Norway Fish Oil Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

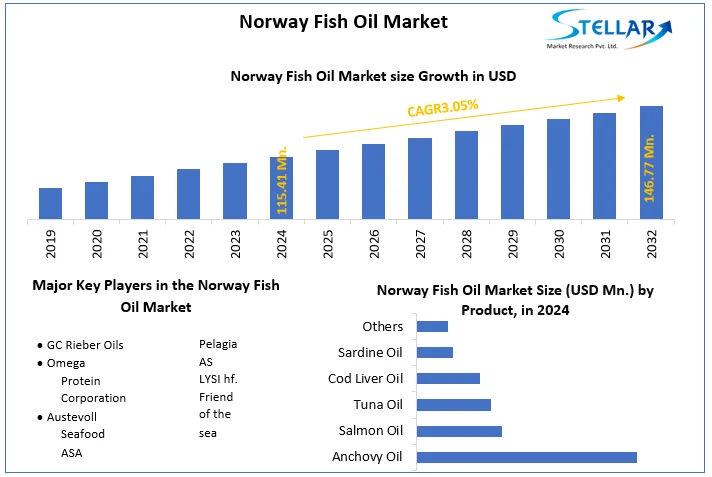

The Norway Fish Oil Market size was valued at USD 115.41 Mn. in 2024 and the total Norway Fish Oil Market revenue is expected to grow at a CAGR of 3.05 % from 2025 to 2032, reaching nearly USD 146.77 Mn. by 2032.

Format : PDF | Report ID : SMR_1775

Norway Fish Oil Market Overview

Fish oil is oil derived from the tissues of oily fish. Fish oils contain the omega-3 fatty acids eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), precursors of certain eicosanoids that are known to reduce inflammation in the body and improve hypertriglyceridemia.

The comprehensive report analyses the key elements in detail, covering the Norway Fish Oil market segments, market outlook, competitive landscape, and company profiles. Key players are evaluated based on their product financial statements, key developments, strategic market approach, market position, geographic distribution, and other key metrics. The report also highlights the Norway Fish Oil market's strengths, weaknesses, opportunities, and threats (SWOT analysis), requirements for victory, current priorities and strategies, and competitive threats of the top three to five players in the Norway Fish Oil market. The report has covered various aspects that highlight Europe Fish Oil Market such as growth drivers, challenges, Restraints, and Opportunities.

To get more Insights: Request Free Sample Report

Norway Fish Oil Market Dynamics

Driving Forces Behind Norway's Growing Fish Oil Market

Increasing consumption of fish oil among people owing to its various advantages is a major factor driving revenue of the market. The rising demand for fish oil owing to the benefits it offers such as reduced risk of heart diseases, blood pressure and levels, etc has driven the market growth in Norway. The rising demand for supplements has boosted the market growth as omega-3 supplements have been associated with a range of mental and physical health benefits.

The increase in the rules and regulations that are implemented on the European fish oil market has accelerated the market growth in Norway. Increasing innovation across various stages of the fish oil value chain mainly production level and refining owing to an increase in competition has boosted the market growth. Manufacturers are focusing on developing high-quality fish oil products with various certifications, quality standards, grades, and product types has propelled the market growth.

Navigating Challenges in Norway's Fish Oil Market

One major factor that could limit the market's revenue growth is the range of side effects linked to consuming excessive amounts of fish oil supplements. These include unpleasant tastes, headaches, heartburn, nausea, diarrhea, and others. Supplements containing omega-3s interact negatively with medications that influence blood coagulation. Micro markets in the Fish oil sector are experiencing a shift in consumer behavior, making it more difficult than ever for brands to bridge the gap between the supply chain and the final customer. The Fish Oil Market also faces a concerning challenge from the Aquaculture Industry’s feed flexibility. The flexibility of feed ingredients offered by aquaculture companies has increased, for example, rapeseed oil is used in place of fish oil which has hindered the market growth.

Norway Fish Oil Market Segment Analysis

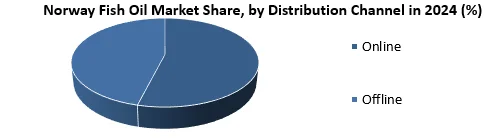

Based on Distribution Channels, the Online segment holds the majority share in the Norway Fish Oil Market and is expected to dominate during the forecast period. The online retail segment accounted for XX revenue share in 2024 owing to improved customer experience, one-touch buys product facility, and technological improvements in terms of Internet connectivity and smartphones. The Factors that have influenced the growth rate of Norway's online segment are no additional costs as products have been shipped directly from sellers. Other factors such as convenience, doorstep service, and availability of a diverse product selection are also contributing to the revenue growth of the segment.

Based on Product, the anchovy oil segment holds the majority share and is expected to rise during the forecast period with an increasing CAGR. Anchovy Oil is the key ingredient that is most frequently used in the Fish Oil industry in Norway. It is extracted from anchovy fish and finds use in several products, such as pharmaceuticals, dietary supplements, and aquaculture feed. With the second-largest market share, salmon fish oil comes in second place to anchovy fish oil. It is utilized in many different products, such as pet food, aquaculture feed, and dietary supplements. Fish oil, or tuna oil, is extracted from tuna and used in pet food, pharmaceuticals, nutritional supplements, and aquaculture feed.

|

Norway Fish Oil Market Scope |

|

|

Market Size in 2024 |

USD 115.41 Mn. |

|

Market Size in 2032 |

USD 146.77 Mn. |

|

CAGR (2025-2032) |

3.05 % |

|

Historic Data |

2019 - 2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By End User

|

|

|

By Distribution Channel

|

|

Norway Fish Oil Market Key Players

- GC Rieber Oils

- Omega Protein Corporation

- Austevoll Seafood ASA

- Pelagia AS

- LYSI hf.

- Friend of the sea

Frequently Asked Questions

High manufacturing costs are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 115.41 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 3.05 % from 2025 to 2032, reaching nearly USD 146.77 Million.

The segments covered in the market report are By Product, End user, Distribution channels.

1. Norway Fish Oil Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Norway Fish Oil Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 - 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Norway Fish Oil Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-User Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaboration and Partnerships

3.4.4. Product Launches and Innovations

4. Norway Fish Oil Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Norway Fish Oil Market Size and Forecast by Segments (by Value USD Million and Volume in Tonnes)

5.1. Norway Fish Oil Market Size and Forecast, By Product (2024-2032)

5.1.1. Anchovy Oil

5.1.2. Salmon Oil

5.1.3. Tuna Oil

5.1.4. Cod Liver Oil

5.1.5. Sardine Oil

5.1.6. Others

5.2. Norway Fish Oil Market Size and Forecast, By End User (2024-2032)

5.2.1. Pharmaceuticals

5.2.2. Animal Nutrition and Pet Food

5.2.3. Aquaculture

5.2.4. Dietary Supplements

5.2.5. Others

5.3. Norway Fish Oil Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Online

5.3.2. Offline

6. Company Profile: Key players

6.1. GC Rieber Oils

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.2.1. Total Revenue

6.1.2.2. Segment Revenue

6.1.3. Product Portfolio

6.1.3.1. Product Name

6.1.3.2. Product Details (Price, Features, etc.)

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. Omega Protein Corporation

6.3. Austevoll Seafood ASA

6.4. Pelagia AS

6.5. LYSI hf.

6.6. Friend of the sea

7. Key Findings

8. Industry Recommendations

8.1.1. Strategic Recommendations

8.1.2. Future Outlook