North America Credit Scoring Market Growth Analysis & Future Projections 2025-2032

North America Credit Scoring Market size was valued at USD 7.81 Bn in 2024 and the total North America Credit Scoring Market revenue is expected to grow at a CAGR of 10% from 2025 to 2032, reaching nearly USD 16.74 Bn by 2032.

Format : PDF | Report ID : SMR_2868

North America Credit Scoring Market Overview

Credit scoring refers to the industry that provides risk evaluation tools to evaluate the credibility of individuals or businesses. This includes reporting services used by scoring models, data analytics and loans, insurers and other financial institutions, which predict the possibility of loan repayment.

North America credit scoring service market has been driven by digital lending growth and AI adoption, with the U.S. dominating (70% share) due to its mature fintech ecosystem and Open Banking integrations. Demand surges from lenders needing real-time scoring (67% use alternative data), while supply lags for underserved segments due to fraud risks and regulatory hurdles. Key players include FICO (AI models), Experian/Equifax/TransUnion (traditional bureaus), and disruptors like Upstart and Affirm. End-users fuel innovation by generating alternative data (rent, BNPL) and demanding transparency, pushing bureaus to adopt consumer-friendly tools like free scores and credit-building apps.

.webp)

To get more Insights: Request Free Sample Report

North America Credit Scoring Market Dynamics

Digital Lending Boom and AI-Powered Innovation to Drive North America Credit Scoring Market

North American credit scoring market is being inspired by the rapid development of digital lending and AI-operated underwriting, with 67% of American lenders to assess creditworthiness using alternative data (e.g., rent, utility payment), more than 48% (Experience, 2024) in 2022. Now the rise of Buy Now Pay Later purchase, (BNPL) platform, which increased by 82% in transactions volume (2023-2025), demands real-time scoring solutions, pushing firms such as FICO and TransUnion to adopt machine learning models.

Regulatory Complexity and Data Privacy Concerns to Create Challenges in the North America Credit Score Market

North American Credit Scoring Market faces significant headwinds due to regulatory framework and developing strict data privacy laws, which create compliance with credit bureau and lenders. In the US, patchwork state-level rules (e.g., CCPA of California and upcoming federal AI regime) struggle with traditional scoring models, increased operating costs for compliance teams (TransUnion, 2024) by 15–20%. Additionally, growing consumer mistrust i.e. 42% of US credits oppose sharing financial data for assessment, limiting alternative data.

Untapped Potential of Alternative Data to Create Opportunity in the North America Credit Score Market

Integration of alternative data (e.g., rental payment, utility bill, and gig economy income) presents a transforming opportunity to expand the credit access to 53 million credits invisible or unskilled consumers. With 90% of lenders recognizing the ability of alternative data to improve the risk evaluation (Experian, 2024), and 67% consumers are willing to share non-traditional financial data for better credit conditions (TransUnion, 2024), leading the), bureaus like FICO and Vantage Score are pioneering next-gen models. This change not only bridges the financial inclusion gap, but also unlocks latent lending revenue (McKinsey, 2025), which takes early adoption to dominate the future of forecast scoring.

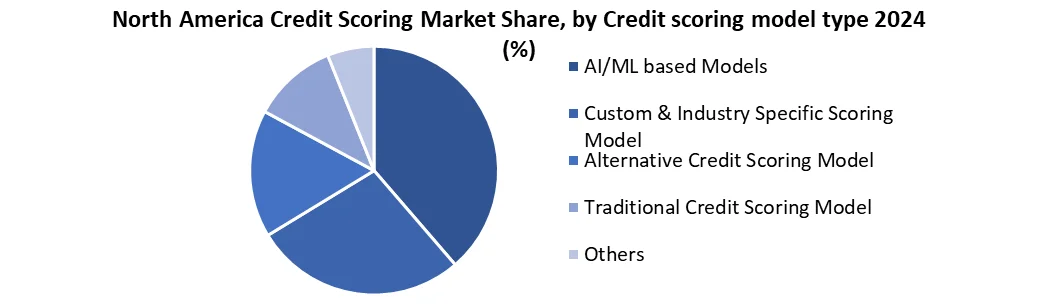

North America Credit Scoring Market Segment Analysis

Based on Credit Scoring Model Type, the North America Credit Scoring Market is segmented into traditional credit scoring model, custom & industry specific scoring model, alternative credit scoring model and AI/ML based models. The AI/ML-based credit scoring model segment dominates the North American market, especially the U.S., due to their better future accuracy, adaptability and ability to take advantage of the huge dataset. More than 65% of the leading American lenders now use the AI-powered scoring system (Experian, 2024), as they make the traditional FICO model better than 15–20% in predicting risk. Rise of open banking and alternative data (e.g., Cash Flow Analytics, Rent Payments) has fuel the adoption, with the AI ??model, a thin-filing or credit-excellent consumers have been processed with real-time behavior to serve consumers.

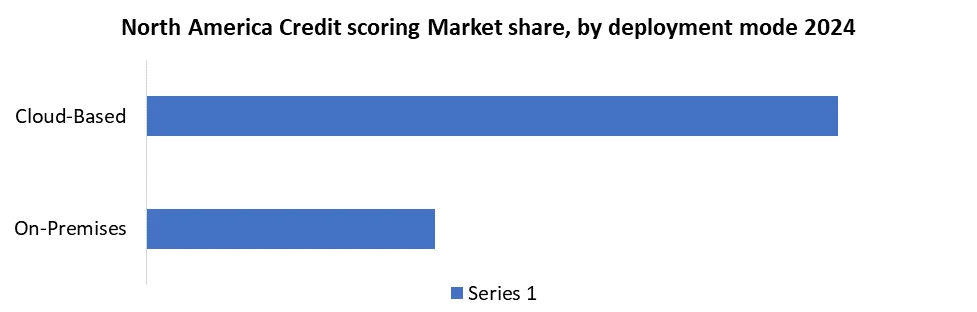

Based on Deployment Mode, the North America Credit Scoring Market is segmented into On-premises and Cloud-based. The cloud-based mode dominated the North American Credit Scoring Market, especially in the US and Canada, due to its scalability, cost-defence and real-time data processing capabilities. More than 75% of financial institutions in the region have adopted cloud-based credit scoring solutions (Deloitte, 2024), which is motivated by the need for seamless API integration with open banking systems and AI-operated analytics.

North America Credit Scoring Market Country Analysis

US dominated the North America Credit Scoring Market in 2024 and is expected to dominate during forecast period

The US dominated the North America Credit Scoring Market due to its advanced Fintech ecosystem, widely adopting alternative data and progressive regulatory framework. More than 53 million American are credits-in-laws or unskilled (CFPB), the driving demand of AI/ML models that include rental payments, utility bills and cash flow data, which are now used by 67% of US lenders (Federal Reserve). The US Open Banks leads to integration, in which 85% of the major banks offer API-based credit assessment (FDIC), while Canada lags behind due to strict privacy laws. Additionally, the US has accounts for 90% of North America's BNPL transactions (NY Fed), forcing the scoring model to grow faster than Canada.

North America Credit Scoring Market Competitive Landscape

In 2024, one of the Big Three Credit Bureau, Experience strengthened its position in the North American Credit Scoring Market by obtaining a majority share in Nigeria's leading credit bureau, CreditRegistry. This strategic move expanded the access to the Experian for alternative data sources and high-development African markets, while also enhanced its global open banking capabilities. The acquisition aligns with the expansion's emerging economies and a cross-device digital Identity firm, complement to the 2023 procurement of Tapad, which has increased the prevention of fraud for US lenders.

Key Developments in the North America Credit Scoring Market

- December 10, 2024- FICO launched the “Lenders Leading Inclusion Program” aimed at expanding credit access for underserved communities. This initiative was announced via FICO’s investor relations press release.

- October 4, 2024- Experian acquired Brazilian cybersecurity firm ClearSale for $350 million, bolstering its identity and fraud prevention business in Latin America.

- April 24, 2025- In its Q1 2025 earnings release, TransUnion emphasized the ongoing importance of fraud and communication solutions—noting these business lines are largely non-cyclical.

North America Credit Scoring Market Scope table

|

North America Credit Scoring Market Scope |

||

|

Market Size in 2024 |

7.81 Bn. |

|

|

Market Size in 2032 |

16.74 Bn. |

|

|

CAGR (2025-2032) |

10% |

|

|

Historic Data |

2019-2024 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments Analysis |

By Scoring Model Type Traditional Credit Scoring Model Custom & Industry Specific Scoring Model Alternative Credit Scoring Model AI/ML Based Models Others |

|

|

By Data Source Internal External |

||

|

By Deployment Mode On-premises Cloud-based |

||

|

By End-Use Banks Non-Banking Financial Companies Fintech Companies Insurance Companies Telecommunication Providers Others |

|

|

|

Regional Scope |

North America: United States, Canada, Mexico |

|

Key Players of the North America Credit Scoring Market

- FICO (Fair Isaac Corporation) (US)

- Experian (US)

- Equifax (US)

- TransUnion (US)

- VantageScore (US)

- Borrowell (Canada)

- Credit Bureau of Canada (Canada)

- Buro de Crédito (Mexico)

- Círculo de Crédito (Mexico)

- Credilikeme (Mexico)

Frequently Asked Questions

The segments covered in the North America Credit Scoring Market are by Credit scoring model type, by data source, by deployment mode and by end user.

US dominated the North America Credit Scoring Market in 2024.

The challenge as Regulatory Complexity and Data Privacy Concerns hinders the North America Credit Scoring Market.

1. North America Credit Scoring Market: Research Methodology

2. North America Credit Scoring Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global North America Credit Scoring Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarters

3.2.3. Service Segment

3.2.4. Application Segment

3.2.5. Revenue (2024)

3.2.6. Geographical Presence

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. North America Credit Scoring Market: Dynamics

4.1. North America Credit Scoring Market Trends

4.2. North America Credit Scoring Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Regulatory Landscape by Region

4.6. Key Opinion Leader Analysis for the Global Industry

4.7. Analysis of Government Schemes and Initiatives for Industry

5. North America Credit Scoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Credit Scoring Market Size and Forecast, By Credit Scoring Model Type (2024-2032)

5.1.1. Traditional Credit Scoring Model

5.1.2. Custom & Industry Specific Scoring Model

5.1.3. Alternative Credit Scoring Model

5.1.4. AI/ML Based Models

5.1.5. Others

5.2. North America Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.2.1. Internal

5.2.2. External

5.3. North America Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.3.1. On-premises

5.3.2. Cloud-based

5.4. North America Credit Scoring Market Size and Forecast, By End-User (2024-2032)

5.4.1. Banks

5.4.2. Non-Banking Financial Companies

5.4.3. Fintech Companies

5.4.4. Insurance Companies

5.4.5. Telecommunication Providers

5.4.6. Others

5.5. North America Credit Scoring Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Credit Scoring Market Size and Forecast, By Credit Scoring Model Type (2024-2032)

5.5.1.1.1. Traditional Credit Scoring Model

5.5.1.1.2. Custom & Industry Specific Scoring Model

5.5.1.1.3. Alternative Credit Scoring Model

5.5.1.1.4. AI/ML Based Models

5.5.1.1.5. Others

5.5.1.2. United States Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.5.1.2.1. Internal

5.5.1.2.2. External

5.5.1.3. United States Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.5.1.3.1. On-premises

5.5.1.3.2. Cloud-based

5.5.1.4. United States Credit Scoring Market Size and Forecast, By End-User (2024-2032)

5.5.1.4.1. Banks

5.5.1.4.2. Non-Banking Financial Companies

5.5.1.4.3. Fintech Companies

5.5.1.4.4. Insurance Companies

5.5.1.4.5. Telecommunication Providers

5.5.1.4.6. Others

5.5.2. Canada

5.5.2.1. Canada Credit Scoring Market Size and Forecast, By Credit Scoring Model Type (2024-2032)

5.5.2.1.1. Traditional Credit Scoring Model

5.5.2.1.2. Custom & Industry Specific Scoring Model

5.5.2.1.3. Alternative Credit Scoring Model

5.5.2.1.4. AI/ML Based Models

5.5.2.1.5. Others

5.5.2.2. Canada Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.5.2.2.1. Internal

5.5.2.2.2. External

5.5.2.3. Canada Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.5.2.3.1. On-premises

5.5.2.3.2. Cloud-based

5.5.2.4. Canada Credit Scoring Market Size and Forecast, By End-User (2024-2032)

5.5.2.4.1. Banks

5.5.2.4.2. Non-Banking Financial Companies

5.5.2.4.3. Fintech Companies

5.5.2.4.4. Insurance Companies

5.5.2.4.5. Telecommunication Providers

5.5.2.4.6. Others

5.5.3. Mexico

5.5.3.1. Mexico Credit Scoring Market Size and Forecast, By Credit Scoring Model Type (2024-2032)

5.5.3.1.1. Traditional Credit Scoring Model

5.5.3.1.2. Custom & Industry Specific Scoring Model

5.5.3.1.3. Alternative Credit Scoring Model

5.5.3.1.4. AI/ML Based Models

5.5.3.1.5. Others

5.5.3.2. Mexico Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.5.3.2.1. Internal

5.5.3.2.2. External

5.5.3.3. Mexico Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.5.3.3.1. On-premises

5.5.3.3.2. Cloud-based

5.5.3.4. Mexico Credit Scoring Market Size and Forecast, By End-User (2024-2032)

5.5.3.4.1. Banks

5.5.3.4.2. Non-Banking Financial Companies

5.5.3.4.3. Fintech Companies

5.5.3.4.4. Insurance Companies

5.5.3.4.5. Telecommunication Providers

5.5.3.4.6. Others

6. Company Profile: Key Players

6.1. FICO (Fair Isaac Corporation)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Experian

6.3. Equifax

6.4. TransUnion

6.5. VantageScore

6.6. Borrowell

6.7. Credit Bureau of Canada

6.8. Buro de Crédito

6.9. Círculo de Crédito

6.10. Credilikeme

7. Key Findings

8. Industry Recommendations