Education PC Market Size, Share & Trends Analysis Report by Type, Application, End-User, Region, and Forecasts (2025-2032)

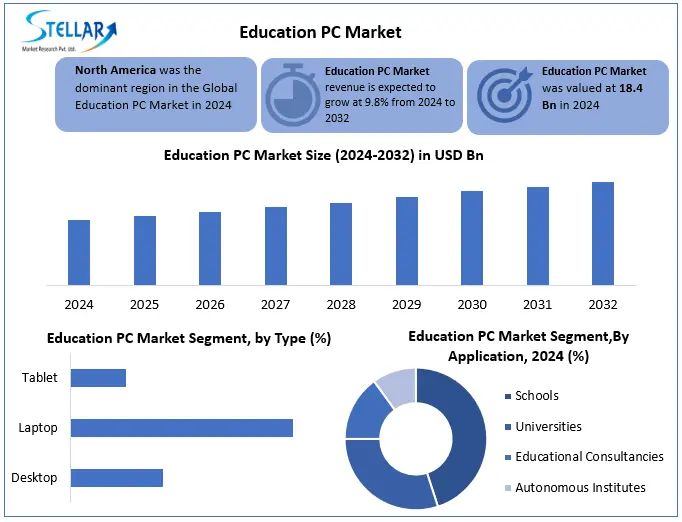

The Education PC Market size was valued at USD 18.4 Bn in 2024, and Global Education PC Market revenue is expected to grow at a CAGR of 9.8% from 2025 to 2032, reaching nearly USD 38.87 Bn.

Format : PDF | Report ID : SMR_2789

Education PC Market Overview:

An Education PC is a computer designed for educational use by students, teachers, and educational institutions. These devices are cost -effective, strong, and come with preloaded learning tools. They provide features such as extended battery life, integrated cameras and safety settings for children, making them ideal for class and online learning. Popular models include laptops, tablets and chromebook designed for a study environment.

The Global Education PC Market has been growing rapidly as schools and colleges find better ways to teach and learn. With more hybrid sections after covid, there has been a major change in digital tools. Governments are also taking steps to support this change by bringing new technical programs. Instead of sharing computers, many schools now give their laptop or tablet to each student. It helps students go from home or anywhere. Teachers are using more digital tools such as video calls, cloud software and smart boards, which require good PCs to work well.

In some places, governments provide free or cheap PCs to schools, especially in in far-off areas where children do not have much access. They sometimes provide low-cost internet. In addition, digital exams and e-books are now more common, and old machines do not work well with these. Because of this, companies are making PCs only for students- light, easy to carry, with strong batteries and simple features. All these things are making PC market big every year, because people see how useful it is to learn better.

To get more Insights: Request Free Sample Report

Education PC Market Dynamics:

Rise of One-to-One Learning Programs to Fuel the Education PC Market

One-to-one learning programs, whereby every student receives a laptop or tablet, are fast becoming a common way of teaching in education systems around the world. This replaces the learning experience with shared equipment, whilst each student has a more personal and flexible moment of learning experience. With their own devices, students can access the texts, complete the assignment, and participate in both traditional and virtual learning at their own pace. For teachers, it simplifies class management and allows customized instructions. These programs also support continuous learning during disruption. Governments and schools are investing in such an initiative to shut down the digital divide and provide similar educational access, especially in remote areas. The growing requirement of digital learning tools is pushing PC manufacturers to design cheap, strong and user-friendly devices that meet classroom needs. Major features such as extended battery life, hardware, and built-in educational software are now standard requirements. At the same time, a strong partnership between technical companies and government education departments leads to large-scale device supply agreements, which promotes the development of the education PC market.

Expansion of Hybrid and Remote Learning Models to Drive Growth of the Education PC Market

The shift towards hybrid and remote learning has become a defined change in modern education. Schools and universities are adopting fast mixed models, where students divide their time between in-person classes and online learning. This transition has greatly increased the demand for individual computing equipment that supports both physical and virtual class environments. Education PCs have become essential tools in this setup. They enable students to participate in virtual lectures, complete online assignments, reach cloud-based teaching resources, and collaborate with teachers and colleagues. For teachers, these tools allow smooth communication, lesson planning, and engagement of students regardless of the location. The pandemic intensified this change, but the flexibility and continuity that the hybrid learning offers have ensured its long-term relevance. Institutions are formalizing remote learning policies and are investing in infrastructure supporting digital education. As a result, education is increasing the need for reliable, durable, and student-friendly PCs as a major driver of development in the PC market, with the position of hybrid and remote learning models.

Integration of AI and Smart Learning Tools to create opportunities for the Education PC Market

The growing adoption of Artificial Intelligence (AI) and Smart Learning Platforms in the education sector is opening new doors for the Education PC Market. AI-powered tools, adaptive learning software, virtual teaching assistants, speech recognition, and individual content require high computing performance and advanced device compatibility. This is creating opportunities for education PC with strong processors, large memory, and underlying support for AI functionalities. As schools and institutions rely on data-driven insight to track rapid student progress and to personalize instruction, the need for compatible hardware becomes important. Education PCs are developing to support these techniques, offering features such as real-time analytics, accessibility tools, and intelligent tutoring systems. Manufacturers and Edtech companies have an opportunity to design and market education PCs that are adapted to the smart learning environment. By integrating AI abilities, tools can provide more attractive, customized, and efficient learning experiences, keeping this trend as a major opportunity of future development in the education PC market.

Low Digital Literacy Among Educators is a restraining factor for the Education PC Market

Limited digital skills among teachers serve as a major obstacle for PC market development. Many teachers are not well trained in using computer or digital learning platforms, which prevents them from fully integrating technology into their teaching methods. This often leads to poor use of equipment and low student interaction, which reduces the overall impact of such investments. In areas where teacher training programs are lacking, introducing PCs into classrooms becomes less effective. Even when schools provide devices, the lack of digital competency among educators can result in minimal improvements in learning outcomes, slowing market expansion.

Education PC Market Segment Analysis

Based on Type, Education PC market is classified into desktops, laptops, and tablets. Laptop segment dominated the market in 2024 and is expected to dominated the largest market share during the forecast period. Laptop is a dominating segment due to their optimal balance of dynamics, performance, and costs. Compared to desktops, laptops provide portability that supports both class-based and remote teaching environment. Increasing hybrid learning models and one-to-one device programs has created a strong need for reliable, high-performing systems capable of supporting video conferencing, digital content delivery and interactive learning. In response, many educational institutions and government bodies are preferring laptops for wholesale purchase, recognizing their durability, scalability and long -term value. These benefits are in the position of laptops as the most practical and widely adopted solutions in modern education, which strengthen their market leadership within the Global Education PC Market.

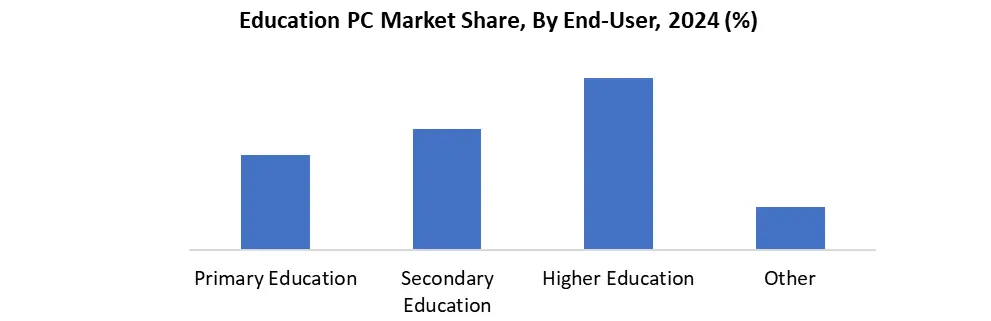

Based on End-User, Education PC market is classified into Primary Education, Secondary Education, Higher Education, Other. Higher Education segment dominated the market in 2024 and is expected to capture the largest market share during the forecast period. Higher education is a dominant section due to digital infrastructure and increased dependence on advanced teaching technologies in universities and colleges. At this stage, students require strong, high-performance computing devices capable of handling complex educational activities, including research, programming, data analytics, digital design, and online evaluation. Higher education institutions are also at the forefront of hybrid and completely remote learning environments, which increases the demand for individual PCs. Many universities collaborate with technical providers to supply students with cost-effective device bundles or subsidized systems, which increase access to the device on a large scale.

Education PC Market Regional Analysis

North America was a dominant region in 2024 and is expected to hold the largest market share in the Education PC Market over the forecast period due to its well-established digital infrastructure, strong government funding for education, and widely adopted technology in classrooms. The region has seen the initial and large implementation of one-to-one device programs in K-12 and higher education institutions, especially in the United States and Canada. In addition, high internet availability, the adoption of Edtech solutions quickly, and strong cooperation between educational institutions and technology giants such as Microsoft, Google, Apple, and Dell have strengthened the ecosystem. These combined factor continues to increase and solidify the leadership of North America in the global education PC market.

Education PC Market Competitive Landscape

Dell plays a major role in the education PC market, which offers a comprehensive selection of laptops, desktops and accessories designed for both K-12 and higher education. The company’s latitude and Chromebook lines are popular for their strong safety, dependability, and easy IT management. The company has built solid relationships with educational institutions across the U.S., offering services like ProSupport and Dell Technologies Education Services. Its strength includes a strong B2B supply chain, responsive support, and compatibility with both Windows and Chrome platforms.

Lenovo is a top player in the Asia-Pacific Education PC market and grows in North America and Europe. The company’s ThinkPad, Ideapad, and Chromebook models are considered durable, budget-friendly, and valuable for education. The company enhances its appearance through partnership with NGOs such as solve education. In 2025, Lenovo introduced AI-managed laptops with Windows 11 and Chromos built for the hybrid learning environment.

Education PC Market Recent Developments

- On January 16, 2025, Lenovo launched a new range of education laptops running Windows 11 and ChromeOS, designed for AI-integrated digital Learning at the Future of Education Technology Conference (FETC). The lineup includes Lenovo Chromebook Plus 2 in-1, 13W, Gen 3, and the General 5 series. These devices provide extended durability and connectivity, and will be showcased at Bett 2025, Lenovo's AI Education Insights, and Ducati STEM partnership.

- On January 24, 2024, at BETT UK, ASUS unveiled its latest BR, CR, and CZ series laptops, including the Flagship BR1204, which was designed for classroom durability. This is the third consecutive education-centered launch of Asus in this program. The new Chromebooks-CR1204, CR1104, CZ1204, and CZ1104- are designed to enhance flexibility and dynamics in hybrid learning, which strengthens Asus' commitment to carry forward educational technology solutions.

|

Education PC Market Scope |

|

|

Market Size in 2024 |

USD 18.4 Bn. |

|

Market Size in 2032 |

USD 38.87 Bn. |

|

CAGR (2025-2032) |

9.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Desktop Laptop Tablet |

|

By Application Schools Universities Educational Consultancies Autonomous Institutes |

|

|

By End-User Primary Education Secondary Education Higher Education Other |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America

|

Leading Players in the Education PC Market

North America

- IBM Corp. (US)

- SMART Technologies Inc. (US)

- AT&T Technologies Inc. (Canada)

- Blackboard Inc. (US)

- Dell Inc. (US)

- Apple Inc. (US)

- Microsoft Corp. (US)

- HP (US)

- Compaq (US)

Asia-Pacific

- Lenovo Group Ltd (Hong Kong)

- Toshiba (Japan)

- Panasonic (Japan)

- Samsung (South Korea)

- LG (South Korea)

- Sony (Japan)

- AsusTek (Taiwan)

- HCL (India)

- NEC (Japan)

- Acer Inc. (Taiwan)

- Elitegroup Computer Systems Co., Ltd (Taiwan)

Frequently Asked Questions

The growth of virtual classes, e-books, and online learning tools is prompting schools and colleges to buy more PCs for both students and teachers.

North America is the dominating region in the Education PC market.

Dell Inc., Apple Inc., Acer Inc., Samsung, Lenovo Group Ltd, Sony, AsusTek, Compaq, SMART Technologies Inc., Etc.

1. Education PC Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Education PC Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Business Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

3. Education PC Market: Dynamics

3.1. Education PC Market Trends by Region

3.1.1. North America Education PC Market Trends

3.1.2. Europe Education PC Market Trends

3.1.3. Asia Pacific Education PC Market Trends

3.1.4. Middle East and Africa Education PC Market Trends

3.1.5. South America Education PC Market Trends

3.2. Education PC Market Dynamics

3.2.1. Education PC Market Drivers

3.2.2. Education PC Market Restraints

3.2.3. Education PC Market Opportunities

3.2.4. Education PC Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Education PC Market Industry

4. Education PC Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Education PC Market Size and Forecast, By Type (2024-2032)

4.1.1. Desktop

4.1.2. Laptop

4.1.3. Tablet

4.2. Education PC Market Size and Forecast, By Application (2024-2032)

4.2.1. Schools

4.2.2. Universities

4.2.3. Educational Consultancies

4.2.4. Autonomous Institutes

4.3. Education PC Market Size and Forecast, By End User (2024-2032)

4.3.1. Primary Education

4.3.2. Secondary Education

4.3.3. Higher Education

4.3.4. Other

4.4. Education PC Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Education PC Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Education PC Market Size and Forecast, By Type (2024-2032)

5.1.1. Desktop

5.1.2. Laptop

5.1.3. Tablet

5.2. North America Education PC Market Size and Forecast, By Application (2024-2032)

5.2.1. Schools

5.2.2. Universities

5.2.3. Educational Consultancies

5.2.4. Autonomous Institutes

5.3. North America Education PC Market Size and Forecast, By End User (2024-2032)

5.3.1. Primary Education

5.3.2. Secondary Education

5.3.3. Higher Education

5.3.4. Other

5.4. North America Education PC Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Education PC Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Desktop

5.4.1.1.2. Laptop

5.4.1.1.3. Tablet

5.4.1.2. United States Education PC Market Size and Forecast, By Application (2024-2032)

5.4.1.2.1. Schools

5.4.1.2.2. Universities

5.4.1.2.3. Educational Consultancies

5.4.1.2.4. Autonomous Institutes

5.4.1.3. United States Education PC Market Size and Forecast, By End User (2024-2032)

5.4.1.3.1. Primary Education

5.4.1.3.2. Secondary Education

5.4.1.3.3. Higher Education

5.4.1.3.4. Other

5.4.2. Canada

5.4.2.1. Canada Education PC Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Desktop

5.4.2.1.2. Laptop

5.4.2.1.3. Tablet

5.4.2.2. Canada Education PC Market Size and Forecast, By Application (2024-2032)

5.4.2.2.1. Schools

5.4.2.2.2. Universities

5.4.2.2.3. Educational Consultancies

5.4.2.2.4. Autonomous Institutes

5.4.3. Canada Education PC Market Size and Forecast, By End User (2024-2032)

5.4.3.1.1. Primary Education

5.4.3.1.2. Secondary Education

5.4.3.1.3. Higher Education

5.4.3.1.4. Other

5.4.4. Mexico

5.4.4.1. Mexico Education PC Market Size and Forecast, By Type (2024-2032)

5.4.4.1.1. Desktop

5.4.4.1.2. Laptop

5.4.4.1.3. Tablet

5.4.4.2. Mexico Education PC Market Size and Forecast, By Application (2024-2032)

5.4.4.2.1. Schools

5.4.4.2.2. Universities

5.4.4.2.3. Educational Consultancies

5.4.4.2.4. Autonomous Institutes

5.4.4.3. Mexico Education PC Market Size and Forecast, By End User (2024-2032)

5.4.4.3.1. Primary Education

5.4.4.3.2. Secondary Education

5.4.4.3.3. Higher Education

5.4.4.3.4. Other

6. Europe Education PC Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Education PC Market Size and Forecast, By Type (2024-2032)

6.2. Europe Education PC Market Size and Forecast, By Application (2024-2032)

6.3. Europe Education PC Market Size and Forecast, By End User (2024-2032)

6.4. Europe Education PC Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Education PC Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Education PC Market Size and Forecast, By Application (2024-2032)

6.4.1.3. United Kingdom Education PC Market Size and Forecast, By End User (2024-2032)

6.4.2. France

6.4.2.1. France Education PC Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Education PC Market Size and Forecast, By Application (2024-2032)

6.4.2.3. France Education PC Market Size and Forecast, By End User (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Education PC Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Education PC Market Size and Forecast, By Application (2024-2032)

6.4.3.3. Germany Education PC Market Size and Forecast, By End User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Education PC Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Education PC Market Size and Forecast, By Application (2024-2032)

6.4.4.3. Italy Education PC Market Size and Forecast, By End User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Education PC Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Education PC Market Size and Forecast, By Application (2024-2032)

6.4.5.3. Spain Education PC Market Size and Forecast, By End User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Education PC Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Education PC Market Size and Forecast, By Application (2024-2032)

6.4.6.3. Sweden Education PC Market Size and Forecast, By End User (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Education PC Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Education PC Market Size and Forecast, By Application (2024-2032)

6.4.7.3. Austria Education PC Market Size and Forecast, By End User (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Education PC Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Education PC Market Size and Forecast, By Application (2024-2032)

6.4.8.3. Rest of Europe Education PC Market Size and Forecast, By End User (2024-2032)

7. Asia Pacific Education PC Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Education PC Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Education PC Market Size and Forecast, By Application (2024-2032)

7.3. Asia Pacific Education PC Market Size and Forecast, By End User (2024-2032)

7.4. Asia Pacific Education PC Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Education PC Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Education PC Market Size and Forecast, By Application (2024-2032)

7.4.1.3. China Education PC Market Size and Forecast, By End User (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Education PC Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Education PC Market Size and Forecast, By Application (2024-2032)

7.4.2.3. S Korea Education PC Market Size and Forecast, By End User (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Education PC Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Education PC Market Size and Forecast, By Application (2024-2032)

7.4.3.3. Japan Education PC Market Size and Forecast, By End User (2024-2032)

7.4.4. India

7.4.4.1. India Education PC Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Education PC Market Size and Forecast, By Application (2024-2032)

7.4.4.3. India Education PC Market Size and Forecast, By End User (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Education PC Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Education PC Market Size and Forecast, By Application (2024-2032)

7.4.5.3. Australia Education PC Market Size and Forecast, By End User (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Education PC Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Education PC Market Size and Forecast, By Application (2024-2032)

7.4.6.3. Indonesia Education PC Market Size and Forecast, By End User (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Education PC Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Education PC Market Size and Forecast, By Application (2024-2032)

7.4.7.3. Philippines Education PC Market Size and Forecast, By End User (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Education PC Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Education PC Market Size and Forecast, By Application (2024-2032)

7.4.8.3. Malaysia Education PC Market Size and Forecast, By End User (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Education PC Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Education PC Market Size and Forecast, By Application (2024-2032)

7.4.9.3. Vietnam Education PC Market Size and Forecast, By End User (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Education PC Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Education PC Market Size and Forecast, By Application (2024-2032)

7.4.10.3. Thailand Education PC Market Size and Forecast, By End User (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Education PC Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Education PC Market Size and Forecast, By Application (2024-2032)

7.4.11.3. Rest of Asia Pacific Education PC Market Size and Forecast, By End User (2024-2032)

8. Middle East and Africa Education PC Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Education PC Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Education PC Market Size and Forecast, By Application (2024-2032)

8.3. Middle East and Africa Education PC Market Size and Forecast, By End User (2024-2032)

8.4. Middle East and Africa Education PC Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Education PC Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Education PC Market Size and Forecast, By Application (2024-2032)

8.4.1.3. South Africa Education PC Market Size and Forecast, By End User (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Education PC Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Education PC Market Size and Forecast, By Application (2024-2032)

8.4.2.3. GCC Education PC Market Size and Forecast, By End User (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Education PC Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Education PC Market Size and Forecast, By Application (2024-2032)

8.4.3.3. Nigeria Education PC Market Size and Forecast, By End User (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Education PC Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Education PC Market Size and Forecast, By Application (2024-2032)

8.4.4.3. Rest of ME&A Education PC Market Size and Forecast, By End User (2024-2032)

9. South America Education PC Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Education PC Market Size and Forecast, By Type (2024-2032)

9.2. South America Education PC Market Size and Forecast, By Application (2024-2032)

9.3. South America Education PC Market Size and Forecast, By End User (2024-2032)

9.4. South America Education PC Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Education PC Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Education PC Market Size and Forecast, By Application (2024-2032)

9.4.1.3. Brazil Education PC Market Size and Forecast, By End User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Education PC Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Education PC Market Size and Forecast, By Application (2024-2032)

9.4.2.3. Argentina Education PC Market Size and Forecast, By End User (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Education PC Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest Of South America Education PC Market Size and Forecast, By Application (2024-2032)

9.4.3.3. Rest Of South America Education PC Market Size and Forecast, By End User (2024-2032)

10. Company Profile: Key Players

10.1. IBM Corp. (US)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. SMART Technologies Inc. (US)

10.3. AT&T Technologies Inc. (Canada)

10.4. Blackboard Inc. (US)

10.5. Dell Inc. (US)

10.6. Apple Inc. (US)

10.7. Microsoft Corp. (US)

10.8. HP (US)

10.9. Compaq (US)

10.10. Lenovo Group Ltd (Hong Kong)

10.11. Toshiba (Japan)

10.12. Panasonic (Japan)

10.13. Samsung (South Korea)

10.14. LG (South Korea)

10.15. Sony (Japan)

10.16. AsusTek (Taiwan)

10.17. HCL (India)

10.18. NEC (Japan)

10.19. Acer Inc. (Taiwan)

10.20. Elitegroup Computer Systems Co., Ltd (Taiwan)

11. Key Findings

12. Analyst Recommendations

13. Education PC Market: Research Methodology