Vibration Monitoring Market Industry Overview (2026-2032) by Offering, Process, System, Industry and, Region

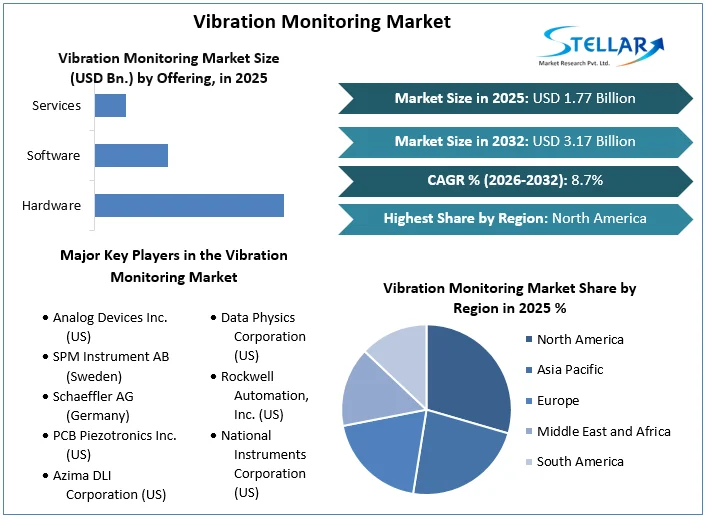

Vibration Monitoring Market size was valued at US$ 1.77 Billion in 2025 and the total revenue is expected to grow at 8.7% from 2026 to 2032, reaching nearly US$ 3.17 Billion.

Format : PDF | Report ID : SMR_411

Vibration Monitoring Market Overview:

A vibration monitoring system is a comprehensive system that can acquire vibration data based on previously decided variables e.g. sampling frequency, vibration intensity, recording duration, recording periods, and frequency wideband. The system is supposed to analyze the captured vibration and convert the data into easy-to-understand indicators for equipment operators, maintenance personnel, and asset owners. The framework should not conflict with the regular functioning of the equipment or configurations being observed, and the device's advantages should outweigh the cost of implementation. The report on Vibration Monitoring Market provides you segment wise by process, offering, system, industry and region.

Excessive human interfered operations, e.g. physical examinations and unplanned adjustments, are reduced via vibration measurements. Technological advances, e.g. system on chip, have extended the bounds of data capture by allowing real-time, precise data logging that can be sent to portable devices e.g. smartphones right away. One of the most inherent benefits of cordless systems is the ability to provide essential data to all linked functionalities of an organization at the same time.

The market's growth drivers, as well as the market's segments (Offering, Process, System, Industry, and, Region), are analyzed in this research. Market participants, regions, and special requirements have all provided data. This market study provides an in-depth look at all of the important advancements that are currently taking place across all industry sectors. Statistics, infographics, and presentations are used to provide key data analysis. The analysis looks at the market's Drivers, Restraints, Opportunities, and Challenges for the Vibration Monitoring market. The study aids in the evaluation of market growth drivers and the determination of how to employ these drivers as a tool. The research also aids in the correction and resolution of difficulties with the global vibration monitoring market.

To get more Insights: Request Free Sample Report

Vibration Monitoring Market Dynamics:

The growing demand for remote monitoring operations after the COVID-19 outbreak is a major driver of the vibration monitoring market. Plant closures and supply chain interference have affected the manufacturing and process sectors throughout the world. Physical separation rules and limits on crowd mobility have also had an impact on the functioning of numerous enterprises. As a consequence of these steps, production and industrial plants now demand distant monitoring and effective control. Because of the financial downturn, firms in several sectors chose not to adopt modern vibration monitoring equipment because of the economic drawback during the outbreak.

Dependability problems related to the forecasting capabilities of monitoring systems are a major restraint in the vibration monitoring market growth. Due to errors produced by these devices in the form of lost measurements, service interruptions, and inaccurate alerting signals, experienced operators are sometimes dubious of the diagnoses and forecasts offered by vibration monitoring systems. Furthermore, personnel may be resistant to the new manner of designing and sustaining process efficiency, leading to a lack of support for the adoption of effective vibration monitoring programs. This is due to the difficulty of production environments, which may comprise various resources on which vibration monitoring systems and services may be hard to execute..

Deep learning, in combination with effective big data analytics and parallel processing architecture, is revolutionizing the vibration monitoring business. Because of its capacity to analyze enormous amounts of data, big data analytics has sped up the process of analyzing data supplied by status monitoring devices. Machine learning makes for simple equipment performance evaluation, the integrity of information, and effective coordination across multiple vibration monitoring system operations. Vibration analysis powered by large datasets eliminates the expense of ownership of equipment and allows businesses to function more effectively.

Vibration Monitoring Market Segment Analysis:

By Industry, the Oil and Gas segment dominated the vibration monitoring market in 2025. It is expected to grow at a CAGR of 9.3% in the aforementioned forecast period.

Due to the growing strain of high operating expenses of oil and gas facilities, the sector has been focusing on enhancing sustainability. Price changes in the worldwide market are yet another element adding to the oil & gas industry's rising demand to decrease operational costs. As a result, vibration monitoring systems and products are projected to be used by this sector to preserve the effective service of its valuable equipment and prevent downtime.

The complete ecology of equipment monitoring systems assures continuous processing equipment functions with little downtime, lowering maintenance expenditure and enhancing the productivity of oil and gas equipment. Furthermore, the growing popularity of digital vibration monitoring systems is likely to spur the vibration monitoring business for the oil and gas segment even further. Even though the industry represented the greatest portion of the market in 2020, oil prices plummeted due to the COVID-19 outbreak in that year.

Vibration Monitoring Market Regional Insights:

North America is expected to account for the largest vibration monitoring market share at the end of the forecast period. The requirement for vibration monitoring technologies and devices in North America is driven by factors e.g. an increased emphasis on maximized resource utilization, rigid regulatory changes for employees and staff safety, and strict quality control in the oil and gas, pesticide, and beverages industry. The rising demand for vibration monitoring systems in the US is fueled by a focus on facility equipment management and the existence of major market participants e.g. Honeywell International and National Instruments.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Vibration Monitoring Market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The market report examines all segments of the industry, with a focus on significant players such as market leaders, followers, and new entrants. The report includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favorable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry. The research also aids in comprehending the Vibration Monitoring Market dynamics and structure by studying market segments and forecasting market size. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Vibration Monitoring Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Breakthroughs in the vibration monitoring market are discussed, as well as organic and inorganic growth plans. Various companies are focusing on organic growth strategies such as new product releases, product approvals, and other items such as patents and events. Inorganic growth strategies used in the industry included acquisitions, partnerships, and collaborations.

Vibration Monitoring Market Scope:

|

Vibration Monitoring Market |

|

|

Market Size in 2025 |

USD 1.77 Bn. |

|

Market Size in 2032 |

USD 3.17 Bn. |

|

CAGR (2026-2032) |

8.7% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

by Offering

|

|

by process

|

|

|

By System

|

|

|

|

By Industry

|

|

Regional Scope |

North America- United States, Canada, and Mexico

Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Vibration Monitoring Market Players:

- Analog Devices Inc. (US)

- SPM Instrument AB (Sweden)

- Schaeffler AG (Germany)

- PCB Piezotronics Inc. (US)

- Azima DLI Corporation (US)

- Data Physics Corporation (US)

- Rockwell Automation, Inc. (US)

- National Instruments Corporation (US)

- General Electric Corporation (US)

- Emerson Electric Company (US)

- Honeywell International Inc.(US)

- Bruel & Kjaer Sound & Vibration Measurement (Denmark)

- Meggit PLC (UK)

Frequently Asked Questions

The growing demand for remote monitoring operations after the COVID-19 outbreak is a major driver of the market.

The key players are Honeywell, National instruments, etc.

the Oil and Gas segment is expected to grow at a CAGR of 9.3% in the aforementioned forecast period.

1. Vibration Monitoring Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumptions

2. Vibration Monitoring Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Vibration Monitoring Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Portfolio

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Vibration Monitoring Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Legal Factors

4.7.5. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Vibration Monitoring Market Size and Forecast by Segments (by Value USD Million)

5.1. Vibration Monitoring Market Size and Forecast, By Offering (2025-2032)

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. Vibration Monitoring Market Size and Forecast, By Process (2025-2032)

5.2.1. Online Vibration Monitoring

5.2.2. Portable Vibration Monitoring

5.3. Vibration Monitoring Market Size and Forecast, By System (2025-2032)

5.3.1. Embedded Systems

5.3.2. Vibration Analyzers

5.3.3. Vibration Meters

5.4. Vibration Monitoring Market Size and Forecast, By Industry (2025-2032)

5.4.1. Oil & Gas

5.4.2. Power Generation

5.4.3. Mining & Metals

5.4.4. Chemical

5.4.5. Automotive

5.4.6. Aerospace & Defense

5.4.7. Food and Beverage

5.4.8. Marine

5.4.9. Other

5.5. Vibration Monitoring Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Vibration Monitoring Market Size and Forecast (by Value USD Million)

6.1. North America Vibration Monitoring Market Size and Forecast, By Offering (2025-2032)

6.1.1. Hardware

6.1.2. Software

6.1.3. Services

6.2. North America Vibration Monitoring Market Size and Forecast, By Process (2025-2032)

6.2.1. Online Vibration Monitoring

6.2.2. Portable Vibration Monitoring

6.3. North America Vibration Monitoring Market Size and Forecast, By System (2025-2032)

6.3.1. Embedded Systems

6.3.2. Vibration Analyzers

6.3.3. Vibration Meters

6.4. North America Vibration Monitoring Market Size and Forecast, By Industry (2025-2032)

6.4.1. Oil & Gas

6.4.2. Power Generation

6.4.3. Mining & Metals

6.4.4. Chemical

6.4.5. Automotive

6.4.6. Aerospace & Defense

6.4.7. Food and Beverage

6.4.8. Marine

6.4.9. Other

6.5. North America Vibration Monitoring Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Vibration Monitoring Market Size and Forecast (by Value USD Million)

7.1. Europe Vibration Monitoring Market Size and Forecast, By Offering (2025-2032)

7.2. Europe Vibration Monitoring Market Size and Forecast, By Process (2025-2032)

7.3. Europe Vibration Monitoring Market Size and Forecast, By System (2025-2032)

7.4. Europe Vibration Monitoring Market Size and Forecast, By Industry (2025-2032)

7.5. Europe Vibration Monitoring Market Size and Forecast, by Country (2025-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Vibration Monitoring Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Vibration Monitoring Market Size and Forecast, By Offering (2025-2032)

8.2. Asia Pacific Vibration Monitoring Market Size and Forecast, By Process (2025-2032)

8.3. Asia Pacific Vibration Monitoring Market Size and Forecast, By System (2025-2032)

8.4. Asia Pacific Vibration Monitoring Market Size and Forecast, By Industry (2025-2032)

8.5. Asia Pacific Vibration Monitoring Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Vibration Monitoring Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Vibration Monitoring Market Size and Forecast, By Offering (2025-2032)

9.2. Middle East and Africa Vibration Monitoring Market Size and Forecast, By Process (2025-2032)

9.3. Middle East and Africa Vibration Monitoring Market Size and Forecast, By System (2025-2032)

9.4. Middle East and Africa Vibration Monitoring Market Size and Forecast, By Industry (2025-2032)

9.5. Middle East and Africa Vibration Monitoring Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Vibration Monitoring Market Size and Forecast (by Value USD Million)

10.1. South America Vibration Monitoring Market Size and Forecast, By Offering (2025-2032)

10.2. South America Vibration Monitoring Market Size and Forecast, By Process (2025-2032)

10.3. South America Vibration Monitoring Market Size and Forecast, By System (2025-2032)

10.4. South America Vibration Monitoring Market Size and Forecast, By Industry (2025-2032)

10.5. South America Vibration Monitoring Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Analog Devices Inc.

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.2.1. Service Name

11.1.2.2. Service Details

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. SPM Instrument AB

11.3. Schaeffler AG

11.4. PCB Piezotronics Inc.

11.5. Azima DLI Corporation

11.6. Data Physics Corporation

11.7. Rockwell Automation, Inc.

11.8. National Instruments Corporation

11.9. General Electric Corporation

11.10. Emerson Electric Company

11.11. Honeywell International Inc.

11.12. Bruel & Kjaer Sound & Vibration Measurement

11.13. Meggit PLC

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook