Global Eyeglasses Market (2026–2032) Market Size, Trends & Key Players

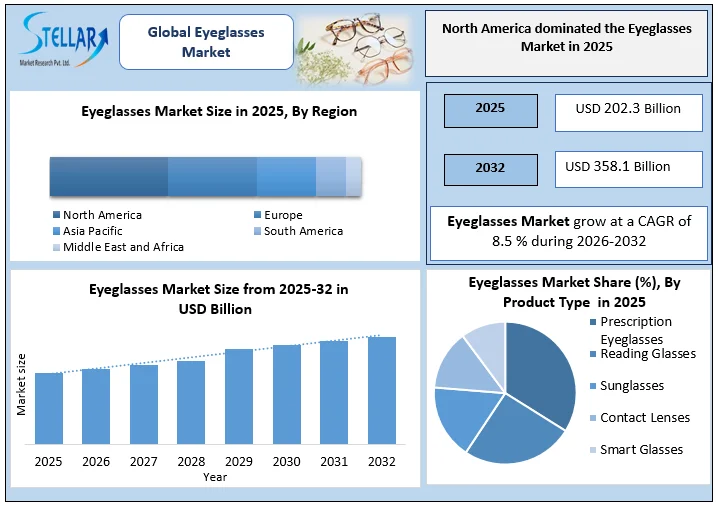

The Global Eyeglasses Market Is Expected to Reach USD 358.1 Bn By 2032. Analyze Trends, Regional Growth, Market Drivers, Key Players, and Innovations in Prescription, Luxury, And Smart Eyewear

Format : PDF | Report ID : SMR_2902

Eyeglasses Market Overview:

The global eyeglasses market continues to grow, driven by increasing prevalence of visual impairment, aging populations, and lifestyle changes that contribute to eye strain. Nearly 4 billion people worldwide, or 57% of the global population, wear prescription glasses, surpassing even the number of smartphone users. In North America, 75% of adults in the USA require vision correction, with 64% wearing prescription eyeglasses, equating to nearly 198 million users. Canada follows closely, with 76–82% of the population using some form of vision care products.

Across Europe, eyeglasses adoption varies widely. Belgium and North Macedonia lead at 70%, followed by Switzerland (67.7%), Norway (66%), and Germany (63.5–68.3%). Conversely, countries like France (29.5%) and Turkey (34.3%) show lower adoption despite well-developed healthcare systems, indicating cultural and lifestyle influences. In Asia-Pacific, Japan leads with 73.9% eyeglasses penetration, while India (29%) and China (28.3%) remain underserved, reflecting disparities in healthcare access and affordability.

Consumer behaviour shows a strong preference for in-store purchases. Prescription eyeglasses accounted for nearly 85% of in-store sales, while sunglasses and reading glasses follow at approximately 77% and 79%, respectively. Online adoption of eyeglasses is gradually increasing through virtual try-on technology, especially among younger consumers. Contact lenses constitute a smaller segment, with 37% of sales occurring online, reflecting convenience but higher dropout rates.

Key Highlights of the Market

- Widespread Impairment: At least 2.2 billion people globally have near or distance vision impairment, with nearly half of these cases being preventable or unaddressed.

- High Usage: 57% of the global population, or over 4 billion people, wear prescription glasses.

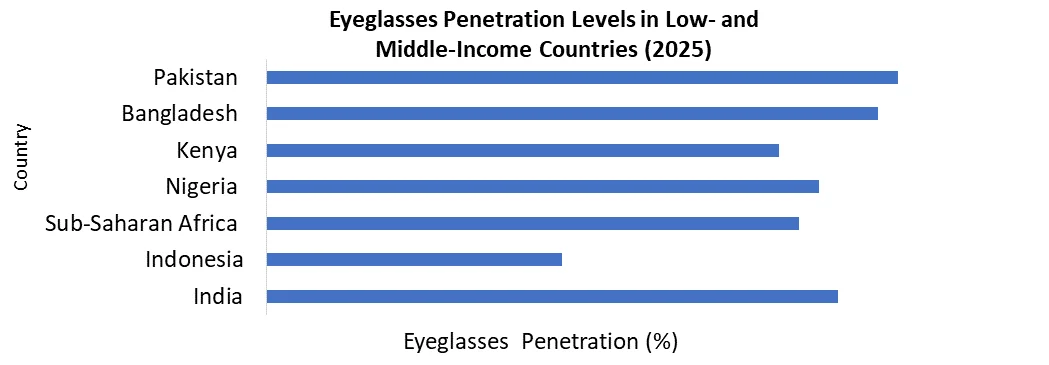

- Unmet Need: The global effective refractive error coverage is around 65.8%, meaning many people who need glasses still lack access, particularly in low- and middle-income regions.

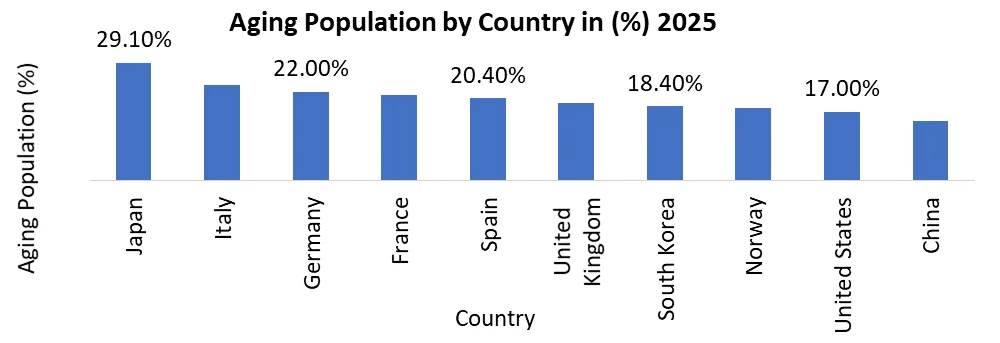

- Aging Population: The need for corrective lenses becomes more frequent with age; between 83-89% of Americans over 45 need reading glasses (presbyopia).

- Gender Differences: Slightly more women tend to wear glasses than men in developed nations, though the gap is narrowing.

To get more Insights: Request Free Sample Report

Eyeglasses Market Dynamics

Aging Populations Driving Vision Correction is Driving Eyeglasses Market Demand

Global ageing trends and increasing life expectancy in countries such as the USA, Japan, Germany, and Norway are driving demand for prescription eyeglasses and reading lenses. With presbyopia affecting a vast majority of adults over 45, eyeglasses remain the most accessible and widely adopted corrective solution, contributing to steady demand across both developed and emerging Eyeglasses market growth.

Limited Access in Low- and Middle-Income Countries

Healthcare disparities in countries like India (29% penetration), Indonesia (15%), and Sub-Saharan Africa (27–30%) restrict eyeglasses market growth. Limited trained personnel, uneven distribution of optical services, and affordability challenges reduce the adoption of affordable eyeglasses, particularly in rural and underserved regions.

Private Sector Expansion in Emerging Markets

Inclusive business models, leveraging last-mile retail, pharmacy chains, and low-cost ready-to-assemble frames, present significant opportunities in low- and middle-income countries. Partnerships with governments and NGOs can expand access to affordable eyeglasses while building sustainable private sector distribution channels.

Eyeglasses Market Segment Analysis

By Type:

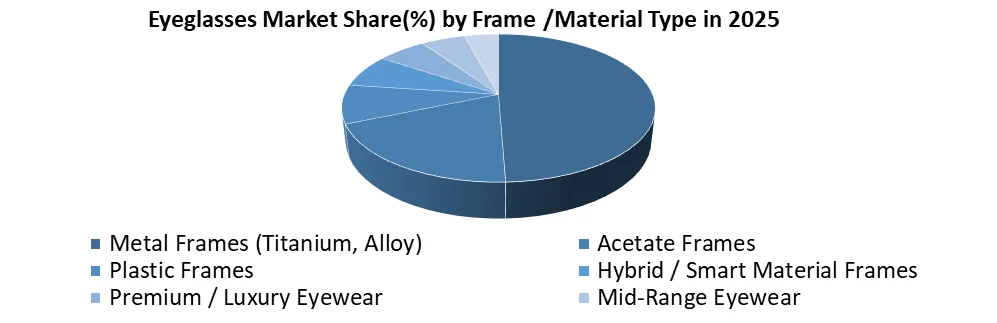

Metal frames dominated the eyeglasses market in 2025 due to their lightweight design, durability, and premium appeal, especially titanium frames. Acetate frames follow, driven by eyewear trends. Plastic frames remain popular in cost-sensitive markets, while hybrid and smart material frames are emerging with rising adoption of smart glasses.

Regional Analysis

North America dominated the Eyeglasses Market in 2025, led by the USA and Canada. Eyeglasses adoption is among the highest globally (64–75%), supported by high healthcare access, insurance coverage, and cultural acceptance. Spectacles dominate the consumer base, particularly among adults over 40, who represent 60% of prescription eyeglasses users.

Asia-Pacific offers rapid growth potential. Japan leads adoption at 73.9%, while markets in India (29%) and China (28.3%) remain largely untapped. Urbanization, lifestyle-driven eye strain, and government initiatives to improve vision care infrastructure are expected to accelerate eyeglasses adoption across the region.

Northern European countries such as Belgium, Switzerland, and Norway have strong penetration, while Southern and Eastern Europe show lower rates, with Turkey, Latvia, and Greece reflecting disparities influenced by cultural perceptions, healthcare structure, and genetic factors.

Recent Developments by Country

- USA: Subscription-based eyeglasses programs and tele-optometry platforms have emerged.

- Japan: Development of ultra-lightweight, high-precision frames for presbyopia glasses.

- India: School eye health programs and rural outreach initiatives are increasing access to affordable eyewear.

- Europe: Adoption of virtual try-on technology and expansion of e-commerce by luxury eyewear brands targeting Gen Z and Millennial consumers.

Competitive Landscape

From 2020 to 2025, the eyeglasses market has become highly competitive, driven by luxury eyewear branding, digital retail expansion, and smart eyewear innovation. Leading players are strengthening online channels, adopting AR-enabled eyewear try-ons, and targeting Asia-Pacific for volume growth, where urban demand and premium eyewear adoption increased by over 25% in key markets such as China and Japan.

Key Competitive Insights

- Cartier (2024–2026): Luxury eyewear contributes nearly 22% of accessory sales, with bespoke frames priced above USD 1,500, focusing on AR-enabled customization.

- Ray-Ban (2023–2025): Sells over 20 million frames annually, supported by smart eyewear and digital lens technologies.

- Tom Ford (2022–2025): Asia-Pacific accounts for around 30% of incremental premium eyewear demand.

- LINDBERG & CHANEL (2021–2025): Custom titanium frames and digital-first strategies drive 15–18% annual growth in online eyeglasses sales.

Eyeglasses Market Scope

|

Global Eyeglassess Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 202.3 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

8.5 % |

Market Size in 2032: |

USD 358.1 Billion |

|

Eyeglasses Segment Analysis |

By Product Type |

Prescription Eyeglasses Reading Glasses Sunglasses Contact Lenses Smart Glasses |

|

|

By Frame / Material Type |

Metal Frames (Titanium, Alloy) Acetate Frames Plastic Frames Hybrid / Smart Material Frames |

||

|

By Price |

Premium / Luxury Eyewear Mid-Range Eyewear Mass Market / Low-Cost Eyewear |

||

|

By Technology |

Traditional Eyeglasses Smart Eyewear (AR, audio, voice-assist) Ready-to-Assemble Eyewear |

||

|

By Distribution Channel |

In-Store Retail Online / E-Commerce |

||

|

By End User |

Adults (25–64 years) Senior Adults (65+ years) Children & Adolescents |

||

Eyeglasses Market Key Players

- EssilorLuxottica

- Ray-Ban (EssilorLuxottica)

- Oakley (EssilorLuxottica)

- Cartier Eyewear

- Tom Ford Eyewear

- Gucci Eyewear

- Prada Eyewear

- CHANEL Eyewear

- LINDBERG

- ic! berlin

- Oliver Peoples

- Zero G Titanium

- MYKITA

- Silhouette International

- Matsuda

- Persol (EssilorLuxottica)

- Warby Parker

- Lenskart

- Vision Express

- GrandVision (HAL Holding)

- Marcolin Group

- Safilo Group

- Kering Eyewear

- Innovative Eyewear

- Ray-Ban Meta Smart Glasses (w/ Meta)

- Lucyd (w/ Geenee AR)

- EyeBuyDirect

- Ace & Tate

- Vue Eyewear

- FittingBox

Frequently Asked Questions

Eyeglasses are primarily used for vision correction, including myopia, hyperopia, presbyopia, and astigmatism. They are also widely adopted for blue-light protection, occupational safety, sports, and fashion-oriented daily wear.

Prescription eyeglasses account for the largest share due to medical necessity, followed by sunglasses and reading glasses. In terms of materials, plastic and lightweight metal frames dominate, while smart and AR-enabled glasses are emerging segments.

Key demand drivers include increasing digital screen usage, rising elderly populations in countries such as Japan, Germany, and the US, growing urbanization, improved access to eye care, and expanding online and omnichannel eyewear retail platforms.

Major consumers include adults aged 40+, students, IT professionals, and urban populations. Key buyers consist of optical retail chains, hospitals, optometrists, e-commerce platforms, and institutional buyers such as schools and corporate offices.

1. Eyeglasses Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Eyeglasses Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2025

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Eyeglasses Market: Dynamics

3.1. Eyeglasses Market Trends

3.2. Eyeglasses Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Key Opinion Leader Analysis for the Global Industry

3.6. Analysis of Government Schemes and Initiatives for Industry

4. Distribution Channel Analysis

4.1. Optical retail store dominance

4.2. Online eyewear platform growth

4.3. Omnichannel retail adoption trends

4.4. Hospital and clinic-based sales

4.5. Pharmacy and mass retail contribution

4.6. Direct-to-consumer brand strategies

5. Demand–Supply Landscape

5.1. Global eyeglasses demand by region

5.2. Manufacturing capacity distribution

5.3. Import–export flow analysis

5.4. Supply chain structure and bottlenecks

5.5. Customization-driven supply complexity

5.6. Inventory and fulfillment challenges

6. Organized vs Unorganized Market

6.1. Organized optical retail penetration

6.2. Unorganized sector pricing dynamics

6.3. Quality and compliance differences

6.4. Consumer trust and brand preference

6.5. Margin comparison across channels

6.6. Transition trends toward organized players

7. Technology and Innovation Analysis

7.1. Smart eyewear technology evolution

7.2. Virtual try-on and AR integration

7.3. AI-based eye testing solutions

7.4. Manufacturing automation adoption

7.5. Lens surfacing and precision advances

7.6. Digital customer engagement tools

8. Regulatory and Policy Landscape

8.1. Vision care regulations by country

8.2. Prescription and dispensing norms

8.3. Import and manufacturing regulations

8.4. Public health and insurance coverage

8.5. School eye health program policies

8.6. Compliance challenges for players

9. Smart Eyewear Market Analysis

9.1. Smart glasses product definition

9.2. Consumer adoption patterns

9.3. Sports and lifestyle smart eyewear

9.4. AR and AI feature integration

9.5. Volume scaling strategies

9.6. Long-term commercialization outlook

10. Manufacturing and Supply Chain Analysis

10.1. Global production hubs mapping

10.2. Automation and cost efficiency

10.3. Customization-driven production challenges

10.4. Logistics and last-mile delivery

10.5. Inventory management practices

10.6. Risk mitigation strategies

11. Investment and Expansion Analysis

11.1. Capital expenditure trends

11.2. Retail network expansion plans

11.3. Manufacturing capacity additions

11.4. Technology investment focus

11.5. M&A and partnerships activity

11.6. Country-level investment hotspots

12. Sustainability and ESG Analysis

12.1. Eco-friendly frame materials adoption

12.2. Recycling and circular economy efforts

12.3. Ethical sourcing of materials

12.4. Energy-efficient manufacturing practices

12.5. ESG compliance by key players

12.6. Consumer response to sustainable eyewear

13. Eyeglasses Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

13.1. Eyeglasses Market Size and Forecast, By Product Type (2025-2032)

13.1.1. Prescription Eyeglasses

13.1.2. Reading Glasses

13.1.3. Sunglasses

13.1.4. Contact Lenses

13.1.5. Smart Glasses

13.2. Eyeglasses Market Size and Forecast, By Frame / Material Type (2025-2032)

13.2.1. Metal Frames (Titanium, Alloy)

13.2.2. Acetate Frames

13.2.3. Plastic Frames

13.2.4. Hybrid / Smart Material Frames

13.3. Eyeglasses Market Size and Forecast, By Price (2025-2032)

13.3.1. Premium / Luxury Eyewear

13.3.2. Mid-Range Eyewear

13.3.3. Mass Market / Low-Cost Eyewear

13.4. Eyeglasses Market Size and Forecast, By Technology (2025-2032)

13.4.1. Traditional Eyeglasses

13.4.2. Smart Eyewear (AR, audio, voice-assist)

13.4.3. Ready-to-Assemble Eyewear (affordable solutions for LMICs)

13.5. Eyeglasses Market Size and Forecast, By Distribution Channel (2025-2032)

13.5.1. In-Store Retail

13.5.2. Online / E-Commerce

13.6. Eyeglasses Market Size and Forecast, By End User (2025-2032)

13.6.1. Adults (25–64 years)

13.6.2. Senior Adults (65+ years)

13.6.3. Children & Adolescents

13.7. Eyeglasses Market Size and Forecast, By Region (2025-2032)

13.7.1. North America

13.7.2. Europe

13.7.3. Asia Pacific

13.7.4. Middle East and Africa

13.7.5. South America

14. North America Eyeglasses Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

14.1. North America Eyeglasses Market Size and Forecast, By Product Type (2025-2032)

14.2. North America Eyeglasses Market Size and Forecast, By Frame / Material Type (2025-2032)

14.3. North America Eyeglasses Market Size and Forecast, By Price (2025-2032)

14.4. North America Eyeglasses Market Size and Forecast, By Technology (2025-2032)

14.5. North America Eyeglasses Market Size and Forecast, By Distribution Channel (2025-2032)

14.6. North America Eyeglasses Market Size and Forecast, By End User (2025-2032)

14.7. North America Eyeglasses Market Size and Forecast, by Country (2025-2032)

14.7.1. United States

14.7.2. Canada

14.7.3. Mexico

15. Europe Eyeglasses Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units and Volume in 000’Units) (2025-2032)

15.1. Europe Eyeglasses Market Size and Forecast, By Product Type (2025-2032)

15.2. Europe Eyeglasses Market Size and Forecast, By Frame / Material Type (2025-2032)

15.3. Europe Eyeglasses Market Size and Forecast, By Price (2025-2032)

15.4. Europe Eyeglasses Market Size and Forecast, By Technology (2025-2032)

15.5. Europe Eyeglasses Market Size and Forecast, By Distribution Channel (2025-2032)

15.6. Europe Eyeglasses Market Size and Forecast, By End User (2025-2032)

15.7. Europe Eyeglasses Market Size and Forecast, by Country (2025-2032)

15.7.1. United Kingdom

15.7.2. France

15.7.3. Germany

15.7.4. Italy

15.7.5. Spain

15.7.6. Sweden

15.7.7. Russia

15.7.8. Rest of Europe

16. Asia Pacific Eyeglasses Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

16.1. Asia Pacific Eyeglasses Market Size and Forecast, By Product Type (2025-2032)

16.2. Asia Pacific Eyeglasses Market Size and Forecast, By Frame / Material Type (2025-2032)

16.3. Asia Pacific Eyeglasses Market Size and Forecast, By Price (2025-2032)

16.4. Asia Pacific Eyeglasses Market Size and Forecast, By Technology (2025-2032)

16.5. Asia Pacific Eyeglasses Market Size and Forecast, By Distribution Channel (2025-2032)

16.6. Asia Pacific Eyeglasses Market Size and Forecast, By End User (2025-2032)

16.7. Asia Pacific Eyeglasses Market Size and Forecast, by Country (2025-2032)

16.7.1. China

16.7.2. S Korea

16.7.3. Japan

16.7.4. India

16.7.5. Australia

16.7.6. Indonesia

16.7.7. Malaysia

16.7.8. Philippines

16.7.9. Thailand

16.7.10. Vietnam

16.7.11. Rest of Asia Pacific

17. Middle East and Africa Eyeglasses Market Size and Forecast (by Value in USD Billion and Volume in 000’Units) (2025-2032)

17.1. Middle East and Africa Eyeglasses Market Size and Forecast, By Product Type (2025-2032)

17.2. Middle East and Africa Eyeglasses Market Size and Forecast, By Frame / Material Type (2025-2032)

17.3. Middle East and Africa Eyeglasses Market Size and Forecast, By Price (2025-2032)

17.4. Middle East and Africa Eyeglasses Market Size and Forecast, By Technology (2025-2032)

17.5. Middle East and Africa Eyeglasses Market Size and Forecast, By Distribution Channel (2025-2032)

17.6. Middle East and Africa Eyeglasses Market Size and Forecast, By End User (2025-2032)

17.7. Middle East and Africa Eyeglasses Market Size and Forecast, by Country (2025-2032)

17.7.1. South Africa

17.7.2. GCC

17.7.3. Egypt

17.7.4. Nigeria

17.7.5. Rest of ME&A

18. South America Eyeglasses Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

18.1. South America Eyeglasses Market Size and Forecast, By Product Type (2025-2032)

18.2. South America Eyeglasses Market Size and Forecast, By Frame / Material Type (2025-2032)

18.3. South America Eyeglasses Market Size and Forecast, By Price (2025-2032)

18.4. South America Eyeglasses Market Size and Forecast, By Technology (2025-2032)

18.5. South America Eyeglasses Market Size and Forecast, By Distribution Channel (2025-2032)

18.6. South America Eyeglasses Market Size and Forecast, By End User (2025-2032)

18.7. South America Eyeglasses Market Size and Forecast, by Country (2025-2032)

18.7.1. Brazil

18.7.2. Argentina

18.7.3. Colombia

18.7.4. Chile

18.7.5. Rest Of South America

19. Company Profile: Key Players

19.1. EssilorLuxottica

19.1.1. Company Overview

19.1.2. Business Portfolio

19.1.3. Financial Overview

19.1.4. SWOT Analysis

19.1.5. Strategic Analysis

19.1.6. Recent Developments

19.2. Ray-Ban (EssilorLuxottica)

19.3. Oakley (EssilorLuxottica)

19.4. Cartier Eyewear

19.5. Tom Ford Eyewear

19.6. Gucci Eyewear

19.7. Prada Eyewear

19.8. CHANEL Eyewear

19.9. LINDBERG

19.10. ic! berlin

19.11. Oliver Peoples

19.12. Zero G Titanium

19.13. MYKITA

19.14. Silhouette International

19.15. Matsuda

19.16. Persol (EssilorLuxottica)

19.17. Warby Parker

19.18. Lenskart

19.19. Vision Express

19.20. GrandVision (HAL Holding)

19.21. Marcolin Group

19.22. Safilo Group

19.23. Kering Eyewear

19.24. Innovative Eyewear

19.25. Ray-Ban Meta Smart Glasses (w/ Meta)

19.26. Lucyd (w/ Geenee AR)

19.27. EyeBuyDirect

19.28. Ace & Tate

19.29. Vue Eyewear

19.30. FittingBox

20. Key Findings

21. Analyst Recommendations

22. Eyeglasses Market: Research Methodology