Europe Cut Flower Market Size, Growth and Export Trends Forecast 2025–2032

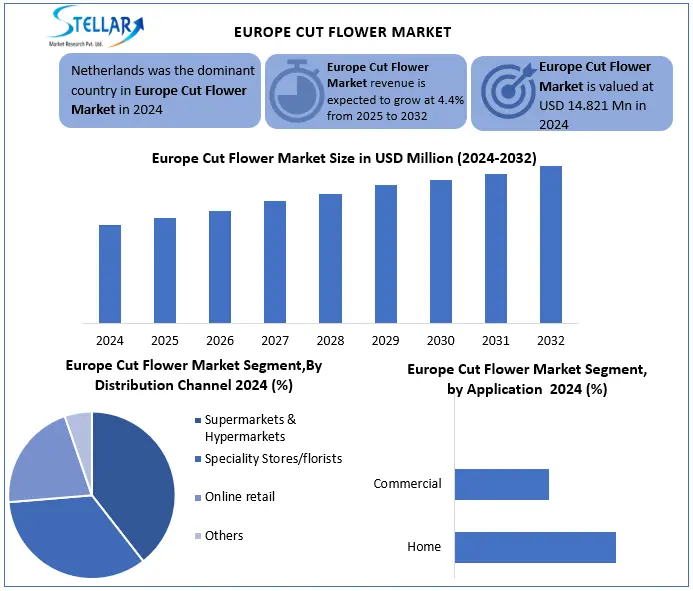

Europe Cut Flower Market was valued at USD 14.821 Mn in 2024 and is expected to reach at USD 20.910 Mn by 2032, driven by floral gifting trends and export hubs at CAGR of 4.4%.

Format : PDF | Report ID : SMR_2863

Europe Cut Flower Market Overview

The Cut Flower is a flower that has been severed from its plant and used for decoration, typically in bouquets, vase arrangements, or other floral displays. A European cut Flower market consists of fresh blooms like roses, lilies and carnations harvested for decorative and gifting purposes. Primarily market is driven by rising disposable incomes, expanding event and hospitality industries and cultural traditions surrounding floral gifting, particularly in Western and Asian markets. Netherlands dominated global trade, serving as Europes floral hub through Aalsmeer Flower Auction and efficient cold-chain logistics. Climate change is a growing threat, with extreme weather disrupting production in key regions like Colombia and Kenya, which account for most of global exports.

Trade policies of Europe Cut Flower influence market dynamics as EU imposes 5-10% tariffs on flowers from non European countries, while U.S. impose 15% duties on Chinese floral imports under Section 301 tariffs, boosting demand for Latin American suppliers. Post-Brexit border checks have also increased costs for UK florists, raising prices by 12% by UK Horticultural Trade Board. Emerging opportunities include e-commerce floral platforms growing at 25% annually and sustainable farming practices to meet eco-conscious consumer demand.

Europe Cut Flower Market Recent Developments

|

Date |

Development |

|

|

October 2024 |

Chrysal launches Transport Stickers to preserve flower freshness during transit by absorbing ethylene gas and reducing moisture loss. |

|

|

February 2025 |

Carccu unveils Boho-style bouquet wrapping using biodegradable materials, catering to Europe’s demand for sustainable and aesthetic packaging. |

|

|

12 February 2025 |

Study highlights eco-efficiency of Fairtrade Kenyan roses, which use up to 22x less energy and 65% less water than Dutch roses. |

|

|

14 February 2025 |

EU increases inspections on Kenyan roses due to false codling moth risk, causing up to 30% financial losses for exporters. |

|

|

26 April 2025 |

New EU import rules on Kenyan roses take effect, enforcing zero tolerance on banned pesticides and pests, impacting access to the EU market. |

|

To get more Insights: Request Free Sample Report

Europe Cut Flower Market Dynamics

Emerging Cut Flowers use in Accessories and Decorations to Drive Europe Cut Flower Market

Fresh-cut flowers are commonly used for decorations to beautify spaces. They are an important part of celebrations like weddings and festivals, over 60% of floral purchases are for gifting purpose, to show love and care and to beautify homes and commercial spaces. They can be arranged into bouquets, corsages and floral wreaths. In hotels and resorts, floral arrangements and decorations can make the area more comfortable and more welcoming to visitors, research shows that 70% of hotel guests associate flowers with cleanliness and warmth. Flower arrangements can introduce a personal touch to hospitality industry. Guests appreciate flowers for freshness they bring to surroundings. Netherlands alone exports USD 6.2 billion worth in Europe Cut flower industry annually, working toward higher productivity per worker and per unit area. The trend in the production of cut flowers, which is very labour intensive, will tend to be in areas with lower labour and other production costs.

Transportation and Storage Challenges to Hamper Europe Cut Flower Market Growth

Europe Cut Flower after harvesting need proper handling and post-harvest treatment. They must be cooled, pruned, graded, bunched, appropriately packed and stored in the cold room. Most clients or markets have specific requirements for flowers and packing. Studies shows that 20-30% of harvested flowers are lost due to mishandling. Many flowers in a box or too few flowers can cause damage to the flowers during transit. Those flowers, on arrival, fail the quality check at the distributor warehouse and are discarded. Flowers are highly perishable, leading to 15% of discard rate in international shipments. Flights are the most widely used mode of transport to reduce the farm-to-market time. Distributors lose market due to lack of space, causing flowers not to be shipped. Scenarios where delivery is impacted by a delay in transportation affect the quality and life of cut flowers. also reduces the number of flowers that can be transported as they are heavier than dry-packed flowers, so air transportation charges are higher.

Europe Cut Flower Market Segment Analysis

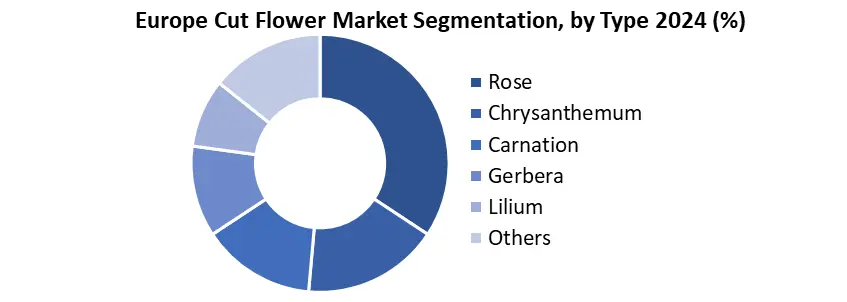

Based on Type, Europe Cut Flower market is segmented in Rose, Chrysanthemum, Carnation, Gerbera, Lilium and Others. The rose cut flowers market was largest in 2024. Rose has established itself as an enduring symbol of romance and passion with roots in ancient times. It is associated with love, passion and longing transcends cultural and religious boundaries, making it a universally cherished. Lilies known for their versatility and popularity, are among most sought-after flowers globally. They are available in range of colors and celebrated for their captivating fragrance.

Based on Distribution Channel, Europe Cut Flower market is segmented as Supermarkets & Hypermarkets, Speciality stores/florists, Online retails and Others. According to the National Agricultural Statistics Service (NASS) report of 2024, Europeans collectively purchase approximately 10 million cut flowers daily, contributing to a robust floriculture market valued at USD 8230 million across all retail channels, including supermarkets & hypermarkets, where its convenient to purchase all types of flowers under one roof. Online flower shopping increase reflects shifting consumer preferences towards convenient digital transactions. Advantage of purchasing flowers online is its convenience, enabling customers to browse diverse selection of floral offerings from the comfort of their homes. This eliminates need for physical store visits, facilitates easy comparing prices and styles across multiple vendors.

Europe Cut Flower Market Regional Analysis

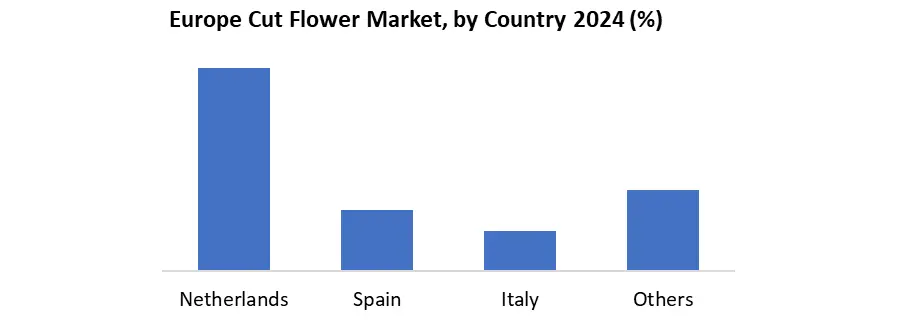

Netherlands led in Europe cut flower market with 44%, dominating over of global trade through its world-class auction system Royal Flora Holland, cutting-edge greenhouse technology, and unparalleled breeding expertise that produces more than 4.5 billion stems annually e.g., Dummen Orange, Florensis. Its strategic logistics hubs, Schiphol Airport, Rotterdam Port and highly efficient supply chains cement its position as the floral powerhouse of Europe. Spain and Italy are emerging as fastest growing domestic producers, fueled by rising consumer demand for locally sourced flowers and shorter, more resilient supply chains in the wake of Brexit and COVID-19 disruptions. Southern Europes warmer climates allow for lower energy costs compared to Dutch greenhouses, while a focus on seasonal specialties and sustainability appeals to eco-conscious buyers. While East Africa challenges the market with cost-competitive imports, Spain and Italy represent the most dynamic growth within Europe itself, blending traditional cultivation with modern agri-tech to reshape regional production.

Europe Cut Flower Market Competitive Landscape

|

Company |

Headquarters |

Market Position |

Competitive Edge |

|

Dummen Orange |

Netherlands |

Global leader in flower breeding & propagation |

Strongest R&D pipeline with 100+ new varieties annually |

|

Royal Flora Holland |

Netherlands |

World's largest flower auction platform |

Processes 12 billion cut flowers annually through hybrid physical/digital auctions |

|

Euro florist |

Sweden |

Pan-European flower delivery network |

Integrated e-commerce platform connecting 20,000 florists |

|

Florensis |

Netherlands |

Leading young plant propagator |

Automated propagation supplying 1.5 billion cuttings/year |

|

Europe Cut Flower Market Scope |

|

|

Market Size in 2023 |

USD 14.820 million |

|

Market Size in 2030 |

USD 20.910 million |

|

CAGR (2024-2030) |

4.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Rose Chrysanthemum Carnation Gerbera Lilium Others |

|

By Application Home Commercial |

|

|

|

By Distribution Channel Supermarkets & Hypermarkets Speciality Stores/florists Online retails Others |

Europe Cut Flower Market Key Players

Netherlands

- Dummen Orange

- Royal Flora Holland

- Margin par BV

- Chrysal

- Florensis

- Porta Nova

Germany

- Selecta One

United Kingdom

- David Austin Roses

Sweden

- Euro florist

Frequently Asked Questions

Growth is fueled by floral gifting traditions, expanding e-commerce, and the region’s strong logistics infrastructure.

The Netherlands led the European cut flower market due to its advanced auction system (Royal Flora Holland), innovative greenhouse technologies, and strategic logistics via Schiphol Airport and Rotterdam Port. Its breeding expertise and global exports make it the floral hub of Europe.

Major trends include rising consumer interest in floral gifting, eco-conscious buying habits, the growth of online flower retail, and the use of flowers in hospitality and events. There is also increasing demand for locally grown and sustainably sourced blooms.

1. Europe Cut Flower Market: Research Methodology

2. Europe Cut Flower Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Europe Cut Flower Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquater

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Europe Cut Flower Market: Dynamics

4.1. Wire and Cables Market Trends

4.2. Wire and Cables Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

4.7. Advancements in Renewable Energy Cables

5. Europe Cut Flower Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Europe Cut Flower Market Size and Forecast, By Type (2024-2032)

5.1.1. Rose

5.1.2. Chrysanthemum

5.1.3. Carnation

5.1.4. Gerbera

5.1.5. Lilium

5.1.6. Others

5.2. Europe Cut Flower Market Size and Forecast, By Application (2024-2032)

5.2.1. Home

5.2.2. Commercial

5.3. Europe Cut Flower Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Supermarkets & Hypermarkets

5.3.2. Speciality Stores/florists

5.3.3. Online retails

5.3.4. Others

5.4. Europe Cut Flower Market Size and Forecast, By Country (2024-2032)

5.4.1. UK

5.4.2. France

5.4.3. Germany

5.4.4. Italy

5.4.5. Spain

5.4.6. Sweden

5.4.7. Russia

5.4.8. Netherlands

5.4.9. Rest of Europe

6. Company Profile: Key Players

6.1. Dummen Orange (Netherlands)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Royal Flora Holland (Netherlands)

6.3. Margin par BV (Netherlands)

6.4. Selecta One (Germany)

6.5. Chrysal (Netherlands)

6.6. Florensis (Netherlands)

6.7. Porta Nova (Netherlands)

6.8. David Austin Roses (UK)

6.9. Euro florist (Sweden)

7. Key Findings

8. Industry Recommendations