2. Third-Party Collections

6.1.2.2.3. Legal Collections

6.1.2.2.4. Others

6.1.2.3. Canada Debt Recovery Services Market Size and Forecast, By End-User (2024-2032)

6.1.2.3.1. Healthcare

6.1.2.3.2. Financial Services

6.1.2.3.3. Government

6.1.2.3.4. Retail

6.1.2.3.5. Others

6.1.3. Mexico

6.1.3.1. Mexico Debt Recovery Services Market Size and Forecast, By Debt Type (2024-2032)

6.1.3.1.1. Commercial Debt

6.1.3.1.2. Consumer Debt

6.1.3.1.3. Others

6.1.3.2. Mexico Debt Recovery Services Market Size and Forecast, By Service Type (2024-2032)

6.1.3.2.1. First-Party Collections

6.1.3.2.2. Third-Party Collections

6.1.3.2.3. Legal Collections

6.1.3.2.4. Others

6.1.3.3. Mexico Debt Recovery Services Market Size and Forecast, By End-User (2024-2032)

6.1.3.3.1. By End-User

6.1.3.3.2. Healthcare

6.1.3.3.3. Financial Services

6.1.3.3.4. Government

6.1.3.3.5. Retail

6.1.3.3.6. Others

7. Company Profile: Key Players

7.1. Encore Capital Group (San Diego, USA)

7.1.1. Company Overview

7.1.2. Business Portfolio

7.1.3. Financial Overview

7.1.4. SWOT Analysis

7.1.5. Strategic Analysis

7.1.6. Recent Developments

7.2. PRA Group (Norfolk, USA)

7.3. Transworld Systems Inc. (TSI) (Lake Forest, USA)

7.4. GC Services LP (Houston, USA)

7.5. CBE Group (Cedar Falls, USA)

7.6. IQOR Holdings Inc. (St. Petersburg, USA)

7.7. Allied Interstate LLC (Minnetonka, USA)

7.8. Credit Bureau of Canada Collections Ltd. (Toronto, Canada)

7.9. CBV Collection Services Ltd. (Vancouver, Canada)

7.10. EOS North America (Montreal, Canada)

8. Key Findings

9. Industry Recommendations