Mexico Revenue Cycle Management Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The Mexico Revenue Cycle Management Market size was valued at USD 3339.25 Mn. in 2024 and the total US Revenue Cycle Management revenue is expected to grow at a CAGR of 13.89% from 2025 to 2032, reaching nearly USD 9452.23 Mn.

Format : PDF | Report ID : SMR_1627

Mexico Revenue Cycle Management Market Overview

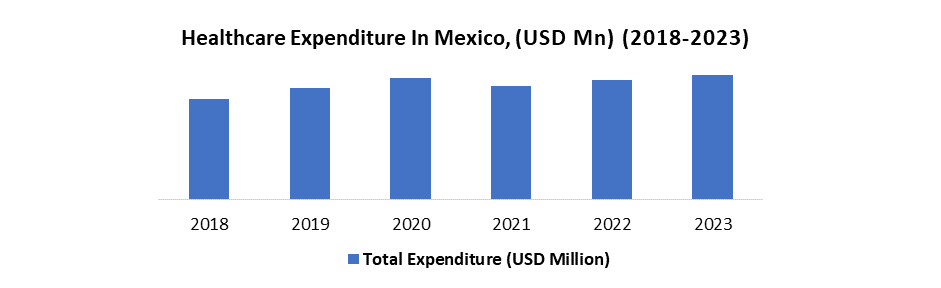

Revenue Cycle Management is a financial process in healthcare using specialized software. It integrates business and clinical aspects by linking administrative data, like patient details and insurance information, to their health records. It involves pre-visit insurance checks, treatment coding, and communication with insurance companies to ensure accurate billing and payment for healthcare services. The rising adoption of outsourcing healthcare Revenue Cycle Management (RCM) solutions is driven by added value, business opportunities, and financial considerations. The Mexico healthcare sector is growing thanks to increased spending, a growing number of established facilities, higher healthcare IT investments, advanced infrastructure, and a focus on patient-provider relationships.

The comprehensive report serves as a detailed analysis of the Mexico Revenue Cycle Management Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the Mexico Revenue Cycle Management Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

Mexico Revenue Cycle Management Market Dynamics:

Growing Demand for Accessible and Efficient Healthcare to Drive the Mexico Revenue Cycle Management Market

The Mexico Revenue Cycle Management market is composed for growth thanks to increased demand driven by the healthcare sector's focus on efficiency and patient-centric care. Technology adoption, including AI and automation, improves workflows, reduces errors, and boosts financial performance. Standardization and transparency trends create a predictable market environment, benefiting RCM companies.

In the Mexico Revenue Cycle Management market, growing demand intensifies competition, leading to price pressures. To stay competitive, companies must differentiate through technology, prioritize data security amidst privacy concerns, and address integration challenges by offering user-friendly solutions and robust support, especially for smaller healthcare providers with limited resources.

The rising demand for efficient healthcare in Mexico brings opportunities and challenges for Revenue Cycle Management. While it fuels growth and technology adoption, it also introduces competition, data privacy concerns, and integration complexities. RCM companies addressing these challenges and prioritizing innovation, data security, and user-friendly solutions are poised for success.

Mexico Revenue Cycle Management Market Segment Analysis

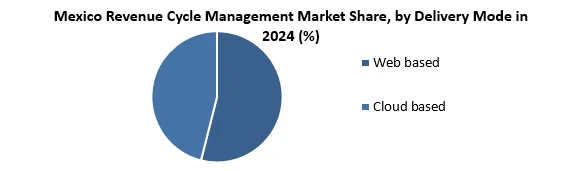

Based on Delivery Mode, the Web-based segment held the largest market share of about 60% in the Mexico Revenue Cycle Management Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 13.91 % during the forecast period. It stands out as the dominant segment within the Mexico Revenue Cycle Management Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

In Mexico Web-based Revenue Cycle Management (RCM) solutions present advantages such as lower upfront costs, accessibility from any location, quick deployment, automatic updates managed by vendors, scalability for changing needs, and robust data security measures. These features make them an appealing choice for smaller healthcare providers with limited budgets, remote teams, and a focus on efficient and secure operations.

Mexico Web-based Revenue Cycle Management (RCM) systems include reliance on stable internet connectivity, security concerns measures, limited customization options, potential vendor lock-in due to data migration challenges, and performance issues in areas with slow internet speeds or high traffic. These factors highlight considerations for organizations adopting such solutions.

Web-based roles in the Mexico Revenue Cycle Management market provide affordability, accessibility, and ease of use. However, factors like internet dependence, security concerns, and limited customization are considered. Choosing the right option depends on individual needs, budget, and technical capabilities.

|

Mexico Revenue Cycle Management Market Scope |

|

|

Market Size in 2024 |

USD 3339.25 Million |

|

Market Size in 2032 |

USD 9452.23 Million |

|

CAGR (2025-2032) |

13.89% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By Type

|

|

|

By Function

|

|

|

By Delivery Mode

|

|

|

By Physician Specialty

|

|

|

By Sourcing

|

|

|

By End User

|

|

Leading Key Players in the Mexico Revenue Cycle Management Market

- Cerner Corporation

- McKesson Corporation

- Epic Systems Corporation

- athenahealth, Inc.

- GE Healthcare

- Allscripts Healthcare Solutions

- eClinicalWorks

- NextGen Healthcare, Inc.

- Quest Diagnostics

- Siemens Healthineers

Frequently Asked Questions

Data Privacy and Security Concerns and Explainability and Trust Issues are expected to be the major restraining factors for the Mexico Revenue Cycle Management Market growth.

The Mexico Revenue Cycle Management Market size was valued at USD 3339.25 Million in 2024 and the total US Revenue Cycle Management revenue is expected to grow at a CAGR of 13.89% from 2025 to 2032, reaching nearly USD 9452.23 Million By 2032.

1. Mexico Revenue Cycle Management Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Mexico Revenue Cycle Management Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Mexico Revenue Cycle Management Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Mexico Revenue Cycle Management Market: Dynamics

4.1. Mexico Revenue Cycle Management Market Trends

4.2. Mexico Revenue Cycle Management Market Drivers

4.3. Mexico Revenue Cycle Management Market Restraints

4.4. Mexico Revenue Cycle Management Market Opportunities

4.5. Mexico Revenue Cycle Management Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Mexico Revenue Cycle Management Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Mexico Revenue Cycle Management Market Size and Forecast, by Product (2024-2032)

5.1.1. Software

5.1.2. Services

5.2. Mexico Revenue Cycle Management Market Size and Forecast, by Type (2024-2032)

5.2.1. Integrated

5.2.2. Standalone

5.3. Mexico Revenue Cycle Management Market Size and Forecast, by Function (2024-2032)

5.3.1. Product Development

5.3.2. Member Engagement

5.3.3. Network Management

5.3.4. Care Management

5.3.5. Claims Management

5.3.6. Risk and Compliances

5.4. Mexico Revenue Cycle Management Market Size and Forecast, by Delivery Mode (2024-2032)

5.4.1. Web based

5.4.2. Cloud based

5.5. Mexico Revenue Cycle Management Market Size and Forecast, by Physician Specialty (2024-2032)

5.5.1. Oncology

5.5.2. Cardiology

5.5.3. Anesthesia

5.5.4. Radiology

5.5.5. Pathology

5.5.6. Pain Management

5.5.7. Emergency Service

5.6. Mexico Revenue Cycle Management Market Size and Forecast, by Sourcing (2024-2032)

5.6.1. In-house

5.6.2. External RCM Apps/ Software

5.6.3. Outsourced RCM Services

5.7. Mexico Revenue Cycle Management Market Size and Forecast, by End-User (2024-2032)

5.7.1. Physician Back office,

5.7.2. Hospitals

5.7.3. Diagnostic Laboratories

6. Company Profile: Key Players

6.1. Cerner Corporation

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. McKesson Corporation

6.3. Epic Systems Corporation

6.4. athenahealth, Inc.

6.5. GE Healthcare

6.6. Allscripts Healthcare Solutions

6.7. eClinicalWorks

6.8. NextGen Healthcare, Inc.

6.9. Quest Diagnostics

6.10. Siemens Healthineers

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook