Next-Generation Solar Cell Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

Global Next-Generation Solar Cell Market size was valued at over USD 3.45 Bn in 2024 and is expected to grow to USD 13.51 Bn in 2032 at a CAGR of 18.60 %.

Format : PDF | Report ID : SMR_2755

Next-Generation Solar Cell Market Overview

Next-Generation Solar Cell are an advanced Photovoltaic technology that uses innovative materials to achieve higher efficiency, lower costs, and greater flexibility than traditional silicon solar panels. They make solar energy more accessible and adaptable for future applications.

The market is quickly changing as the global demand for clean, efficient, cost-effective renewable energy solutions grows. Next-Generation Solar Cell Market is captivating the renewable energy section with new and innovative technologies that promise to transform how we utilise sunlight. Perovskite solar cells, with their efficiency rates and low production costs, are taking the prestigious place. According to Oxford PV, a world-record 28.6% efficient commercial perovskite-silicon tandem cell, moving toward mass adoption. The photovoltaics, flexible and lightweight organic photovoltaics (OPVs), are solving solar applications in wearable tech, electric vehicles, and even solar windows.

The market is driven by aggressive climate goals and plummeting costs; governments and corporations are pouring billions into next-gen solar R&D. The U.S. Department of Energy recently unveiled a minimum 82 million in funding for advanced solar projects, while China dominates manufacturing with gigawatt-scale perovskite production plans. Despite challenges like long-term stability, industry leaders are confident—startups like Swift Solar and established players like First Solar are racing to bring these futuristic cells to market by 2025. With solar energy demand surging, next-gen technologies are set to redefine the energy landscape, offering sleeker, cheaper, and more powerful alternatives to traditional panels.

To get more Insights: Request Free Sample Report

Next-Generation Solar Cell Dynamics

Benefits of New Solar Cells for Humanity and Industry Drive Next Generation Solar Cell Market Growth

Next-Generation Solar Cell Market is experiencing rapid growth as the Digital revolution is reshaping lives, and it is providing clean and Affordable Energy for all. The electricity bill is low, as the manufacturing and installation cost of solar energy is cheaper than fossil fuels in many regions. There is an efficient solar cell that reduces carbon emissions, such as Lead-free perovskites, which is making life easier, and the Solar Cell is also reshaping businesses. The cost of production is low, and it also gives a high ROI the Tandem solar cells generate more power per square meter, improving commercial viability.

Stability and Degradation Issues Restrain The Growth of Next-Generation Solar Cells

Perovskite Solar Cells are moisture and oxygen-sensitive; the cells decompose when exposed to humidity. We can use encapsulation, but it adds to the cost and Complexity. Perovskite solar cells have limited usage in hot climates, as above 85°C, their crystals degrade, and Photo-induced ion migration causes phase segregation.

Innovation In Next Generation Solar Cell Is Creating The Solar Cell Market Opportunity

In Next-Generation Solar Cell, the Organic photovoltaics (OPVs) represent a bright new horizon in future solar technology, giving unique advantages since they are light and flexible. Unlike traditional rigid silicon panels, OPVs can easily be embedded on curved surfaces, making them uniquely well-suited for leading-edge applications like Internet of Things (IoT) devices, wearable electronics, and handheld consumer electronics. A second significant opportunity lies in their semi-transparent forms, with which solar windows and greenhouse panels can be constructed to allow buildings and agricultural structures to generate electricity without compromising form or function. Additionally, OPVs consist of organic (carbon-based) materials whose manufacturing reduces their environmental footprint but also fits global sustainability goals. With advancing technology, becoming more efficient and long-lasting, OPVs are poised to find themselves a niche in consumer devices as well as in building-integrated photovoltaics (BIPV), offering a green and low-cost substitute to conventional solar systems.

Next-Generation Solar Cell Segments

Based on the Material type, Next-generation solar cell is segmented into Transceivers, Cadmium Telluride (CdTe), Copper Indium Gallium Selenide(CIGS), Amorphous Silicon (a-Si), Gallium-Arsenide (GaAs), and Others (Organic Solar Cells, dye-sensitised solar Cells and Perovskite Solar Cell) In this segments Perovskite Solar Cells has dominated the market in 2024 and is expected to dominate the market in forecast period as they offer flexibility and lightweight properties, making them suitable for diverse applications.

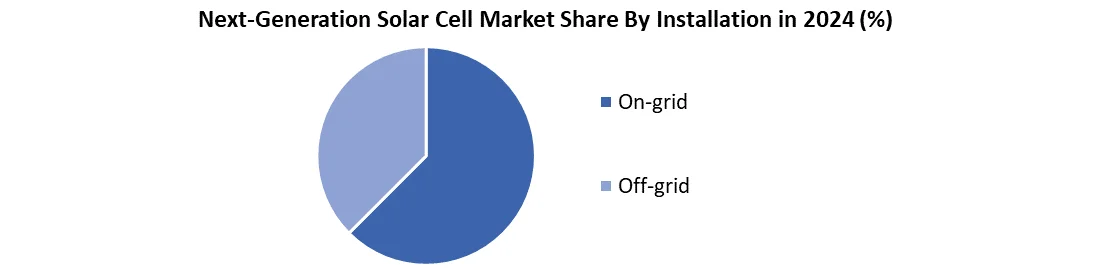

Based on the Installation, Next-generation solar cell is segmented into on-grid and off-grid. The On-grid Segment has dominated the market in 2024 and is expected to dominate the market in the forecast period as the Governments and utilities heavily support grid-tied solar installations, that is, on-grid solar cells. The government also provide subsidies and incentives to people for the installation of solar cells

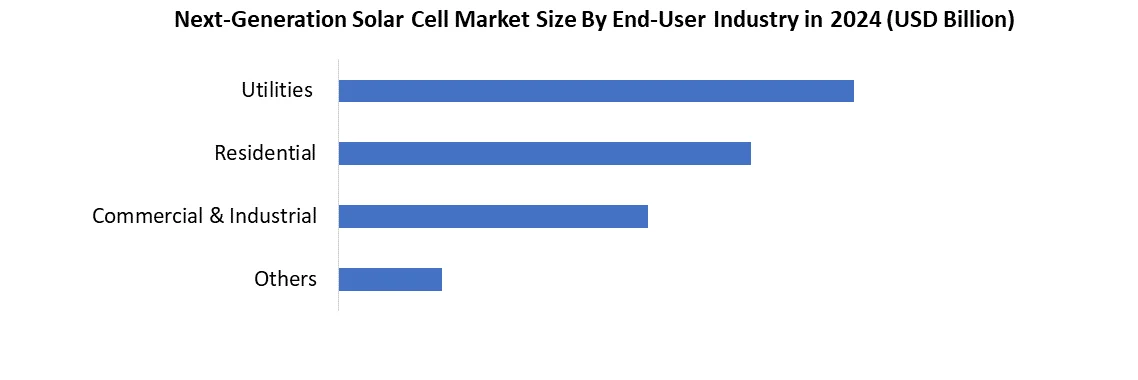

Based on the End-User industry, Next-generation solar cell is segmented into Residential, Commercial & Industrial, Utilities, and Others. In this segment, Utilities has dominated the market in 2024 and are expected to dominate the market in the forecast period, as utilities provide large-scale renewable energy, which is being adopted by governments and corporations in solar cells.

Next-Generation Solar Cell Regional Insights

Asia-Pacific is the Global Leader in Production & Deployment in Next-generation solar cell market.

Globally, the Asia-Pacific (APAC) region dominates Next-Generation Solar Cell Market as the region has strict government policies, a large production scale for solar cells, and a highly growing energy demand. China being the world’s top producer of solar panels worldwide and they are investing heavily in perovskite, CdTe, and CIGS technologies to balance its silicon dominance. India has many solar targets and is highly supported by initiatives like the National Solar Mission, which enhances the large-scale utility projects, whereas Japan focuses on high-efficiency solar cells (GaAs, perovskite) for residential and commercial use.

Additionally, Southeast Asian nations like Vietnam and Malaysia are emerging as key manufacturing Asia has positioned itself as the global solar powerhouse due to low production costs of solar cells, favourable trade policies, large-scale manufacturing and policy-driven deployments, while other region like North America leads in advanced R&D and specialised applications. Together, these regions enhance the future of next-generation solar cells, with Asia enhancing affordability and adoption, and North America pushing efficiency and technological innovations.

Next-Generation Solar Cell Competitive Analysis

Next-gen solar cell market is extremely competitive. The topmost competitors of solar cells are First Solar and SunPower. The First Solar company deals in thin-film cadmium telluride (CdTe) solar panels, which give high efficiency during high temperatures and low-light exposure, and CdTe are suitable for utility-scale projects and large-scale projects. Their new Series 6 and future Series 7 panels focus on lower production costs and sustainability, with robust recycling schemes. The other company that is SunPower, is at the lead of high-efficiency interdigitated back contact (IBC) solar cells, with its Maxeon line.

These types of cells are famous for their durability and good performance in residential and commercial applications. Another player in Next generation solar cell is REC Group, this company specialises in heterojunction technology solar cells, where crystalline silicon and thin-film layers are used together for higher efficiency and temperature performance. REC's Alpha Pure-R series competes directly with Maxeon in the high-end residential segment. In the perovskite space, Oxford PV is a leader, creating perovskite-on-silicon tandem solar cells with world-record efficiencies. Both companies are moving toward higher efficiency and new materials, where First Solar and Maxeon are evolving commercialised options, and REC and Oxford PV are evolving next-generation technology.

|

Next-Generation Solar Cell Market |

|

|

Market Size in 2024 |

USD 3.45 billion |

|

Market Size in 2032 |

USD 13.51 billion |

|

CAGR (2025-2032) |

18.60% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Material Type Transceivers Cadmium Telluride (CdTe) Copper Indium Gallium Selenide(CIGS) Amorphous Silicon (a-Si) Gallium-Arsenide (GaAs) Others Organic Solar Cells Dye-Sensitised Solar Cells Perovskite Solar Cell |

|

By Installation On Grid Off Grid |

|

|

By End-User Utilities Residential Commercial & Industrial Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, South Korea, India, Japan, , Australia, Taiwan Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific region Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Next-Generation Solar Cell

North America

- First Solar, Inc. (United States)

- SunPower Corporation (United States)

- Ubiquitous Energy (United States)

- Solaria Corporation (United States)

- Calyxo USA (United States)

Europe

- Oxford PV (United Kingdom)

- Heliatek GmbH (Germany)

- Saule Technologies (Poland)

- NanoFlex Power Europe (United Kingdom)

- Horizon Energy Ventures (Germany)

Asia-Pacific

- Panasonic Corporation (Japan)

- Sharp Corporation (Japan)

- Hanwha Q CELLS (South Korea)

- JA Solar Technology Co., Ltd. (China)

- JinkoSolar Holding Co., Ltd. (China)

- Borosil Renewables Ltd. (India)

- Greatcell Solar Ltd. (Australia)

Middle East

- SolarFrontier (Japan)

- Abengoa Solar (Spain)

- JinkoSolar (China)

- First Solar (United States)

- ACWA Power (Saudi Arabia)

- Al-Futtaim Group (UAE)

South America

- Renova Energia –(Brazil)

- Trina Solar (China)

- LONGi Green Energy (China)

- Canadian Solar (Canada)

- SunEdison (United States)

Frequently Asked Questions

Cadmium Telluride (CdTe) dominates due to its efficiency, low cost, and scalable production.

The market is projected to reach USD 13.51 billion by 2032.

The Asia-Pacific region leads due to strong policy support and rapid solar expansion.

Key players include First Solar, Oxford PV, Trina Solar, LONGi, and Enel Green Power.

Global Next Generation of Solar Cell Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Next Generation of Solar Cell Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Global Next Generation of Solar Cell Market: Dynamics

3.1. Global Next Generation of Solar Cell Market Trends

3.2. The Global Next Generation of Solar Cell Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis For the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Global Next Generation of Solar Cell Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. Global Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

4.1.1. Transceivers

4.1.2. Cadmium Telluride (CdTe)

4.1.3. Copper Indium Gallium Selenide(CIGS)

4.1.4. Amorphous Silicon (a-Si)

4.1.5. Gallium-Arsenide (GaAs)

4.1.6. Others

4.2. Global Next Generation of Solar Cell Market Size and Forecast, By Installation Type(2024-2032)

4.2.1. On-grid

4.2.2. Off-grid

4.3. Global Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

4.3.1. Utilities

4.3.2. Residential

4.3.3. Commercial & Industrial

4.3.4. Others

4.4. Global Next Generation of Solar Cell Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Next Generation of Solar Cell Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Next Generation of Solar Cell Market Size and Forecast, By Material Type(2024-2032)

5.1.1. Transceivers

5.1.2. Cadmium Telluride (CdTe)

5.1.3. Copper Indium Gallium Selenide(CIGS)

5.1.4. Amorphous Silicon (a-Si)

5.1.5. Gallium-Arsenide (GaAs)

5.1.6. Others

5.2. North America Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

5.2.1. On-grid

5.2.2. Off-grid

5.3. North America Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

5.3.1. Utilities

5.3.2. Residential

5.3.3. Commercial & Industrial

5.3.4. Others

5.4. North America Next Generation of Solar Cell Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)Perovskite solar cell

5.4.1.1.1. Transceivers

5.4.1.1.2. Cadmium Telluride (CdTe)

5.4.1.1.3. Copper Indium Gallium Selenide(CIGS)

5.4.1.1.4. Amorphous Silicon (a-Si)

5.4.1.1.5. Gallium-Arsenide (GaAs)

5.4.1.1.6. Others

5.4.1.2. United States Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

5.4.1.2.1. On-grid

5.4.1.2.2. Off-grid

5.4.1.3. United States Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

5.4.1.3.1. Utilities

5.4.1.3.2. Residential

5.4.1.3.3. Commercial & Industrial

5.4.1.3.4. Others

5.4.2. Canada

5.4.2.1. Canada Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

5.4.2.1.1. Transceivers

5.4.2.1.2. Cadmium Telluride (CdTe)

5.4.2.1.3. Copper Indium Gallium Selenide(CIGS)

5.4.2.1.4. Amorphous Silicon (a-Si)

5.4.2.1.5. Gallium-Arsenide (GaAs)

5.4.2.1.6. Others

5.4.2.2. Canada Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

5.4.2.2.1. On-grid

5.4.2.2.2. Off-grid

5.4.2.3. Canada Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

5.4.2.3.1. Utilities

5.4.2.3.2. Residential

5.4.2.3.3. Commercial & Industrial

5.4.2.3.4. Others

5.4.3. Mexico

5.4.3.1. Mexico Next Generation of Solar Cell Market Size and Forecast, By Material Type(2024-2032)

5.4.3.1.1. Transceivers

5.4.3.1.2. Cadmium Telluride (CdTe)

5.4.3.1.3. Copper Indium Gallium Selenide(CIGS)

5.4.3.1.4. Amorphous Silicon (a-Si)

5.4.3.1.5. Gallium-Arsenide (GaAs)

5.4.3.1.6. Others

5.4.3.2. Mexico Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

5.4.3.2.1. On-grid

5.4.3.2.2. Off-grid

5.4.3.3. Mexico Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

5.4.3.3.1. Utilities

5.4.3.3.2. Residential

5.4.3.3.3. Commercial & Industrial

5.4.3.3.4. Others

6. Europe Next Generation of Solar Cell Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

6.1. Europe Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.2. Europe Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.3. Europe Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4. Europe Next Generation of Solar Cell Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.1.2. United Kingdom Next Generation of Solar Cell Market Size and Forecast, By Installation(2024-2032)

