Germany Brewer’s Spent Grain Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

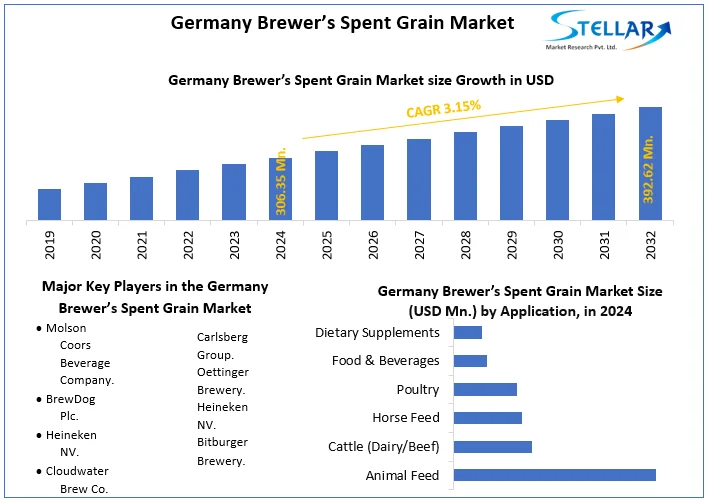

The Germany Brewer’s Spent Grain Market size was valued at USD 306.35 Mn. in 2024 and the total Germany Brewer’s Spent Grain Market revenue is expected to grow at a CAGR of 3.15% from 2025 to 2032, reaching nearly USD 392.62 Mn.

Format : PDF | Report ID : SMR_1700

Germany Brewer’s Spent Grain Market Overview

Brewers' spent grain (BSG) is the most abundant by-product generated in the beer-brewing process. The material consists of the barley grain husks obtained as solid residue after the production of worth. BSG is rich in fiber and protein and, the main use for the elimination of the by-product has been as an animal feed.

The Report includes a comprehensive study of the German Brewer’s Spent Grain Market that has impacted the growth, challenges, restraints, and opportunities of the market. The Report consists of a detailed study of key players present in the market and focuses on their strategic, and financial analysis of the market. The report also covers Qualitative and Quantitative data that is used in Research to analyze market trends in the market. With the adoption of new technologies in their organizations, key companies in Germany have made significant profits and are estimated to grow faster by reaching their target audience. The report consists of a comprehensive study of various strategies such as collaborations, partnerships, mergers, and acquisitions adopted by the market leaders.

To get more Insights: Request Free Sample Report

Germany Brewer’s Spent Grain Market Dynamics

Fuelling Growth in the Brewer’s Spent Grain Market

Germany led the market with the largest market share and a growing CAGR during the forecast period. The increase in demand for the manufacture of brewery-spent grain has increased as Germany is the nation that produces the most beer globally. Recent advancements in the food industry's studies indicate that the use of brewery grain in food has improved human nutrition since it has a high protein content that is advantageous to people's health. Additionally, the wasted grain from the brewery has the ability to generate biogas, it is also utilized in biotechnological applications resulting in higher demand for Brewer’s spent grain.

Companies are also realizing and seizing the opportunity to commercially create and supply BSG-derived substances to the food industry has propelled the market. In the European Union, 3.4 million tons of beer are produced, of which 2 million tons are exported. 70% of these used grains are used for feed, 10% for biogas production, and the remaining 20% ??for landfill. The growing acceptance of 100% recycled food products points to significant potential in the rapidly growing recycled foods industry as a result of accelerating the brewer’s spent grain market.

Germany Brewer’s Spent Grain Market Challenges

The rising Legal constraints, raw material composition differences, and consumer perception of waste as low-value waste are some of the challenges associated with the widespread use or inclusion of recycled BSG ingredients. Macroeconomic indicators like GDP growth, employment rates, and consumer sentiment have impacted the beer consumption rate as a result production of beer decreased leading to the Economic impact on the Brewer’s spent grain market.

Germany Brewer’s Spent Grain Market Segment Analysis

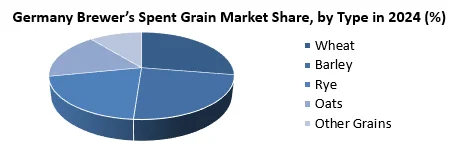

Based on Type, the Barley segment dominates the market with the highest market share and a growing CAGR during the forecast years. Germany is self-sufficient, and frequently an exporter of wheat, barley, and rye. Barley is mostly used in the production of beers in Germany resulting in 41 % of waste that is brewer’s spent grain. Production of brewer’s spent grain in Germany is on a large scale owing to the increase in demand for the beer consumption has propelled the market growth.

The increase in Global warming poses a serious challenge to the global barley supply, as more than 60% of the world’s barley production is provided by Europe, most of it grown under rain-fed conditions. It is estimated that BSG forms around 85% of solid waste from brewing and more than 30% of initial malt. 41. In 2024, barley production for Germany was 11.2 million thousand tonnes.

|

|

Germany Brewer’s Spent Grain Market |

|

Market Size in 2024 |

USD 306.35 Mn. |

|

Market Size in 2032 |

USD 392.62 Mn. |

|

CAGR (2025-2032) |

3.15% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Type

|

|

By Application

|

Germany Brewer’s Spent Grain Market Key Players

- Molson Coors Beverage Company.

- BrewDog Plc.

- Heineken NV.

- Cloudwater Brew Co.

- Carlsberg Group.

- Oettinger Brewery.

- Heineken NV.

- Bitburger Brewery.

Frequently Asked Questions

High Costs of storage are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 306.35 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 3.15% from 2025 to 2032, reaching nearly USD 392.62 Million.

1. Germany Brewer’s Spent Grain Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Germany Brewer’s Spent Grain Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Germany Brewer’s Spent Grain Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Germany Brewer’s Spent Grain Market: Dynamics

4.1. Germany Brewer’s Spent Grain Market Trends

4.2. Germany Brewer’s Spent Grain Market Drivers

4.3. Germany Brewer’s Spent Grain Market Restraints

4.4. Germany Brewer’s Spent Grain Market Opportunities

4.5. Germany Brewer’s Spent Grain Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Germany Brewer’s Spent Grain Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032)

5.1. Germany Brewer’s Spent Grain Market Size and Forecast, by Type (2024-2032)

5.1.1. Wheat

5.1.2. Barley

5.1.3. Rye

5.1.4. Oats

5.1.5. Other Grains

5.2. Germany Brewer’s Spent Grain Market Size and Forecast, by Application (2024-2032)

5.2.1. Animal Feed

5.2.2. Cattle (Dairy/Beef)

5.2.3. Horse Feed

5.2.4. Poultry

5.2.5. Food & Beverages

5.2.6. Dietary Supplements

6. Company Profile: Key Players

6.1. Molson Coors Beverage Company

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. BrewDog Plc.

6.3. Heineken NV.

6.4. Cloudwater Brew Co.

6.5. Carlsberg Group.

6.6. Oettinger Brewery.

6.7. Heineken NV.

6.8. Bitburger Brewery.

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook