Europe Oral Care Market- Industry Analysis and Forecast (2025-2032) by Product, Application, Distribution Channel, and Country

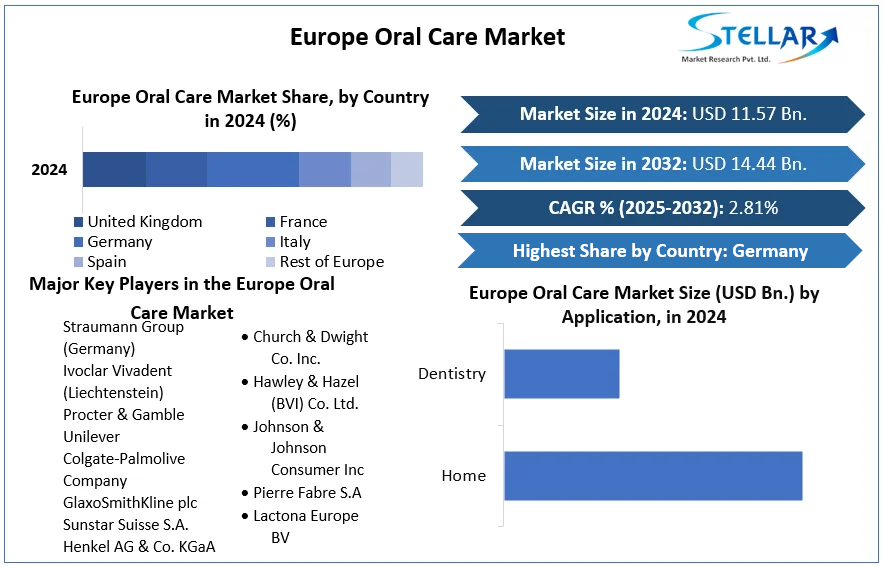

Europe Oral Care Market size was valued at USD 11.57 Bn in 2024 and is expected to reach USD 14.44 Bn by 2032, at a CAGR of 2.81%.

Format : PDF | Report ID : SMR_2280

Europe Oral Care Market Overview-

Oral health involves the care and maintenance of your teeth and gums. Regular dental hygiene, such as brushing, flossing, and mouthwash, is crucial to avoid dental problems like cavities and gum disease. Europe oral care market is primarily driven by toothpaste, toothbrushes, and replacement heads, which have captured significant market shares. Over 50% of the European population may suffer from some form of periodontitis (gum disease), with over 10% having severe disease. The prevalence increases to 70-85% in those aged 60-65 years. In 2022, 4.8% of the EU population aged 16 and over reported an unmet need for dental examination or treatment Toothpaste is considered a fundamental necessity for maintaining oral hygiene, while the high cost of electric toothbrushes contributes to the larger market share of manual toothbrushes and replacement heads.

Oral care encompasses practices such as brushing, cleaning between teeth, and rinsing, which help prevent dental and gum problems like periodontitis, caries, gingivitis, and others. The growing popularity of cosmetic dentistry, the evolving dental care segment, and the increasing demand for teeth whitening products are some of the key factors driving the growth of the Europe oral care market. In Europe, Germany is leading the way in the oral care market with its innovative dental care products and high oral hygiene standards.

- For example, in January 2024, Dr. Dento announced the launch of its new oral care product line, aiming to combine technology and nature. This product line range includes aloe grass mouthwash, watermelon mint mouthwash, cucumber mint mouthwash, vanilla icey mint toothpaste, and matcha green tea hemp seed oil toothpaste.

To get more Insights: Request Free Sample Report

Europe Oral Care Market Dynamics-

The Europe oral care market is undergoing a rapid transformation driven by technological advancements.

Innovative products like electric and smart toothbrushes, which connect to smartphone apps and offer features like brushing timers, pressure sensors, and coverage trackers, are gaining popularity as they help improve oral hygiene practices. Advances in materials and formulations are also enabling more effective solutions for oral health issues, further driving consumer interest and Europe oral care market growth.