6.4.1.3. United Kingdom Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4.2. France

6.4.2.1. France Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.2.2. France Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.4.2.3. France Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.3.2. Germany Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.4.3.3. Germany Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.4.2. Italy Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.4.4.3. Italy Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.5.2. Spain Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.4.5.3. Spain Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.6.2. Sweden Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.4.6.3. Sweden Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.7.2. Russia Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.4.7.3. Russia Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

6.4.8.2. Rest of Europe Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

6.4.8.3. Rest of Europe Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7. Asia Pacific Next Generation of Solar Cell Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

7.1. Asia Pacific Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.2. Asia Pacific Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.3. Asia Pacific Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4. Asia Pacific Next Generation of Solar Cell Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.1.2. China Next Generation of Solar Cell Market Size and Forecast, By Installation(2024-2032)

7.4.1.3. China Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.2.2. S Korea Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.2.3. S Korea Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.3.2. Japan Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.3.3. Japan Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.4. India

7.4.4.1. India Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.4.2. India Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.4.3. India Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.5.2. Australia Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.5.3. Australia Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.6.2. Indonesia Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.6.3. Indonesia Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.7.2. Malaysia Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.7.3. Malaysia Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.8.2. Philippines Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.8.3. Philippines Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.9.2. Thailand Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.9.3. Thailand Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.10.2. Vietnam Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.10.3. Vietnam Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

7.4.11.3. Rest of Asia Pacific Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

8. Middle East and Africa Next Generation of Solar Cell Market Size and Forecast (by Value in USD Bn) (2024-2032

8.1. Middle East and Africa Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

8.2. Middle East and Africa Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

8.3. Middle East and Africa Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

8.4. Middle East and Africa Next Generation of Solar Cell Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

8.4.1.2. South Africa Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

8.4.1.3. South Africa Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

8.4.2.2. GCC Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

8.4.2.3. GCC Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

8.4.3.2. Egypt Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

8.4.3.3. Egypt Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

8.4.4.2. Nigeria Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

8.4.4.3. Nigeria Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

8.4.5.2. Rest of ME&A Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

8.4.5.3. Rest of ME&A Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

9. South America Next Generation of Solar Cell Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032

9.1. South America Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

9.2. South America Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

9.3. South America Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

9.4. South America Next Generation of Solar Cell Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

9.4.1.2. Brazil Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

9.4.1.3. Brazil Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

9.4.2.2. Argentina Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

9.4.2.3. Argentina Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

9.4.3.2. Colombia Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

9.4.3.3. Colombia Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

9.4.4.2. Chile Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

9.4.4.3. Chile Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Next Generation of Solar Cell Market Size and Forecast, By Material Type (2024-2032)

9.4.5.2. Rest Of South America Next Generation of Solar Cell Market Size and Forecast, By Installation (2024-2032)

9.4.5.3. Rest Of South America Next Generation of Solar Cell Market Size and Forecast, By End User (2024-2032)

10. Company Profile: Key Players

10.1 First Solar, Inc.

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Developments

10.2 SunPower Corporation

10.3 Ubiquitous Energy

10.4 Solaria Corporation

10.5 Calyxo USA

10.6 Oxford PV

10.7 Heliatek GmbH

10.8 Saule Technologies

10.9 NanoFlex Power Europe

10.10 Horizon Energy Ventures

10.11 Panasonic Corporation

10.12 Sharp Corporation

10.13 Hanwha Q CELLS

10.14 JA Solar Technology Co., Ltd

10.15 JinkoSolar Holding Co., Ltd

10.16 Borosil Re ables Ltd.

10.17 Greatcell Solar Ltd.

10.18 SolarFrontier

10.19 Abengoa Solar

10.20 JinkoSolar

10.21 First Solar

10.22 ACWA Power

10.23 Al-Futtaim Group

10.24 Renova Energia

10.25 Trina Solar

10.26 LONGi Green Energy

10.27 Canadian Solar

10.28 SunEdison

11. Key Findings

12. Industry Recommendations

13. Next Generation of Solar Cell Market: Research Methodology