Telemedicine Market- Global Industry Analysis and Forecast (2025-2032) by Component, Categories, End User, and region.

Telemedicine Market size was valued at USD 104.4 Billion in 2024 and is expected to grow at a CAGR of 16 % from 2025 to 2032, reaching nearly USD 342.26 Billion.

Format : PDF | Report ID : SMR_1601

Telemedicine Market Objective

Stellar Market Research conducted brief analysis on Global Telemedicine Market. The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Global Telemedicine Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Global Telemedicine Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Telemedicine Market Overview

Telemedicine is practice of providing medical care remotely by telecommunications technology. It involves sharing of medical data by encrypted messaging apps, phone conversations, or video chats between a patient and a medical expert.

The key driving factors for Telemedicine market such as aging population, regulatory support, rise in consumer demands, and many others are analysed in the report. Recent technologies, like AI for observing and tracking patients' health status Virtually and Data Analytics for keeping records to improve accessibility to medical data and streamlining healthcare processes, are applied to cater the rising demand for Telemedicine Market. Use of artificial intelligence in Telemedicine is surging as for data analysis, personalized medicine, and bettering patient outcomes, AI has created huge opportunity for Telemedicine market players to enhance their sales. Recent trends in Telemedicine market, such as, Integration with Electronic Health Records (EHR) to streamline the sharing of patient information and improve overall continuity of care, Telemedicine Startups to offer innovative solutions and disrupting traditional healthcare delivery models, and many others are analysed thoroughly in the report.

Stellar market research conducted the analysis of for Telemedicine market over past 5 years and by using the data, came to a conclusion that North America dominated the global Telemedicine market with around 45% market share and is expected to continue its dominance during the forecast period. The dominance is majorly supported by United States and Canada. United States, with a CAGR of 20%, has dominated the Telemedicine market in North America. Companies like Teladoc Health Inc., American Well Corporation, MDLive Inc., and others are few major companies operating in North America region analysed in the report. APAC and Europe are also contributing significantly to the Global Telemedicine market.

To get more Insights: Request Free Sample Report

Telemedicine Market Dynamics

Increase in adoption of Telemedicine

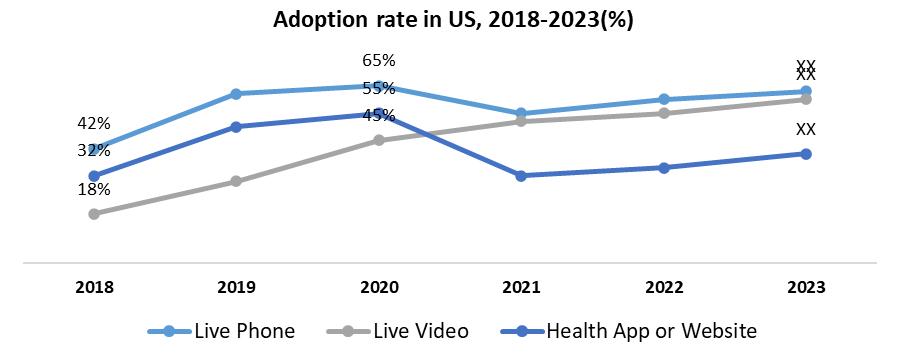

The global telemedicine market witnessed surge in adoption and acceptance, with drastic shift during and after COVID-19 pandemic. According to SMR analysis, telemedicine utilization in the United States increased from 10% of total outpatient visits in 2019 to a 40% in 2023. This shift showcase the rapid acceptance and mainstream integration of telemedicine solutions.

Globally, chronic illnesses is rising, and to provide effective treatment, telemedicine plays an important role by keeping an eye on a patient, and sharing information that leverages the newest telecommunications technologies. Monitoring makes it feasible to prevent chronic illnesses and diagnose diseases early. Recent initiatives like Denmark's TELEKART, the US's veterans' health segmentation (VHA), and the UK's whole system demonstration (WSD) are done to cater the growing demand of consumers.

Advancement in technologies related to telemedicine

As the global healthcare industry advances digitally, advanced technologies are playing a crucial role in reshaping the telemedicine market. These cutting-edge tools are transforming telemedicine by improving diagnostic accuracy, tailoring patient care, and streamlining healthcare delivery. Artificial Intelligence (AI) and machine learning algorithms are increasingly being incorporated into telemedicine platforms to enhance the efficiency and precision of remote diagnostics. Virtual Reality (VR) and Augmented Reality (AR) applications are changing the landscape of telehealth by offering immersive experiences for both patients and healthcare providers. The Internet of Things (IoT) enables remote monitoring through connected devices, contributing to a more comprehensive approach to patient care.

In Europe, countries like Germany, the United Kingdom, and France are leading the way in improving telemedicine through technological advancements. This progress is driven by the rising demand for affordable and time-efficient healthcare services. According to SMR analysis, the telemedicine market in Europe is projected to reach €16 billion by 2025, underscoring the substantial growth made possible by technological innovations.

Companies such as Siemens Healthineers, Philips Healthcare, and Teleperformance are putting a lot of money into research and development to come up with new and clever telemedicine solutions. Siemens Healthineers is leading the way in making diagnostic tools that use artificial intelligence (AI), making telemedicine services better and faster. Philips Healthcare is adding the Internet of Things (IoT) to its telehealth solutions, letting doctors monitor patients from a distance and use data to manage healthcare more effectively.

Regulation impact on Telemedicine Market

Telemedicine regulations in the USA include consent, online prescribing, licensing across states, licensure compacts, and professional board standards. The Interstate Medical Licensure Compact (IMLC) enables practitioners licensed in one state to offer telemedicine services in another state. The American Medical Association (AMA) is actively working to permanently eliminate restrictions on telehealth coverage and payment at the federal level.

The Ministry of Health, Labour and Welfare (MHLW) in Japan updated its guidelines for telemedicine. These guidelines now allow telemedicine to begin with the first patient visit, as long as a primary care physician generally conducts the initial contact. The MHLW has also outlined specific requirements regarding the security systems and measures that must be in place for telemedicine, ensuring the protection of patient information.

Telemedicine Market Segment Analysis

Based on Application, in 2024, the telemedicine market had different specialized areas like Teleradiology, Telepsychiatry, Telepathology, Teledermatology, Telecardiology, and others. Among these, Teleradiology is the most dominant and expected to continue leading in market share. This is because more healthcare providers are using Teleradiology due to an increase in imaging practices. Additionally, the simplification and regulation of Teleradiology processes contribute to its widespread adoption.

One of the key reasons for Teleradiology's dominance is the integration of Artificial Intelligence (AI) into the field. AI is making the interpretation of radiological images more efficient.

The use of Picture Archiving and Communication System (PACS) is also contributing to Teleradiology's growth. PACS helps in the digital storage and retrieval of medical images, streamlining the process. The expansion of research and development (R&D) activities in the health sector is playing a crucial role in Teleradiology's growth. As more advancements are made in technology and processes, Teleradiology is becoming even more integral to the broader telemedicine market.

Telemedicine Market Competitive Analysis

In M&A, the United States has been the major player in gathering funds for telemedicine. Since 2015, they have raised over $28 billion through over 2,200 transactions, making up more than 60% of the total funds collected globally.

- Teladoc Health, Inc.

- Invested $400 million in research and development (R&D) and innovation in 2023.

- A global leader in whole-person virtual care, offering technology for connecting patients with trusted expertise and improving health outcomes.

- Acquired Livongo Health for $18.5 billion in 2020, which marked a major move in the telehealth space.

- American Well Corporation

- Partnered with Cleveland Clinic to form a joint venture, under the name CCAW, JV LLC, to provide broad access to comprehensive and high acuity care services via digital care delivery.

- Acquired Conversa Health, an automated care company, in August 2021 for an aggregate purchase price of approximately $320 million.

