Europe Ceramic Sanitary Ware Market- Industry Analysis and Forecast (2025-2032)

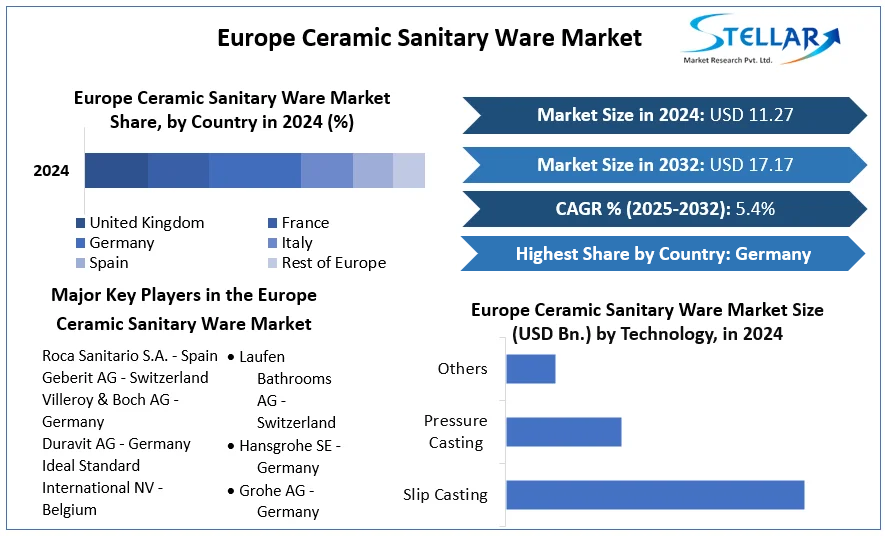

The Europe Ceramic Sanitary Ware Market size was valued at USD 11.27 Bn. in 2024 and the total Market revenue is expected to grow at a CAGR of 5.4 % from 2025 to 2032, reaching nearly USD 17.17 Bn. by 2032.

Format : PDF | Report ID : SMR_1715

Europe Ceramic Sanitary Ware Market Overview

Sanitary wares refer to a category of plumbing fixtures designed for hygiene and cleanliness in domestic and commercial spaces. These fixtures include toilets, sinks, bidets, and urinals, each playing a crucial role in maintaining sanitation standards within our living and working environments.

The Report analyses the current market trends and emerging technologies that influenced the market growth in the European ceramic Sanitary Ware Market. The report focuses on the strategic partnerships, mergers, and acquisitions that are held in 2024. The report also considers the impact of changing lifestyles on the growth of the market in Europe Ceramic Sanitary Ware Market. In-depth analysis of market dynamics that includes drivers, trends, opportunities, restraints, and challenges that impact the market growth in Europe. The Report is intended to provide market intelligence and strategic insights about the market to help investors get valuable insights into the market.

- Europe accounts for around 20% of the total market in sanitary ceramics and daily-use ceramic equipment.

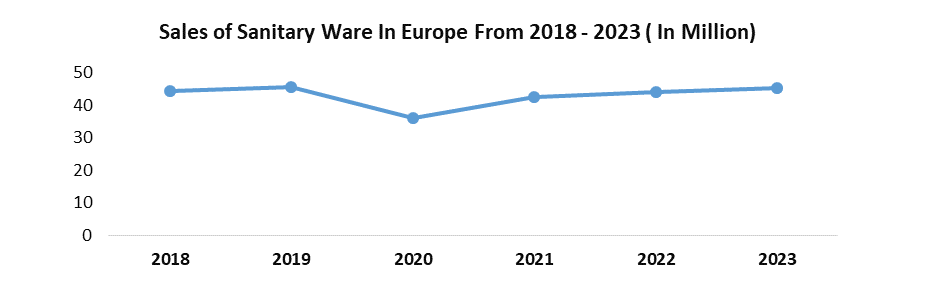

According to Stellar Analysis, in 2023, 41.6% of all sanitary ware sales were through bathroom and sanitary retailers with 27.2% through DIY stores.

To get more Insights: Request Free Sample Report

Europe Ceramic Sanitary Ware Market Dynamics

Driving Forces Behind the Growth of Ceramic Sanitary Ware Market in Europe

Surged Ceramic material that has a high growth potential owing to its high durability, aesthetic appeal, and eco-friendliness is expected to drive market growth. Rising per capita income and the growing number of people concerned about their hygiene are driving the market growth in the European Countries. The initiatives by the governments of developing nations to improve access to basic sanitation and maintain hygiene are the key factors for market growth.