Smart toothbrushes equipped with sensors that track brushing habits, provide real-time feedback, and sync with mobile apps are revolutionizing daily dental care by bringing a new level of interactivity and personalization, while advanced dental technologies like Cone Beam Computed Tomography (CBCT), intraoral scanners, and 3D printing are enabling more accurate diagnosis, personalized treatment planning, and the creation of custom dental solutions; laser dentistry is also gaining traction, offering benefits like reduced bleeding, pain, and faster healing times for procedures like gum disease management and teeth whitening; the integration of Artificial Intelligence (AI) tools that can analyze dental data to detect early signs of oral health issues, as well as the rise of teledentistry and remote consultations, are enabling more proactive and preventive dental interventions

Europe Oral Care Market by Import Export Analysis

Europe Oral Care Market in 2022, Germany was the world's largest exporter of Dental Products, exporting $648 million worth of these products. Dental Products were the 373rd most exported product from Germany that year. The main destinations for Germany's Dental Products exports were Poland ($73.9 million), Austria ($67.8 million), the United Kingdom ($55.1 million), France ($51.5 million), and Italy ($49.2 million). Meanwhile, Germany was the second-largest importer of Dental Products in 2022, importing $400 million worth of these products. Dental Products were the 483rd most imported product in Germany that year. Germany's primary sources of Dental Products imports were Poland ($104 million), the United Kingdom ($56.5 million), Italy ($40.7 million), and Switzerland ($31.5 million)

Oral Care Market Segment Analysis

Based on Products, The toothpaste segment is expected to witness the highest growth during the forecast period from 2025 to 2032. Europe oral care market growth is mainly driven by innovations in the toothpaste production process and growing research activities exploring the creation of reliable toothpaste formulations. The evolution of certain toothpastes offering enhanced benefits like anti-inflammatory and whitening properties is positively boosting the overall oral care market growth, particularly in Europe.

The dental accessories segment led the market with a substantial revenue share of XX% in 2024, largely attributable to the ability of these products to provide effective tooth whitening, which can build confidence among people in professional and social settings. The increasing consumer concerns about enhancing their smiles are driving enormous demand for cosmetic tooth-whitening products in the marketplace. The toothbrush segment is also gaining traction nowadays with the rising development of sustainable and effective oral care products, leading to a higher rate of adoption among the consumer base in the region.

Based on Distribution- The online retail segment of the Europe oral care market held the largest share in 2024 due to increased access to oral care products among a wider consumer base compared to traditional distribution channels. Online shopping offers greater convenience and lower transaction costs, leading to wider adoption. The growing e-commerce platforms in Europe are positively driving demand for oral care products.

The supermarkets and hypermarkets segment is expected to grow at the fastest rate over the next few years due to the rapid increase in demand for purchasing multiple household and consumer goods at one place and time. The rising employment opportunities are encouraging consumers to purchase all required goods, including oral care products, at one time every month, propelling demand for oral care products.

Europe Oral Care Market Regional Insights-

Germany Region Registered the Largest Share of the Market in 2024

Germany held the largest market share in 2024, driven by the largest consumer market, The growing beauty and personal care sector in Germany is also stimulating the flourishing Europe oral care market, driven by rising consumer investments in grooming and hygiene products, including oral care. A key factor contributing to Germany's larger share in the European oral care market is the substantial increase in the proportion of people opting for mouthwash and dental accessories.

The UK region is also expected to experience rapid growth in the oral care market. According to the British Dental Association, many UK oral care patients are seeking treatment in foreign countries due to lower healthcare costs. Additionally, the prevalence of health problems after dental treatment is rising, with around 76% of respondents in a survey reporting experiencing pain. These health concerns have led to increased government initiatives promoting oral health care in the region, further driving market growth.

In Germany, the Beauty & Personal Care market is projected to grow by 1.23% from 2024-2028, reaching a market volume of US$21.29 billion by 2028. The Feminine Hygiene market in Germany is also expected to grow, with a projected increase of 2.68% from 2024-2029, resulting in a market volume of US$0.97 billion by 2029. These statistics highlight the significant potential for continued expansion in Germany's beauty and personal care industry.

The report aims to provide industry stakeholders with a thorough study of the Europe oral care Market. The research presents the industry& historical and present state with projected market size and trends, analyzing complex data in an easy-to-read manner. The research includes PORTER and PESTLE analyses along with the possible effects of market microeconomic factors. Analyzing both internal and external elements that could have a good or negative impact on the firm will provide decision-makers with a clear picture of the industry& future. By understanding the market segments and projecting the size of the Europe oral care market, the reports also help understand the market dynamics and structure.

Europe Oral Care Market Scope

|

Europe Oral Care Market |

|

|

Market Size in 2024 |

USD 11.57 Bn. |

|

Market Size in 2032 |

USD 14.44 Bn. |

|

CAGR (2025-2032) |

2.81% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Europe Oral Care Market Segments |

By Product Toothbrush Toothpaste Mouthwash Denture products |

|

By Application Home Dentistry |

|

|

By Distribution Channel Supermarkets and hypermarkets Retail Pharmacies Online Distribution |

|

|

Country Scope |

United Kingdom, France, Germany, Italy, Spain, Russia, Sweden, Norway, Austria, and Rest of Europe |

Europe Oral Care Market Key players

- Straumann Group (Germany)

- Ivoclar Vivadent (Liechtenstein)

- Procter & Gamble

- Unilever

- Colgate-Palmolive Company

- GlaxoSmithKline plc

- Sunstar Suisse S.A.

- Henkel AG & Co. KGaA

- Church & Dwight Co. Inc.

- Hawley & Hazel (BVI) Co. Ltd.

- Johnson & Johnson Consumer Inc

- Pierre Fabre S.A

- Lactona Europe BV

- Pierrot (Fushima SL)

For Global Scenario:

Frequently Asked Questions

Germany is expected to dominate the Europe Oral Care Market during the forecast period.

The Europe Oral Care Market size is expected to reach USD 14.44 Billion by 2032.

The top players in Europe Oral Care Market are Colgate-Palmolive Company, Procter & Gamble, GlaxoSmithKline plc, Johnson & Johnson, Inc. Unilever, Church & Dwight Co., Inc. Henkel AG & Co. KG aA.

The segments covered in the Europe Oral Care Market report are based on Product, Distribution Channel and Application, and region.

1. Europe Oral Care Market: Research Methodology

2. Europe Oral Care Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Europe Oral Care Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Europe Oral Care Market: Dynamics

4.1. Oral Care Market Trends

4.2. Oral Care Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Europe Oral Care Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Europe Oral Care Market Size and Forecast, By Component (2024-2032)

5.1.1. Toothbrush

5.1.2. Toothpaste

5.1.3. Mouthwash

5.1.4. Denture Products

5.2. Europe Oral Care Market Size and Forecast, By Water Depth (2024-2032)

5.2.1. Home

5.2.2. Dentistry

5.3. Europe Oral Care Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Supermarkets and hypermarkets

5.3.2. Retail Pharmacies

5.3.3. Online Distribution.

5.4. Europe Oral Care Market Size and Forecast, by Country (2024-2032)

5.4.1. United Kingdom

5.4.2. France

5.4.3. Germany

5.4.4. Italy

5.4.5. Spain

5.4.6. Sweden

5.4.7. Russia

5.4.8. Norway

5.4.9. Poland

5.4.10. Netherland

5.4.11. Rest of Europe

6. Company Profile: Key Players

6.1. Straumann Group (Germany)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Ivoclar Vivadent (Liechtenstein)

6.3. Procter & Gamble

6.4. Unilever

6.5. Colgate-Palmolive Company

6.6. GlaxoSmithKline plc

6.7. Sunstar Suisse S.A.

6.8. Henkel AG & Co. KGaA

6.9. Church & Dwight Co. Inc.

6.10. Hawley & Hazel (BVI) Co. Ltd.

6.11. Johnson & Johnson Consumer Inc

6.12. Pierre Fabre S.A

6.13. Lactona Europe BV

6.14. Pierrot (Fushima SL)

7. Key Findings

8. Industry Recommendations