Europe Brewery’s Spent Grain Market- Industry Analysis and Forecast (2025-2032)

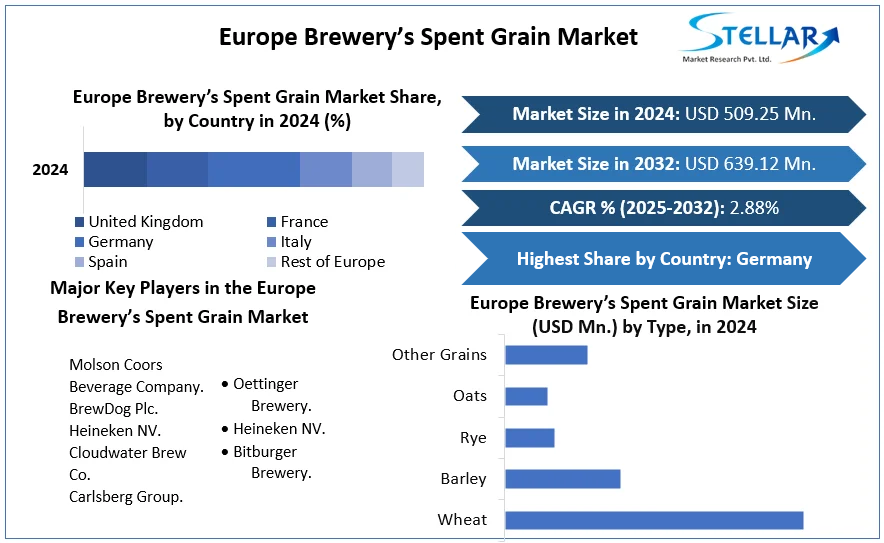

The Europe Brewery’s Spent Grain Market size was valued at USD 509.25 Mn. in 2024 and the total Europe Brewery’s Spent Grain Market revenue is expected to grow at a CAGR of 2.88% from 2025 to 2032, reaching nearly USD 639.12 Mn.

Format : PDF | Report ID : SMR_1697

Europe Brewery’s Spent Grain Market Overview

Brewers' spent grain (BSG) is the most abundant by-product generated in the beer-brewing process. The material consists of the barley grain husks obtained as solid residue after the production of worth. BSG is rich in fiber and protein and, the main use for the elimination of the by-product has been as an animal feed.

The Report analyses the current market situation of the European Brewer's spent grains Market that covers factors influencing growth, challenges, restraints, and opportunities of the market. Qualitative and Quantitative data are used in Research to analyse market trends in the market. Analytical tools such as Porter's five forces analysis, feasibility study, and investment return analysis have been used to analyse the European Brewer’s Spent Grain market. By leveraging new technologies in organizations, key Companies in Europe have gained significant profit and are estimated to grow faster by reaching targeted audiences. The report consists of broad research on various Leading players strategies like collaboration, partnership, mergers, and acquisition which are adopted by the companies.

To get more Insights: Request Free Sample Report

Europe Brewer’s Spent Grain Market Dynamics

Exploring the Surging Market Growth of Spent Grain in Europe

Surged in the production of beers has resulted in the market growth of Europe. Increasing research for alternative uses of BSG is pertinent, not only from the perspective of the brewer who benefits from the valorization of the by-product but also from an environmental perspective as the recycling and re-use of industrial wastes has driven the market growth. Rising Demand for BSG flour that is offered to consumers directly or through the baking industry, local bakeries, and bread and cookie manufacturers has propelled the market. The rapidly growing up cycled food market has led to increasing consumer acceptability and opportunities for significant market growth via effective new product innovation and communication strategies. The rising incorporation of spent grain in the manufacturing of bakery products such as bread, biscuits, and snacks has accelerated the market in the food industry.

Europe Brewer’s Spent Grain Market Challenges

Navigating the Brewery's Spent Grain Market in Europe

Europe Brewery’s Spent Grain Market faces various challenges such as limited application, high moisture content, short shelf life, costly preservation techniques, and low economic value have rendered the market growth. BSG is a waste that ends up in landfills which leads to the generation of various environmental problems resulting in reduced demand. The brewing sector is also facing other pressures of high price rises for raw materials such as wheat, cereal, barley, etc. Additionally, Challenges facing the widespread utilization of upcycled BSG ingredients include regulatory status, variability of raw material composition, and consumer perception as low-value waste products have hindered the market growth.

Europe Brewer’s Spent Grain Market Segment Analysis

Based on Application, the Animal feed segment dominates the market with the highest market share and a growing CAGR during the forecast years. Brewer's spent grain is widely used to feed animals as it is referred to as an ideal supplement for high-quality feed ration. Brewer’s grains are used to feed ruminant and monogastric animals resulting in higher demand for the Brewer’s spent grain. Compared to cereals, spent grains are characterized by a particularly high protein content and high rumen stability of the protein.

As a high-quality brewery by-product obtained as a solid residue of malt during beer production, spent grains contain the nutrients of barley in a concentrated form. UK breweries generate extensive by-products in the form of spent grain, slurry, and yeast. Much of the spent grain is produced by large breweries and processed in bulk for animal feed. Currently, the majority of produced spent grain is used as a low-value animal feed with a market value of ~€35 per tonne in Europe.

Europe Brewer’s Spent Grain Market Regional Insights

Germany dominated the market with the highest market share with a growing CAGR during the forecast period. Germany is the largest beer-producing country increasing the demand for the production of brewery-spent grain. Recent Developments in the research of the food industry have suggested that the use of brewery grain in foods has led to increased human nutrition as it contains high proteins which is beneficial for humans. Additionally, the Brewery's spent grain is also used in biotechnological as it has the potential to produce biogas. Companies are also recognizing and seizing the opportunity to produce and provide functional BSG-derived ingredients to the food industry at a commercial scale.

A total of 3.4 million Tonnes of beer is produced in the European Union, 2 million tonnes of which are produced in Germany alone. The European region has witnessed an increase in the number of active microbreweries in France, the United Kingdom, Germany, Italy, and Spain among others. France had the highest number of active beer breweries in Europe, followed by the United Kingdom and Germany. More than 3 million tons of brewer's spent grain is annually generated in Europe.

Europe Brewer’s Spent Grain Market Competitive Landscape

- A joint venture called Circular Food Solutions Switzerland AG was established in July 2022 by Bühler, a global provider of process and equipment technologies for the food and beverage, agricultural, and feed sectors, and CN & Partners, an investment firm with headquarters in Switzerland. The goal of the venture is to create a Swiss meat substitute by utilizing recycled spent grain.

|

|

Europe Brewer’s Spent Grain Market Scope |

|

Market Size in 2024 |

USD 509.25 Mn. |

|

Market Size in 2032 |

USD 639.12 Mn. |

|

CAGR (2025-2032) |

2.88% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Type

|

|

By Application

|

|

|

Country Scope |

|

Europe Brewery’s Spent Grain Market Key Players

- Molson Coors Beverage Company.

- BrewDog Plc.

- Heineken NV.

- Cloudwater Brew Co.

- Carlsberg Group.

- Oettinger Brewery.

- Heineken NV.

- Bitburger Brewery.

Frequently Asked Questions

High Costs are expected to be the major restraining factors for the market growth.

Germany is expected to lead the European brewery’s Spent Grain Market during the forecast period.

The Market size was valued at USD 509.25 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 2.88% from 2025 to 2032, reaching nearly USD 639.12 Million.

The segments covered in the market report are By Type and Application.

1. Europe Brewery’s Spent Grain Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. Europe Brewery’s Spent Grain Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. Europe Brewery’s Spent Grain Market: Dynamics

3.1.1. Market Drivers

3.1.2. Market Restraints

3.1.3. Market Opportunities

3.1.4. Market Challenges

3.2. PORTER’s Five Forces Analysis

3.3. PESTLE Analysis

3.4. Regulatory Landscape

3.5. Analysis of Government Schemes and Initiatives for the European Brewery’s Spent Grain Industry

4. Europe Brewery’s Spent Grain Market Size and Forecast by Segments (by Value USD)

4.1. Europe Brewery’s Spent Grain Market Size and Forecast, by Type (2024-2032)

4.1.1. On-premises

4.1.2. Cloud-based

4.2. Monitors Europe Brewery’s Spent Grain Market Size and Forecast, by Application (2023-2030)

4.2.1.1. Virtual Assistants

4.2.1.2. Business Analytics and Reporting

4.2.1.3. Customer Behavioral Analytics

4.2.1.4. Fraud Detection

4.2.1.5. Quantitative and Asset Management

4.2.1.6. Other

4.3. Europe Brewery’s Spent Grain Market Size and Forecast, by Country (2023-2030)

4.3.1. Germany

4.3.2. United Kingdom

4.3.3. Spain

4.3.4. France

4.3.5. Italy

4.3.6. Belgium

4.3.7. Sweden

4.3.8. Poland

4.3.9. Russia

5. Europe Brewery’s Spent Grain Market: Competitive Landscape

5.1. STELLAR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Service Segment

5.3.3. End-user Segment

5.3.4. Revenue (2023)

5.3.5. Company Locations

5.4. Leading Europe Brewery’s Spent Grain Companies, by market capitalization

5.5. Market Structure

5.5.1. Market Leaders

5.5.2. Market Followers

5.5.3. Emerging Players

5.6. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Drägerwerk AG & Co. KGaA (Germany)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Scale of Operation (small, medium, and large)

6.1.7. Details on Partnership

6.1.8. Regulatory Accreditations and Certifications Received by Them

6.1.9. Awards Received by the Firm

6.1.10. Recent Developments

6.2. Compumedics Limited (Australia)

6.3. Koninklijke Philips N.V. (Netherlands)

6.4. Getinge AB (Sweden)

6.5. BIOTRONIK (Germany)

6.6. SCHILLER (Switzerland)

6.7. GE Healthcare (United Kingdom)

6.8. Medtronic plc (Ireland)

6.9. Roche Diagnostics (Switzerland)

6.10. Biotronik SE & Co. KG (Germany)

6.11. Smiths Medical (United Kingdom)

6.12. Fresenius SE & Co. KGaA (Germany)

6.13. Getinge AB (Sweden)

6.14. Draeger Medical GmbH (Germany)

6.15. Acorai (Sweden)

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary