Autotransfusion Devices Market Size, Share & Trends Analysis Report by Type, Application, End Use Region and Growth Forecasts

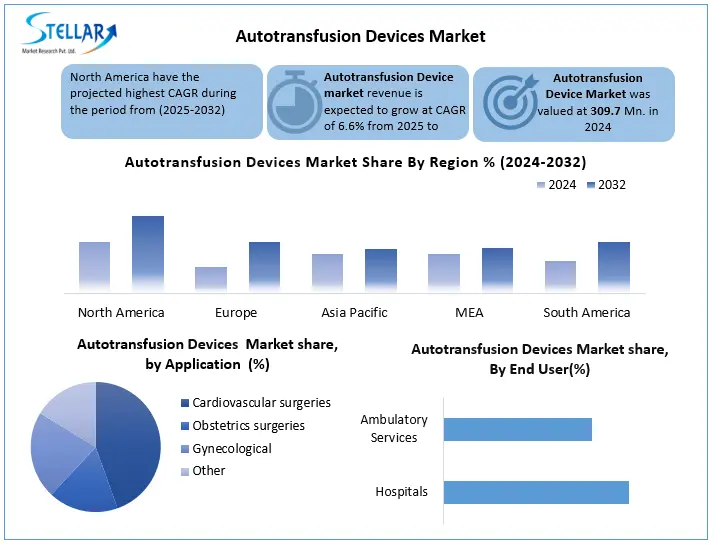

The Autotransfusion Devices Market was valued at USD 309.7 Million in 2024 and the total revenue is expected to grow at CAGR of 6.6% From 2025 to 2032 Reaching nearly USD 516.41 Million by 2032

Format : PDF | Report ID : SMR_2852

Autotransfusion Devices Market Overview:

Autotransfusion is the collection of blood or blood products derived from a patient’s own circulation (autologous blood) which is collected or shed from a wound of the body cavity during surgery for later reinfusion to the patient. Utilizing the Latham Bowl device, a centrifugal force separates the blood components relative to their respective densities as listed below. The higher density components will move farther from the axis of rotation than those of lower density. The remaining erythrocytes transfused, and all other blood components are washed out into the waste bag.

The global growing tendency towards a population highlights the importance of addressing age-related health issues such as anaemia, coagulopathy and risk of surgical bleeding. Self-transfusion devices provide a personalised strategy for blood management in the elderly, improving perioperative care and reducing the burden of transfusion-related problems in this vulnerable group. The Autotransfusion device market is undergoing significant growth, driven mainly by the growing number of organ transplant procedures worldwide. In 2024, the US registered 48,149 organ transplants, an increase of 3.3% compared to 2023, feeding the demand for intraoperative blood rescue self-transfusion systems (IBSA). IBSA helps manage blood loss during procedures, reducing dependence on allogenic transfusions, which can lead to immunosuppression and risk of infection.

Recent global commercial tensions, particularly among the main economies, led to the imposition of tariffs on various medical devices, including car transfusion equipment. For example, the US has imposed a 104% rate on certain Chinese products, affecting imports from medical devices, these tariffs can increase the cost of imported car transfusion devices, potentially impacting their adoption, especially on price sensitive markets.

To get more Insights: Request Free Sample Report

Autotransfusion Devices Market Dynamics:

Increase in Organ Transplant Procedures to Boost the Autotransfusion Devices Market

In 2024, the United States achieved a milestone with 48,149 organ transplants, marking a 3.3% increase from 2023 and a 23.3% rise over the past five years. This achievement was made possible by 16,988 deceased donors and 7,030 living donors.

Preoperative Autotransfusion involves collecting and storing patients' blood for a period of time. Blood collection in advance is normally impossible because there is no set a date for liver transplants, except for cases involving living donors. As a result, intraoperative blood salvage Autotransfusion (IBSA) is used as an autologous transfusion strategy. IBSA involves fixing lost blood during the procedure and restarting it in the patient's body through infusion. This eliminates the requirement of an allogenic blood transfusion, which can affect the recipient's existence and have an immunosuppressive effect. Elicited transfusion increases the risk of viral infection transmission and transaction errors in patients. This, in turn, is contributing to the demand for Autotransfusion systems in organ transplant processes to manage blood loss and increase safety and effectiveness during the process.

Advancements in technology to drive the Autotransfusion Devices Market

Autotransfusion technology advances have led to the development of more efficient and easy-to-use devices. In March 2023, Haemonetics Corporation received a 510 (K) (K) from the US Food and Drug Administration (FDA) for the next-generation software for the elite system transfusion of cell corridors. This software update, called Intelligent Control, offers the main customer improvements to help simplify operations, supporting greater efficiency and an enhanced user experience. The growth of blood conservation awareness is boosting the self-transfusion market revenue. Self-transfusion helps reduce the need for allogeneic blood transfusions. Uses a patient's blood, which helps to avoid or minimise the need for donor blood transfusions. This further aids in blood conservation. Autotransfusion salvages and reinfuses blood lost during the surgical process. This Is turns into helps in blood conservation.

High-Cost System Impact on the Autotransfusion Device market

The public awareness of the risks associated with the Auto Transfusion Devices system, and concerns about various initiatives and applications organised by the governments to promote blood donation globally are major factors serving as a ban, and the development of the market for Autotransfusion systems during the forecast period. One of the factors that Autotransfusion Systems hinders the development of the market is the cost of automatic-transfusion.

The most common type of heart surgery costs between 25,000 and to 250,000, depending on the type of surgery, the surgeons involved and where the surgery is performed. This Autotransfusion Systems Market Report includes new recent developments, trade rules, import-export analysis, product analysis, value chain optimisation, market share, impact of domestic and local market players, emerging income pockets, changes in market rules analyses opportunities.

Autotransfusion Device Market Segment Analysis:

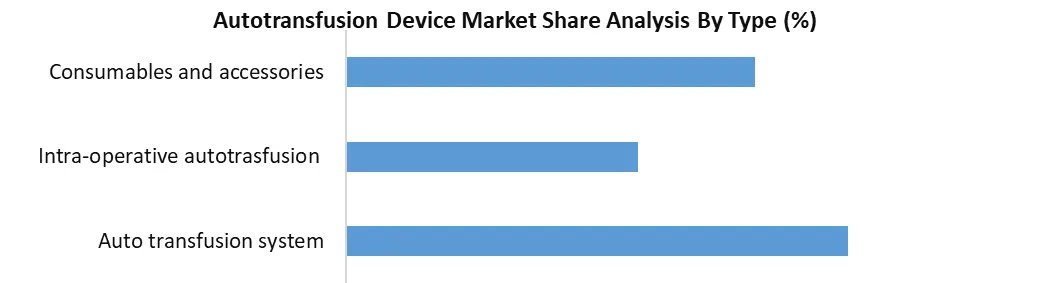

Based on the Type market is segmented into Autotransfusion system, Intra-0perative Autotransfusion, Post-operative, Duel mode, Autotransfusion system, Consumables &Accessries. The Autotransfusion systems segment Dominated market in 2024 & is expected to hold the largest market share over the forecast period. Growth is attributed to the numerous benefits given on traditional blood transfusion methods. Using a patient's blood, self-transfusion also eliminates concerns related to blood consistency and immune responses, making it a safe alternative to many patients.

Moreover, the increasing adoption of Autotransfusion systems in a wide range of surgical features, including cardiac surgery, orthopaedics, trauma surgery and transplant processes, has further enhanced the development of this segment. According to a Perfusion article published in August 2023, researchers are studying the effects of using Autotransfusion or cardiology aspirator during open heart surgery. The goal is to understand how these blood-preserving systems, which separate red blood cells through centrifugation and recirculate the collected blood in the surgical area, impact the patients' hemodynamic, haemostasis, and inflammation levels to reduce complications.

Based on Application, the Autotransfusion Market is segmented into cardiovascular surgeries, Obstetric surgeries, and Gynaecological surgeries. The cardiovascular surgeries segment Dominated The market in and is expected to hold the largest market share over the forecast Period 2024. The global increase in cardiovascular disease is one of the main factors for the development of the Autotransfusion segment. According to the World Health Organisation (WHO), cardiovascular disease represents more than 17.9 million deaths annually, representing 32% of all global deaths. With the more sedentary lifestyle, the incidence of conditions such as coronary artery disease, heart failure and arrhythmias in the next decade is estimated at 15 to 20%. As a result, the demand for cardiovascular surgery-or bypass surgery, valve replacement and heart transplants, annually is increasing by about 6-8%, many of which require Autotransfusion techniques to reduce intraoperative blood loss and improve patient results.

Based on End User market the market is segmented into The hospital and ambulatory and others. Hospital segment Dominated the market in 2024 and is expected to hold the largest Autotransfusion market share over the forecast period. The growing number of hospital surgeries worldwide is leading to segment growth. These systems allow the patient's blood storage and purification during surgical procedures, which reduces the need for allogenic blood transfer and associated risks. In addition, hospitals are increasingly focused on patient safety and results, and automatic transfusion technology aligns with these goals, reducing the risk of reactions and bleeding infections. Moreover, the advances in the self-transfusion technology have led to more efficient and user-friendly systems, making them more attractive to hospitals to enhance their surgical capabilities.

Autotransfusion Device Market Regional Analysis

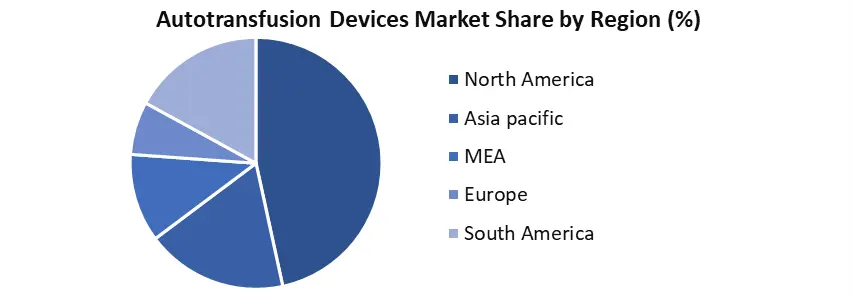

North America dominated the Autotransfusion Devices Market in 2024 and is expected to hold largest share during the forecast. which accounts for about 40-45% of the volume of the global market, which runs with high volume of implants-based processes. US alone In 2023, more than 39,000 organs were implanted, with significant proportions associated with cardiovascular and orthopaedic surgery where Autotransfusion is commonly used. Country-specific market prediction includes major data points such as upstream and downstream value chain analysis, technological advancement (growing on 5-7% CAGR), and five forces of porter. In addition, the analysis considers the influence of domestic rules, tariffs and trade policies, in which import duties range from 2% to 8% based on the classification of the device. Market forecasts are also a factor in the presence of global brands and prices, availability and distribution network challenges, from local competitors to 15-20% market share pressure.

Autotransfusion Device Market Competitive landscape:

Autotransfusion industry players such as Livanova PLC., Haemonetics Corporation and Fresenius SE & Co. KGaA are among the main indispensable, responding for a significant market share of self-transfusion devices in 2024. The significant presence of these companies in the market is attributed to the focus on expanding product offers in the global market. Livanova PLC has a strong brand presence, robust distribution channels and a strong product portfolio. Market participants are increasingly focused on strategic initiatives such as acquisitions and partnerships to increase their footprint in the global market.

|

Autotransfusion Device Market Scope |

|

|

Market Size in 2024 |

USD 309.7 Mn. |

|

Market Size in 2032 |

USD 516.41 Mn. |

|

CAGR (2024-2032) |

6.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Segments |

By Type Auto transfusion system Intra-operative autotrasfusion Consumables and accessories |

|

By End User Hospitals Ambulatory services Others |

|

|

By Application Cardiovascular surgeries Obstetrics surgeries Gynaecological surgeries Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Autotransfusion Devices Market:

North America

- Haemonetics Corporation (U.S.)

- Medtronic PLC (U.S.)

- Fresenius Kabi (U.S.)

- Stryker Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- ProCell Surgical Inc. (U.S.)

- Omnicell, Inc. (U.S.)

- Soma Tech Intl (U.S.)

- LivaNova Inc. (U.S.)

- Cook Medical (U.S.)

Europe

- LivaNova PLC (U.K.)

- Becton, Dickinson and Company (BD) (U.K.)

- Fresenius SE & Co. KGaA (Germany)

- SARSTEDT AG & Co. (Germany)

- Redax S.p.A. (Italy)

- Grifols (Spain)

- Atrium Medical Corporation (Sweden)

- Gambro (Sweden)

- i-SEP (France)

- Advancis Surgical (U.K.)

Asia Pacific

- Terumo Corporation (Japan)

- JMS Co., Ltd. (Japan)

- Beijing ZKSK Technology Co., Ltd. (China)

- Beijing Jingjing Medical Equipment Co., Ltd. (China)

- Gen World Medical Devices (India)

- idsMED (Indonesia)

Middle East & South America

- Braile Biomédica (Brazil)

- Masimo Corporation (U.S.)

- Fresenius Kabi (Germany)

- LivaNova PLC (U.K.)

Frequently Asked Questions

Autotransfusion device market size was 309.7 Mn in 2024.

North America is the Held the largest market share in Autotransfusion devices Market.

LivaNova PLC (U.K.), Haemonetics Corporation (U.S.), Medtronic PLC (Ireland), Fresenius SE & Co. KGaA (Germany), Becton, Dickinson and Company (BD) (U.S.) is the top key players in the Autotransfusion Devices Market.

1. Autotransfusion Device Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Autotransfusion Device Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Autotransfusion Device Market: Dynamics

3.1. Autotransfusion Device Market Trends by Region

3.1.1. North America Autotransfusion Device Market Trends

3.1.2. Europe Autotransfusion Device Market Trends

3.1.3. Asia Pacific Autotransfusion Device Market Trends

3.1.4. Middle East and Africa Autotransfusion Device Market Trends

3.1.5. South America Autotransfusion Device Market Trends

3.2. Autotransfusion Device Market Dynamics

3.2.1. Global Autotransfusion Device Market Drivers

3.2.2. Global Autotransfusion Device Market Restraints

3.2.3. Global Autotransfusion Device Market Opportunities

3.2.4. Global Autotransfusion Device Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Trade Analysis

3.5.1. Top 10 Importing Countries

3.5.2. Top 10 Exporting Countries

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

3.7. Key Opinion Leader Analysis for Industry

4. Autotransfusion Device: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

4.1.1. Auto transfusion system

4.1.2. Intra-operative autotrasfusion

4.1.3. Consumables and accessories

4.2. Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

4.2.1. Hospitals

4.2.2. Ambulatory services

4.2.3. Others

4.3. Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

4.3.1. Cardiovascular surgeries

4.3.2. Obstetrics surgeries

4.3.3. Gynaecological

4.3.4. Others

4.4. Autotransfusion Device Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Autotransfusion Device Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

5.1.1. Auto transfusion system

5.1.2. Intra-operative autotrasfusion

5.1.3. Consumables and accessories

5.2. North America Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

5.2.1. Hospitals

5.2.2. Ambulatory services

5.2.3. Others

5.3. North America Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

5.3.1. Cardiovascular surgeries

5.3.2. Obstetrics surgeries

5.3.3. Gynaecological

5.3.4. Others

5.4. North America Autotransfusion Device Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Auto transfusion system

5.4.1.1.2. Intra-operative autotrasfusion

5.4.1.1.3. Consumables and accessories

5.4.1.2. United States Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

5.4.1.2.1. Hospitals

5.4.1.2.2. Ambulatory services

5.4.1.2.3. Others

5.4.1.3. United States Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

5.4.1.3.1. Cardiovascular surgeries

5.4.1.3.2. Obstetrics surgeries

5.4.1.3.3. Gynaecological

5.4.1.3.4. Others

5.4.1.4. Canada Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

5.4.1.4.1. Auto transfusion system

5.4.1.4.2. Intra-operative autotrasfusion

5.4.1.4.3. Consumables and accessories

5.4.1.5. Canada Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

5.4.1.5.1. Hospitals

5.4.1.5.2. Ambulatory services

5.4.1.5.3. Others

5.4.2. Canada Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

5.4.2.1.1. Cardiovascular surgeries

5.4.2.1.2. Obstetrics surgeries

5.4.2.1.3. Gynaecological

5.4.2.1.4. Others

5.4.3. Mexico

5.4.3.1. Mexico Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

5.4.3.1.1. Auto transfusion system

5.4.3.1.2. Intra-operative autotrasfusion

5.4.3.1.3. Consumables and accessories

5.4.3.2. Mexico Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

5.4.3.2.1. Hospitals

5.4.3.2.2. Ambulatory services

5.4.3.2.3. Others

5.4.3.3. Mexico Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

5.4.3.3.1. Cardiovascular surgeries

5.4.3.3.2. Obstetrics surgeries

5.4.3.3.3. Gynaecological

5.4.3.3.4. Others

6. Europe Autotransfusion Device Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.2. Europe Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.3. Europe Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4. Europe Autotransfusion Device Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.1.3. United Kingdom Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4.2. France

6.4.2.1. France Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.2.3. France Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.3.3. Germany Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.4.3. Italy Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.5.3. Spain Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.6.3. Sweden Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.7.3. Austria Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

6.4.8.3. Rest of Europe Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Autotransfusion Device Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.3. Asia Pacific Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Autotransfusion Device Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.1.3. China Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.2.3. S Korea Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.3.3. Japan Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.4.3. India Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.5.3. Australia Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.6.3. Indonesia Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.7.3. Philippines Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.8.3. Malaysia Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.9.3. Vietnam Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.10. Taiwan

7.4.10.1. Taiwan Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Taiwan Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.10.3. Taiwan Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

7.4.11.3. Rest of Asia Pacific Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Autotransfusion Device Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

8.3. Middle East and Africa Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Autotransfusion Device Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

8.4.1.3. South Africa Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

8.4.2.3. GCC Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

8.4.3.3. Nigeria Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

8.4.4.3. Rest of ME&A Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

9. South America Autotransfusion Device Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

9.2. South America Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

9.3. South America Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

9.4. South America Autotransfusion Device Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

9.4.1.3. Brazil Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

9.4.2.3. Argentina Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Autotransfusion Device Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest of South America Autotransfusion Device Market Size and Forecast, By End User (2024-2032)

9.4.3.3. Rest of South America Autotransfusion Device Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. Haemonetics Corporation (U.S.)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Medtronic PLC (U.S.)

10.3. Fresenius Kabi (U.S.)

10.4. Stryker Corporation (U.S.)

10.5. Teleflex Incorporated (U.S.)

10.6. ProCell Surgical Inc. (U.S.)

10.7. Omnicell, Inc. (U.S.)

10.8. Soma Tech Intl (U.S.)

10.9. LivaNova Inc. (U.S.)

10.10. Cook Medical (U.S.)

10.11. LivaNova PLC (U.K.)

10.12. Becton, Dickinson and Company (BD) (U.K.)

10.13. Fresenius SE & Co. KGaA (Germany)

10.14. SARSTEDT AG & Co. (Germany)

10.15. Redax S.p.A. (Italy)

10.16. Grifols (Spain)

10.17. Atrium Medical Corporation (Sweden)

10.18. Gambro (Sweden)

10.19. i-SEP (France)

10.20. Advancis Surgical (U.K.)

10.21. Terumo Corporation (Japan)

10.22. JMS Co., Ltd. (Japan)

10.23. Beijing ZKSK Technology Co., Ltd. (China)

10.24. Beijing Jingjing Medical Equipment Co., Ltd. (China)

10.25. Gen World Medical Devices (India)

10.26. idsMED (Indonesia)

10.27. Braile Biomédica (Brazil)

10.28. Masimo Corporation (U.S., operating in the Middle East)

10.29. Fresenius Kabi (Germany, operating in South America)

10.30. LivaNova PLC (U.K., operating in the Middle East)

11. Key Findings

12. Analyst Recommendations

13. Autotransfusion Devices Market: Research Methodology