Europe Fish Oil Market- Industry Analysis and Forecast (2025-2032)

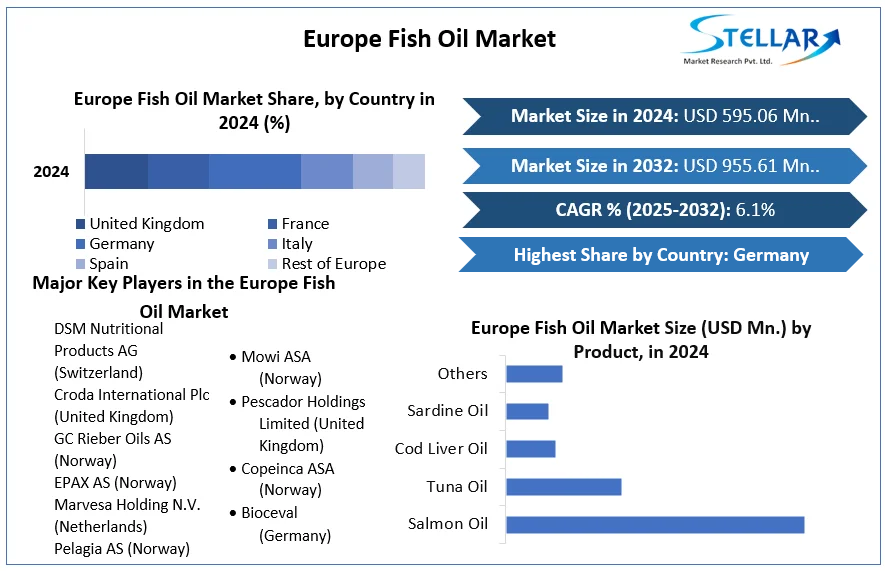

The Europe Fish Oil Market size was valued at USD 595.06 Mn. in 2024 and the total Market revenue is expected to grow at a CAGR of 6.10 % from 2025 to 2032, reaching nearly USD 955.61 Mn.

Format : PDF | Report ID : SMR_1777

Europe Fish Oil Market Overview

Fish oil is oil derived from the tissues of oily fish. Fish oils contain the omega-3 fatty acids eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), precursors of certain eicosanoids that are known to reduce inflammation in the body and improve hypertriglyceridemia.[1][2] There has been a great deal of controversy in the 21st century about the role of fish oil in cardiovascular disease, with recent meta-analyses reaching different conclusions about its potential impact.

The report has covered various aspects that highlight Europe Fish Oil Market such as growth drivers, challenges, Restraints, and Opportunities. The Report consists of systematic qualitative and quantitative research focusing on interpreting data, identifying the patterns of data, and extracting meaningful insights. The market revenue is expected to grow from xx to xx during the forecast year with an increase in sales of fish oil in Europe. The demand for fish oil has boosted economic growth by xx % and financial revenue by xx%. By leveraging technologies in the fishery industry, key Companies in Europe have gained significant profit and are estimated to grow faster by reaching targeted audiences. The report consists of broad research on various Leading players strategies like collaboration, partnership, mergers, and acquisition which are adopted by the companies.

- Fish oil production in the EU accounts for approximately 10-15% of global production. Annually, the EU produces between 370,000 to over 520,000 tons of fishmeal and between 120,000 to 190,000 tons of fish oil.

- The export volume is estimated to witness an increase for the seventh consecutive year to 163.33 thousand tonnes.

To get more Insights: Request Free Sample Report

Driving Forces behind the Rapid Growth of Europe's Fish Oil Market

Fish oil is used as a feed ingredient for farmed fish, and the aquaculture industry is growing rapidly in Europe as a result it has been driving the market. The increase in popularity of fish oil has been driven along with increased awareness of health benefits, especially lowering blood pressure, triglycerides, and cholesterol, with omega-3 fatty acids propelling the market growth. The rising demand for supplements has boosted the market growth as omega-3 supplements have been associated with a range of mental and physical health benefits.

The increase in the rules and regulations that are implemented on the European fish oil market has accelerated the market growth. For instance, The Common Fisheries Policy (CFP) is a set of regulations and measures implemented by the European Union (EU) to manage and regulate fishing activities in European waters. Its primary concern was the sustainable management of fish stocks to ensure their long-term viability while also supporting the fishing industry and coastal communities.

Navigating Price Surges, Regulations, and Sustainability Challenges in Europe's Fish Oil Industry

There are several barriers affecting the European Fish oil industry such as rising prices, regulations implemented by the government, and sustainability issues faced by the European fish oil industry.

The surge in the prices of manufacturing cost has led to hinder the market growth in the European region. For Instance, The prices of European fishmeal and fish oil are closely linked to global prices, which are highly influenced by South American production, particularly in Peru. One of the main issues faced by the European Fish Oil industry is to maintain sustainability, sustainability has led to concerns related to the sourcing of fish oil products and has been impacting the consumer perception and market sustainability. Environmental changes, such as fluctuations in sea temperatures, pollution, habitat degradation, and ecosystem disturbances, have affected the availability and health of fish populations. These changes have impacted fish stocks, reducing their abundance and making it more challenging to sustainably harvest fish for oil production.

The regulations imposed by the government of Europe have created a barrier to the Fishery industry. For example, Fishery regulations range from prohibiting or limiting the use of certain fishing gear to implementing protected national parks that prohibit commercial fishing and setting the maximum limit of global fish catch. In the EU, a common approach for regulating fisheries has been to set quota standards called total allowable catch, or ‘TACs.

Europe Fish Oil Market Segment Analysis

Based on Product, the Salmon Oil segment held the highest market share and is expected to maintain its dominance through the forecast period. In Europe, There is a rise in the demand for Salmon oils owing to omega-3s having anti-inflammatory properties. While inflammation is the body’s natural response to stress and infection, high levels over time raise the risk of chronic diseases, including cancer, diabetes, and arthritis.

Salmon oil supplements are a common way for people to consume fish oil. These supplements come in various forms, including capsules, liquid extracts, and softgels. Salmon Oil provides a convenient way to increase omega-3 intake, especially for individuals who do not consume enough fish in their diet. In addition to supplements, salmon oil is also used in various food and beverage products, such as functional foods, fortified beverages, and dietary supplements. It has been added to products like salad dressings, spreads, and snack bars to enhance their nutritional profile with omega-3 fatty acids. Salmon Fish oil contains a high concentration of omega-3 fatty acids and it is widely used in supplements and food products to promote health benefits.

Europe Fish Oil Market Regional Analysis

Denmark holds the largest share in the European fish Oil Market and is expected to grow with an increasing CAGR during the forecast period. Denmark is one of the leading producers in the European region owing to the increase in the production of fish oil. The production of fish oil is primarily based on catches of small pelagic species like sprat, sand eels, blue whiting, and herring as well as trimmings from the fish processing industry. Denmark accounts for the largest production of Fish oil 40-50% of the total production in Europe.

Norway is the fastest-growing Country in the European fish oil market and is expected to grow through the forecast period owing to its aquaculture production (salmon and trout), Norway is one of the world’s largest consumers of fish oil. Norway has a long tradition of fishing and seafood processing, and it's one of the world's largest exporters of seafood products, including fish oil. The country's well-developed fishing industry, along with strict quality standards and sustainable fishing practices, has contributed to its prominence in the fish oil market. In Europe,

- Norway and Denmark together produced 390.000 tonnes of fishmeal and 120.000 tonnes of fish oil.

The three main suppliers of fishmeal to the EU are Morocco, Peru, and Iceland. Regarding exports, the top three destinations for fishmeal are Norway, the UK, and Canada, while for fish oil, the primary destination is Norway. Other countries in Europe also play important roles in the fish oil market, including Iceland, and the United Kingdom. These countries have sizable fishing industries and contribute to the overall supply of fish oil in Europe.

Spain is Europe's largest fishing nation, accounting for about one-fifth of all EU catches by weight, followed by Denmark and France. Based on catch value, Spain also comes first, followed by France and Italy.

Europe Fish Oil Market Competitive Landscape

- In 2024, Epax announced a major upgrade to its omega-3 fatty acids facility with the launch of a new molecular distillation technology. The Norwegian marine lipid specialist previously guaranteed omega-3 fatty acid ingredients standardized to 90% minimum triglyceride content. A recent $40 million investment in its facility in Aalesund will increase its distillation capacity, and output of omega-3 concentrates.

- In 2023, GC Rieber VivoMega, omega-3 oil concentrates, announced that it is fully supported with 100% renewable energy. Over several months, the company implemented an electric steam boiler to power its marine and microalgae omega-3 operations.

|

Europe Fish Oil Market Scope |

|

|

Market Size in 2024 |

USD 595.06 Mn. |

|

Market Size in 2032 |

USD 955.61 Mn. |

|

CAGR (2025-2032) |

6.1 % |

|

Historic Data |

2019 - 2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By End User

|

|

|

By Distribution Channel

|

|

|

Country Scope |

|

Europe Fish Oil Market Key Players

- DSM Nutritional Products AG (Switzerland)

- Croda International Plc (United Kingdom)

- GC Rieber Oils AS (Norway)

- EPAX AS (Norway)

- Marvesa Holding N.V. (Netherlands)

- Pelagia AS (Norway)

- GC Rieber Vivo AS (Norway)

- Mowi ASA (Norway)

- Pescador Holdings Limited (United Kingdom)

- Copeinca ASA (Norway)

- Bioceval (Germany)

Frequently Asked Questions

High manufacturing costs are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 595.06 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 6.10 % from 2025 to 2032, reaching nearly USD 955.61 Million.

The segments covered in the market report are By Product, End User, and Distribution Channel.

1. Europe Fish Oil Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Europe Fish Oil Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Europe Fish Oil Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Europe Fish Oil Market: Dynamics

4.1. Europe Fish Oil Market Trends

4.2. Europe Fish Oil Market Drivers

4.3. Europe Fish Oil Market Restraints

4.4. Europe Fish Oil Market Opportunities

4.5. Europe Fish Oil Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Europe Fish Oil Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

5.1. Europe Fish Oil Market Size and Forecast, by Product (2024-2032)

5.1.1. Salmon Oil

5.1.2. Tuna Oil

5.1.3. Cod Liver Oil

5.1.4. Sardine Oil

5.1.5. Others

5.2. Europe Fish Oil Market Size and Forecast, by End User (2024-2032)

5.2.1. Pharmaceuticals

5.2.2. Animal Nutrition and Pet Food

5.2.3. Aquaculture

5.2.4. Dietary Supplements

5.2.5. Others

5.3. Europe Fish Oil Market Size and Forecast, by Distribution Channel (2024-2032)

5.3.1. Online

5.3.2. Offline

5.4. Europe Fish Oil Market Size and Forecast, by Country (2024-2032)

5.4.1. Germany

5.4.2. United Kingdom

5.4.3. Spain

5.4.4. France

5.4.5. Italy

5.4.6. Belgium

5.4.7. Sweden

5.4.8. Poland

5.4.9. Russia

5.4.10. Rest of Europe

6. Company Profile: Key Players

6.1. DSM Nutritional Products AG (Switzerland)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Croda International Plc (United Kingdom)

6.3. GC Rieber Oils AS (Norway)

6.4. EPAX AS (Norway)

6.5. Marvesa Holding N.V. (Netherlands)

6.6. Pelagia AS (Norway)

6.7. GC Rieber Vivo AS (Norway)

6.8. Mowi ASA (Norway)

6.9. Pescador Holdings Limited (United Kingdom)

6.10. Copeinca ASA (Norway)

6.11. Bioceval (Germany)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook