Denmark Fish Oil Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

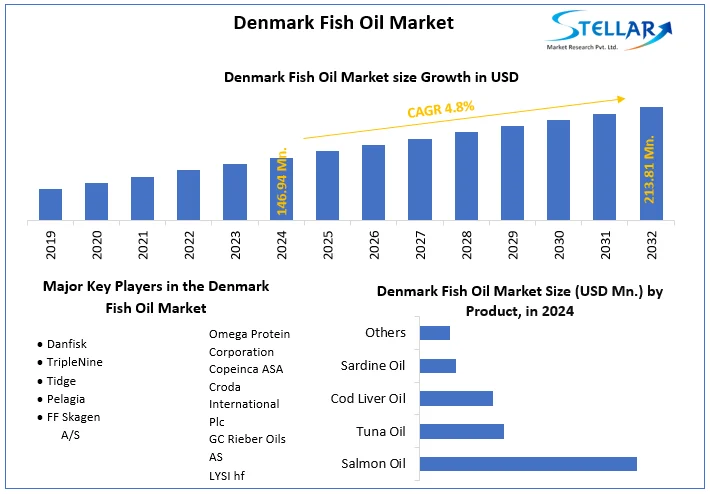

The Denmark Fish Oil Market size was valued at USD 146.94 Mn. in 2024 and the total Denmark Fish Oil Market revenue is expected to grow at a CAGR of 4.8% from 2025 to 2032, reaching nearly USD 213.81 Mn. by 2032.

Format : PDF | Report ID : SMR_1776

Denmark Fish Oil Market Overview

Fish oil is an oil taken from the tissues of fatty fish such as herring, mackerel, salmon, and tuna. The process involves pressing cooked fish, and then separating the oil from the extracted fluid.

In the Denmark Fish Oil Market, leading manufacturers have adopted several trends that are covered in the report. These include the use of technologies, government funding for R&D, and an increasing focus on sustainability. A thorough analysis of the competitive environment is also included in the report, along with the market shares and positions of the major companies involved in the fish oil market. Additionally, the report offers a comprehensive analysis of the present and potential developments within the Denmark Fish Oil industry.

It also provides a thorough analysis of the Denmark Fish Oil Market value chain and important market segments. It also offers strategic recommendations for the market's success to the investors. The current Fishmeal & Fish Oil market offers a wide range of products customized to different products and user preferences. The surging popularity of this industry has further contributed to the market's growth.

- Denmark holds the position as the 7th largest exporter of fishmeal and the 3rd largest exporter of fish oil, underscoring its substantial contribution to the global trade in these essential marine products.

- Fisheries management in Denmark is largely based on transferable fishing rights, such as Individual Transferable Quotas (ITQ). This has resulted in fewer commercial vessels and increased profitability in many segments.

To get more Insights: Request Free Sample Report

Denmark Fish Oil Market Dynamics

Driving Forces Behind Denmark's Growing Fish Oil Market

The increasing prevalence of fish oil benefits has been driven in Denmark owing to the larger production of fish oil in the country. The fishing industry has become one of the most technologically advanced owing to its use of solutions that reduce unwanted catch and its carbon footprint as a result it has boosted the market growth. The escalating demand for the sustainability of fish oil has driven the market growth in Denmark. For example, The Danish seafood industry has a global reputation for driving fish and shellfish production in a sustainable direction.

The fishing industry has drawn a strong Danish tradition of high-quality food production and stringent regulations requirements from the industry that have influenced the market growth. The surge in imports and exports has been a major factor that has influenced the market growth in the country. For instance, the main destinations of Denmark's exports of Fish oil were Norway ($174M), United Kingdom ($31.6M), Gibraltar ($11.2M), Germany ($5.08M), and Greece ($4.64M).

Certification Challenges and Environmental Concerns: Impacts on Denmark's Fish Oil Industry

The fish oil industry is struggling to get certified, due to non-cooperation from concerned government institutions and agencies. Lack of certification poses challenges to the industry in terms of sustainability and market acceptance. The growing demand for seafood places more responsibility on market leaders of the fish oil industry as there is uncertain change in climatic conditions that affect the product life shell resulting in steady market growth. The rising environmental concerns about overfishing have posed a barrier to the manufacturers of the fish oil market in Denmark.

Denmark Fish Oil Market Segment Analysis

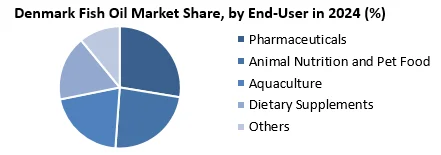

Based on End Users, Aquaculture holds the majority of the share and is expected to grow till 2030 with a growing CAGR. Aquaculture is experiencing rapid growth in Denmark, and fish from aquaculture currently account for 50 % of the human consumption of fish. Aquaculture has demonstrated its resilience to change and is increasingly recognized for its environmental responsibility, reduced footprint, and high efficiency in protein transformation and provision has driven the market in the country. Denmark has a strong position in fish production and aquaculture has a long and well-established tradition in the country. Aquaculture is the fastest-growing food production sector but it suffers from societal, environmental, and technical challenges that require interdisciplinary collaboration.

The Rise in the research on the development of rearing systems and technologies that ensure efficient production with minimum environmental impact has enhanced the market growth in Denmark. Feed and its utilization by the fish are central to water quality and the potential discharge from aquaculture. The Danish aquaculture industry has been set, covering technology as well as fish production. Danish aquaculture is strictly regulated by environmental rules, except for full recirculation eel farms, all Danish fish farms have to be officially approved following the Danish Environmental Protection Act.

|

Denmark Fish Oil Market Scope |

|

|

Market Size in 2024 |

USD 146.94 Mn. |

|

Market Size in 2032 |

USD 213.81 Mn. |

|

CAGR (2025-2032) |

4.8 % |

|

Historic Data |

2019 - 2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By End User

|

|

|

By Distribution Channel

|

|

Denmark Fish Oil Market key Players

- Danfisk

- TripleNine

- Tidge

- Pelagia

- FF Skagen A/S

- Omega Protein Corporation Copeinca ASA

- Croda International Plc

- GC Rieber Oils AS

- LYSI hf

Frequently Asked Questions

High manufacturing costs are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 146.94 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 4.8 % from 2025 to 2032, reaching nearly USD 213.81 Million.

The segments covered in the market report are By Product, End user, Distribution channels

1. Denmark Fish Oil Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Denmark Fish Oil Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Denmark Fish Oil Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Denmark Fish Oil Market: Dynamics

4.1. Denmark Fish Oil Market Trends

4.2. Denmark Fish Oil Market Drivers

4.3. Denmark Fish Oil Market Restraints

4.4. Denmark Fish Oil Market Opportunities

4.5. Denmark Fish Oil Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Denmark Fish Oil Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

5.1. Denmark Fish Oil Market Size and Forecast, by Product (2024-2032)

5.1.1. Salmon Oil

5.1.2. Tuna Oil

5.1.3. Cod Liver Oil

5.1.4. Sardine Oil

5.1.5. Others

5.2. Denmark Fish Oil Market Size and Forecast, by End User (2024-2032)

5.2.1. Pharmaceuticals

5.2.2. Animal Nutrition and Pet Food

5.2.3. Aquaculture

5.2.4. Dietary Supplements

5.2.5. Others

5.3. Denmark Fish Oil Market Size and Forecast, by Distribution Channel (2024-2032)

5.3.1. Online

5.3.2. Offline

6. Company Profile: Key Players

6.1. Danfisk

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. TripleNine

6.3. Tidge

6.4. Pelagia

6.5. FF Skagen A/S

6.6. Omega Protein Corporation Copeinca ASA

6.7. Croda International Plc

6.8. GC Rieber Oils AS

6.9. LYSI hf

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook