Netherlands Coffee Market: Industry Analysis and Forecast (2024-2030) by Source, Type, Process, and Region.

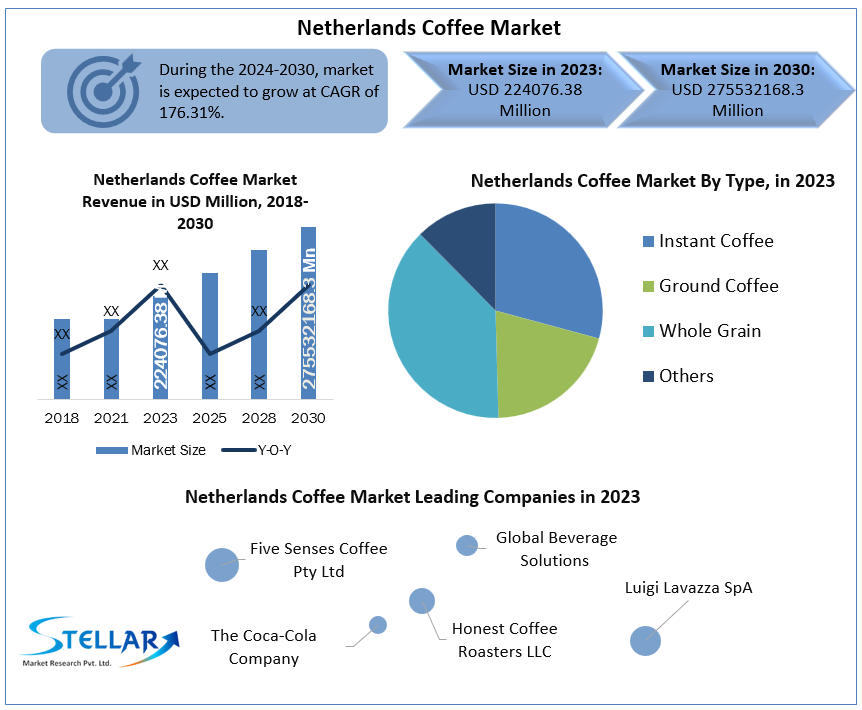

Netherlands Coffee Market size was valued at US$ 224076.38 Mn. in 2023. Coffee will encourage a great deal of transformation in Beverage Sector in Netherlands.

Format : PDF | Report ID : SMR_76

Netherlands Coffee Market

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product.

To get more Insights: Request Free Sample Report

Netherlands Coffee Market Dynamics:

Most people in western countries begin their day with a fresh cup of coffee, essentially to be fully awake for the rest of the day, and be able to maintain coherence in thought because coffee stimulates their brains. The link between coffee and better cognitive function is due to the caffeine factor, which enters the bloodstream and acts as a stimulant that causes arousal in the body and mind. This factor is driving the demand for coffee in this region.

The Netherlands is Europe's major trading center, re-exporting many different products, including large amounts of coffee. In 2020, the Netherlands was Europe's third-largest re-exporter of green coffee beans, with over 24,000 tonnages of re-exports. Factors such as height and weight, gender, physical activity, age, and lifestyle are positively affecting coffee consumption in the Netherlands.

The main destinations for re-exporting green coffee from the Netherlands in 2020 were the United Kingdom, Portugal, and Ukraine, each importing 2,400 tonnes in 2020. Germany and Poland imported 2,200 tonnes of 2,000 tonnes of green coffee from the Netherlands and Italy.

The average cup of coffee in the Netherlands is a strong coffee compared to the English blend, but it tastes worse than Italian coffee. This type of coffee is the most powerful variety and tastes a bit similar. Dutch people like to drink coffee, the most common type is milk-free coffee.

PEST ANALYSIS OF NETHERLANDS COFFEE MARKET:

Political: The political environment in Netherland is stable with parliamentary democracy. The policies of the government are internationalization friendly; based on free trade policies, there is a lack of local demarcation and national boundaries in international trade. Netherlands` international policy is one of the most open policies in the world. Foreign companies are free to invest in all sectors and there is no distinction in the legal rights of the local and international companies.

Economic: The Netherlands is the sixth-largest economy and an important member of the European Union. The unemployment rate in the Netherlands is low. The Netherlands is considered a transportation hub with stable international cooperation and is known worldwide as the second-largest exporter of agricultural products. The economic environment suggests that foreign companies in the Netherlands may enter the coffee market with a variety of market entry strategies. The Netherlands is reportedly one of the largest coffee importers in Europe, geographically between Antwerp and Hamburg, the largest coffee port.

Socio-cultural: The Netherlands is experiencing the development of coffee culture. Demand for premium and green coffee has increased in the Netherlands rapidly. The change in the current trend from the cheap bulk segment to the increase in premium coffee is essentially an increase in the number of educated consumers who are willing to pay premium prices for the best coffee quality and green coffee. The culture of coffee story, which is based on the story of the origin of the coffee bean, and the circumstances of its production in the Netherlands is gaining popularity. The history of coffee, the influence of various brewing methods is also increasing.

Technology: Based on the current trends in coffee in the Netherlands, there is a shift to coffee machines and different brewing methods to improve the taste of coffee. Coffee machines are popular in the Netherlands. Machines are installed in the office or at home to deliver the best coffee at home with the help of coffee pods. Innovative technology makes it easy to enjoy delicious taste and quality at home or in the office. The Dutch coffee market is an opportunity for innovative coffee brewing techniques to improve the taste of coffee.

The objective of the report is to present a comprehensive analysis of the Netherlands Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Netherlands Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Netherlands Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Netherlands Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Netherlands Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Netherlands Coffee market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Netherlands Coffee market. The report also analyses if the Netherlands Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Netherlands Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Netherlands Coffee market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Netherlands Coffee market is aided by legal factors.

Netherlands Coffee Market Scope:

|

Netherlands Coffee Market |

|

|

Market Size in 2024 |

USD 224076.38 Mn. |

|

Market Size in 2030 |

USD 275532168.3 Mn. |

|

CAGR (2024-2030) |

176.31% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

KEY PLAYERS:

• Jacobs Douwe Egberts

• Nestle SA

• Merlo Coffee

• Five Senses Coffee Pty Ltd

• Global Beverage Solutions

• Luigi Lavazza SpA

• Honest Coffee Roasters LLC

• The Coca-Cola Company

• Conga Foods Pty Ltd

Frequently Asked Questions

1. Netherlands Coffee Market: Research Methodology

2. Netherlands Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Netherlands Coffee Market: Dynamics

3.1. Netherlands Coffee Market Trends

3.2. Netherlands Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Netherlands Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2030)

4.1. Netherlands Coffee Market Size and Forecast, by Source (2024-2030)

4.1.1. Arabica

4.1.2. Robusta

4.2. Netherlands Coffee Market Size and Forecast, by Type (2024-2030)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. Netherlands Coffee Market Size and Forecast, by Process (2024-2030)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. Netherlands Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2023)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Jacobs Douwe Egberts

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Vittoria Coffee Pty Ltd

6.3. Nestle SA

6.4. Merlo Coffee

6.5. Five Senses Coffee Pty Ltd

6.6. Global Beverage Solutions

6.7. Luigi Lavazza SpA

6.8. Honest Coffee Roasters LLC

6.9. The Coca-Cola Company

6.10. Conga Foods Pty Ltd

7. Key Findings

8. Industry Recommendations