Gas Turbine Services Market: Trends, Growth drivers, Key players, Global Industry Analysis and forecast 2025-2032

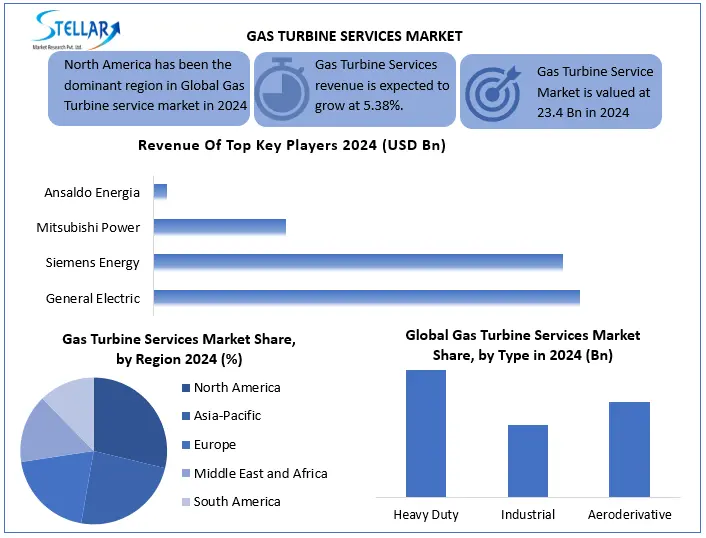

Gas Turbine Services Market was valued at USD 23.4 Bn in 2024 and is expected to grow at a CAGR of 5.38% from 2025 to 2032, reaching nearly USD 35.6 Bn by 2032.

Format : PDF | Report ID : SMR_2827

Gas Turbine Services Market Overview

A Gas turbine is a combustion device that produces kinetic energy from natural gas or other fossil fuels. This energy drives a generator that produces electrical energy.

The rise in environmental problems due to the large carbon emissions from electricity generation based on coal has boosted the adoption of low-carbon emission technologies, such as natural gas turbines. The shift has also increased the demand for gas turbine services globally. Although natural gas-fired turbines will no doubt become popular overall, particularly in North America and Europe, developing economies in the Asia-Pacific region, such as China and India, remain with coal-based power generation because it is more affordable. The U.S. boasts a highly developed natural gas infrastructure, with access to top-notch end-user industries, key drivers of gas turbine demand in the nation.

Heavy-duty gas turbines accounted for most of the market in 2024, but with aeroderivative turbines currently a smaller proportion compared to heavy-duty and industrial turbines in the American market, opportunities for small aeroderivative power generation are favourable. This is primarily due to the fact that the aerospace and defense sectors are growing, wherein these turbines are applied extensively. These forecasts indicate that the Gas Turbine Services Market will witness remarkable growth and profitability from 2025 to 2032.

To get more Insights: Request Free Sample Report

Gas Turbine Services Market Dynamics

Increase In Demand For Maintenance Services to fuel the Gas Turbine Services Market

Gas turbines are high-duty engines running for thousands of hours at high pressure and temperature, especially in power generation, oil & gas, and aviation applications. Naturally, they do eventually get worn out and need routine service to stay efficient and safe. In fact, an estimated 60% or more of the cost of a turbine's life goes into routine servicing and maintenance. In addition, with ever-growing energy demands, particularly among developing countries, keeping turbines performing at their peak is more essential than ever before. This makes governments and private companies alike to seek out reliable maintenance services, creating stable business opportunities for service providers of turbines across the globe, fueling the gas turbine services market.

The Market Faces Restraints Related to the High Cost of Maintenance and Repair

The gas turbine services market is subjected to obstacles responsible for high maintenance and repair costs, which is an important challenge for operators. Gas turbine servicing calls due to their complex designs and operations for high quality, accurate service. Regular maintenance, overhaul and replacement of important components such as turbine blades and combustion components comes with considerable cost. These expenses are particularly important for small and medium -sized businesses, which may not be able to bear the cost of full services. In addition, OEM-specific components and dependence on special labor also add to financial burden. For most operators, the cost of maintaining turbines in optimal conditions is delayed due to low repair, eventually affecting performance, efficiency, and reliability.

Global Shift toward Cleaner Energy Sources is an Opportunity for the Gas Turbine Services Market

As the world is far from coal and other dirty fuels, natural gas is gaining popularity as a cleaner source of energy. This movement is opening big opportunities for the gas turbine services market. Gas turbines play an important role in producing electricity from natural gas-they are more efficient and cleaner than traditional coal-powered power plants. Due to this, many nations are building additional gas turbines. These turbines have to be subjected to periodic repairs, replacement, and upgrades for them to operate efficiently and as smoothly as required. As there is growing utilization of gas turbines across the globe, there also is a rise in demand for skilled service agencies. This clean energy revolution isn't just sparing the environment; it's also opening up possibilities for long-term growth for companies that specialize in keeping gas turbines in their peak condition.

Gas Turbine Services Market Segment Analysis

Based on types, the gas turbine services market is segmented into heavy duty, Industrial, and aeroderivative. The heavy-duty segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). Heavy-duty gas turbines are usually used in power plants and industrial applications, where they have to produce large amounts of energy. Turbines are designed for efficiency and dependence and ideally high performance suited for continuous operation. It is powered by a variety of factors, including reliable, increasing demand for large-scale power generation, especially in areas with industrial bases or energy demands. In addition, with increasing pressure to reduce carbon emissions worldwide, heavy-duty gas turbines are even more sought for their cleaner, more efficient power generation, is traditionally used coal or oil features.

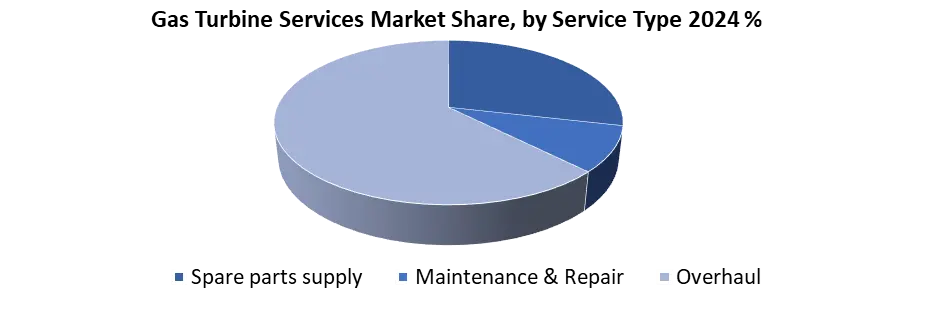

Based on services, the gas turbine services market is segmented into spare parts supply, Maintenance & repair, and overhaul. The spare parts segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). The Spare Parts segment has a largest revenue of 64% in 2024. The primary cause is the recurrent replacement of parts due to the challenging operating environment of gas turbine. Blade, seal, nozzle and combustion lines have a high tendency to wear persistent wear, and recurrent replacement becomes mandatory for performance, efficiency and safety. The world's fleet of gas turbines is also getting old, especially in developed economies, causing further demands. Turbines that are becoming older require greater maintenance and replacement of components, promoting further stable growth for the spare part segment.

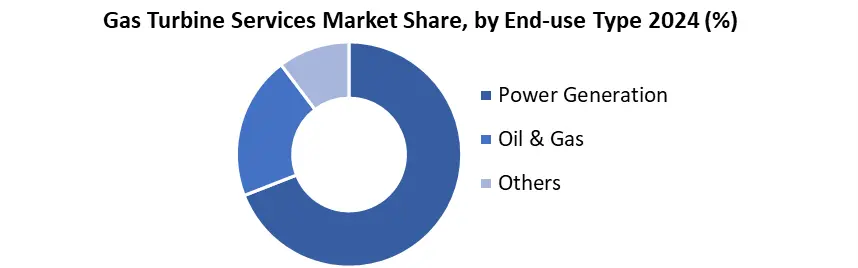

Based on End-user, the gas turbine services market is segmented into power generation, oil and gas, and others. The power generation segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). Due to the increasing demand for gas turbines in both the joint-cycle and open-cycle power plants. Oil and gas fields also remain a major consumer of gas turbines, especially for power generation and mechanical drive applications, ensure continuous demand for turbine services. In addition, increasing demand for efficient and stable energy options, especially during extreme demand, is in favor of the use of gas turbines for power generation.

Gas Turbine Services Market Regional Analysis

The North America segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032)

The region has strong natural gas infrastructure, a well-established industrial area and high demand from electricity, oil and gas and aerospace industries. Since more energy providers move away from coal and switch to cleaner fuel like natural gas, gas turbine is increasing and increasing the need for upgrades. Along with the rise of distributed electrical systems, the use of small aeroderative turbines in defense and remote places is also helping the gas turbine services market to grow. Moreover, government support to utilize cleaner energy and continuous investments towards upgrading the infrastructure of the energy sector are increasingly driving the gas turbine services market.

Gas Turbine Services Market Competitive Landscape

The gas turbine services market is a competitive and rapidly growing area, in which prominent players constantly compete to stay forward. It is fuel from the increasing requirement of efficient and durable energy solutions, technological growth, and effective gas turbine maintenance and support services. These top companies of this industry distribute not only to the main services such as repair, maintenance and upgradation, but they are moving forward with great jump in adopting new technologies to maximize turbine efficiency. General Electric (GE), Siemens Energy, Mitsubishi Power, and Ansaldo Energia are the most recognized leaders in the gas turbine services market, each of them offers a wide range of services designed to increase turbine credibility and efficiency.

| Gas Turbine Services Market Scope | ||

|

Market Size in 2024 |

USD 23.4 Bn |

|

|

Market Size in 2032 |

USD 35.6 Bn |

|

|

CAGR (2025-2032) |

5.38% |

|

|

Historic Data |

2019-2023 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments |

By Type Heavy Duty Industrial Aeroderivative |

|

|

By Services Maintenance and repair Overhaul Spare parts supply |

|

|

|

By End-User Power generation Oil and Gas Others |

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

|

Key Players in the Gas Turbine Services Market

North America

- General Electric (U.S)

- EthosEnergy (U.S)

- Proenergy Services (U.S)

- Caterpillar (U.S)

- Solar Turbines Incorporated (U.S)

Europe

- MAN SE (Germany)

- Siemens (Germany)

- MTU Aero Engines (Germany)

- Ansaldo Energia (Italy)

- ATLA S.r.l. (Italy)

- Suzler Ltd (Switzerland)

- Rolls-Royce plc (U.K)

- Centrax Ltd. (U.K)

- BHI Energy (U.K)

- Wood Group (U.K)

Asia

- Mitsubishi Heavy Industries, Ltd (Japan)

- Kawasaki Heavy Industries Ltd. (Japan)

- Hitachi Ltd. (Japan)

- Bharat Heavy Electricals Limited (India)

Middle East

- MJB International Limited LLC (UAE)

Frequently Asked Questions

The Global Gas Turbine Services Market size was USD 23.4 Bn in 2024 with a CAGR of 5.38%.

The important key players in the Global Market are – MAN SE (Germany), General Electric (U.S), EthosEnergy (U.S), Proenergy Services (U.S), Caterpillar (U.S), MJB International Limited LLC (UAE).

Spare parts supply is the largest segment by service type during the forecasted period in the Gas Turbine Services Market.

The heavy-duty type segment is the dominant in the gas turbine services market.

1. Gas Turbine Services Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Gas Turbine Services Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Gas Turbine Services Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Gas Turbine Services Market: Dynamics

3.1. Gas Turbine Services Market Trends by Region

3.1.1. North America Gas Turbine Services Market Trends

3.1.2. Europe Gas Turbine Services Market Trends

3.1.3. Asia Pacific Gas Turbine Services Market Trends

3.1.4. Middle East & Africa Gas Turbine Services Market Trends

3.1.5. South America Gas Turbine Services Market Trends

3.2. Gas Turbine Services Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

3.7. Analysis of Government Schemes and Initiatives for the Gas Turbine Services Industry

4. Gas Turbine Services Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

4.1. Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

4.1.1. Heavy Duty

4.1.2. Industrial

4.1.3. Aeroderivative

4.1.4. Others

4.2. Gas Turbine Services Market Size and Forecast, By Service (2025-2032)

4.2.1. Maintenance and repair

4.2.2. Overhaul

4.2.3. Spare parts supply

4.2.4. Others

4.3. Gas Turbine Services Market Size and Forecast, By End User (2025-2032)

4.3.1. Power generation

4.3.2. Oil and Gas

4.3.3. Others

4.4. Gas Turbine Services Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Gas Turbine Services Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn) (2025-2032)

5.1. North America Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

5.1.1. Heavy duty

5.1.2. Industrial

5.1.3. Aeroderivative

5.1.4. Others

5.2. North America Gas Turbine Services Market Size and Forecast, By M(2025-2032)

5.2.1. Maintenance and repair

5.2.2. Overhaul

5.2.3. Spare parts supply

5.2.4. Others

5.3. North America Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

5.3.1. Power generation

5.3.2. Oil and gas

5.3.3. Others

5.4. North America Gas Turbine Services Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

5.4.1.1.1. Heavy duty

5.4.1.1.2. Industrial

5.4.1.1.3. Aeroderivative

5.4.1.1.4. Others

5.4.1.2. United States United States Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

5.4.1.2.1. Maintenance and repair

5.4.1.2.2. Overhaul

5.4.1.2.3. Spare parts supply

5.4.1.2.4. Others

5.4.1.3. United States Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

5.4.1.3.1. Power generation

5.4.1.3.2. Oil and gas

5.4.1.3.3. Others

5.4.2. Canada

5.4.2.1. Canada Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

5.4.2.1.1. Heavy duty

5.4.2.1.2. Industrial

5.4.2.1.3. Aeroderivative

5.4.2.1.4. Others

5.4.2.2. Canada Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

5.4.2.2.1. Maintenance and repair

5.4.2.2.2. Overhaul

5.4.2.2.3. Spare parts supply

5.4.2.2.4. Others

5.4.2.3. Canada Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

5.4.2.3.1. Power generation

5.4.2.3.2. Oil and gas

5.4.2.3.3. Others

5.4.3. Mexico

5.4.3.1. Mexico Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

5.4.3.1.1. Heavy duty

5.4.3.1.2. Industrial

5.4.3.1.3. Aeroderivative

5.4.3.1.4. Others

5.4.3.2. Mexico Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

5.4.3.2.1. Maintenance and repair

5.4.3.2.2. Overhaul

5.4.3.2.3. Spare parts supply

5.4.3.2.4. Others

5.4.3.3. Mexico Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

5.4.3.3.1. Power generation

5.4.3.3.2. Oil and gas

5.4.3.3.3. Others

6. Europe Gas Turbine Services Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn) (2025-2032)

6.1. Europe Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.2. Europe Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.3. Europe Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4. Europe Gas Turbine Services Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.1.2. United Kingdom Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.1.3. United Kingdom Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4.2. France

6.4.2.1. France Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.2.2. France Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.2.3. France Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.3.2. Germany Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.3.3. Germany Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.4.2. Italy Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.4.3. Italy Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.5.2. Spain Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.5.3. Spain Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.6.2. Sweden Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.6.3. Sweden Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.7.2. Austria Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.7.3. Austria Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

6.4.8.2. Rest of Europe Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

6.4.8.3. Rest of Europe Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7. Asia Pacific Gas Turbine Services Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

7.1. Asia Pacific Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.2. Asia Pacific Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.3. Asia Pacific Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4. Asia Pacific Gas Turbine Services Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.1.2. China Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.1.3. China Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.2.2. S Korea Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.2.3. S Korea Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.3.2. Japan Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.3.3. Japan Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.4. India

7.4.4.1. India Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.4.2. India Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.4.3. India Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.5.2. Australia Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.5.3. Australia Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.6.2. Indonesia Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.6.3. Indonesia Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.7. Philippines

7.4.7.1. Philippines Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.7.2. Philippines Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.7.3. Philippines Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.8.2. Malaysia Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.8.3. Malaysia Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.9.2. Vietnam Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.9.3. Vietnam Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.10. Thailand

7.4.10.1. Thailand Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.10.2. Thailand Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.10.3. Thailand Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.11.2. ASEAN Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.11.3. ASEAN Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

7.4.12.2. Rest of Asia Pacific Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

7.4.12.3. Rest of Asia Pacific Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

8. Middle East and Africa Gas Turbine Services Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn) (2025-2032)

8.1. Middle East and Africa Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

8.2. Middle East and Africa Gas Turbine Services Market Size and Forecast, By Services Model (2025-2032)

8.3. Middle East and Africa Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

8.4. Middle East and Africa Gas Turbine Services Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

8.4.1.2. South Africa Gas Turbine Services Market Size and Forecast, By Services Model (2025-2032)

8.4.1.3. South Africa Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

8.4.2.2. GCC Gas Turbine Services Market Size and Forecast, By Services Model (2025-2032)

8.4.2.3. GCC Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

8.4.3.2. Nigeria Gas Turbine Services Market Size and Forecast, By Services Model (2025-2032)

8.4.3.3. Nigeria Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

8.4.4.2. Rest of ME&A Gas Turbine Services Market Size and Forecast, By Services Model (2025-2032)

8.4.4.3. Rest of ME&A Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

9. South America Gas Turbine Services Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn.) (2025-2032)

9.1. South America Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

9.2. South America Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

9.3. South America Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

9.4. South America Gas Turbine Services Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

9.4.1.2. Brazil Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

9.4.1.3. Brazil Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

9.4.2.2. Argentina Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

9.4.2.3. Argentina Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Gas Turbine Services Market Size and Forecast, By Type (2025-2032)

9.4.3.2. Rest Of South America Gas Turbine Services Market Size and Forecast, By Services (2025-2032)

9.4.3.3. Rest Of South America Gas Turbine Services Market Size and Forecast, By End users (2025-2032)

10. Company Profile: Key Players

10.1 General Electric (U.S)

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Developments

10.2 EthosEnergy (U.S)

10.3 Proenergy Services (U.S)

10.4 Caterpillar (U.S)

10.5 Solar Turbines Incorporated (U.S)

10.6 MAN SE (Germany)

10.7 Siemens (Germany)

10.8 MTU Aero Engines (Germany)

10.9 Ansaldo Energia (Italy)

10.10 ATLA S.r.l. (Italy)

10.11 Suzler Ltd (Switzerland)

10.12 Rolls-Royce plc (U.K)

10.13 Centrax Ltd. (U.K)

10.14 BHI Energy (U.K)

10.15 Wood Group (U.K)

10.16 Mitsubishi Heavy Industries, Ltd (Japan)

10.17 Kawasaki Heavy Industries Ltd. (Japan)

10.18 Hitachi Ltd. (Japan)

10.19 Bharat Heavy Electricals Limited (India)

10.20 MJB International Limited LLC (UAE)

10 Key Findings & Analyst Recommendations

11 Gas Turbine Services Market: Research Methodology