North America Financial Advisory Services Market Industry Analysis and Forecast (2025-2032)

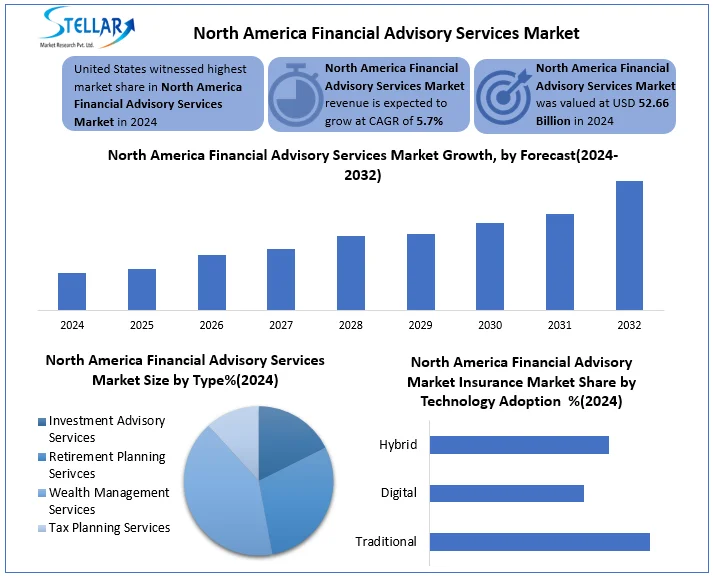

North America Financial Advisory Service Market was valued at USD 33.8 Billion in 2024. The Total North America Financial Advisory Services Market revenue is expected to grow by CAGR 5.7% from 2025 to 2032 and reach nearly USD 52.66 Billion in 2032.

Format : PDF | Report ID : SMR_2872

North America Financial Advisory Services Market Overview

Financial advisors are the process of providing guidance and recommendations to customers about their financial decisions. Financial advisors use their expertise and knowledge to help customers make informed decisions about their investment, retirement plan, taxes, insurance and other financial matters. Financial advisory section covers the revenue generated by this service by both financial institutions and advisors, and it includes property under the number of financial advisors, per advisory average revenue and management (AUM).

The North America Financial Advisory Services Market is inspired by increasing demand for personal money management, retirement plan to increase awareness and increase digital advisory equipment. A major opportunity lies in the expansion of hybrid consultant models that combine human expertise with AI-managed platforms. The money management section 2024 dominated with more than 42% market share, especially among individuals with high-purpose. Increasing demand is also observed in sustainable investment and interstate funds transfer services. Major players include Fidelity Investments, Charles Schwab, Morgan Stanley, taking advantage of technology to expand the offerings in retail and institutional markets.

Trade and tariff changes in North America have increased economic uncertainty, boosting demand for financial advisory services. Clients seek help with tax planning, global investment, and risk management, while advisors face stricter cross-border compliance requirements.

To get more Insights: Request Free Sample Report

North America Financial Advisory Services Market Dynamics

High-Net-Worth Individual (HNWI) to Drive the North America Financial Advisory Services Market Growth

According to Capgemini's World Wealth Report, North America remains a leading area for high-net-world individuals (HNWIS) with over 7.6 million HNWIs recorded in 2024. It is a major driver of the growing rich population North America Financial Advisory Services Market as HNWIS demands money protection, investment management, tax adaptation and sewn solution for property schemes. Their complex financial departments require ongoing strategic guidance, which increases dependence on experienced financial advisors. This trend has inspired these customers to develop money management divisions, increased digital platforms and hybrid advisory models to serve efficiently. The increasing number of HNWIS also increases property under management (AUM), which strengthens revenue creation in advisory firms. As the competition intensifies to attract and maintain these high-value customers, firms are investing in AI tools, individual dashboards and cross-border advisory capabilities to meet the growing expectations of this section.

Growing Demand from HNWIs to Create Significant Market Opportunity in North America

The North America Financial Advisory Services Market is experiencing strong growth-run by the extended population of high-net-world individuals (HNWIS), which exceeded 7.6 million in 2024 (Capjemini, World Wealth Report). These individuals seek premium, individual financial services to manage complex portfolio, tax strategies, estate planning and interpolation wealth transfer. The growing demand for sewn solutions offers a major opportunity to distribute high-value services for advisory firms that address specific financial goals and risk hunger. Wealth management divisions are integrating advanced technologies such as AI and real-time data analytics to improve customer engagement, future flirting scheme and customer retention. HNWIS expects a seamless digital interface with human expertise - the hybrid consultant model makes an important offer. Since the wealth continues to focus in this demographic, which give new looks to the firms and adapt to the expectations of rich customers, gain a competitive edge and increase long -term revenue growth in the region.

High Operational and Administrative Costs Restrain Market Growth

In North America Financial Advisory Services Market firms face high operations and administrative costs due to the need to apply strict regulatory compliance and advanced technology systems. These expenses include compliance monitoring cyber security measures for investment, reporting equipment, staff training and safety of customer data. the cost to stay updated with laws and standards developing firms increases the cost, which increases the overall cost of service distribution. This financial burden can limit the growth of small firms and reduce the profit margin in the entire industry.

North America Financial Advisory Services Market Segment Analysis

Based on Type, the segment divided into Investment Advisory Services, Retirement Planning Services, Wealth Management Services, Tax Planning Services. The Wealth Management Services Segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period.This dominance is powered by rich customers looking for high-net-forth individuals (HNWIS) and wide, personal management of their assets. Wealth Management Investment provides a holistic approach in combination with advice, tax plan, estate planning and retirement strategies, appealing to customers targeting long term financial security and heritage schemes.the increase in funds and the complexity of financial portfolio is the demand for fuel fuel for integrated solutions that provide money management services. According to recent North America Financial Advisory Services Market reports, money management exceeds 40% of the total Financial Advisory Services market share in 2024, which reflects its important role in widely addressing diverse customer requirements compared to other special segments such as retirement plan or tax advice.

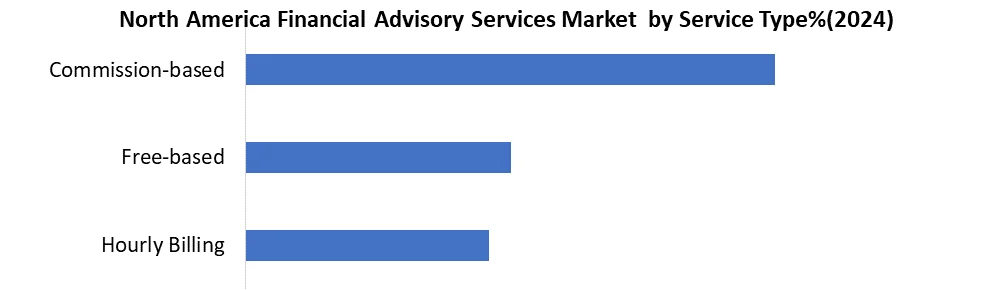

Based on Service Type, segmented into the hourly billing, free-based, and commission-based. The commission-based segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. This model remains popular as it aligns the compensation of the advisor with the customer's investment performance, encouraging advisors to maximize returns. Many customers, especially in money management and investment advisors, prefer this structure as it can reduce advance costs. the Commission-based model is widely adopted by traditional advisory firms and brokerage services, which have established customer base. While fees-based and hour billing models are increasing due to transparency and increasing demand for fixed costs, commission-based in encouraging its entry and performance remains-based, which accounting for the largest part of the North America Financial Advisory Services market revenue.

Based on Technology Adoption, the market is segmented into traditional, digital, hybrid.

The traditional segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period.This approach combines the personal expertise of traditional face-to-face advisors with convenience and efficiency of digital platforms. Customers benefit from advice supported by advanced technology such as AI-operated Analytics and Robo-Hellow, while offering real-time portfolio management and cost-affect solutions. The hybrid model addresses the needs of both the technology-loving young investors seeking digital access and older customers who give importance to human contacts. it captures a comprehensive customer base, drives high -adopting rates. Industry reports show that hybrid services for the largest North America Financial Advisory Services market share in 2024 reflect the increasing demand for flexible and integrated advisory experiences.

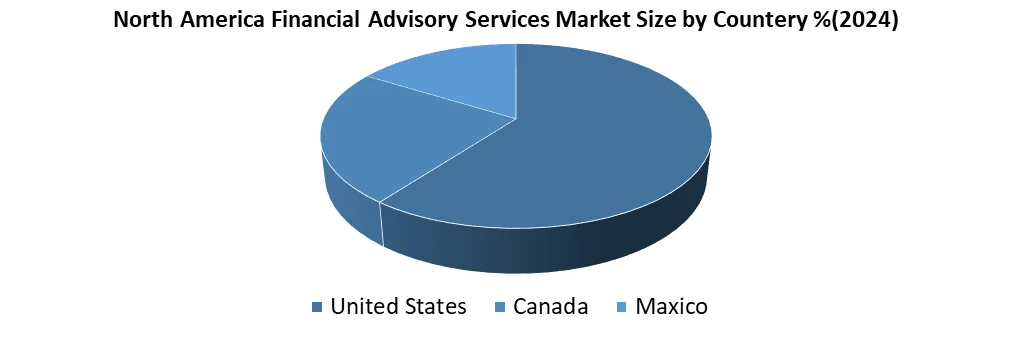

Based on the Country, United States dominated the financial advisory services market in 2024 and is expected to hold largest share during the forecast period which is motivated by its large population to widely adopt high-net-world individuals (HNWIS), advanced financial infrastructure and digital advisory platforms. In 2024, the US was responsible for most of the market revenue due to its mature economy, strong regulatory structures and the presence of several global financial institutions. strong investor awareness and individual money management and retirement plan services further promote market growth. The country also increases the country's leadership, service access and customer engagement in fintech innovations, including the AI-manual advisory equipment and hybrid models, strengthens its dominance in the region.

