Mining Equipment Market: Global Market Size Growth, Demand Acceleration and Competitive Benchmarking (2025-2032)

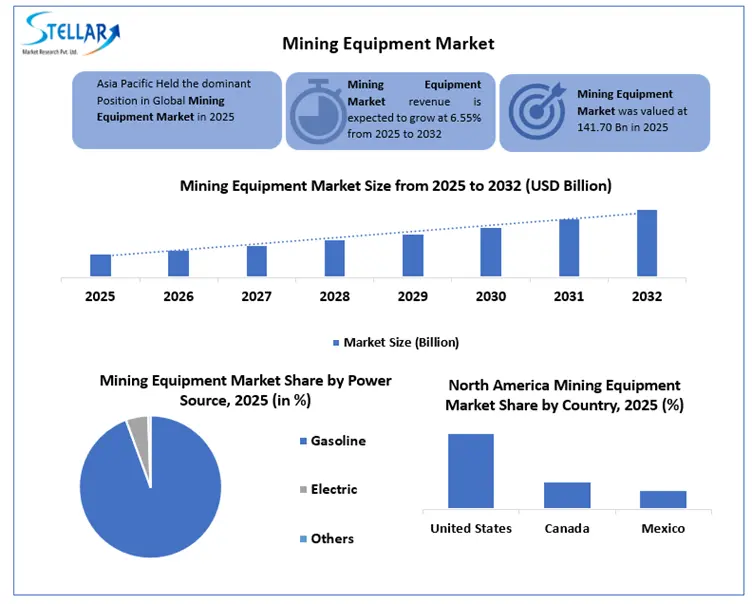

The Mining Equipment Market is expected to reach from USD 141.70 billion in 2025 to USD 214.34 billion by 2032, at a CAGR of 5.65% during the forecast period. The mining sector worldwide is in the center of a green revolution, and the transition to zero carbon has become a shared consent across the sector. An integration of green technologies places mining equipment manufacturers as leaders in the ongoing global push for zero-carbon emissions.

Format : PDF | Report ID : SMR_258

Mining Equipment Market Overview

An increase in demand for metals and minerals like gold, iron, copper, coal, aluminium is driving the growth of the mining equipment market. In 2025, global demand for iron ore is expected to reach 2.6 billion metric tons. The gold demand had reached 4,600 metric tons by 2025, driven by investments in jewelry, technology, and financial products. High mineral demand, technological innovation in the mining equipment, and sustainability efforts are some of the prominent factors behind the market growth. China is one of the world's top producers and reserve holders of metals currently, which makes the Chinese mining industry very economically and politically significant. China's dominant position in the mining industry, both in terms of production and reserves have significant economic and political implications, both domestically and internationally. The presence of mining industry is an important driver behind the mining equipment adoption. In terms of volume, total 198,222.59 mining equipment unit were sold in 2025. Asia Pacific accounted largest volume number with 81,547 units sold.

To get more Insights: Request Free Sample Report

Key Market Highlights

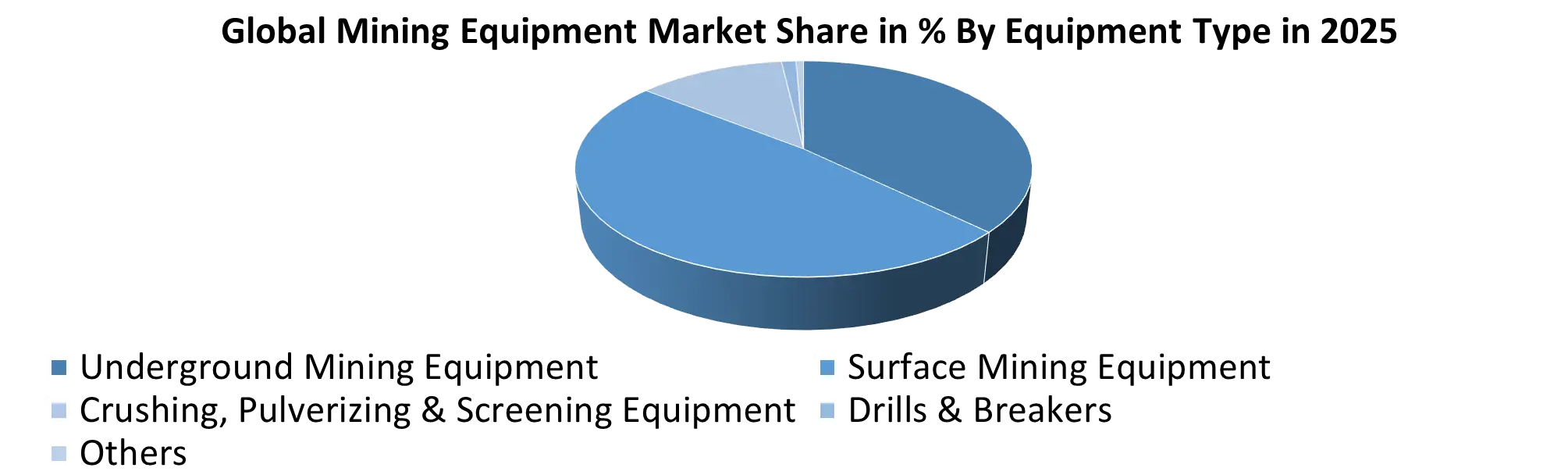

- By equipment type, surface mining equipment held the dominant position with a share of 67% of 2025 revenue and underground mining equipment is expected to grow at a CAGR of 6.55 % during the forecast period.

- By application, metal mining held the dominant Mining Equipment Market share of 47.12% in 2025.

- By power source, the gasoline segment accounted for the largest market share in 2025.

- Asia Pacific held a leading position in the global underground mining equipment demand with the with a of 40.2% share in 2025.

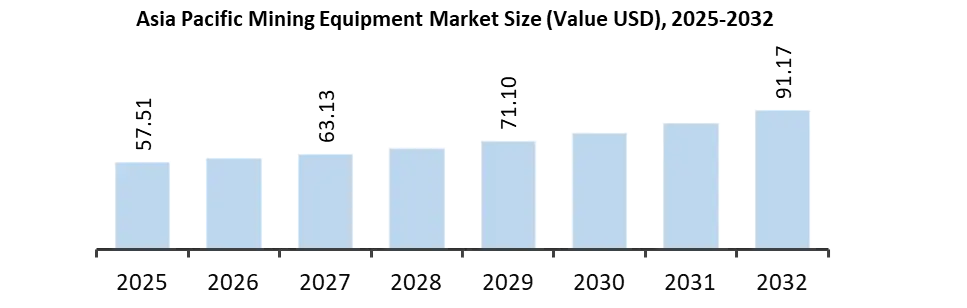

- The Asia Pacific Mining Equipment Market size was valued at USD 57.51 billion in 2025 and is expected to reach around USD 91.17 billion by 2032, at a CAGR of 6.80% during the forecast period.

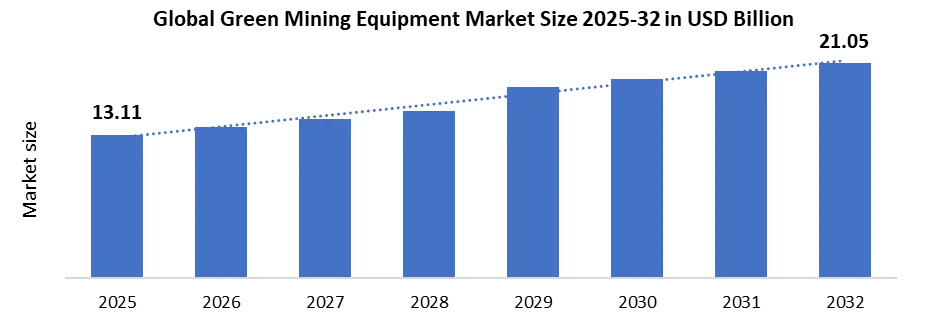

An introduction of Green Mining Equipment: A Game Changer for the Industry

The shift towards green mining equipment characters a transformative milestone in the mining industry. Manufacturers are focusing on global sustainability goals and the urgent need to reduce carbon footprints. The green mining technologies are expected to presents a unique opportunity to meet regulatory standards and also gain a competitive edge in a mining equipment market where sustainability is becoming a critical driver of growth. In 2025, XCMG company has marked a new chapter in supportable mining with the largest-ever export order of green mining equipment from China. Fortescue, a global mining leader, is at the head of the green revolution, directing complete decarbonization by abolishing fossil fuels from its iron ore operations. The Global Green Mining Equipment Market was valued at USD 13.11 billion in 2025 and is projected to grow at a 7% rate of CAGR during the forecast period.

One of the main challenges is the capital intensity of mining operations, chiefly in underground mining, where equipment costs range from USD 500,000 to USD 1.5 million. Small and medium enterprises (SMEs) are struggling to cope with the high costs of mining equipment, which are expected to limit their access to advanced machinery and technologies. The capital-intensive nature of mining projects, particularly as resources are extracted from deeper and more complex deposits are increasing demand for advanced machinery.

Mining Equipment Market Segment Analysis

The surface mining equipment segment held a dominant position in the global mining equipment market in 2025. It accounted for more than 39.55 % share because of high demand for large-scale mineral extraction operations. Haul trucks are the leading category within this segment, which has accounted for a significant 32.28% of the surface mining equipment market share in 2025. In terms of regional demand, Asia Pacific is expected to maintain a dominant share for the surface mining equipment adoption over the forecast period.

|

Comparative Analysis of Surface and Underground Mining Equipment (2025) |

||

|

Parameter |

Surface Mining Equipment |

Underground Mining Equipment |

|

Market Share (%) In 2025 |

33.55% |

30.00% |

|

Revenue in 2025 (USD Bn) |

~56.04 |

~42.51 |

|

Expected CAGR (2026–2032) |

5.70% |

6.55% |

|

Average Equipment Cost (USD/unit) |

250,000 – 800,000 |

500,000 – 1,500,000 |

|

Primary Demand Drivers |

Bulk mineral extraction, coal & iron ore |

Deep mineral reserves, safety & automation |

|

Automation Adoption Rate (%) |

Medium |

High |

The demand for Underground Mining Equipment is expected to grow at a 5.8% rate of CAGR during the forecast period. According to MMR research, there are over 2290 underground mines in operation globally, of which 736 are in Asia-Pacific in 2025. An increase in mining ongoing exploration activities at underground location, is expected to drive the demand for mining equipment at a rapid rate.

Regional Analysis: Global Mining Equipment Market

In 2025, the global mining equipment market is experiencing varied growth across different regions. Asia Pacific held the dominant position in the global mining equipment market with a share of 39% in 2025. The region is projected to continue its dominance with a growth rate of 6.80%. The robust mining activities, especially in China, Australia, and India, ongoing industrialization and Australia's vast natural resource reserves, mainly in iron ore, coal, and gold are the prominent factors, which are expected to drive the demand for mining equipment. North America follows closely with a strong CAGR of 5.00%, with the market revenue of USD 31.89 billion in 2025. Europe mining equipment market is expected to grow at a growth rate of 4.88% during the forecast period. The Middle East and Africa market is expected to grow at a CAGR of 5%. The demand is expected to increase by mineral extraction activities in African nations, where mining corporations are increasingly investing in modern equipment to enhance productivity.

Competitive Landscape:

Key players operating in the mining equipment market are focusing on product development attention towards designing a battery powered fleet that would respond to the mining industry and growing need for cost containment through energy and mine design efficiencies. They are concentrating to take ‘EV-proven, EV-ready’ concept to the mining world for production support mining vehicles taking into account the benefits of incremental battery electric vehicle introduction.

- Sandvik company has secured a major underground mining equipment order from Northern Star Resources Ltd, valued at SEK 260 million, with transport scheduled for Q4 2025.

- Silver Storm Mining Ltd has placed significant orders for critical underground mining equipment like drills and ventilation system fans, for its La Parrilla Silver Mine in Mexico.

- In 2025, XCMG and Fortescue company have formalized a strategic cooperation agreement in Beijing to deliver 150-200 units of 240T, battery-electric haul trucks from 2028 to 2030, which is marking China’s largest-ever green mining equipment export.

- In 2026, Caterpillar Inc. has launched Cat AI Assistant, which is an AI-driven solution that enhancing customer interaction with its mining equipment and digital applications, showcasing innovation in digital mining technologies.

Mining Equipment Market Scope

|

Mining Equipment Market |

|||

|

This Report Covers |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 141.70 Bn |

|

Forecast Period 2026 to 2032 CAGR: |

5.65% |

Market Size in 2032: |

USD 214.34 Bn |

|

Mining Equipment Market Segments Covered: |

By Equipment Type |

Underground Mining Equipment Surface Mining Equipment Crushing, Pulverizing & Screening Equipment Drills & Breakers Others |

|

|

By Power Source |

Gasoline Electric Others |

||

|

By Power Output |

<500 HP 500-2000 HP >2000 HP |

||

|

By Automation Level |

Manual Equipment Semi-Autonomous Equipment Fully Autonomous Equipment

|

||

|

|

By Application

|

Metal Mining Non-metal Mining Coal Mining |

|

Mining Equipment industry key Players

- Caterpillar Inc.

- Komatsu Ltd.

- The Liebherr Group.

- Terex Corporation.

- Epiroc AB

- United Motors & Heavy Equipment

- United Tractors

- Taiyuan Heavy Industry Co., Ltd (TYHI)

- Sany Heavy Industry Co., Ltd.

- Voltas

- XCMG

- Zoomlion

- Deere & Company

- Doosan Infracore

- UMPESL

- Atlas Copco

- Sandvik

- Eimco Elecon (India) Limited

- Vardhman Machinery

- Gainwell Engineering

- Boart Long Year Ltd

- China Coal Energy Group Co. Ltd

- Henan Baichy Machinery Equipment Co. Ltd

- Metso Qutotec

- BEML Ltd.

- J.C. Bamford Excavators Ltd.

- Siton

- Others

Frequently Asked Questions

China held the dominant market share in the Asia Pacific mining equipment market because of its dominant position in coal mining, rare-earth elements, and other mineral extraction activities.

The market size of the Mining Equipment Market is expected to reach USD 214.34 Bn by 2032.

Gasoline engines remain the largest share of the mining equipment market globally in 2025.

1. Mining Equipment Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Mining Equipment Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2024

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Mining Equipment Market: Dynamics

3.1. Mining Equipment Market Trends

3.2. Mining Equipment Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Technological Innovations in Mining Equipment

4.1. Automation and Robotics in Mining

4.2. Smart Mining: IoT Sensors and AI in Equipment

4.3. Electric and Hybrid Mining Equipment

4.4. Autonomous Haulage Systems (AHS)

4.5. Enhanced Safety Features in Mining Equipment

4.6. 3D Printing and Additive Manufacturing for Mining Parts

4.7. Big Data and Analytics in Equipment Management

5. Regulatory Environment and Government Policies

5.1. National and International Regulations for Mining Equipment

5.2. Mining Equipment Safety Standards and Certifications

5.3. Environmental Regulations Impacting Mining Equipment

5.4. Government Initiatives to Encourage Equipment Modernization

5.5. Trade Policies and Import/Export Regulations

6. Investment and Market Opportunities

6.1. Investment Trends in Mining Equipment Industry

6.2. Emerging Markets for Mining Equipment (APAC, MEA, LATAM)

6.3. Market Potential for Automation and Electrification Technologies

6.4. Investment Attractiveness by Region

6.5. Opportunities in Mining Equipment Leasing and Maintenance Services

7. Import-Export and Trade Analysis (2025), by Country

7.1. Top Exporting Countries of Mining Equipment

7.2. Leading Import Markets and Regional Demand Dependencies

7.3. Key Trade Routes, Regional Trade Agreements & Tariffs Impact

7.4. Certification & Quality Standards for Cross-Border Material Trade

7.5. Trade Barriers & Compliance Challenges

8. Price Trend Analysis (2025)

8.1. Historical and Current Pricing Trends by equipment Type & Region

8.2. Key Drivers Influencing Prices: Raw Material Costs, Labor, Energy, Transportation

8.3. Regional Price Differentials & Currency Fluctuations

8.4. Influence of Government Policies & Subsidies on mining equipment Pricing

9. Mining Equipment Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

9.1. Mining Equipment Market Size and Forecast, By Equipment Type (2025-2032)

9.1.1. Underground Mining Equipment

9.1.2. Surface Mining Equipment

9.1.3. Crushing, Pulverizing & Screening Equipment

9.1.4. Drills & Breakers

9.1.5. Others

9.2. Mining Equipment Market Size and Forecast, By Power Source (2025-2032)

9.2.1. Gasoline

9.2.2. Electric

9.2.3. Others

9.3. Mining Equipment Market Size and Forecast, By Power Output (2025-2032)

9.3.1. <500 HP

9.3.2. 500-2000 HP

9.3.3. >2000 HP

9.4. Mining Equipment Market Size and Forecast, By Application (2025-2032)

9.4.1. Metal Mining

9.4.2. Non-metal Mining

9.4.3. Coal Mining

9.5. Mining Equipment Market Size and Forecast, By Automation Level (2025-2032)

9.5.1. Manual Equipment

9.5.2. Semi-Autonomous Equipment

9.5.3. Fully Autonomous Equipment

9.6. Mining Equipment Market Size and Forecast, By Region (2025-2032)

9.6.1. North America

9.6.2. Europe

9.6.3. Asia Pacific

9.6.4. Middle East and Africa

9.6.5. South America

10. North America Mining Equipment Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

10.1. North America Mining Equipment Market Size and Forecast, By Equipment Type (2025-2032)

10.2. North America Mining Equipment Market Size and Forecast, By Power Source (2025-2032)

10.3. North America Mining Equipment Market Size and Forecast, By Power Output (2025-2032)

10.4. North America Mining Equipment Market Size and Forecast, By Application (2025-2032)

10.5. North America Mining Equipment Market Size and Forecast, By Automation Level (2025-2032)

10.6. North America Mining Equipment Market Size and Forecast, by Country (2025-2032)

10.6.1. United States

10.6.2. Canada

10.6.3. Mexico

11. Europe Mining Equipment Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

11.1. Europe Mining Equipment Market Size and Forecast, By Equipment Type (2025-2032)

11.2. Europe Mining Equipment Market Size and Forecast, By Power Source (2025-2032)

11.3. Europe Mining Equipment Market Size and Forecast, By Power Output (2025-2032)

11.4. Europe Mining Equipment Market Size and Forecast, By Application (2025-2032)

11.5. Europe Mining Equipment Market Size and Forecast, By Automation Level (2025-2032)

11.6. Europe Mining Equipment Market Size and Forecast, by Country (2025-2032)

11.6.1. United Kingdom

11.6.1.1. United Kingdom Mining Equipment Market Size and Forecast, By Equipment Type (2025-2032)

11.6.1.2. United Kingdom Mining Equipment Market Size and Forecast, By Power Source (2025-2032)

11.6.1.3. United Kingdom Mining Equipment Market Size and Forecast, By Power Output (2025-2032)

11.6.1.4. United Kingdom Mining Equipment Market Size and Forecast, By Application (2025-2032)

11.6.1.5. United Kingdom Mining Equipment Market Size and Forecast, By Automation Level (2025-2032)

11.6.2. France

11.6.3. Germany

11.6.4. Italy

11.6.5. Spain

11.6.6. Sweden

11.6.7. Russia

11.6.8. Rest of Europe

12. Asia Pacific Mining Equipment Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

12.1. Asia Pacific Mining Equipment Market Size and Forecast, By Equipment Type (2025-2032)

12.2. Asia Pacific Mining Equipment Market Size and Forecast, By Power Source (2025-2032)

12.3. Asia Pacific Mining Equipment Market Size and Forecast, By Power Output (2025-2032)

12.4. Asia Pacific Mining Equipment Market Size and Forecast, By Application (2025-2032)

12.5. Asia Pacific Mining Equipment Market Size and Forecast, By Automation Level (2025-2032)

12.6. Asia Pacific Mining Equipment Market Size and Forecast, by Country (2025-2032)

12.6.1. China

12.6.2. S Korea

12.6.3. Japan

12.6.4. India

12.6.5. Australia

12.6.6. Indonesia

12.6.7. Malaysia

12.6.8. Philippines

12.6.9. Thailand

12.6.10. Vietnam

12.6.11. Rest of Asia Pacific

13. Middle East and Africa Mining Equipment Market Size and Forecast (by Value in USD Million and Volume in Units) (2025-2032)

13.1. Middle East and Africa Mining Equipment Market Size and Forecast, By Equipment Type (2025-2032)

13.2. Middle East and Africa Mining Equipment Market Size and Forecast, By Power Source (2025-2032)

13.3. Middle East and Africa Mining Equipment Market Size and Forecast, By Power Output (2025-2032)

13.4. Middle East and Africa Mining Equipment Market Size and Forecast, By Application (2025-2032)

13.5. Middle East and Africa Mining Equipment Market Size and Forecast, By Automation Level (2025-2032)

13.6. Middle East and Africa Mining Equipment Market Size and Forecast, by Country (2025-2032)

13.6.1. South Africa

13.6.2. GCC

13.6.3. Egypt

13.6.4. Nigeria

13.6.5. Rest of ME&A

14. South America Mining Equipment Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

14.1. South America Mining Equipment Market Size and Forecast, By Equipment Type (2025-2032)

14.2. South America Mining Equipment Market Size and Forecast, By Power Source (2025-2032)

14.3. South America Mining Equipment Market Size and Forecast, By Power Output (2025-2032)

14.4. South America Mining Equipment Market Size and Forecast, By Application (2025-2032)

14.5. South America Mining Equipment Market Size and Forecast, By Automation Level (2025-2032)

14.6. South America Mining Equipment Market Size and Forecast, by Country (2025-2032)

14.6.1. Brazil

14.6.2. Argentina

14.6.3. Colombia

14.6.4. Chile

14.6.5. Rest Of South America

15. Company Profile: Key Players

15.1. Caterpillar Inc.

15.1.1. Company Overview

15.1.2. Business Portfolio

15.1.3. Financial Overview

15.1.4. SWOT Analysis

15.1.5. Strategic Analysis

15.1.6. Recent Developments

15.1.7. BYD Auto

15.2. Komatsu Ltd.

15.3. The Liebherr Group.

15.4. Terex Corporation.

15.5. Epiroc AB

15.6. United Motors & Heavy Equipment

15.7. United Tractors

15.8. Taiyuan Heavy Industry Co., Ltd (TYHI)

15.9. Sany Heavy Industry Co., Ltd.

15.10. Voltas

15.11. XCMG

15.12. Zoomlion

15.13. Deere & Company

15.14. Doosan Infracore

15.15. UMPESL

15.16. Atlas Copco

15.17. Sandvik

15.18. Eimco Elecon (India) Limited

15.19. Vardhman Machinery

15.20. Gainwell Engineering

15.21. Boart Long Year Ltd

15.22. China Coal Energy Group Co. Ltd

15.23. Henan Baichy Machinery Equipment Co. Ltd

15.24. Metso Qutotec

15.25. BEML Ltd.

15.26. J.C. Bamford Excavators Ltd.

15.27. Siton

15.28. Others

16. Key Findings

17. Analyst Recommendations

18. Mining Equipment Market: Research Methodology