Global Transformer Core Market Size, Market Dynamics by Service Type, Product Type, and Application Type

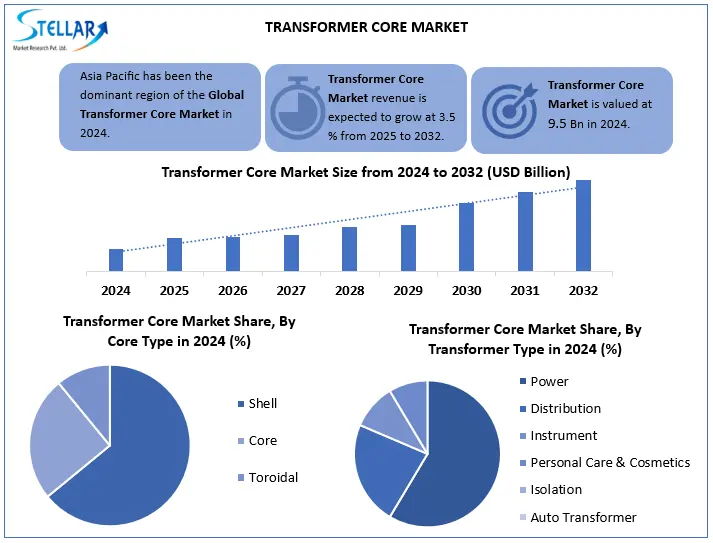

Global Transformer Core Market Size was estimated at USD 9.5 Bn in 2024, and it is expected to reach USD 12.61 Bn in 2032. The Market CAGR is expected to be around 3.5 % during the forecast period (2025-2032)

Format : PDF | Report ID : SMR_2790

Transformer Core Market Overview

A transformer core is the central part of a transformer, made from thin metal sheets (usually silicon steel) that help to carry magnetic energy. It allows electricity to move efficiently from one coil (winding) to another by guiding the magnetic field, while reducing energy losses. The Global Transformer Core Market is experiencing significant growth, which is inspired by increasing power demand, rapid urbanization, and large-scale grid expansion projects, especially in non-OECD countries such as China and India. According to the international energy approach of the US EIA, global energy consumption is expected to increase by about 50% by 2050, with Asia accounting for this increase. This has increased the demand for energy-efficient transformer cores used in power and distribution transformers. In 2024, core-type transformers held the largest market share over 55% due to their superior cooling and maintenance characteristics, while power transformers accounted for nearly 50% of the market owing to increased utility-scale grid investments.

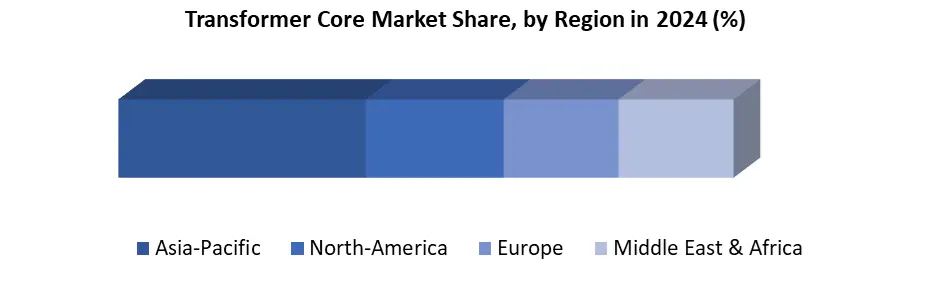

The Asia-Pacific dominated the global transformer market with the highest revenue share in 2024, led by China and India's large-scale renewable energy targets and smart grid development. For example, China alone contributed about 1.89 billion in the amorphous core segment. While the Middle East and Africa emerged as the fastest-growing areas due to increasing electrification and urban development projects.

The transformer core market is dominated by prominent players like Siemens AG, ABB, Hitachi Energy, General Electric, and Schneider Electric. In 2024, Hitachi Energy featured 6 billion USD towards transformer manufacturing expansion, and Siemens introduced advanced smart amorphous core transformers. Overall, the market is being aligned with digital integration, predictive maintenance solutions, and a shift towards durable, high efficiency materials, with global smart grids and decarbonization purposes.

To get more Insights: Request Free Sample Report

Transformer Core Market Dynamics:

Rising Electricity Demand & Grid Expansion to Drive the Transformer Core Market Growth

Rapid urbanization, industrialization, and population growth, especially in non?OECD nations like China and India, are fueling an unprecedented growth in electricity demand and transformer core requirements. According to the EIA’s International Energy Outlook, world energy usage is estimated to increase around 50% by 2050, mainly by Asia where energy consumption is expected to almost double from 2020 levels. This surge in rapid electrification and grid modernization requires extensive installation of power and distribution transformers hence a strong demand for high-performance transformer cores.

High Production Costs and Material Price Volatility to Restrain the Transformer Core Market

A significant challenge in the transformer core market is the high cost of raw materials such as grain-oriented silicone steel and amorphous metals, which are essential for energy-efficient core. These materials are not only expensive, but also subject to frequently ups and downs in the price, affecting the production budget. Combined with complex manufacturing requirements, it significantly increases overall production costs. Small manufacturers face the most pressure, as they struggle to maintain profitability between rising input costs.

Smart Grid Integration & Digitalization to Provide Opportunity in Transformer Core Market

The growing shift towards IoT-enabled smart grids create a strong demand for advanced transformer cores equipped with embedded sensors, communication units, and remote monitoring features. These smart cores enable real-time performance tracking and predictive maintenance, improving grid reliability. In the U.S. alone, around 2.1% of transformers are retired annually, opening a significant opportunity for retrofitting with smart transformer technology. This trend supports grid modernization and aligns with global digital infrastructure goals.

Transformer Core Market Segment Analysis:

Based on Core Type, the transformer core market is segmented by core type into shell, core, and toroidal. The core segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. According to industry estimates, core-type transformers account for more than 55% of the market share by 2024. Their composition allows better cooling and easy maintenance, making them ideal for utilities and high-voltage applications in industrial operations. While Shell and toroidal cores are more efficient in some compact and having high-frequency applications and are limited in large-scale power transmission utilities.

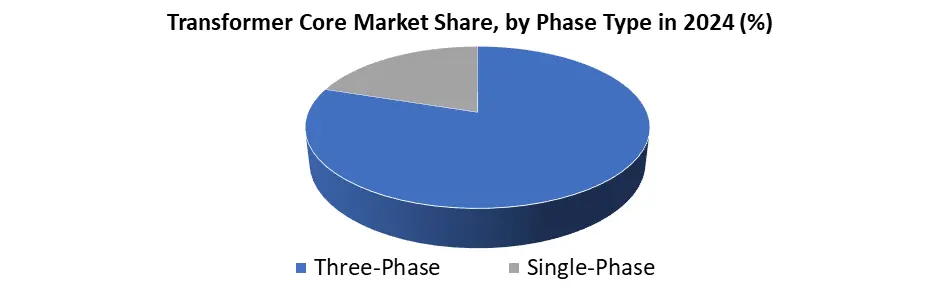

Based on Phase Type, the transformer core market is segmented by phase type into single and three-phase transformer cores. The three-phase segment dominated the global transformer core market in 2024, and is projected to remain the fastest growing segment during the forecast period. It accounts for about 60% of the global share in 2024. This dominance is attributed to their high efficiency in industrial and utility-scale applications, especially in moderate to higher voltage systems. Three-phase core support balanced power distribution and low core losses, making them ideal for power transmission and distribution networks. Single-phase cores are mainly used in residential or low-load rural applications, thus having a small yet stable market share.

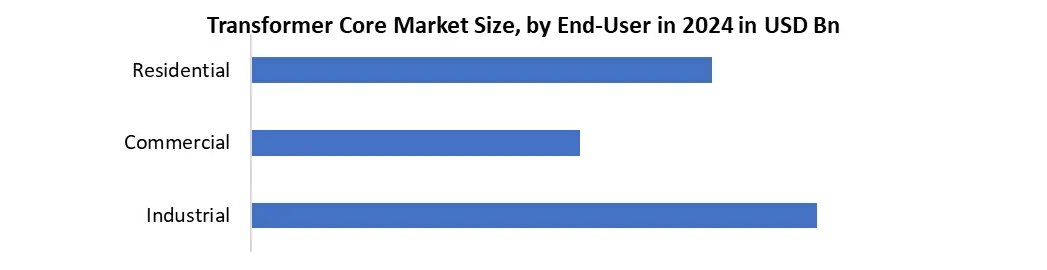

Based on End-User Industry, the transformer core market is segmented by end-user industry into industrial, commercial, and residential sectors. The industrial segment dominated the global transformer core market in 2024 and is expected to hold the largest market share during the forecast period. This dominance is inspired by the development of manufacturing, oil and gas, mining and heavy electrical industries, especially in Asia-Pacific and North America, enhances this demand significantly. Industrial operation requires continuous, high capacity and reliable power that requires strong transformer core. Commercial areas like IT Park, Hospital and Mall, are the second largest consumer due to growing urban infrastructure.

Transformer Core Market Regional Analysis:

Asia-Pacific dominates the global transformer core market, and it solidified its position in the global transformer core market, accounting for approximately 41.6% of the total market revenue. The region’s dominance is primarily fueled by China and India due to their Massive investments in renewable energy integration, such as China’s target of 2,890 GW of installed capacity by 2030 and India’s 500 GW renewable energy ambition, which has led to increased demand for efficient transformer cores. The region leads to adopting amorphous core transformers, which holding around 23% of the global market, with China alone contributing approximately USD 1.89 billion and India USD 0.5 billion in 2024 alone. The ongoing expansion of smart grid infrastructure and rural electrification further fuels this growth trajectory. While the Middle East and Africa (MEA) emerged as the fastest-growing region in the transformer core market in 2024, supported by expanding electrification efforts, urbanization, and renewable energy projects.

Transformer Core Market Competitive Landscape:

The transformer core market is shaped by an integrated competitive landscape, with dominance of global power equipment manufacturers such as Siemens AG, Hitachi Energy, ABB Limited, General Electric, and Schneider Electric. All these companies maintain a strong market appearance through comprehensive manufacturing capabilities, advanced R&D and strong global distribution networks.

- In 2024, Hitachi Energy announced an investment of USD 6 billion to expand its global transformer production capacity, supporting grid modernization in North America and Asia. Siemens AG introduced a smart amorphous core transformer for Europe's renewable energy sector, while ABB enhances its digital transformer offerings by integrating advanced monitoring and asset management features. General Electric U.S. Focus on developing high-efficiency grain-oriented silicone steel core to meet infrastructure upgradation demands.

Competition in the market increasingly revolves around improving core efficiency, advancing digital integration, and adopting sustainable materials. Companies are incorporating AI-powered monitoring and predictive maintenance solutions, while also localizing production to reduce lead times. This strategic change reflects the focus of the industry on smart grid readiness, reliability, and regulatory compliance in a developed energy landscape.

|

Transformer Core Market Scope |

|

|

Market Size in 2024 |

USD 9.5 Bn |

|

Market Size in 2032 |

USD 12.61 Bn |

|

CAGR (2024-2032) |

3.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Core Type Shell Core Toroidal |

|

By Transformer Type Power Transformers Distribution Transformers Instrument Transformers Isolation Transformers Auto Transformers |

|

|

By Phase Single-Phase Transformer Core Three-Phase Transformer Core |

|

|

By End-User Industry Industrial Sector Commercial Sector Residential Sector |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Transformer Core Market

North America

- ABB Ltd. – United States

- General Electric Company – United States

- SPX Transformer Solutions, Inc. – United States

- Howard Industries, Inc. – United States

- Power Partners, Inc. – United States

- ERMCO (Electric Research and Manufacturing Cooperative) – United States

Europe

- Siemens AG – Germany

- SGB-SMIT Group – Germany

- Schneider Electric SE – France

- TMC Transformers S.p.A. – Italy

- Meggitt PLC – United Kingdom

- Celduc Relais – France

- Luvata Oy – Finland

- CG Power Systems Belgium NV – Belgium

- TESAR S.r.l. – Italy

Asia Pacific

- Hitachi Energy Ltd. – Japan

- Toshiba Energy Systems & Solutions Corporation – Japan

- Fuji Electric Co., Ltd. – Japan

- Hyosung Heavy Industries – South Korea

- Crompton Greaves Power and Industrial Solutions Ltd. – India

- Bharat Heavy Electricals Limited (BHEL) – India

- Voltamp Transformers Ltd. – India

- TBEA Co., Ltd. – China

- Jiangsu Huapeng Transformer Co., Ltd. – China

- Baoding Tianwei Group Co., Ltd. – China

South America

- WEG S.A. – Brazil

- Transformadores Unión S.A. – Argentina

MEA

- Elsewedy Electric Co S.A.E. – Egypt

- Saudi Transformers Co. Ltd. (STC) – Saudi Arabia

- Actom (Pty) Ltd. – South Africa

Frequently Asked Questions

Rapid urbanization, industrialization, and population growth drive momentum in the Transformer Core Market.

High Production Costs and Material Price Volatility are the major restraints to the market.

Asia-Pacific dominates the Transformer Core Market.

Siemens AG, Hitachi Energy, ABB Limited, General Electric, and Schneider Electric. These are the major key players in the global Transformer Core Market.

1. Transformer Core Market: Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Transformer Core Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Transformer Core Market: Dynamics

3.1. Transformer Core Market Trends by Region

3.1.1. North America Transformer Core Market Trends

3.1.2. Europe Transformer Core Market Trends

3.1.3. Asia Pacific Transformer Core Market Trends

3.1.4. Middle East and Africa Transformer Core Market Trends

3.1.5. South America Transformer Core Market Trends

3.2. Transformer Core Market Dynamics

3.2.1. Transformer Core Market Drivers

3.2.2. Transformer Core Market Restraints

3.2.3. Transformer Core Market Opportunities

3.2.4. Transformer Core Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Transformer Core Industry

4. Transformer Core Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Transformer Core Market Size and Forecast, By Core Type (2024-2032)

4.1.1. Shell

4.1.2. Core

4.1.3. Toroidal

4.2. Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

4.2.1. Power Transformers

4.2.2. Distribution Transformers

4.2.3. Instrument Transformers

4.2.4. Isolation Transformers

4.2.5. Auto Transformers

4.3. Transformer Core Market Size and Forecast, By Phase (2024-2032)

4.3.1. Single-Phase Transformer Core

4.3.2. Three-Phase Transformer Core

4.4. Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

4.4.1. Industrial Sector

4.4.2. Commercial Sector

4.4.3. Residential Sector

4.5. Transformer Core Market Size and Forecast, by Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Transformer Core Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Transformer Core Market Size and Forecast, By Core Type (2024-2032)

5.1.1. Shell

5.1.2. Core

5.1.3. Toroidal

5.2. North America Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

5.2.1. Power Transformers

5.2.2. Distribution Transformers

5.2.3. Instrument Transformers

5.2.4. Isolation Transformers

5.2.5. Auto Transformers

5.3. North America Transformer Core Market Size and Forecast, By Phase (2024-2032)

5.3.1. Single-Phase Transformer Core

5.3.2. Three-Phase Transformer Core

5.4. North America Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

5.4.1. Industrial Sector

5.4.2. Commercial Sector

5.4.3. Residential Sector

5.5. North America Transformer Core Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Transformer Core Market Size and Forecast, By Core Type (2024-2032)

5.5.1.1.1. Shell

5.5.1.1.2. Core

5.5.1.1.3. Toroidal

5.5.1.2. United States Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

5.5.1.2.1. Power Transformers

5.5.1.2.2. Distribution Transformers

5.5.1.2.3. Instrument Transformers

5.5.1.2.4. Isolation Transformers

5.5.1.2.5. Auto Transformers

5.5.1.3. United States Transformer Core Market Size and Forecast, By Phase (2024-2032)

5.5.1.3.1. Single-Phase Transformer Core

5.5.1.3.2. Three-Phase Transformer Core

5.5.1.4. United States Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

5.5.1.4.1. Industrial Sector

5.5.1.4.2. Commercial Sector

5.5.1.4.3. Residential Sector

5.5.2. Canada

5.5.2.1. Canada Transformer Core Market Size and Forecast, By Core Type (2024-2032)

5.5.2.1.1. Shell

5.5.2.1.2. Core

5.5.2.1.3. Toroidal

5.5.2.2. Canada Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

5.5.2.2.1. Power Transformers

5.5.2.2.2. Distribution Transformers

5.5.2.2.3. Instrument Transformers

5.5.2.2.4. Isolation Transformers

5.5.2.2.5. Auto Transformers

5.5.2.3. Canada Transformer Core Market Size and Forecast, By Phase (2024-2032)

5.5.2.3.1. Single-Phase Transformer Core

5.5.2.3.2. Three-Phase Transformer Core

5.5.2.4. Canada Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

5.5.2.4.1. Industrial Sector

5.5.2.4.2. Commercial Sector

5.5.2.4.3. Residential Sector

5.5.3. Mexico

5.5.3.1. Mexico Transformer Core Market Size and Forecast, By Core Type (2024-2032)

5.5.3.1.1. Shell

5.5.3.1.2. Core

5.5.3.1.3. Toroidal

5.5.3.2. Mexico Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

5.5.3.2.1. Power Transformers

5.5.3.2.2. Distribution Transformers

5.5.3.2.3. Instrument Transformers

5.5.3.2.4. Isolation Transformers

5.5.3.2.5. Auto Transformers

5.5.3.3. Mexico Transformer Core Market Size and Forecast, By Phase (2024-2032)

5.5.3.3.1. Single-Phase Transformer Core

5.5.3.3.2. Three-Phase Transformer Core

5.5.3.4. Mexico Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

5.5.3.4.1. Industrial Sector

5.5.3.4.2. Commercial Sector

5.5.3.4.3. Residential Sector

6. Europe Transformer Core Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.2. Europe Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.3. Europe Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.4. Europe Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5. Europe Transformer Core Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.1.2. United Kingdom Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.1.3. United Kingdom Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.1.4. United Kingdom Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5.2. France

6.5.2.1. France Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.2.2. France Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.2.3. France Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.2.4. France Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.3.2. Germany Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.3.3. Germany Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.3.4. Germany Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.4.2. Italy Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.4.3. Italy Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.4.4. Italy Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.5.2. Spain Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.5.3. Spain Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.5.4. Spain Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.6.2. Sweden Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.6.3. Sweden Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.6.4. Sweden Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5.7. Austria

6.5.7.1. Austria Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.7.2. Austria Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.7.3. Austria Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.7.4. Austria Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Transformer Core Market Size and Forecast, By Core Type (2024-2032)

6.5.8.2. Rest of Europe Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

6.5.8.3. Rest of Europe Transformer Core Market Size and Forecast, By Phase (2024-2032)

6.5.8.4. Rest of Europe Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7. Asia Pacific Transformer Core Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.2. Asia Pacific Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.3. Asia Pacific Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.4. Asia Pacific Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5. Asia Pacific Transformer Core Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.1.2. China Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.1.3. China Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.1.4. China Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.2.2. S Korea Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.2.3. S Korea Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.2.4. S Korea Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.3.2. Japan Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.3.3. Japan Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.3.4. Japan Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.4. India

7.5.4.1. India Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.4.2. India Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.4.3. India Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.4.4. India Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.5.2. Australia Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.5.3. Australia Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.5.4. Australia Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.6.2. Indonesia Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.6.3. Indonesia Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.6.4. Indonesia Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.7. Philippines

7.5.7.1. Philippines Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.7.2. Philippines Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.7.3. Philippines Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.7.4. Philippines Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.8. Malaysia

7.5.8.1. Malaysia Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.8.2. Malaysia Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.8.3. Malaysia Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.8.4. Malaysia Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.9. Vietnam

7.5.9.1. Vietnam Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.9.2. Vietnam Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.9.3. Vietnam Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.9.4. Vietnam Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.10. Thailand

7.5.10.1. Thailand Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.10.2. Thailand Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.10.3. Thailand Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.10.4. Thailand Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Transformer Core Market Size and Forecast, By Core Type (2024-2032)

7.5.11.2. Rest of Asia Pacific Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

7.5.11.3. Rest of Asia Pacific Transformer Core Market Size and Forecast, By Phase (2024-2032)

7.5.11.4. Rest of Asia Pacific Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

8. Middle East and Africa Transformer Core Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Transformer Core Market Size and Forecast, By Core Type (2024-2032)

8.2. Middle East and Africa Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

8.3. Middle East and Africa Transformer Core Market Size and Forecast, By Phase (2024-2032)

8.4. Middle East and Africa Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

8.5. Middle East and Africa Transformer Core Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Transformer Core Market Size and Forecast, By Core Type (2024-2032)

8.5.1.2. South Africa Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

8.5.1.3. South Africa Transformer Core Market Size and Forecast, By Phase (2024-2032)

8.5.1.4. South Africa Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Transformer Core Market Size and Forecast, By Core Type (2024-2032)

8.5.2.2. GCC Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

8.5.2.3. GCC Transformer Core Market Size and Forecast, By Phase (2024-2032)

8.5.2.4. GCC Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

8.5.3. Nigeria

8.5.3.1. Nigeria Transformer Core Market Size and Forecast, By Core Type (2024-2032)

8.5.3.2. Nigeria Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

8.5.3.3. Nigeria Transformer Core Market Size and Forecast, By Phase (2024-2032)

8.5.3.4. Nigeria Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

8.5.4. Rest of ME&A

8.5.4.1. Rest of ME&A Transformer Core Market Size and Forecast, By Core Type (2024-2032)

8.5.4.2. Rest of ME&A Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

8.5.4.3. Rest of ME&A Transformer Core Market Size and Forecast, By Phase (2024-2032)

8.5.4.4. Rest of ME&A Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

9. South America Transformer Core Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Transformer Core Market Size and Forecast, By Core Type (2024-2032)

9.2. South America Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

9.3. South America Transformer Core Market Size and Forecast, By Phase (2024-2032)

9.4. South America Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

9.5. South America Transformer Core Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Transformer Core Market Size and Forecast, By Core Type (2024-2032)

9.5.1.2. Brazil Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

9.5.1.3. Brazil Transformer Core Market Size and Forecast, By Phase (2024-2032)

9.5.1.4. Brazil Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Transformer Core Market Size and Forecast, By Core Type (2024-2032)

9.5.2.2. Argentina Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

9.5.2.3. Argentina Transformer Core Market Size and Forecast, By Phase (2024-2032)

9.5.2.4. Argentina Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

9.5.3. Rest of South America

9.5.3.1. Rest of South America Transformer Core Market Size and Forecast, By Core Type (2024-2032)

9.5.3.2. Rest of South America Transformer Core Market Size and Forecast, By Transformer Type (2024-2032)

9.5.3.3. Rest of South America Transformer Core Market Size and Forecast, By Phase (2024-2032)

9.5.3.4. Rest of South America Transformer Core Market Size and Forecast, By End-User Industry (2024-2032)

10. Company Profile: Key Players

10.1. ABB Ltd. – United States

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. General Electric Company – United States

10.3. SPX Transformer Solutions, Inc. – United States

10.4. Howard Industries, Inc. – United States

10.5. Power Partners, Inc. – United States

10.6. ERMCO (Electric Research and Manufacturing Cooperative) – United States

10.7. Siemens AG – Germany

10.8. SGB-SMIT Group – Germany

10.9. Schneider Electric SE – France

10.10. TMC Transformers S.p.A. – Italy

10.11. Meggitt PLC – United Kingdom

10.12. Celduc Relais – France

10.13. Luvata Oy – Finland

10.14. CG Power Systems Belgium NV – Belgium

10.15. TESAR S.r.l. – Italy

10.16. Hitachi Energy Ltd. – Japan

10.17. Toshiba Energy Systems & Solutions Corporation – Japan

10.18. Fuji Electric Co., Ltd. – Japan

10.19. Hyosung Heavy Industries – South Korea

10.20. Crompton Greaves Power and Industrial Solutions Ltd. – India

10.21. Bharat Heavy Electricals Limited (BHEL) – India

10.22. Voltamp Transformers Ltd. – India

10.23. TBEA Co., Ltd. – China

10.24. Jiangsu Huapeng Transformer Co., Ltd. – China

10.25. Baoding Tianwei Group Co., Ltd. – China

10.26. WEG S.A. – Brazil

10.27. Transformadores Unión S.A. – Argentina

10.28. Elsewedy Electric Co S.A.E. – Egypt

10.29. Saudi Transformers Co. Ltd. (STC) – Saudi Arabia

10.30. Actom (Pty) Ltd. – South Africa

11. Key Findings

12. Analyst Recommendations

13. Transformer Core Market: Research Methodology