The increasing demand for luxurious ceramic sanitary wares in hotels, resorts, and villas is the major factor supporting the growth of the market in the hospitality segment. EU manufacturers are mainly represented by SMEs that react quickly to changing demand and new opportunities as a result the use of automation and environmental technologies is widespread.

Navigating the Ceramic Sanitary Ware Market

One of the biggest challenges facing companies developing sanitary ceramics is staining. The problem has two basic categories i.e. it is caused by hard water stains. Hard water contains silica, which chemically combines with the hydroxyl groups on the surface of the ceramic. With Orient Ceramics, these groups are not exposed, and the stain does not build up. As a result, the surface of the ceramic remains flat and stain-free.

Ceramic sanitary ware makers have faced challenging operating conditions due to the significant level of import competition within the industry, as sanitary ware is made from cheaper materials, like plastic, and comes with lower price tags. In the current inflationary environment, it has been a major challenging factor for the buyers of ceramic sanitary ware. The increased competition among market players to produce mass volumes of low-cost products from emerging economies is expected to restrain the market growth.

Europe Ceramic Sanitary Ware Market Segment Analysis

Based on Product, the Toilet Sinks Segment hold the largest share in Europe Ceramic Sanitary Ware with a growing CAGR and is expected to witness lucrative growth during the forecast years. The demand for ceramic sanitary ware is influenced by several factors, including population growth, urbanization, disposable income, and lifestyle trends. Toilet Sinks are more advanced in terms of shapes and specifications and it is essential for toilet hygiene.

Consequently, the market for toilet seats is expected to grow at a high CAGR during the forecast years. In Europe, almost 5.8 million toilets, washbasins, and urinals were sold in 2024. The domestic market supply in the top 10 European countries of sanitary ceramics and shower toilets reached €3.4 billion (£2.88bn). Manufacturers of sanitary ware are capitalizing on these opportunities by increasing their product portfolios and developing value-added products.

Europe Ceramic Sanitary Ware Market Regional Analysis

Germany dominated the market with the highest market share and is expected to grow during the forecast period. The surge in the need for smart bathrooms and the ever-evolving demands and lifestyles of consumers in Germany for sanitary ware is expected to grow at a moderate pace in the forecast period. European manufacturers have had to rely on premium markets to survive. The increased exports to Eastern Europe has reduced the cost of production in the country and reduced the market share of western European manufacturers in the sanitary ware market.

Italy accounts for a significant percentage of the market for ceramic sanitary ware and tile. Italy ranked among the top countries that exported ceramic sanitary ware. It accounted for nearly half of Europe's imports and the factor that influenced the market growth is the increasing demand for environmentally friendly products in Europe, as well as the growing market for sanitary ware. The two most popular types of sanitary ware in Europe are ceramic and iron/steel.

The United Kingdom is the fastest-growing country in the European region. In the UK, the government has funded a range of initiatives and targets to bolster the UK's housing stock, inadvertently supporting demand for ceramic sanitary ware as it is a necessity in all residential properties. Market share concentration for the Ceramic Sanitary Ware Manufacturing industry in the UK is moderate which means the top four companies generate revenue between 40% and 70% of industry revenue.

France, Spain, Russia, Poland, Netherlands, etc., are expected to witness steady growth in the Ceramic Sanitary Ware Market owing to an increase in demand for construction and eco-friendly products that enhance the productivity of the product.

Europe Ceramic Sanitary Ware Market Competitive Landscape

Competitive Landscape focuses on several aspects such as mergers, acquisitions, and Recent developments in the Market Leaders. The Report has covered an in-depth analysis of the key players present in the market to provide insights to the stakeholders.

- In October 2023, Spain’s Roca Group, one of the global market leader in the design and production of bathroom furnishings, is growing in Germany and acquired the German company Alape GmbH, based in Goslar/Hahndorf. The acquisition primarily aims to deliver advantages in sales and the market position of both companies. The Group benefits from Alape's expertise in steel enamel and increases its multi-brand portfolio with a premium brand with special material competence that only very few manufacturers have mastered.

- In September 2023, Villeroy & Boch AG signed binding agreements to acquire operating companies in the Ideal Standard Group. The two companies are a strong strategic fit given their regional presence, sales strategies, and product and brand portfolios, laying the foundations for a stronger market position and additional growth. In an industry with global growth potential, the integrated company will, after completion of the transaction, join the ranks of Europe’s largest manufacturers of bathroom products. The acquisition price is based on a company valuation of approximately € 600 million.

|

|

Europe Ceramic Sanitary Ware Market Scope |

|

Market Size in 2024 |

USD 11.27 Bn. |

|

Market Size in 2032 |

USD 17.17 Bn. |

|

CAGR (2025-2032) |

5.4 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By Technology

|

|

|

By End Users

|

|

|

By Distribution Channel

|

|

|

Country Scope |

|

Europe Ceramic Sanitary Ware Market Key Players

- Roca Sanitario S.A. - Spain

- Geberit AG - Switzerland

- Villeroy & Boch AG - Germany

- Duravit AG - Germany

- Ideal Standard International NV - Belgium

- Laufen Bathrooms AG - Switzerland

- Hansgrohe SE - Germany

- Grohe AG - Germany

Frequently Asked Questions

Low Cost materials are expected to be the major restraining factors for the market growth.

Germany is expected to lead the Europe Ceramic Sanitary Ware Market during the forecast period.

The Market size was valued at USD 11.27 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 5.4 % from 2025 to 2032, reaching nearly USD 17.17 Billion.

The segments covered in the market report are By product, Technology, End user, and Distribution Channel.

1. Europe Ceramic Sanitary Ware Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. Europe Ceramic Sanitary Ware Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. Europe Ceramic Sanitary Ware Market Import Export Landscape

3.1. Import Trends

3.2. Export Trends

3.3. Regulatory Compliance

3.4. Major Export Destinations

3.5. Import-Export Disparities

4. Europe Ceramic Sanitary Ware Market: Dynamics

4.1.1. Market Drivers

4.1.2. Market Restraints

4.1.3. Market Opportunities

4.1.4. Market Challenges

4.2. PORTER’s Five Forces Analysis

4.3. PESTLE Analysis

4.4. Regulatory Landscape

4.5. Analysis of Government Schemes and Initiatives for the Europe Ceramic Sanitary Ware Industry

5. Europe Ceramic Sanitary Ware Market Size and Forecast by Segments (by Value USD)

5.1. Europe Ceramic Sanitary Ware Market Size and Forecast, by Product (2024-2032)

5.1.1. Toilet Sink

5.1.2. Wash Basins

5.1.3. Urinal

5.1.4. Bathtubs

5.1.5. Others

5.2. Europe Ceramic Sanitary Ware Market Size and Forecast, by Technology (2024-2032)

5.2.1. Slip Casting

5.2.2. Pressure Casting

5.2.3. Others

5.3. Europe Ceramic Sanitary Ware Market Size and Forecast, by End User (2024-2032)

5.3.1. Residential

5.3.2. Commercial

5.4. Europe Ceramic Sanitary Ware Market Size and Forecast, by Distribution Channel (2024-2032)

5.4.1. Offline

5.4.2. Online

5.5. Europe Ceramic Sanitary Ware Market Size and Forecast, by Country (2023-2030)

5.5.1. Germany

5.5.2. United Kingdom

5.5.3. Spain

5.5.4. France

5.5.5. Italy

5.5.6. Belgium

5.5.7. Sweden

5.5.8. Poland

5.5.9. Russia

6. Europe Ceramic Sanitary Ware Market: Competitive Landscape

6.1. STELLAR Competition Matrix

6.2. Competitive Landscape

6.3. Key Players Benchmarking

6.3.1. Company Name

6.3.2. Service Segment

6.3.3. End-user Segment

6.3.4. Revenue (2024)

6.3.5. Company Locations

6.4. Leading Europe Ceramic Sanitary Ware Market Companies, by market capitalization

6.5. Market Structure

6.5.1. Market Leaders

6.5.2. Market Followers

6.5.3. Emerging Players

6.6. Mergers and Acquisitions Details

7. Company Profile: Key Players

7.1. Roca Sanitario S.A. - Spain

7.1.1. Company Overview

7.1.2. Business Portfolio

7.1.3. Financial Overview

7.1.4. SWOT Analysis

7.1.5. Strategic Analysis

7.1.6. Scale of Operation (small, medium, and large)

7.1.7. Details on Partnership

7.1.8. Regulatory Accreditations and Certifications Received by Them

7.1.9. Awards Received by the Firm

7.1.10. Recent Developments

7.2. Geberit AG - Switzerland

7.3. Villeroy & Boch AG - Germany

7.4. Duravit AG - Germany

7.5. Ideal Standard International NV - Belgium

7.6. Laufen Bathrooms AG - Switzerland

7.7. Hansgrohe SE - Germany

7.8. Grohe AG - Germany

8. Key Findings

9. Industry Recommendations