- Acquired SilverCloud Health, a digital mental health platform, in 2021 for $320 million.

- Grand Rounds Health

- Grand Rounds Health merged with Doctor on Demand in 2021.

- Apple

- Apple has played a significant role in telemedicine by creating digital health tools. These include features like wellness trackers on the Apple Watch and their exclusive telemedicine application, Apple Health.

- SnapMD

- SnapMD has secured $20.7 million in funding from six investors, which include J.F. Shea Co and MBX Capital. This financial backing will support the growth and development of SnapMD's business in telemedicine market.

- The research includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favourable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry.

The research also aids in comprehending the Telemedicine Market dynamics and structure by studying market segments and forecasting market size.

The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Telemedicine Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

|

Telemedicine Market Scope |

|

|

Market Size in 2024 |

USD 104.4 Bn. |

|

Market Size in 2032 |

USD 342.26 Bn. |

|

CAGR (2025-2032) |

16% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Delivery Mode

|

|

By Application

|

|

|

By End User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Telemedicine Market Players

- Koninklijke Philips N.V.

- American Well Corporation

- Medtronic plc

- Siemens AG

- AMC Health, LLC

- The Cigna Group

- Teladoc Health Inc.

- General Electric Company

- Oracle Corporation

- MDlive, Inc. (Evernorth)

- Twilio Inc.

- Doctor On Demand, Inc. (Included Health)

- Zoom Video Communications, Inc.

- SOC Telemed, Inc.

- NXGN Management, LLC

- Plantronics, Inc.

- Practo

- VSee

- AMD Global Telemedicine Inc.

- Resideo Technologies Inc. (Honeywell Life Care Solutions)

- Allscripts Healthcare Solutions Inc.

- Aerotel Medical Systems

Frequently Asked Questions

The product segment of telemedicine, including kits, software, and hardware, is an important tool for making healthcare more cost-effective, accessible, and engaging for patients. It benefits the elderly population by allowing them to receive medical care from the comfort of their homes.

Telemedicine is a versatile technology for delivering health education, information, and healthcare services over long distances. It significantly contributes to health education in regions where provider investment in healthcare applications is more challenging, providing more access to remote areas.

Telemedicine addresses the demand for mental healthcare through services like telepsychiatry and virtual counseling, providing convenient and accessible options for patients. It helps overcome geographical barriers, ensuring medical expertise is available beyond traditional healthcare facilities.

An estimated $250 billios attributed to the country's high adoption of advanced healthcare technoln of US healthcare spend is potentially expected to be shifted to virtual or virtually enabled care. The rapid increase in telemedicine in the United States iogies, the rising burden of chronic diseases, and the significant benefits of telemedicine in enhancing care management, improving patients' quality of life, and reducing healthcare costs

1. Telemedicine Market: Research Methodology

2. Telemedicine Market: Executive Summary

3. Telemedicine Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Telemedicine Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Telemedicine Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Telemedicine Market Size and Forecast, by Delivery Mode (2024-2032)

5.1.1. On-Premise Delivery

5.1.2. Cloud-Based Delivery

5.2. Telemedicine Market Size and Forecast, by Application (2024-2032)

5.2.1. Teleradiology

5.2.2. Telepsychiatry

5.2.3. Telepathology

5.2.4. Teledermatology

5.2.5. Telecardiology

5.2.6. Others

5.3. Telemedicine Market Size and Forecast, by End User (2024-2032)

5.3.1. Providers

5.3.2. Payers

5.3.3. Patients

5.3.4. Other

5.4. Telemedicine Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Telemedicine Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Telemedicine Market Size and Forecast, by Delivery Mode (2024-2032)

6.1.1. On-Premise Delivery

6.1.2. Cloud-Based Delivery

6.2. North America Telemedicine Market Size and Forecast, by Application (2024-2032)

6.2.1. Teleradiology

6.2.2. Telepsychiatry

6.2.3. Telepathology

6.2.4. Teledermatology

6.2.5. Telecardiology

6.2.6. Others

6.3. North America Telemedicine Market Size and Forecast, by End User (2024-2032)

6.3.1. Providers

6.3.2. Payers

6.3.3. Patients

6.3.4. Other

6.4. North America Telemedicine Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Telemedicine Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Telemedicine Market Size and Forecast, by Delivery Mode (2024-2032)

7.1.1. On-Premise Delivery

7.1.2. Cloud-Based Delivery

7.2. Europe Telemedicine Market Size and Forecast, by Application (2024-2032)

7.2.1. Teleradiology

7.2.2. Telepsychiatry

7.2.3. Telepathology

7.2.4. Teledermatology

7.2.5. Telecardiology

7.2.6. Others

7.3. Europe Telemedicine Market Size and Forecast, by End User (2024-2032)

7.3.1. Providers

7.3.2. Payers

7.3.3. Patients

7.3.4. Other

7.4. Europe Telemedicine Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Telemedicine Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Telemedicine Market Size and Forecast, by Delivery Mode (2024-2032)

8.1.1. On-Premise Delivery

8.1.2. Cloud-Based Delivery

8.2. Asia Pacific Telemedicine Market Size and Forecast, by Application (2024-2032)

8.2.1. Teleradiology

8.2.2. Telepsychiatry

8.2.3. Telepathology

8.2.4. Teledermatology

8.2.5. Telecardiology

8.2.6. Others

8.3. Asia Pacific Telemedicine Market Size and Forecast, by End User (2024-2032)

8.3.1. Providers

8.3.2. Payers

8.3.3. Patients

8.3.4. Other

8.4. Asia Pacific Telemedicine Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Telemedicine Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Telemedicine Market Size and Forecast, by Delivery Mode (2024-2032)

9.1.1. On-Premise Delivery

9.1.2. Cloud-Based Delivery

9.2. Middle East and Africa Telemedicine Market Size and Forecast, by Application (2024-2032)

9.2.1. Teleradiology

9.2.2. Telepsychiatry

9.2.3. Telepathology

9.2.4. Teledermatology

9.2.5. Telecardiology

9.2.6. Others

9.3. Middle East and Africa Telemedicine Market Size and Forecast, by End User (2024-2032)

9.3.1. Providers

9.3.2. Payers

9.3.3. Patients

9.3.4. Other

9.4. Middle East and Africa Telemedicine Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Telemedicine Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Telemedicine Market Size and Forecast, by Delivery Mode (2024-2032)

10.1.1. On-Premise Delivery

10.1.2. Cloud-Based Delivery

10.2. South America Telemedicine Market Size and Forecast, by Application (2024-2032)

10.2.1. Teleradiology

10.2.2. Telepsychiatry

10.2.3. Telepathology

10.2.4. Teledermatology

10.2.5. Telecardiology

10.2.6. Others

10.3. South America Telemedicine Market Size and Forecast, by End User (2024-2032)

10.3.1. Providers

10.3.2. Payers

10.3.3. Patients

10.3.4. Other

10.4. South America Telemedicine Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Koninklijke Philips N.V.

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. American Well Corporation

11.3. Medtronic plc

11.4. Siemens AG

11.5. AMC Health, LLC

11.6. The Cigna Group

11.7. Teladoc Health Inc.

11.8. General Electric Company

11.9. Oracle Corporation

11.10. MDlive, Inc. (Evernorth)

11.11. Twilio Inc.

11.12. Doctor On Demand, Inc. (Included Health)

11.13. Zoom Video Communications, Inc.

11.14. SOC Telemed, Inc.

11.15. NXGN Management, LLC

11.16. Plantronics, Inc.

11.17. Practo

11.18. VSee

11.19. AMD Global Telemedicine Inc.

11.20. Resideo Technologies Inc. (Honeywell Life Care Solutions)

11.21. Allscripts Healthcare Solutions Inc.

11.22. Aerotel Medical Systems

12. Key Findings

13. Industry Recommendation