North America Financial Advisory Services Market Competitive Landscape

Morgan Stanley and Bank of America Meril Lynch (Bofa Merryl) are two major players in the North America Financial Advisory Services Market, each availing each different competitive strength. Morgan Stanley has maintained a prominent place in client assets with more than $ 4.8 trillion, inspired by focusing on high-net-global and institutional customers with strong digital tools such as wealthdesk. Strategic acquisitions such as ETrade and Eaton Vance have increased its digital and investment capabilities.

Meanwhile, Bofa Merrill commands more than $ 3.7 trillion in assets of $ 3.7 trillion under its Money Management Division, which benefits from deep integration of Bank of America with retail and corporate banking weapons. Merrill Lynch's hybrid advisory model, supported by platforms such as Merryl Age and AI Tools, enables it to serve both prosperous and mass market clients. While Morgan focuses on Stanley Elite, Personal Advisor, Bofa Merryl Excel, which are in Skelable, Bank-Employed Services. Both firms face challenges from Fintech disruptives, but remain highly competitive through innovation and scale.

Key Development Financial Advisory Services

In March 12, 2024, Vanguard Group expanded its Personal Advisor Services (VPAS) by introducing tiered advisory plans for both younger and high-net-worth clients. The update also added ESG investment options and real-time chat access to certified financial planners (CFPs), enhancing personalized support.

In February 13, 2025, Raymond James Financial partnered with Salesforce to launch an advanced client relationship management (CRM) system. The platform features real-time client data, next-best-action insights, and secure communication tools to enhance advisor-client engagement.

In October 3, 2024, Wells Fargo launched a dedicated ESG-focused advisory platform to help clients build portfolios aligned with their environmental and social values. Advisors also received specialized training in ESG analytics and client preference mapping to enhance personalized advice.

|

The North America Financial Advisory Services Market Scope |

|

|

Market Size in 2024 |

USD 33.8 Billion |

|

Market Size in 2032 |

USD 52.66 Billion |

|

CAGR (2025-2032) |

5.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Investment Advisory Services Retirement Planning Services Wealth Management Services Tax Planning Services |

|

By Service Type hourly billing free-based commission-based |

|

|

By Technology Adoption Traditional Digital Hybrid |

|

Key Players North America Financial Advisory Services Market

- Morgan Stanley (USA)

- Bank of America Merrill Lynch (USA)

- Charles Schwab Corporation (USA)

- Edward Jones (USA)

- Vanguard Group (USA)

- Raymond James Financial (USA)

- Wells Fargo Advisors (USA)

- JP Morgan Private Bank (USA)

- Fidelity Investments (USA)Goldman Sachs Group, Inc. (USA)

Frequently Asked Questions

The North America financial Advisory Services Market is expected to reach USD 52.66 billion by 2032.

The North America financial Advisory Services market is projected to grow at a CAGR of 5.7%.

Wealth Management Services dominated with over 42% market share.

1. North America Financial Advisory Services Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Financial Advisory Services Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Financial Advisory Services Market: Dynamics

3.1. North America Financial Advisory Services Market Trends

3.2. North America Financial Advisory Services Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Financial Advisory Services Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. North America Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

4.1.1. Investment Advisory Services

4.1.2. Retirement Planning Services

4.1.3. Wealth Management Services

4.1.4. Tax Planning Services

4.2. North America Financial Advisory Services Market Size and Forecast, By Services Type (2024-2032)

4.2.1. Hourly Billing

4.2.2. Free-based

4.2.3. Commission-based

4.3. North America Financial Advisory Services Market Size and Forecast, By Technological Adoption (2024-2032)

4.3.1. Traditional

4.3.2. Digital

4.3.3. Hybrid

4.4. North America Aesthetic Financial Advisory Services Market Size and Forecast, By Country (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. Company Profile: Key Players

5.1. Morgan Stanley

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Development

5.2. Bank of America Merrill Lynch

5.3. Charles Schwab Corporation

5.4. Edward Jones

5.5. Vanguard Group

5.6. Raymond James Financial

5.7. Wells Fargo Advisors

5.8. JP Morgan Private Bank

5.9. Fidelity Investments

5.10. Goldman Sachs Group, Inc.

6. Key Findings

7. Industry Recommendations