Spinal Fusion Bone Graft Substitutes Market - Global Industry Analysis and Forecast (2025-2032)

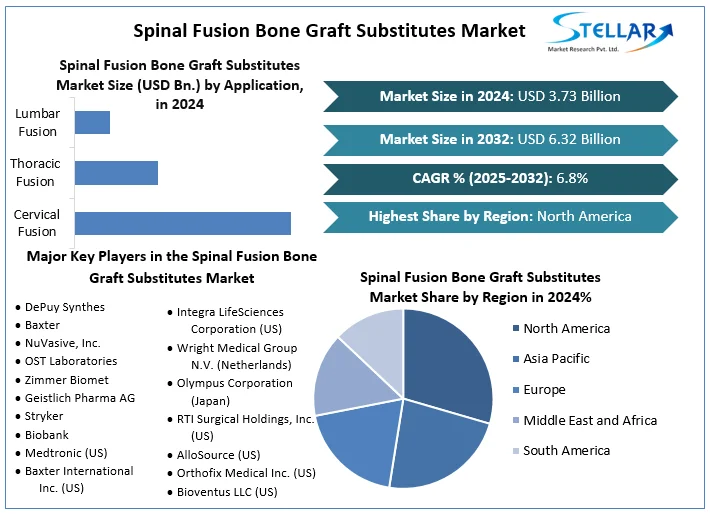

The Spinal Fusion Bone Graft Substitutes Market size was valued at USD 3.73 Bn. in 2024 and the total Global Spinal Fusion Bone Graft Substitutes revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 6.32 Bn. by 2032.

Format : PDF | Report ID : SMR_1783

Spinal Fusion Bone Graft Substitutes Market Overview

The report thoroughly covers the profit margins of key players across different regions and segments, providing insights into the financial performance of industry stakeholders. The analysis helps stakeholders to understand the profitability dynamics within the market and identify areas for improvement or investment. Identifying and analyzing market trends is crucial for understanding the direction of the Spinal Fusion Bone Graft Substitutes market. Trends such as technological advancements, shifting consumer preferences, regulatory changes, and emerging market opportunities are examined to expect developments and capitalize on growth prospects.

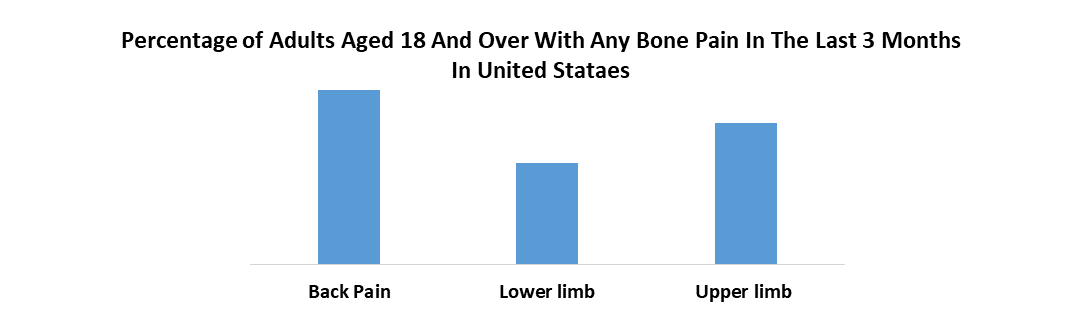

The Report covers the investment opportunities in the Spinal Fusion Bone Graft Substitutes market, as demand surges for orthopedic and spine procedures. With a global rise in spinal disorders and aging population, the market for bone graft substitutes is set for substantial growth. Technological advancements, including bioactive materials and 3D printing, drive innovation, enhancing safety and efficacy. The prevalence of spinal disorders like degenerative disc disease drives the demand for spinal fusion surgeries, necessitating bone graft substitutes for healing. The aging demographic, particularly in developed regions, drives demand for spinal fusion procedures, creating a burgeoning market for bone graft substitutes catering to this segment.

The market is expected to rise by 2032 because of several factors including innovative bone graft substitute products with enhanced efficiency and safety profiles. Also, the report covers the growing indications for spinal fusion surgeries, and advancements in surgical techniques are expected to drive market growth. strategic collaborations between healthcare providers, medical device manufacturers, and research institutions are estimated to accelerate market growth and facilitate the adoption of novel technologies. As a result, the Spinal Fusion Bone Graft Substitutes market is expected to emerge as a significant segment within the orthopedic industry, offering attractive investment opportunities for stakeholders aiming to capitalize on the growing demand for spinal fusion procedures and bone graft substitute

To get more Insights: Request Free Sample Report

Spinal Fusion Bone Graft Substitutes Market Dynamics

Allograft and autograft bone substitutes

Autografts, sourced from the patient's own body, commonly the iliac crest, are prized for their inherent bone growth and formation properties. Despite their effectiveness, they necessitate an additional surgical site, leading to heightened pain and recovery periods. Allografts, obtained from donors and sterilized for transplantation, provide osteoconductivity but lack the innate bone-forming capabilities of autografts. While less invasive than autograft procedures, allografts carry risks of disease transmission and rejection. From 2018 to 2020, autografts were still the top choice because they were known to work well. But allografts had some problems.

They had to deal with safety rules that made things harder, and it cost more to prepare them for use. Between 2021 and 2023, more people started using allografts. The change happened because new technology made them safer and reduced the chances of getting sick from them. Doctors also liked using methods that didn't need donor sites, which made allografts more popular. Older people needing spine surgery also increased during that time, and it was harder to use autografts in them because of their health issues.

Key Findings of the SMR Spinal Fusion Bone Graft Substitutes Market Report:

- The SMR investigation highlighted the detection of two nationwide TB outbreaks in 2021 and 2023, involving spinal surgical procedures using bone allografts. In 2021, XX numbers of recipients in 18 states were affected, while the 2023 outbreak involved two patients in different states. These outbreaks underscore the potential risks associated with bone allografts in spinal fusion procedures.

- The rapid public health response to the 2023 outbreak prevented as many as XX number of additional surgical procedures using the implicated bone allograft material. It indicates the significance of timely detection and intervention to mitigate risks associated with bone graft substitutes in spinal surgeries.

Clinical Adoption Hurdles and the Spinal Fusion Bone Graft Substitutes Market

Adopting new technologies such as allograft bone substitutes poses a major hurdle for the spinal fusion bone graft substitutes market. Surgeons and healthcare providers often stick to established methods like autografts due to several reasons such as they prioritize proven techniques backed by extensive clinical evidence and a history of successful outcomes. Also, surgeons are unwilling to invest time and resources in learning and becoming proficient with new technologies, preferring familiar procedures. Patient trust in their doctors' judgment and preference for proven treatments contribute to the challenge of overcoming inertia in adopting innovative bone graft substitutes.

Spinal Fusion Bone Graft Substitutes Market Segment Analysis

By Type, the Autografts segment helds the largest market share in the Global Spinal Fusion Bone Graft Substitutes Market in 2024. According to SMR analysis, the segment is further expected to grow at a CAGR of XX% during the forecast period. Autografts, sourced from the patient's own body, typically the iliac crest, are hailed as the pinnacle of bone grafting materials. Their acclaimed osteoconductive and osteoinductive properties make them the gold standard in bone regeneration. However, their reliance necessitates an additional surgical site, leading to increased patient discomfort and prolonged recovery periods. Also, challenges arise for patients with underlying health issues or limited bone availability.

Despite these drawbacks, autografts retain their widespread usage in the market. Their dominance is expected to face challenges as alternative options emerge. Even so, their enduring popularity comes from their unparalleled efficiency in promoting bone growth and formation. From a market perspective, autografts gain significant profit margins because of their minimal material cost. Hospitals and surgeons stand to benefit, provided surgical efficiency and overhead costs are optimized. Shifting trends and emerging technologies are expected to impact their market dominance by 2032, prompting a reassessment of their role in bone grafting procedures.

Spinal Fusion Bone Graft Substitutes Market Regional Analysis

North America leads the global Spinal Fusion Bone Graft Substitutes market, holding 40% of the market share in 2024. The dominance is driven by factors such as a significant prevalence of spinal conditions among the aging population, including spondylosis and degenerative disc disease. Advanced medical infrastructure in North America offers access to innovative surgical techniques and advanced bone graft substitutes. Also, favorable reimbursement policies for spinal fusion procedures facilitate patient access to these treatments, further solidifying North America's position at the lead of the Spinal Fusion Bone Graft Substitutes market. Minimally invasive surgeries are progressively preferred for their quicker recovery and reduced patient discomfort, driving demand for allograft bone substitutes.

North America's status as a medical device innovation hub increases the development of advanced bone graft substitutes, enhancing efficacy and safety. The cost of bone graft substitutes, ranging from allografts to synthetic options, can vary widely from a few hundred to several thousand dollars, impacting overall profit margins. Surgical expenses include surgeon fees, hospital charges, anesthesia, and facility costs, subject to variation based on location, surgeon expertise, and hospital type. Profit margins for hospitals and surgeons fluctuate, influenced by negotiated rates with insurance companies and overall cost structures. The SMR report examines these profit margins for key players across regions and different market segments, providing valuable insights into financial dynamics within the industry.

- According to the SMR estimation, more than 200,000 spine fusion and 500,000 bone graft procedures are performed each year in the United States.

Spinal Fusion Bone Graft Substitutes Market Competitive Landscape

The launching of new products with distinct attributes, such as accelerated healing and compatibility with minimally invasive procedures, appeals to surgeons and patients seeking enhanced outcomes. It drives market share growth for the launching company and encourages competitors to innovate.

- In October 2023, Orthofix Medical Inc. unveiled the full commercial release of OsteoCoveTM, an advanced bioactive synthetic graft, following its 510k approval. OsteoCove is available in both putty and strip formats and boasts exceptional bone-forming properties tailored for a range of orthopedic and spine surgeries.

- In February 2023, NuVasive, Inc. obtained FDA clearance for its Modulus Cervical interbody implant, marking a significant expansion of its C360 product range.

- In June 2022, Medtronic obtained FDA clearance for a ligament-augmenting implant, thus broadening its spine surgery portfolio.

- In March 2022, Zimmer Biomet finalized a distribution agreement with Biocomposites for the supply of Genex bone graft substitutes.

|

Spinal Fusion Bone Graft Substitutes Market Scope |

|

|

Market Size in 2024 |

USD 3.73 Bn. |

|

Market Size in 2032 |

USD 6.32 Bn. |

|

CAGR (2025-2032) |

6.8 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Type Autografts Allografts Xenografts |

|

By Application Cervical Fusion Thoracic Fusion Lumbar Fusion |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Spinal Fusion Bone Graft Substitutes Market

- DePuy Synthes (Johnson & Johnson Inc.)

- Baxter

- NuVasive, Inc.

- OST Laboratories

- Zimmer Biomet

- Geistlich Pharma AG

- Stryker

- Biobank

- Medtronic (US)

- Baxter International Inc. (US)

- Integra LifeSciences Corporation (US)

- Wright Medical Group N.V. (Netherlands)

- Olympus Corporation (Japan)

- RTI Surgical Holdings, Inc. (US)

- AlloSource (US)

- Orthofix Medical Inc. (US)

- Bioventus LLC (US)

- SeaSpine Holdings Corporation (US)

- Xtant Medical Holdings, Inc. (US)

- Aziyo Biologics, Inc. (US)

- Coloplast Corp. (Denmark)

- Arthrex, Inc. (US)

- LifeNet Health (US)

- RTI Surgical Holdings, Inc. (US)

Frequently Asked Questions

Several factors are driving the growth of the market, including an increasing prevalence of spinal disorders, advancements in surgical techniques and materials, and the aging population demographic.

Challenges include safety concerns related to certain graft materials, regulatory constraints, and the high cost associated with some advanced graft substitutes.

The Market size was valued at USD 3.73 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 6.32 Billion.

The segments covered in the market report are by Type and Application.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Spinal Fusion Bone Graft Substitutes Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Spinal Fusion Bone Graft Substitutes Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Spinal Fusion Bone Graft Substitutes Market: Dynamics

4.1. Spinal Fusion Bone Graft Substitutes Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Spinal Fusion Bone Graft Substitutes Market Drivers

4.3. Spinal Fusion Bone Graft Substitutes Market Restraints

4.4. Spinal Fusion Bone Graft Substitutes Market Opportunities

4.5. Spinal Fusion Bone Graft Substitutes Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Spinal Fusion Bone Graft Substitutes Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Type (2024-2032)

5.1.1. Autografts

5.1.2. Allografts

5.1.3. Xenografts

5.2. Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Application (2024-2032)

5.2.1. Cervical Fusion

5.2.2. Thoracic Fusion

5.2.3. Lumbar Fusion

5.3. Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Spinal Fusion Bone Graft Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Type (2024-2032)

6.1.1. Autografts

6.1.2. Allografts

6.1.3. Xenografts

6.2. North America Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Application (2024-2032)

6.2.1. Cervical Fusion

6.2.2. Thoracic Fusion

6.2.3. Lumbar Fusion

6.3. North America Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Spinal Fusion Bone Graft Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Type (2024-2032)

7.2. Europe Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Application (2024-2032)

7.3. Europe Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Country (2024-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Spinal Fusion Bone Graft Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Type (2024-2032)

8.2. Asia Pacific Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Application (2024-2032)

8.3. Asia Pacific Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Spinal Fusion Bone Graft Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Application (2024-2032)

9.3. Middle East and Africa Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Spinal Fusion Bone Graft Substitutes Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Type (2024-2032)

10.2. South America Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Application (2024-2032)

10.3. South America Spinal Fusion Bone Graft Substitutes Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. DePuy Synthes (Johnson & Johnson Inc.)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Baxter

11.3. NuVasive, Inc.

11.4. OST Laboratories

11.5. Zimmer Biomet

11.6. Geistlich Pharma AG

11.7. Stryker

11.8. Biobank

11.9. Medtronic (US)

11.10. Integra LifeSciences Corporation (US)

11.11. Wright Medical Group N.V. (Netherlands)

11.12. Olympus Corporation (Japan)

11.13. RTI Surgical Holdings, Inc. (US)

11.14. AlloSource (US)

11.15. Orthofix Medical Inc. (US)

11.16. Bioventus LLC (US)

11.17. SeaSpine Holdings Corporation (US)

11.18. Xtant Medical Holdings, Inc. (US)

11.19. Aziyo Biologics, Inc. (US)

11.20. Coloplast Corp. (Denmark)

11.21. Arthrex, Inc. (US)

11.22. LifeNet Health (US)

11.23. RTI Surgical Holdings, Inc. (US)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook