Battery IoT Market: Global Industry Analysis and Forecast (2025-2032)

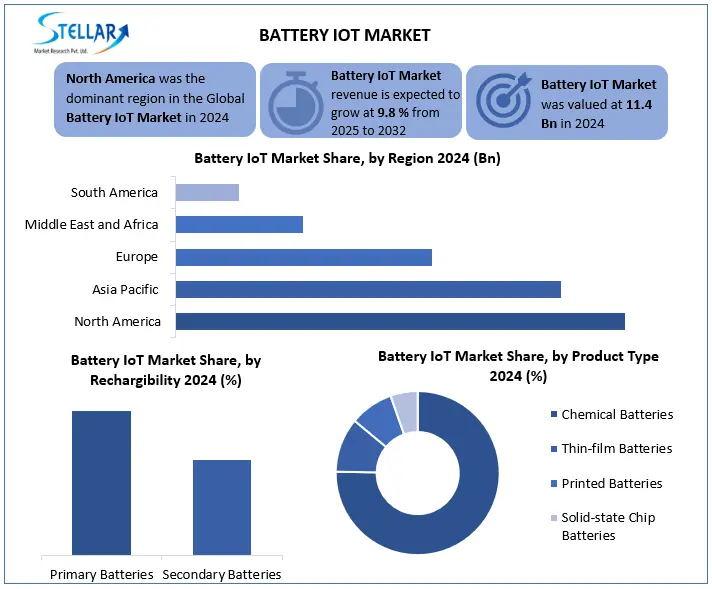

The Battery IoT Market size was valued at USD 11.4 Bn in 2024, and the total Battery IoT Market revenue is expected to grow at a CAGR of 9.8% from 2025 to 2032, reaching nearly USD 24.08 Bn.

Format : PDF | Report ID : SMR_2805

Battery IoT Market Overview:

Battery is the application of Internet of Things (IoT) technology to monitor, manage, and optimize battery performance and health. The rising demand for IoT Devices is the key driver of the Battery IoT Market. Government programs like the CHIPS Act and the Inflation Reduction Act further rise domestic battery manufacturing and revolution, mainly in solid-state and printed battery technologies. the trend in the Battery IoT industry is huge deployment of 5G technology is reshaping IoT connectivity and meeting demand for strong and efficient battery solutions. The Asia-Pacific region is the most dominant in the Battery for IoT Market. The top two leading global companies in the battery IoT market are CATL and STMicroelectronics.

In 2025, the U.S. government has been implementing extensive tariff rises on Chinese imports, with an important effect on the Battery IoT market. Tariffs on lithium-ion electric vehicle batteries rise from 7.5% to 25%, and electric vehicles now have a 100% tariff.

To get more Insights: Request Free Sample Report

Battery IoT Market Dynamics:

Growing Demand for IoT Devices to Drive the Battery IoT Market

IoT devices are heavily dependent on battery power, mainly for their continuous and independent operation, particularly in a distant or mobile environment where cable power is not an option. In the Battery IoT Market, IoT applications spread throughout areas such as consumer electronics, healthcare, industrial IoT (IIoT), and smart cities, there is a greater demand for high-performance, long-lasting, and small batteries.

Consumer Electronics: Goods such as smartwatches, fitness trackers, smart speakers, and home automation are gaining popularity and require small and low-energy batteries.

Healthcare: Use of wearable medical devices, remote patient monitoring, and implantable sensors is growing, completely dependent on long-life batteries to support to operations and patient care.

Industrial IoT (IIoT): Analytical maintenance, asset tracking, and environmental monitoring sensors are becoming stimulated throughout workshops, supply chains, and agriculture and are requiring rugged, low-maintenance power sources.

Smart Cities: Infrastructure such as smart meters, traffic devices, surveillance systems, and conservation monitors operate battery-powered IoT nodes to facilitate city digital transformation.

Advancements in Solid-State Battery Technology to Drive the Battery IoT Market

Solid-state batteries have additional protection features, high energy density, long lifespan, and higher charge capacity than traditional lithium-ion batteries. Hence, advancements in solid-state battery technology to driving the battery IoT market. They are meeting the energy needs of sophisticated IoT systems. Also, they reduce the chance of leaks or fires and offer improved performance in extremely hot or cold temperatures. These features support IoT devices running more efficiently with reduced maintenance needs, boosting the demand for advanced battery technologies within the IoT market.

Limited Battery Life and Replacement to Restrain the Battery IoT Market Growth

Limited Battery Life and Replacement directly disturb the cost-effectiveness, scalability, and long-term behaviour of IoT deployments. IoT devices are expected to continuously work for at least 5 to 10 years. Therefore, traditional battery technologies like lithium-ion and alkaline do not meet these long-duration use, mostly in extreme weather situations such as heavy heat, high moisture, or strong vibration. This leads to higher operational expenses, restricts scalability, and generates logistical irritations for the replacement of batteries in the Battery IoT Market.

Battery IoT Market Segment Analysis:

Based on product type, the Battery for IoT Market are divided into Chemical Batteries, Thin-film Batteries, Printed Batteries and Solid-state Chip Batteries. The most dominant product type in the Battery IoT Market is Chemical Batteries, primarily Lithium-ion batteries. Due to their high energy density, long lifecycle, cost-effectiveness, and broad compatibility with a wide range of IoT devices. Globally, Li-ion batteries account for over 70% of the whole battery share in the IoT market. China dominates global Li-ion battery manufacture over 75% of capacity, followed by South Korea and Japan.

Based on rechargeability, the Battery IoT Market is divided into Primary Batteries and Secondary Batteries. The secondary battery segment holds a larger share in the Battery IoT Market. Due to their rechargeability, longer life, and affordability for IoT use. Secondary batteries, like lithium-ion, are recharged hundreds or thousands of times and are best suitable for long usage in devices that require continuous operation, such as smart home devices. The Asia-Pacific region dominates the secondary batteries market globally, with China, Japan, and South Korea leading the lithium-ion battery production due to their lower prices, enhanced energy density, and faster charging times of lithium-ion batteries, mainly for electric vehicles and IoT devices.

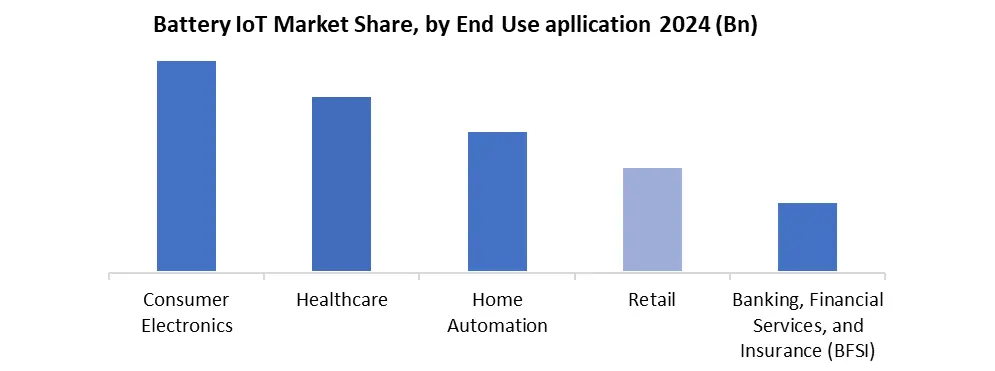

Based on End-use application, the Battery IoT market is segmented into wearable devices, consumer electronics, healthcare, home automation, retail, banking, financial services and insurance (BFSI), aerospace and Défense, industrial, agriculture, and smart packaging. The most dominant segment in the Battery IoT market is consumer electronics. This segment has the largest market share because of the growing need for smart devices and connected technologies in everyday life. The swift digitization of ordinary life, accelerated internet penetration, and the trend of smart homes have greatly pushed up the requirement for consumer electronics.

Battery IoT Market Regional Analysis:

R&D expenditure to boost North America Battery IoT Market growth

North America is the most dominant region in the global battery IoT market. Because of its vast R&D expenditure, a highly developed production ecosystem and early investment in digital infrastructure. The U.S. leads the battery IoT market because of the high emphasis on research and development, new adoption of next-generation technologies such as 5G, and vast IoT application deployment overall healthcare, smart cities, industrial, and defence sectors. The growth of 5G networks throughout the U.S. and Canada is crucial to the IoT battery market. The major problems of the North America IoT battery market depend on raw materials imported from outside, with lithium, cobalt, nickel, and rare earth elements used to produce advanced battery chemistries like lithium-ion and solid-state types.

Battery IoT Market Competitive Landscape:

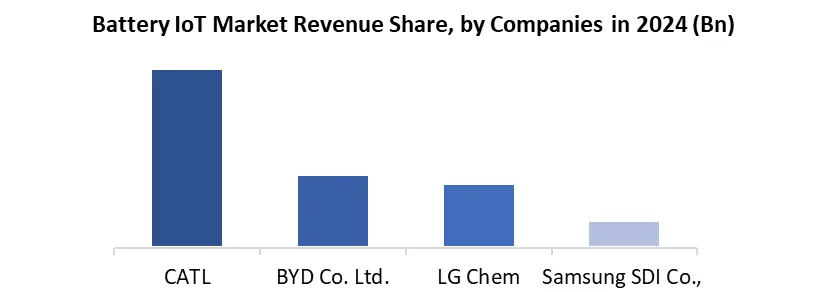

The two major leading global players in the battery IoT Market are CATL and STMicroelectronics. CATL is the world’s largest battery manufacturer, known for its high-capacity lithium-ion batteries used in electric vehicles, energy storage systems, and increasingly, in IoT power infrastructure. Also, CATL powers the hardware with cutting-edge battery cells. In contrast, STMicroelectronics focuses on the electronics side, offering advanced battery management systems, microcontrollers, and sensors that enable smart, energy-efficient IoT devices. Also, provides the control and intelligence needed for optimized performance in IoT ecosystems.

Recent Developments:

- In 2023, CATL declared a compact matter battery with an energy density of 500 Wh/kg, also enhancing the performance of both IoT devices and electric vehicles, representing a dramatic rise in battery capacity and miniaturization.

- In April 2024, STMicroelectronics released the STM32U0 microcontroller, planned to rise the energy efficiency in IoT and electronics, therefore improving battery life as well as performance.

- In Sept 2024, Xiaomi presented the SU7 electric vehicle in its entirety, combined with its HyperOS IoT ecosystem, showing the connection between automotive and consumer IoT driven by innovative batteries.

- In 2024, LG Chem and GM extended their U.S. joint venture for producing battery cells to address increasing demand from IoT-connected EVs and smart mobility networks.

|

Battery IoT Market Scope |

|

|

Market Size in 2024 |

USD 11.4 Bn. |

|

Market Size in 2032 |

USD 24.08 Bn. |

|

CAGR (2025-2032) |

9.8 % |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product type Chemical Batteries Thin-film Batteries Printed Batteries Solid-state Chip Batteries |

|

By Rechargeability Primary Batteries Secondary Batteries |

|

|

By end-use application Wearable Devices Consumer Electronics Healthcare Home Automation Retail Banking, Financial Services, and Insurance (BFSI) Aerospace & Défense Industrial Agriculture Smart Packaging |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia-Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America

|

Battery IoT Market Key Players include:

North America

1. Tesla, Inc. (USA)

2. Solid Power, Inc. (USA)

3. QuantumScape Corporation (USA)

4. Cymbet (USA)

5. Enovix Corporation (USA)

6. Energizer Holdings, Inc. (USA)

Europe

7. Flatiron Health (London, UK)

8. Saft Groupe S.A. (France)

9. VARTA AG (Germany)

10. Leclanché SA (Switzerland)

11. InoBat Auto (Slovakia)

12. ACC – Automotive Cells Company (France)

Asia-Pacific

13. Panasonic Holdings Corporation (Japan)

14. Samsung SDI Co., Ltd. (South Korea)

15. LG Chem Ltd. (South Korea)

16. BYD Company Limited (China)

17. CATL – Contemporary Amperex Technology Co. Ltd. (China)

18. Xiaomi (China)

19. STMicroelectronics (China)

Middle East & Africa

20. Metair Investments Ltd. (South Africa)

21. RAZI Energy (South Africa)

22. ZOLA Electric (Tanzania)

23. SolarNow (Uganda)

24. BBOXX (Rwanda)

25. DPA Africa (Kenya)

South America

26. Baterias Moura (Brazil)

27. Pluricell (Brazil)

28. Unicoba Energia (Brazil)

29. Ergon Batteries (Chile)

30. CBL – Companhia Brasileira de Lítio (Brazil)

31. Quantum Batteries (Uruguay)

Frequently Asked Questions

Growing Demand for IoT Devices is Key Driver of the Battery IoT Market.

The North America region is the most dominant in the Battery IoT Market.

The key players in the Battery IoT Market are LG Chem Ltd., Samsung SDI Co., Ltd., Panasonic Corporation, CATL (Contemporary Amperex Technology Co., Ltd.) and BYD Co., Ltd.

Due to their high energy density, long life span, cost-effectiveness, and broad compatibility with a wide range of IoT devices.

1. Battery IoT Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Battery IoT Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. Indication Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Battery IoT Market: Dynamics

3.1. Battery IoT Market Trends

3.2. Battery IoT Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Battery IoT Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Battery IoT Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Chemical Batteries

4.1.2. Thin-film Batteries

4.1.3. Printed Batteries

4.1.4. Solid-state Chip Batteries

4.2. Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

4.2.1. Primary Batteries

4.2.2. Secondary Batteries

4.3. Battery IoT Market Size and Forecast, By End-use application (2024-2032)

4.3.1. Wearable Devices

4.3.2. Consumer Electronics

4.3.3. Healthcare

4.3.4. Home Automation

4.3.5. Retail

4.3.6. Banking, Financial Services, and Insurance (BFSI)

4.3.7. Aerospace & Défense

4.3.8. Industrial

4.3.9. Agriculture

4.3.10. Smart Packaging

4.4. Battery IoT Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Battery IoT Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Battery IoT Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Chemical Batteries

5.1.2. Thin-film Batteries

5.1.3. Printed Batteries

5.1.4. Solid-state Chip Batteries

5.2. North America Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

5.2.1. Primary Batteries

5.2.2. Secondary Batteries

5.3. North America Battery IoT Market Size and Forecast, By End-use application (2024-2032)

5.3.1. Wearable Devices

5.3.2. Consumer Electronics

5.3.3. Healthcare

5.3.4. Home Automation

5.3.5. Retail

5.3.6. Banking, Financial Services, and Insurance (BFSI)

5.3.7. Aerospace & Défense

5.3.8. Industrial

5.3.9. Agriculture

5.3.10. Smart Packaging

5.4. North America Battery IoT Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Battery IoT Market Size and Forecast, By Product Type (2024-2032)

5.4.1.1.1. Chemical Batteries

5.4.1.1.2. Thin-film Batteries

5.4.1.1.3. Printed Batteries

5.4.1.1.4. Solid-state Chip Batteries

5.4.1.2. United States Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

5.4.1.2.1. Primary Batteries

5.4.1.2.2. Secondary Batteries

5.4.1.3. United States Battery IoT Market Size and Forecast, By End-use application (2024-2032)

5.4.1.3.1. Wearable Devices

5.4.1.3.2. Consumer Electronics

5.4.1.3.3. Healthcare

5.4.1.3.4. Home Automation

5.4.1.3.5. Retail

5.4.1.3.6. Banking, Financial Services, and Insurance (BFSI)

5.4.1.3.7. Aerospace & Défense

5.4.1.3.8. Industrial

5.4.1.3.9. Agriculture

5.4.1.3.10. Smart Packaging

5.4.2. Canada

5.4.2.1. Canada Battery IoT Market Size and Forecast, By Product Type (2024-2032)

5.4.2.1.1. Chemical Batteries

5.4.2.1.2. Thin-film Batteries

5.4.2.1.3. Printed Batteries

5.4.2.1.4. Solid-state Chip Batteries

5.4.2.2. Canada Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

5.4.2.2.1. Primary Batteries

5.4.2.2.2. Secondary Batteries

5.4.2.3. Canada Battery IoT Market Size and Forecast, By End-use application (2024-2032)

5.4.2.3.1. Wearable Devices

5.4.2.3.2. Consumer Electronics

5.4.2.3.3. Healthcare

5.4.2.3.4. Home Automation

5.4.2.3.5. Retail

5.4.2.3.6. Banking, Financial Services, and Insurance (BFSI)

5.4.2.3.7. Aerospace & Défense

5.4.2.3.8. Industrial

5.4.2.3.9. Agriculture

5.4.2.3.10. Smart Packaging

5.4.3. Mexico

5.4.3.1. Mexico Battery IoT Market Size and Forecast, By Product Type (2024-2032)

5.4.3.1.1. Chemical Batteries

5.4.3.1.2. Thin-film Batteries

5.4.3.1.3. Printed Batteries

5.4.3.1.4. Solid-state Chip Batteries

5.4.3.2. Mexico Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

5.4.3.2.1. Primary Batteries

5.4.3.2.2. Secondary Batteries

5.4.3.3. Mexico Battery IoT Market Size and Forecast, By End-use application (2024-2032)

5.4.3.3.1. Wearable Devices

5.4.3.3.2. Consumer Electronics

5.4.3.3.3. Healthcare

5.4.3.3.4. Home Automation

5.4.3.3.5. Retail

5.4.3.3.6. Banking, Financial Services, and Insurance (BFSI)

5.4.3.3.7. Aerospace & Défense

5.4.3.3.8. Industrial

5.4.3.3.9. Agriculture

5.4.3.3.10. Smart Packaging

6. Europe Battery IoT Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

6.1. Europe Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.2. Europe Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.3. Europe Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4. Europe Battery IoT Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.1.2. United Kingdom Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.1.3. United Kingdom Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4.2. France

6.4.2.1. France Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.2.2. France Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.2.3. France Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.3.2. Germany Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.3.3. Germany Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.4.2. Italy Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.4.3. Italy Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.5.2. Spain Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.5.3. Spain Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.6.2. Sweden Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.6.3. Sweden Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.7.2. Russia Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.7.3. Russia Battery IoT Market Size and Forecast, By End-use application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Battery IoT Market Size and Forecast, By Product Type (2024-2032)

6.4.8.2. Rest of Europe Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

6.4.8.3. Rest of Europe Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7. Asia Pacific Battery IoT Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

7.1. Asia Pacific Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.2. Asia Pacific Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.3. Asia Pacific Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4. Asia Pacific Battery IoT Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.1.2. China Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.1.3. China Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.2.2. S Korea Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.2.3. S Korea Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.3.2. Japan Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.3.3. Japan Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.4. India

7.4.4.1. India Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.4.2. India Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.4.3. India Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.5.2. Australia Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.5.3. Australia Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.6.2. Indonesia Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.6.3. Indonesia Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.7.2. Malaysia Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.7.3. Malaysia Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.8.2. Philippines Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.8.3. Philippines Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.9.2. Thailand Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.9.3. Thailand Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.10.2. Vietnam Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.10.3. Vietnam Battery IoT Market Size and Forecast, By End-use application (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Battery IoT Market Size and Forecast, By Product Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

7.4.11.3. Rest of Asia Pacific Battery IoT Market Size and Forecast, By End-use application (2024-2032)

8. Middle East and Africa Battery IoT Market Size and Forecast (by Value in USD Bn.) (2024-2032)

8.1. Middle East and Africa Battery IoT Market Size and Forecast, By Product Type (2024-2032)

8.2. Middle East and Africa Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

8.3. Middle East and Africa Battery IoT Market Size and Forecast, By End-use application (2024-2032)

8.4. Middle East and Africa Battery IoT Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Battery IoT Market Size and Forecast, By Product Type (2024-2032)

8.4.1.2. South Africa Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

8.4.1.3. South Africa Battery IoT Market Size and Forecast, By End-use application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Battery IoT Market Size and Forecast, By Product Type (2024-2032)

8.4.2.2. GCC Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

8.4.2.3. GCC Battery IoT Market Size and Forecast, By End-use application (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Battery IoT Market Size and Forecast, By Product Type (2024-2032)

8.4.3.2. Egypt Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

8.4.3.3. Egypt Battery IoT Market Size and Forecast, By End-use application (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Battery IoT Market Size and Forecast, By Product Type (2024-2032)

8.4.4.2. Nigeria Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

8.4.4.3. Nigeria Battery IoT Market Size and Forecast, By End-use application (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Battery IoT Market Size and Forecast, By Product Type (2024-2032)

8.4.5.2. Rest of ME&A Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

8.4.5.3. Rest of ME&A Battery IoT Market Size and Forecast, By End-use application (2024-2032)

9. South America Battery IoT Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

9.1. South America Battery IoT Market Size and Forecast, By Product Type (2024-2032)

9.2. South America Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

9.3. South America Battery IoT Market Size and Forecast, By End-use application (2024-2032)

9.4. South America Battery IoT Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Battery IoT Market Size and Forecast, By Product Type (2024-2032)

9.4.1.2. Brazil Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

9.4.1.3. Brazil Battery IoT Market Size and Forecast, By End-use application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Battery IoT Market Size and Forecast, By Product Type (2024-2032)

9.4.2.2. Argentina Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

9.4.2.3. Argentina Battery IoT Market Size and Forecast, By End-use application (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Battery IoT Market Size and Forecast, By Product Type (2024-2032)

9.4.3.2. Colombia Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

9.4.3.3. Colombia Battery IoT Market Size and Forecast, By End-use application (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Battery IoT Market Size and Forecast, By Product Type (2024-2032)

9.4.4.2. Chile Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

9.4.4.3. Chile Battery IoT Market Size and Forecast, By End-use application (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Battery IoT Market Size and Forecast, By Product Type (2024-2032)

9.4.5.2. Rest Of South America Battery IoT Market Size and Forecast, By Rechargeability (2024-2032)

9.4.5.3. Rest Of South America Battery IoT Market Size and Forecast, By End-use application (2024-2032)

10. Company Profile: Key Players

10.1. CATL – Contemporary Amperex Technology Co. Ltd. (China)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Tesla, Inc. (USA)

10.3. STMicroelectronics (China)

10.4. Solid Power, Inc. (USA)

10.5. QuantumScape Corporation (USA)

10.6. Cymbet (USA)

10.7. Enovix Corporation (USA)

10.8. Energizer Holdings, Inc. (USA)

10.9. Flatiron Health (London, UK)

10.10. Saft Groupe S.A. (France)

10.11. VARTA AG (Germany)

10.12. Leclanché SA (Switzerland)

10.13. InoBat Auto (Slovakia)

10.14. ACC – Automotive Cells Company (France)

10.15. Panasonic Holdings Corporation (Japan)

10.16. Samsung SDI Co., Ltd. (South Korea)

10.17. BYD Company Limited (China)

10.18. LG Energy Solution Ltd. (South Korea)

10.19. Xiaomi (China)

10.20. ZOLA Electric (Tanzania)

10.21. SolarNow (Uganda)

10.22. BBOXX (Rwanda)

10.23. DPA Africa (Kenya)

10.24. Baterias Moura (Brazil)

10.25. Pluricell (Brazil)

10.26. Unicoba Energia (Brazil)

10.27. Ergon Batteries (Chile)

10.28. CBL – Companhia Brasileira de Lítio (Brazil)

10.29. Quantum Batteries (Uruguay)

11. Key Findings

12. Industry Recommendations

13. Battery IoT Market: Research Methodology