Industrial Safety Footwear Market Global Industry Analysis and Forecast (2026-2032) by Product, Application, and Region

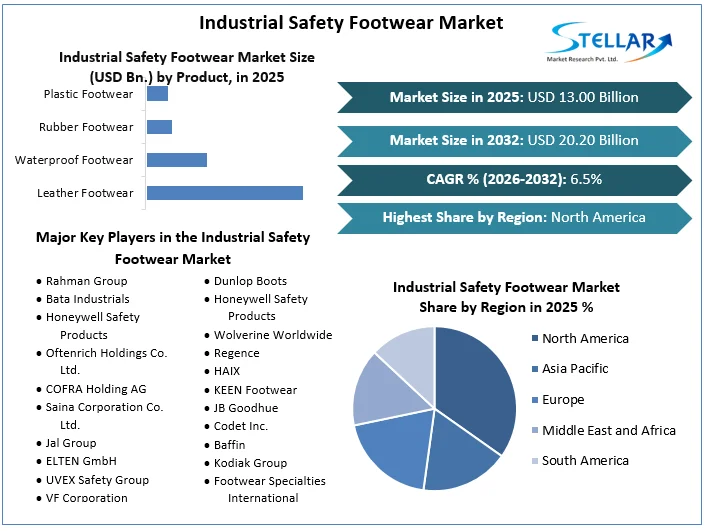

Industrial Safety Footwear Market size was valued at US$ 13.00 Bn. in 2025. Global Industrial Safety Footwear Market is estimated to grow at a CAGR of 6.5% over the forecast period.

Format : PDF | Report ID : SMR_499

Industrial Safety Footwear Market Overview:

Industrial footwear is specially designed to safeguard workers from physical harm and feet injuries caused at the workplace by accidents. Industries have chosen to prevent injuries and hazards such as slip, trip and fall hazards, Struck by objects, falling objects, electrical contacts, moving machinery for the worker’s safety. Increasing focus towards worker safety in manufacturing and construction sectors to avoid accidents is expected to fuel the industrial safety footwear market. In all manufacturing industries and construction sectors, it is mandatory to wear safety shoes as per Factory Act in their respective jurisdiction.

The rapid industrial development, rising number of worker accidents, and Rising health concerns regarding personal protection have created a demand for innovative safety footwear alternatives for footwear manufacturers. Which in turn is expected to boost the Industrial Safety Footwear market growth throughout the forecast period. During Covid 19 market had fallen down due to Order Cancellations, Price Reductions, Liquidity crises, Bankruptcy Threats, Unemployment, Currency Risk, and De-Globalization.

The report analyzes the Industrial Safety Footwear market’s Drivers, Restraints, opportunities, challenges, and segments (Product, End-Use industries, and Region) which helps to assess the market growth. The report also shows the current situation of the Industrial Safety Footwear market and region-wise demand of Industrial Safety Footwear during the forecast period.

To get more Insights: Request Free Sample Report

Industrial Safety Footwear Market Dynamics:

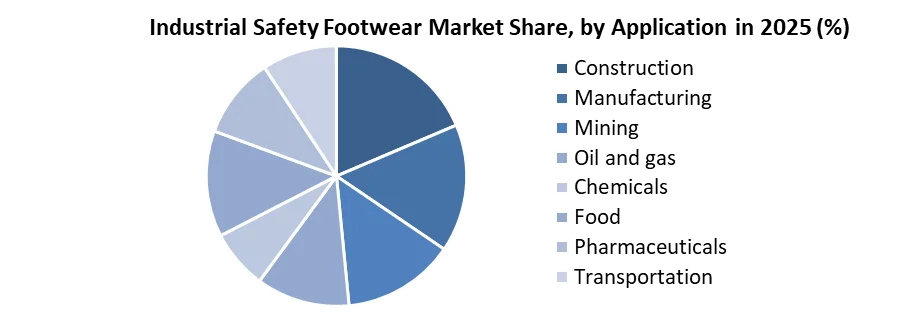

Pharmaceutical, Construction, manufacturing, mining, oil and gas, chemicals, food, and transportation industries are raising the demand for industrial safety footwear owing to the Growing adoption of health and safety practices to reduce workplace accidents and the introduction of various government initiatives and programs related to worker safety. Which is expected to boost the demand for the industrial safety footwear market during the forecast period.

The growth of the U.S. industrial safety footwear is anticipated to exceed USD 2 billion by 2027. Footwear is manufactured in compliance with ANSI in this region. Increasing demand for women's safety shoes is the driving factor for the industrial safety footwear market in the U.S.

Manufacturers are introducing light wear footwear that is much more comfortable compared to those available in past and provides even more protection. The Industrial Safety Footwear market holds a major scope for growth globally. The market is in its growth stage; however, its contribution to the global market would increase significantly within the forecast period owing to the rising health concerns and increasing the use of industrial safety footwear in various industries.

AS per OSHA, construction workers are required to wear safety footwear with slip and puncture-resistant soles. Therefore, the strict regulations made by the government to prevent workers from workplace hazards at the construction site is boosting the industrial safety footwear market during the forecast period.

The cost of industrial footwear is high compared to normal footwear. The local manufacturer is engaged in manufacturing footwear from low-quality material to reduce its price. This will hinder the growth of industrial safety footwear during the forecast period

Industrial Safety Footwear Market Segment Analysis:

By Type, the Leather footwear segment market was valued at over USD 1.4 Billion in 2025 and is expected to grow at a considerable rate over the forecast period. Leather has a non-conductivity nature therefore, manufacturers are used leather for the manufacturing of safety shoes because it protects against electric shocks. Moreover, leather provides protection against falling objects, cutting hazards, burns, and extreme weather.

The rubber footwear segment is expected to expand at a CAGR of 7.3% over the forecast period. Nowadays manufacturers are using bright-colored rubber material for the manufacturing of rubber footwear. Rubber footwear is water-resistant, lightweight, and can be easily cleaned, therefore it is preferred by several industries.

By Application,The construction segment was valued at US$ 4.95 billion in 2025 and it is estimated to grow at a CAGR of 7.6% over the forecast period. An increasing number of fatal accidents in construction sites and Growing awareness among the builders towards worker’s safety is expected to drive market growth over the forecast period.

The manufacturing segment was valued at USD 1.9 billion in 2020 and is expected to grow at a significant CAGR in the forthcoming years. The growth can be attributed to the intensive use of flammable liquids and considerable fire hazards associated with manufacturing activity in industries, which increases the risk of accidents at the workplace.

Industrial Safety Footwear Market Regional Insights:

In the North American region, the Industrial Safety Footwear market is expected to exceed USD 4.9 billion at a CAGR of over 6.2% during the forecast period. Oil and gas industries are increasing in the central and South American region, in addition to increasing investment in healthcare and agriculture industries. Therefore, the demand for safety footwear is increased in this region. Moreover, growing urbanization, rapid industrialization, and a rise in income levels are key factors for the growth of the industrial safety footwear market in North America.

In Europe, the Industrial safety footwear market share is expected to retain dominance over the forecast period. The demand in this region is mainly driven by the implementation of stringent regulations that mandate the use of safety shoes at the workplace. Germany’s industrial safety footwear market is expected to grow at a CAGR of 7.2% during the forecast period. Germany is the largest footwear market in Western Europe because the country has various independent retailers.

Asia Pacific is estimated to witness a substantial CAGR of over 7.5% during the forecast period. The growing construction sector owing to increasing disposable income and government spending on infrastructural projects and the increasing adoption of health and safety practices to reduce workplace fatalities may stimulate the demand for the industrial safety footwear market in the Asia Pacific region.

The objective of the report is to present a comprehensive analysis of the Global Industrial Safety Footwear Market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Industrial Safety Footwear Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the global garket dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Industrial Safety Footwear Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Industrial Safety Footwear Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the global garket.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Global Industrial Safety Footwear Market. The report also analyses if the Global Industrial Safety Footwear Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Industrial Safety Footwear Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Global Industrial Safety Footwear Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the global market is aided by legal factors.

Industrial Safety Footwear Market Scope:

|

Industrial Safety Footwear Market |

|

|

Market Size in 2025 |

USD 13.00 Bn. |

|

Market Size in 2032 |

USD 20.20 Bn. |

|

CAGR (2026-2032) |

6.5% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

by Product

|

|

by Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Industrial Safety Footwear Market Key Players:

- Rahman Group

- Bata Industrials

- Honeywell Safety Products

- Oftenrich Holdings Co. Ltd.

- COFRA Holding AG

- Saina Corporation Co. Ltd.

- Jal Group

- ELTEN GmbH

- UVEX Safety Group

- VF Corporation

- Rock Fall Ltd.

- Dunlop Boots

- Honeywell Safety Products

- Wolverine Worldwide

- Regence

- HAIX

- KEEN Footwear

- JB Goodhue

- Codet Inc.

- Baffin

- Kodiak Group

- Footwear Specialties International

- Royer

- Mellow Walk

- SureWerx

- H.H.Brown

Frequently Asked Questions

The market size of the Industrial Safety Footwear Market by 2032 is expected to reach US$ 20.20 Bn.

The forecast period for the Industrial Safety Footwear Market is 2026-2032

The cost of industrial footwear is high compared to normal footwear. The local manufacturer is engaged in manufacturing footwear from low-quality material to reduce its price. This will hinder the growth of industrial safety footwear during the forecast period.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Industrial Safety Footwear Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Industrial Safety Footwear Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Industrial Safety Footwear Market: Dynamics

4.1. Industrial Safety Footwear Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Industrial Safety Footwear Market Drivers

4.3. Industrial Safety Footwear Market Restraints

4.4. Industrial Safety Footwear Market Opportunities

4.5. Industrial Safety Footwear Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Industrial Safety Footwear Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Industrial Safety Footwear Market Size and Forecast, by Product (2025-2032)

5.1.1. Leather Footwear

5.1.2. Waterproof Footwear

5.1.3. Rubber Footwear

5.1.4. Plastic Footwear

5.2. Industrial Safety Footwear Market Size and Forecast, by Application (2025-2032)

5.2.1. Construction

5.2.2. Manufacturing

5.2.3. Mining

5.2.4. Oil and gas

5.2.5. Chemicals

5.2.6. Food

5.2.7. Pharmaceuticals

5.2.8. Transportation

5.3. Industrial Safety Footwear Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Industrial Safety Footwear Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Industrial Safety Footwear Market Size and Forecast, by Product (2025-2032)

6.1.1. Leather Footwear

6.1.2. Waterproof Footwear

6.1.3. Rubber Footwear

6.1.4. Plastic Footwear

6.2. North America Industrial Safety Footwear Market Size and Forecast, by Application (2025-2032)

6.2.1. Construction

6.2.2. Manufacturing

6.2.3. Mining

6.2.4. Oil and gas

6.2.5. Chemicals

6.2.6. Food

6.2.7. Pharmaceuticals

6.2.8. Transportation

6.3. North America Industrial Safety Footwear Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Industrial Safety Footwear Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Industrial Safety Footwear Market Size and Forecast, by Product (2025-2032)

7.2. Europe Industrial Safety Footwear Market Size and Forecast, by Application (2025-2032)

7.3. Europe Industrial Safety Footwear Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Industrial Safety Footwear Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Industrial Safety Footwear Market Size and Forecast, by Product (2025-2032)

8.2. Asia Pacific Industrial Safety Footwear Market Size and Forecast, by Application (2025-2032)

8.3. Asia Pacific Industrial Safety Footwear Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Industrial Safety Footwear Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Industrial Safety Footwear Market Size and Forecast, by Product (2025-2032)

9.2. Middle East and Africa Industrial Safety Footwear Market Size and Forecast, by Application (2025-2032)

9.3. Middle East and Africa Industrial Safety Footwear Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Industrial Safety Footwear Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Industrial Safety Footwear Market Size and Forecast, by Product (2025-2032)

10.2. South America Industrial Safety Footwear Market Size and Forecast, by Application (2025-2032)

10.3. South America Industrial Safety Footwear Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Rahman Group

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Bata Industrials

11.3. Honeywell Safety Products

11.4. Oftenrich Holdings Co. Ltd.

11.5. COFRA Holding AG

11.6. Saina Corporation Co. Ltd.

11.7. Jal Group

11.8. ELTEN GmbH

11.9. UVEX Safety Group

11.10. VF Corporation

11.11. Rock Fall Ltd.

11.12. Dunlop Boots

11.13. Honeywell Safety Products

11.14. Wolverine Worldwide

11.15. Regence

11.16. HAIX

11.17. KEEN Footwear

11.18. JB Goodhue

11.19. Codet Inc.

11.20. Baffin

11.21. Kodiak Group

11.22. Footwear Specialties International

11.23. Royer

11.24. Mellow Walk

11.25. SureWerx

11.26. H.H.Brown

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook