Microneedling Market Global Industry Analysis and Forecast (2026-2032)

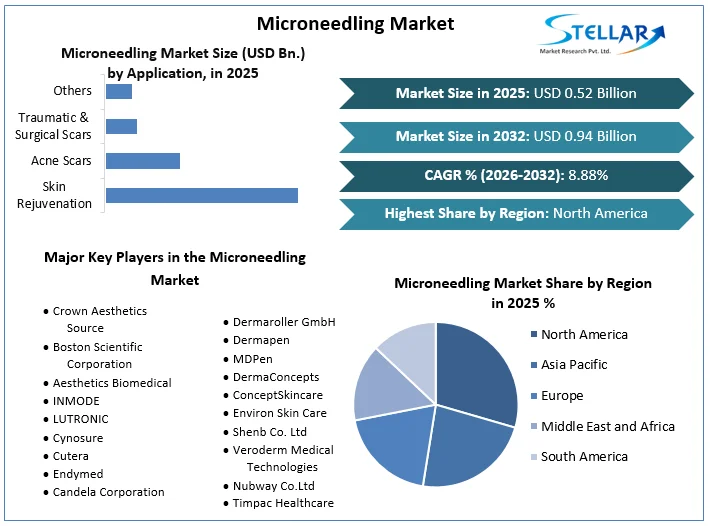

The Microneedling Market size was valued at USD 0.52 Bn. in 2025 and the Microneedling revenue is expected to grow at a CAGR of 8.88% from 2026 to 2032, reaching nearly USD 0.94 Bn. by 2032.

Format : PDF | Report ID : SMR_2047

Microneedling Market Overview:

Microneedling is a minimally invasive medical procedure that uses a handheld device with tiny needles to create microscopic punctures in the skin. The procedure is also known as percutaneous collagen induction therapy and is commonly used in dermatology. The microneedling market has experienced significant growth in recent years, driven by increasing consumer awareness and demand for non-invasive skin rejuvenation treatments. This market encompasses a variety of devices and procedures that utilize microneedles to create controlled micro-injuries in the skin, promoting natural collagen production and offering improvements in skin texture, tone, and overall appearance.

- The American Society for Dermatologic Surgery (ASDS) in 2023 revealed that 73% of dermatologists and plastic surgeons considered RF microneedling as their preferred treatment option for skin tightening and rejuvenation, compared to other modalities like lasers or chemical peels.

To get more Insights: Request Free Sample Report

Microneedling Market Dynamics:

The Rise of Advancement in Microneedling

The microneedling market has witnessed significant growth in recent years, driven by the increasing demand for minimally invasive cosmetic procedures and the versatility of microneedling in addressing various skin concerns. Here are some notable trends and statistics shaping the microneedling market

- Rising Popularity: Microneedling has gained immense popularity as a safe and effective treatment option for various skin conditions, including acne scars, fine lines, wrinkles, hyperpigmentation, and hair loss.

- Combination Treatments: Combining microneedling with other therapies, such as platelet-rich plasma (PRP), topical medications, or radiofrequency (RF) energy, has become increasingly popular. These combination treatments have shown enhanced efficacy in skin rejuvenation and scar reduction.

- Technological Advancements: The development of advanced microneedling devices with adjustable needle depths, customizable energy settings, and integrated cooling systems has contributed to the market's growth. These advancements have improved treatment precision and patient comfort, attracting more consumers and professionals to adopt microneedling procedures.

- Home-Use Devices: The availability of at-home microneedling devices has expanded the market's reach to a broader consumer base. While professional treatments are still preferred for more advanced concerns, home-use devices have made microneedling accessible for routine skincare and maintenance.

- Geographic Expansion: While North America and Europe currently dominate the microneedling market, the Asia-Pacific region is expected to witness the highest growth rate in the coming years. Factors such as increasing disposable incomes, rising awareness about aesthetic procedures, and the rise of medical tourism in countries like China, India, and South Korea are driving the market's expansion in this region.

- Diverse Applications: Microneedling has found applications beyond cosmetic treatments, including in the delivery of therapeutic agents for skin cancer and wound healing. This diversification of applications is expected to further fuel the market's growth.

High Costs and Accessibility in the Microneedling Market

Microneedling treatments are typically priced between $100 to $700 per session, depending on the provider, geographic location, and the extent of the area being treated. Since optimal results usually require multiple sessions, the total cost can quickly add up, making it unaffordable for many individuals. The need for repeat treatments further exacerbates the financial burden on patients, limiting the accessibility of microneedling to those with higher disposable incomes. The cost of microneedling devices varies significantly based on their sophistication and brand.

Professional microneedling devices can range from a few hundred to several thousand dollars. For clinics and aesthetic practices, investing in high-quality, FDA-approved microneedling equipment represents a substantial upfront cost. Additionally, the need for regular maintenance and the purchase of consumables such as needles and serums adds to the overall expense.

Microneedling Market Segment Analysis:

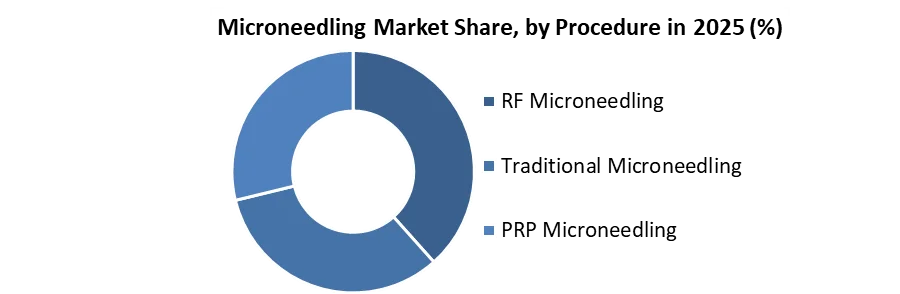

By Procedure, the RF Microneedling segment held 56% of Microneedling Market share in 2025. Radio Frequency (RF) Microneedling is an advanced, noninvasive skin rejuvenation treatment that combines traditional microneedling with the added benefit of radiofrequency energy. Consumers favor its minimally invasive approach and effective results in improving skin texture, wrinkles, and scars. RF Microneedling has gained significant traction thanks to its dual-action approach, addressing both superficial and deeper layers of the skin. This treatment creates controlled microdamage, stimulating a natural wound-healing response that boosts collagen and elastin production, counteracting the effects of aging and environmental damage.

As the demand for noninvasive cosmetic procedures rises, RF Microneedling stands out for its efficacy, safety, and minimal downtime, making it a preferred choice among consumers and practitioners alike. Continuous advancements in technology keep it competitive, although companies must address competition from other microneedling options, manage cost perceptions, and educate consumers about its benefits and safety to solidify its leadership position.

- The majority of RF microneedling procedures were performed in medical spas and dermatology clinics, accounting for approximately 56% of the total market share.

Microneedling Market Regional Insight:

North America held xxx % market share in 2023 for the Microneedling Market. In North American region, particularly the United States, is a leading market for microneedling devices and treatments. The increasing prevalence of skin conditions such as acne scars, hyperpigmentation, and wrinkles, coupled with rising disposable incomes and a growing demand for minimally invasive cosmetic procedures, are driving the microneedling market growth in this region.

- The American Society of Plastic Surgeons reported that in 2023, over 2.8 million microneedling procedures were performed in the United States, reflecting the increasing popularity of this treatment.

Key players in the North American microneedling market include Dermapen, Derminator, and Bellaire Industry. These companies offer a wide range of microneedling devices and products, catering to both professional and at-home use. Additionally, the presence of well-established distribution channels and a favorable regulatory environment have contributed to the market's growth in North America. As the demand for anti-aging and skin rejuvenation treatments continues to rise, and with the increasing acceptance of microneedling as a safe and effective treatment option, the North American microneedling market is expected to maintain its strong growth trajectory in the coming forecast years (2024 - 2030).

Microneedling Market Competitive Landscape:

- In May 2024, Lasering USA and Aesthetics Biomedical Inc. have partnered to offer an advanced non-surgical skin rejuvenation treatment combining Vivace® Ultra Vision RF microneedling and MiXto® Pro Venezia Lift CO? fractional laser. This combination targets both the dermis and epidermis, providing superior facial rejuvenation with no downtime. The Vivace® Ultra Vision uses ultrasound technology for precise needle penetration, while the MiXto® Venezia Lift employs a patented system for enhanced heat delivery, improving clinical outcomes and patient satisfaction.

- In Jan 2024, Cynosure and Lutronic have announced a definitive merger agreement to form a global leader in medical aesthetic systems. The combined company will offer a diversified product portfolio, expanded R&D capabilities, and a commercial presence in over 130 countries. The transaction is expected to close in the first quarter of 2024.

- In Sep 2023, Cutera, Inc. has launched Secret DUO®, a new skin resurfacing and revitalization platform that combines a 1540 nm laser and radiofrequency microneedling technology. This innovative device offers customizable treatments for fine lines, texture, pigment, stretch marks, and scars, catering to all skin types.

Microneedling Market Scope:

|

Microneedling Market |

|

|

Market Size in 2025 |

USD 0.52 Bn. |

|

Market Size in 2032 |

USD 0.94 Bn. |

|

CAGR (2026-2032) |

8.88 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Procedure RF Microneedling Traditional Microneedling PRP Microneedling |

|

By Product Derma-Stamp Dermapen Dermarollers RF Microneedling Devices |

|

|

By Application Skin Rejuvenation Acne Scars Traumatic & Surgical Scars Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Microneedling Market Key Players:

- Crown Aesthetics Source

- Boston Scientific Corporation

- Aesthetics Biomedical

- INMODE

- LUTRONIC

- Cynosure

- Cutera

- Endymed

- Candela Corporation

- Dermaroller GmbH

- Dermapen

- MDPen

- DermaConcepts

- ConceptSkincare

- Environ Skin Care

- Shenb Co. Ltd

- Veroderm Medical Technologies

- Nubway Co.Ltd

- Timpac Healthcare

- XXX Inc.

Frequently Asked Questions

Regulatory Hurdles, and high treatment cost are challenges of the Microneedling Market.

The Market size was valued at USD 0.52 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 8.88 % from 2026 to 2032, reaching nearly USD 0.94 Billion.

The segments covered in the market report are by Procedure, Product, and Application.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Microneedling Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Microneedling Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Microneedling Market: Dynamics

4.1. Microneedling Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Microneedling Market Drivers

4.3. Microneedling Market Restraints

4.4. Microneedling Market Opportunities

4.5. Microneedling Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

5. Microneedling Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Microneedling Market Size and Forecast, by Procedure (2025-2032)

5.1.1. RF Microneedling

5.1.2. Traditional Microneedling

5.1.3. PRP Microneedling

5.2. Microneedling Market Size and Forecast, by Product (2025-2032)

5.2.1. Derma-Stamp

5.2.2. Dermapen

5.2.3. Dermarollers

5.2.4. RF Microneedling Devices

5.3. Microneedling Market Size and Forecast, by Application (2025-2032)

5.3.1. Skin Rejuvenation

5.3.2. Acne Scars

5.3.3. Traumatic & Surgical Scars

5.3.4. Others

5.4. Microneedling Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Microneedling Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Microneedling Market Size and Forecast, by Procedure (2025-2032)

6.1.1. RF Microneedling

6.1.2. Traditional Microneedling

6.1.3. PRP Microneedling

6.2. North America Microneedling Market Size and Forecast, by Product (2025-2032)

6.2.1. Derma-Stamp

6.2.2. Dermapen

6.2.3. Dermarollers

6.2.4. RF Microneedling Devices

6.3. North America Microneedling Market Size and Forecast, by Application (2025-2032)

6.3.1. Skin Rejuvenation

6.3.2. Acne Scars

6.3.3. Traumatic & Surgical Scars

6.3.4. Others

6.4. North America Microneedling Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Microneedling Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Microneedling Market Size and Forecast, by Procedure (2025-2032)

7.2. Europe Microneedling Market Size and Forecast, by Product (2025-2032)

7.3. Europe Microneedling Market Size and Forecast, by Application (2025-2032)

7.4. Europe Microneedling Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Microneedling Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Microneedling Market Size and Forecast, by Procedure (2025-2032)

8.2. Asia Pacific Microneedling Market Size and Forecast, by Product (2025-2032)

8.3. Asia Pacific Microneedling Market Size and Forecast, by Application (2025-2032)

8.4. Asia Pacific Microneedling Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Microneedling Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Microneedling Market Size and Forecast, by Procedure (2025-2032)

9.2. Middle East and Africa Microneedling Market Size and Forecast, by Product (2025-2032)

9.3. Middle East and Africa Microneedling Market Size and Forecast, by Application (2025-2032)

9.4. Middle East and Africa Microneedling Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Microneedling Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Microneedling Market Size and Forecast, by Procedure (2025-2032)

10.2. South America Microneedling Market Size and Forecast, by Product (2025-2032)

10.3. South America Microneedling Market Size and Forecast, by Application (2025-2032)

10.4. South America Microneedling Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Crown Aesthetics Source

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Boston Scientific Corporation

11.3. Aesthetics Biomedical

11.4. INMODE

11.5. LUTRONIC

11.6. Cynosure

11.7. Cutera

11.8. Endymed

11.9. Candela Corporation

11.10. Dermaroller GmbH

11.11. Dermapen

11.12. MDPen

11.13. DermaConcepts

11.14. ConceptSkincare

11.15. Environ Skin Care

11.16. Shenb Co. Ltd

11.17. Veroderm Medical Technologies

11.18. Nubway Co.Ltd

11.19. Timpac Healthcare

11.20. XXX Inc.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook