US Antibody Drug Conjugates Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

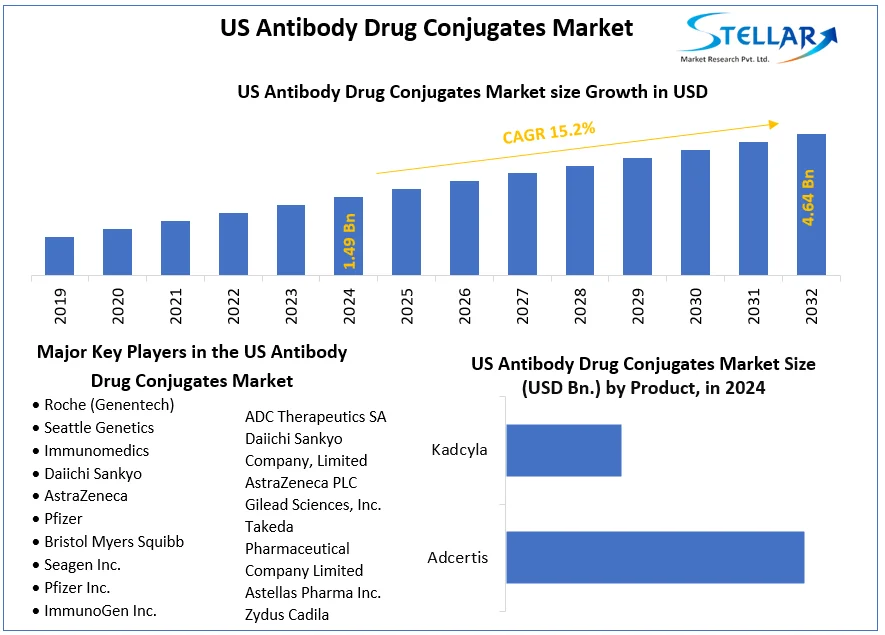

The US Antibody Drug Conjugates Market size was valued at USD 1.49 Billion in 2024 and the total US Antibody Drug Conjugates revenue is expected to grow at a CAGR of 15.2% from 2025 to 2032, reaching nearly USD 4.64 Billion in 2032.

Format : PDF | Report ID : SMR_1618

US Antibody Drug Conjugates Market Overview-

Antibody drug conjugates merge potent cell-killing small molecule drugs with unique anti-tumor effects and provide an innovative therapeutic approach. In contrast to conventional chemotherapy, they minimize systemic toxicity by targeting carcinogenic cells, sparing healthy cells, and improving safety in treating cancer. In the surge in cancer cases, antibody-drug conjugates emerge as a powerful tool in oncology. The targeted cancer therapy combines monoclonal antibodies with cytotoxic payloads, delivering potent treatment directly to cancer cells while minimizing harm to healthy ones. It represents a dynamic frontier in novel cancer therapy.

The report analyses the US Antibody Drug Conjugates market and covers trends, technological advancements, and potential disruptions that shape the market. It assesses market size, growth, economic factors, regulations, and commercial drivers. The competitive landscape is analyzed, highlighting differentiation among key operators and drawing on historical data, industry insights, and the report forecasts sector. The economic downturn prompted this analysis and revealed the US Antibody Drug Conjugates industry's resilience challenges. The report aims to equip stakeholders with crucial, concise information for informed decision-making in this dynamic sector. The targeted audiences include People with Healthcare professionals, Secondary Audiences, Government agencies, policymakers, and pharmaceutical companies in the US Antibody Drug Conjugates industry.

To get more Insights: Request Free Sample Report

US Antibody Drug Conjugates Market Dynamics

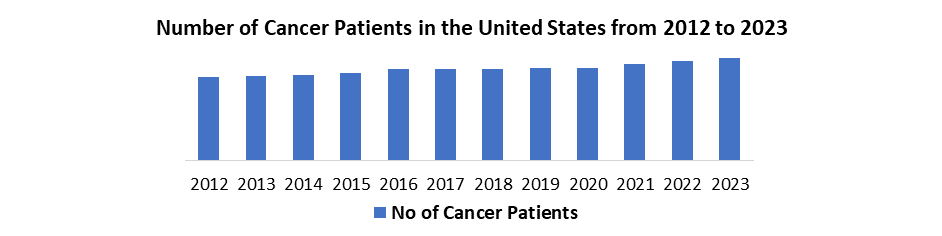

Rising Incidence of Cancer to Drive the US Antibody Drug Conjugates Market

Increasing cancer diagnoses drive demand for the US Antibody Drug Conjugates market and drive research and development. Antibody Drugs Conjugates technology innovations address the urgent need for potent and targeted cancer therapies, pledging improved patient outcomes. Higher healthcare investment bolsters research, manufacturing, and infrastructure, fostering job creation and economic growth. Effective ADCs provide cancer patients with improved treatment options, potentially reducing side effects and enhancing their quality of life.

Rising cancer rates and the high cost of ADCs raise ethical concerns, intensifying healthcare disparities. The growing demand for US Antibody Drug Conjugates industry strains healthcare systems grappling with rising costs and resource limitations. Over-relying on ADCs, neglecting early detection, and prevention may pose challenges. Manufacturing and disposing of complex ADC components raise environmental concerns without responsible management.

The increasing cancer incidence drives the US Antibody Drug Conjugates market, fostering development and treatment optimism. However, ethical, economic, and environmental concerns accompany these advancements, emphasizing the need for responsible development, pricing, and access strategies.

US Antibody Drug Conjugates Market Segment Analysis

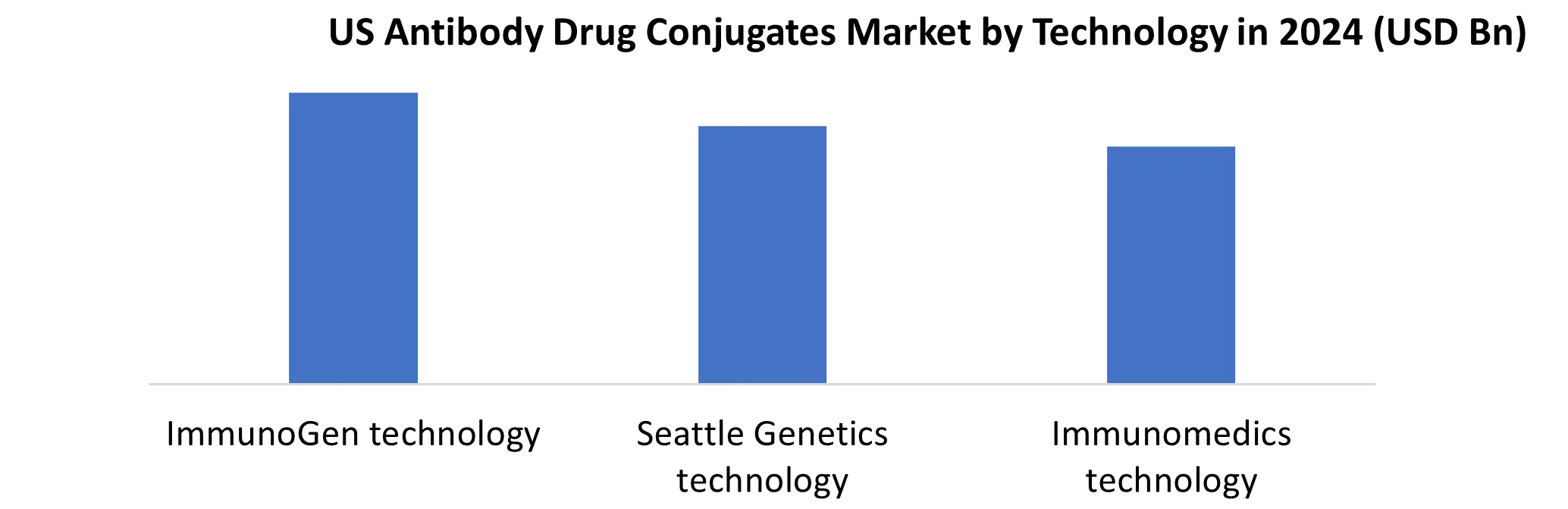

Based on Technology, the ImmunoGen Technology segment held the largest market share of about 30% in the US Antibody Drug Conjugates Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 15.4% during the forecast period. It stands out as the dominant segment within the US Antibody Drug Conjugates Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

In the US Antibody Drug Conjugates Market Approved Antibody Drug Conjugates like Kadcyla actively improve efficacy and minimize side effects through groundbreaking linker-payload technology. Novel ADC platforms and advanced linker technologies result from active R&D investments. Enfortumab Vedotin and Kadcyla actively broaden cancer treatment options in the market. Licensing agreements actively spur ADC tech access, accelerating development and propelling the US ADC market. Clinically, these active advancements address unmet medical needs, potentially elevating survival rates and patients' quality of life, while actively driving research and development in targeted cancer therapy.

US Antibody Drug Conjugates ImmunoGen's limited market share actively hampers its broader impact compared to larger players, impeding competition for resources and partnerships. High development costs and time constraints actively impede innovation, disadvantaging smaller companies like ImmunoGen. Safety concerns persist actively due to ADCs' potent payloads, posing a continuous challenge to the balance between efficacy and safety. Rising competition from Seagen and AstraZeneca actively complicates ImmunoGen's differentiation, making partnership acquisition and market share maintenance more challenging.

The US Antibody Drug Conjugates companies excel by leveraging expertise in specific targets or linker technologies for differentiation. Larger firms actively provide crucial resources and broaden their reach through strategic partnerships. Efficiently introducing new, safe, and effective ADCs to the market is ensured by prioritizing clinical development. Continuous technology refinement and collaboration with stakeholders actively address safety concerns to ensure patient well-being.

US Antibody Drug Conjugates Market Scope:

|

US Antibody Drug Conjugates Market |

|

|

Market Size in 2024 |

USD 1.49 Billion |

|

Market Size in 2032 |

USD 4.64 Billion |

|

CAGR (2025-2032) |

15.2 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Application

|

|

By Type

|

|

|

By Product

|

|

|

By Technology

|

|

|

End-User

|

|

Leading Key Players in the US Antibody Drug Conjugates Market

- Roche (Genentech)

- Seattle Genetics

- Immunomedics

- Daiichi Sankyo

- AstraZeneca

- Pfizer

- Bristol Myers Squibb

- Seagen Inc.

- Pfizer Inc.

- ImmunoGen Inc.

- ADC Therapeutics SA

- Daiichi Sankyo Company, Limited

- AstraZeneca PLC

- Gilead Sciences, Inc.

- Takeda Pharmaceutical Company Limited

- Astellas Pharma Inc.

- Zydus Cadila

Frequently Asked Questions

High drug costs and Limited reimbursement are expected to be the major restraining factors for the US Antibody Drug Conjugates market growth.

The US Antibody Drug Conjugates Market size was valued at USD 1.49 Billion in 2024 and the total US Antibody Drug Conjugates revenue is expected to grow at a CAGR of 15.2 % from 2025 to 2032, reaching nearly USD 4.64 Billion By 2032.

1. US Antibody Drug Conjugates Market Introduction

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Executive Summary

1.4 Emerging Technologies

1.5 Market Projections

1.6 Strategic Recommendations

2. US Antibody Drug Conjugates Market Import Export Landscape

2.1 Import Trends

2.2 Export Trends

2.3 Regulatory Compliance

2.4 Major Export Destinations

2.5 Import-Export Disparities

3. US Antibody Drug Conjugates Market: Dynamics

3.1.1 Market Drivers

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the US Antibody Drug Conjugates Industry.

3.6 The Pandemic and Redefining of The US Antibody Drug Conjugates Industry Landscape

4. US Antibody Drug Conjugates Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 US Antibody Drug Conjugates Market Size and Forecast, By Application (2024-2032)

4.1.1 Blood Cancer

4.1.2 Prostate cancer

4.1.3 kidney cancer

4.1.4 Pancreas cancer

4.1.5 Ovary cancer

4.1.6 Glioblastoma

4.1.7 lung cancer

4.1.8 Colon cancer

4.1.9 Breast cancer

4.1.10 Skin cancer

4.1.11 Solid tumors

4.2 US Antibody Drug Conjugates Market Size and Forecast, By Type (2024-2032)

4.2.1 Monoclonal antibodies

4.2.2 linker

4.2.3 Drug/toxin

4.3 US Antibody Drug Conjugates Market Size and Forecast, By Product (2024-2032)

4.3.1 Adcertis

4.3.2 Kadcyla

4.4 US Antibody Drug Conjugates Market Size and Forecast, By Technology (2024-2032)

4.4.1 ImmunoGen technology

4.4.2 Seattle Genetics technology

4.4.3 Immunomedics technology

4.5 US Antibody Drug Conjugates Market Size and Forecast, By End-User (2024-2032)

4.5.1 Hospitals

4.5.2 Specialized cancer centers

4.5.3 Academic research institutes

4.5.4 Biotechnology companies

4.5.5 Biopharmaceutical companies

5. US Antibody Drug Conjugates Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading US Antibody Drug Conjugates Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 Roche (Genentech)

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Seattle Genetics

6.3 Immunomedics

6.4 Daiichi Sankyo

6.5 AstraZeneca

6.6 Pfizer

6.7 Bristol Myers Squibb

6.8 Seagen Inc.

6.9 Pfizer Inc.

6.10 ImmunoGen Inc.

6.11 ADC Therapeutics SA

6.12 Daiichi Sankyo Company, Limited

6.13 AstraZeneca PLC

6.14 Gilead Sciences, Inc.

6.15 Takeda Pharmaceutical Company Limited

6.16 Astellas Pharma Inc.

6.17 Zydus Cadila

7. Key Findings

8. Industry Recommendations

9. US Antibody Drug Conjugates Market: Research Methodology