Germany Ceramic Sanitary Ware Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

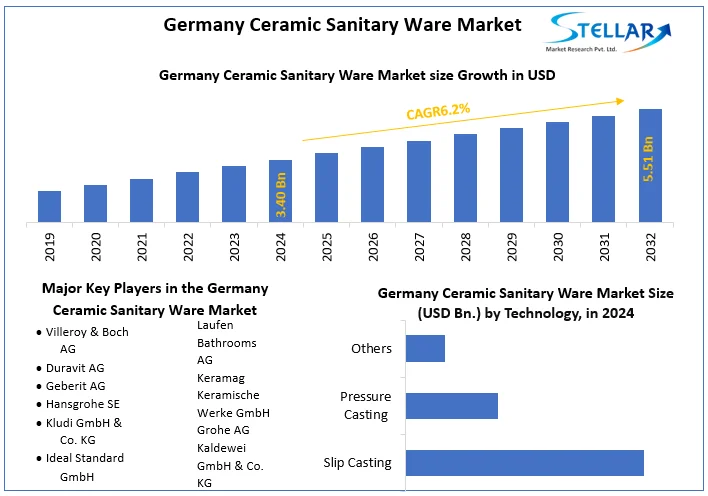

The Germany Ceramic Sanitary Ware Market size was valued at USD 3.40 Bn. in 2024 and the total Germany Ceramic Sanitary Ware Market revenue is expected to grow at a CAGR of 6.2% from 2024 to 2032, reaching nearly USD 5.51 Bn. by 2032.

Format : PDF | Report ID : SMR_1720

Germany Ceramic Sanitary Ware Market Overview

Ceramic sanitary ware refers to the bathroom fixtures and fittings and waste disposal appliances installed in bathrooms and restrooms. The main types of ceramic sanitary ware are washbasin and kitchen sinks, faucets, water closets, bathtubs, bidets, urinals, and others.

The Report has covered various aspects realted to market strategies, competition landscape, dynamics, segment analysis and key players present in the Germany’s Ceramic Sanitary Ware Market. The Ceramic Sanitary Ware Market revenue is expected to grow from xx to xx during the forecast year with increased in sales of the product. Commercial Sector has boosted the economic growth by xx%. The in depth analysis of leading Market leaders and their product strategies which is implemented for Ceramic Sanitary Ware Manufacturing is provided to get insights about the German Market. Intrinsic factors such as drivers and restraints are examined, along with extrinsic factors like opportunities and challenges in the market.

For the manufacturing of ceramics in Europe to be viable and sustainable, a range of EU and national policies must be adapted to restore competitiveness and create the conditions that has allow for further investments to secure the future of the sector in Europe. German Ceramic Sanitary ware has gained global recognition for its high quality precision craftsmanship, and innovative designs. Brands like Villeroy & Boch, Duravit, and Hansgro have set industry standards in the German Ceramic Sanitary Ware Industry.

To get more Insights: Request Free Sample Report

Germany Ceramic Sanitary Ware Market Dynamics

Surged in the sanitation and growing awareness among german people about hygiene has propelled the market growth. In Germany, Ceramic technology has revolutionized the manufacturing of toilets, making them more efficient, durable, and hygienic as a result it has brought about new designs and functionalities, which have improved user experience and helped meet the growing demand for sanitation products.

The demand for Ceramic sanitary ware in Germany has been increasing owing to the increasing population and improved living standards. Continuous development, merger and acquisition has led surged in employment rate of Germany and enhanced the productivity of the Market Leaders present in the Germany. For Instance, In September 2023, Villeroy & Boch AG has signed binding agreements to acquire operating companies in the Ideal Standard Group. The two companies are a strong strategic fit given their regional presence, sales strategies and product and brand portfolios, laying the foundations for a stronger market position and additional growth. In an industry with global growth potential, the integrated company is estimated, after completion of the transaction, join the ranks of Europe’s biggest manufacturers of Ceramic Sanitary ware products.

Germany Ceramic Sanitary Ware Market Challenges

Reducing the carbon footprint of ceramic sanitaryware manufacturing involves adopting sustainable practices and innovative technologies ranging from mineral selection, production and firing innovation and transportation optimization. The reduction of environmental impact is today the main challenge of the ceramic industry that is always more focusing on materials in line with the principles of economic and environmental sustainability. The market for sanitary ware has been affected by the cheap supply of low-priced products from Germany.The increase in the energy prices ans reliance on raw materials from non – European Producers has created the barrier in the German Sanitary Ware Market.

Germany Ceramic Sanitary Ware Market Segment Analysis

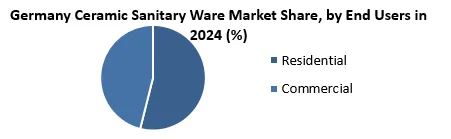

Based On End User, Commercial segment helds the highest share in German sanitary ware market of 60% with a growing CAGR and is expected to the grow during the forecast period. Ceramic sanitary wares have a wide range of applications in the commercial sector. As more people move to urban areas and disposable income increases, the demand for modern and aesthetically pleasing bathrooms increases. Germany is known for its engineering process and attention to detail, the market for for Cermanic Sanitary Ware is rich and diverse in Geramny as a result the demand has icreased in the commercial sector in the country. The adoption rate in the commercial sector such as real estate, hotels, etc., has propelled the demand for the Ceramic Sanitary Ware Industry in the Germany.

|

|

Germany Ceramic Sanitary Ware Market |

|

Market Size in 2024 |

USD 3.40 Bn. |

|

Market Size in 2032 |

USD 5.51 Bn. |

|

CAGR (2025-2032) |

6.2 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By Technology

|

|

|

By End Users

|

|

|

By Distribution Channel

|

Germany Ceramic Sanitary Ware Market Key Players

- Villeroy & Boch AG

- Duravit AG

- Geberit AG

- Hansgrohe SE

- Kludi GmbH & Co. KG

- Ideal Standard GmbH

- Laufen Bathrooms AG

- Keramag Keramische Werke GmbH

- Grohe AG

- Kaldewei GmbH & Co. KG

Frequently Asked Questions

Low-cost materials are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 3.40 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 6.2 % from 2025 to 2032, reaching nearly USD 5.51 Billion.

The segments covered in the market report are By product, Technology, End-user, and Distribution Channel.

1. Germany Ceramic Sanitary Ware Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. Germany Ceramic Sanitary Ware Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. Germany Ceramic Sanitary Ware Market Import Export Landscape

3.1. Import Trends

3.2. Export Trends

3.3. Regulatory Compliance

3.4. Major Export Destinations

3.5. Import-Export Disparities

4. Germany Ceramic Sanitary Ware Market: Dynamics

4.1.1. Market Drivers

4.1.2. Market Restraints

4.1.3. Market Opportunities

4.1.4. Market Challenges

4.2. PORTER’s Five Forces Analysis

4.3. PESTLE Analysis

4.4. Regulatory Landscape

4.5. Analysis of Government Schemes and Initiatives for the Germany Ceramic Sanitary Ware Industry

5. Germany Ceramic Sanitary Ware Market Size and Forecast by Segments (by Value USD)

5.1. Germany Ceramic Sanitary Ware Market Size and Forecast, by Product (2024-2032)

5.1.1. Toilet Sink

5.1.2. Wash Basins

5.1.3. Urinal

5.1.4. Bathtubs

5.1.5. Others

5.2. Germany Ceramic Sanitary Ware Market Size and Forecast, by Technology (2024-2032)

5.2.1. Slip Casting

5.2.2. Pressure Casting

5.2.3. Others

5.3. Germany Ceramic Sanitary Ware Market Size and Forecast, by End User (2024-2032)

5.3.1. Residential

5.3.2. Commercial

5.4. Germany Ceramic Sanitary Ware Market Size and Forecast, by Distribution Channel (2024-2032)

5.4.1. Offline

5.4.2. Online

6. Germany Ceramic Sanitary Ware Market: Competitive Landscape

6.1. STELLAR Competition Matrix

6.2. Competitive Landscape

6.3. Key Players Benchmarking

6.3.1. Company Name

6.3.2. Service Segment

6.3.3. End-user Segment

6.3.4. Revenue (2024)

6.3.5. Company Locations

6.4. Leading Germany Ceramic Sanitary Ware Market Companies, by market capitalization

6.5. Market Structure

6.5.1. Market Leaders

6.5.2. Market Followers

6.5.3. Emerging Players

6.6. Mergers and Acquisitions Details

7. Company Profile: Key Players

7.1. Villeroy & Boch AG

7.1.1. Company Overview

7.1.2. Business Portfolio

7.1.3. Financial Overview

7.1.4. SWOT Analysis

7.1.5. Strategic Analysis

7.1.6. Scale of Operation (small, medium, and large)

7.1.7. Details on Partnership

7.1.8. Regulatory Accreditations and Certifications Received by Them

7.1.9. Awards Received by the Firm

7.1.10. Recent Developments

7.2. Duravit AG

7.3. Geberit AG

7.4. Hansgrohe SE

7.5. Kludi GmbH & Co. KG

7.6. Ideal Standard GmbH

7.7. Laufen Bathrooms AG

7.8. Keramag Keramische Werke GmbH

7.9. Grohe AG

7.10. Kaldewei GmbH & Co. KG

8. Key Findings

9. Industry Recommendations