North America Arc Flash Protection Market: Global Industry Analysis and Forecast (2025-2032)

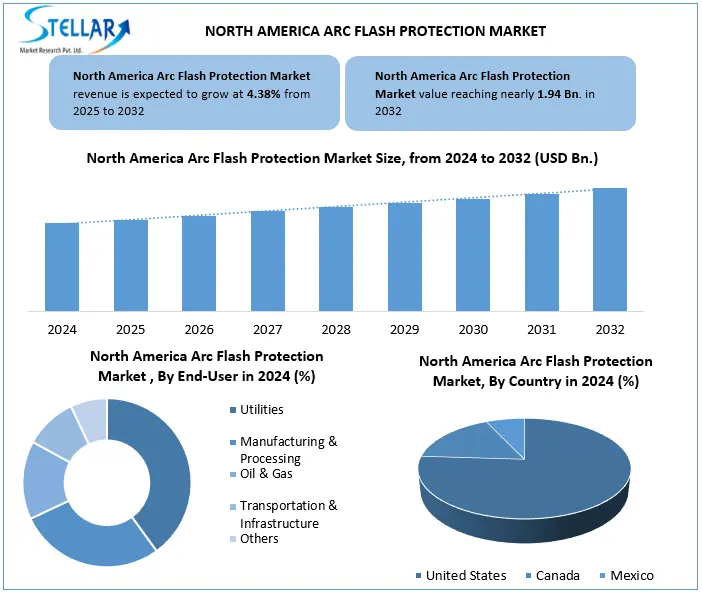

The North America Arc Flash Protection Market was valued at USD 1.38 Bn. in 2024. The Total North America Arc Flash Protection Market revenue is expected to grow by CAGR 4.38% from 2024 to 2032 and reach nearly USD 1.94 Bn. in 2032.

Format : PDF | Report ID : SMR_2887

North America Arc Flash Protection Market Overview:

ARC Flash Protection is a set of security measures, technologies and protective equipment, designed to prevent, detect and reduce the effects of arc flash incidents caused by Arc flash events and faults or short circuits, which reduces the risk to personnel and damage the power systems. Increase in power safety rules to promote the North America Arc Flash Protection Market.

The North America Arc Flash Protection Market is now growing due to strict enforcement of security rules (such as OSHA and NFPA 70E), increasing retrofit activities in aging electrical infrastructure and there is an increasing demand for activities in high-risk industries. Major trends in the North America Arc Flash Protection Market include smart arc detection systems, digital integration with grid, increased use of advanced PPE.

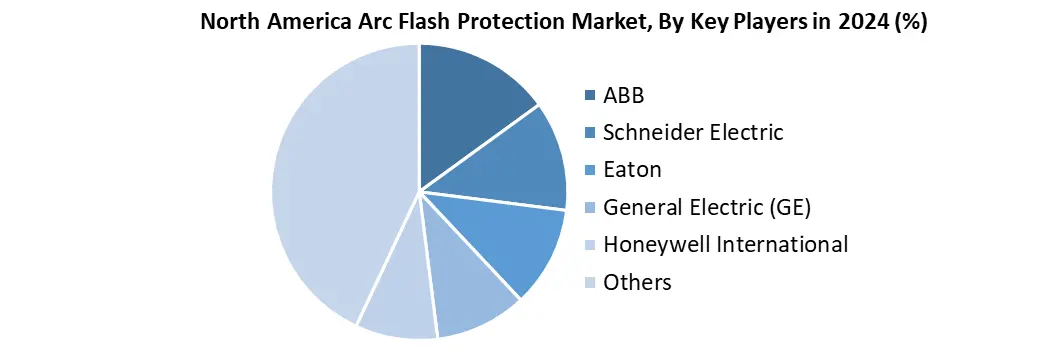

The United States is dominate the North America Arc Flash Protection Market in 2024. North America Arc Flash Protection Market key players such as ABB, Schneider Electric, Eaton, General Electric (GE) and Honeywell. Trade and tariff rules directly affect the Arc Flash Protection Market. For example, American tariffs under Section 301 still apply to many Chinese imports-such as flame-retardant textiles and electrical parts, from 7.5% to 25%, push manufacturers to transfer sources to North America or affiliated countries. This local production hub is restarting investment and efforts. Arc flash protection solutions in North America are widely used across industries with utilities, manufacturing & processing industries, oil & gas, transportation & Infrastructure and others.

To get more Insights: Request Free Sample Report

North America Arc Flash Protection Market Dynamics:

Rising Electrical Safety Regulations to boost North America Arc Flash Protection Market

The government and industry bodies implement strict standards to reduce workplace accidents and ensure employees safety in North America Arc Flash Protection Market. Organizations such as OSHA (occupational Safety and Health Administration) and NFPA (National Fire Protection Association) are give extensive guidelines includes NFPA 70E in the U.S. That mandate proper arc flash hazard assessments, training, labeling, and arc-rated personal protective equipment (PPE) use. Compliance with these standards is not optional. Failure may result in heavy fines, legal consequences or operational shutdowns. As a result, industries such as manufacturing, oil and gas, utilities and construction are rapidly invested in protective gear, engineering control and monitoring systems. This regulatory pressure is accelerating the adoption of safety solutions and is expected to demand in developed and emerging markets.

Retrofit Demand in U.S. Electrical Utilities to Boost the North America Arc Flash Protection Market Growth

The aging electrical infrastructure in the United States is undergoing widespread retrofitting and modernization, which is a major catalyst for the development of the North America Arc Flash Protection Market in North America. Many Decades ago, there was a lack of adequate arc flash detection and mitigation facilities in many substations, switchgear units and power distribution panels. Since, utilities work to upgrade these old systems to follow current safety standards such as NFPA 70E and OSHA rules, there is a growing requirement of advanced Arc flash protective solutions. This includes installing Arc detection relay, replacing non-Arc-rated components and equipping workers with updated arc-rated individual safety equipment (PPE). These retrofit activities not only improve system reliability but also reduce the risk of electrical injuries, making Arc flash protection technology necessary.

Lack of Qualified Electrical Safety Professionals to Restrain the North America Arc Flash Protection Market

Effective implementation of arc flash mitigation strategies requires special knowledge in electrical engineering, safety codes and dangerous analysis. Arc flash risk assessment, proper labelling, PPE selection and system design modifications done by trained personnel to ensure compliance with standards such as NFPA 70E or CSA Z462. However, in many regions, there is a shortage of efficient professionals, especially in developing economies and among small or medium-sized enterprises. Therefore, there is a rising risk of delays or incorrect implementation of safety measures, non-compliance with rules, and workplace accidents. Also, ARC flash makes the complexity of calculations and the ongoing updates due to changes in electrical systems make it difficult for the undertaking staff to maintain effective security.

Smart Technology Integration Opportunity in the North America Arc Flash Protection Market

Increasing integration of smart technologies such as IOT (Internet of Things), AI-based analytics and real-time monitoring presents an important opportunity for an increase in the North America Arc Flash Protection Market. Traditional arc flash safety solutions are developing in intelligent systems that detect discrepancies to prevent injuries and equipment damage, predict failures, and automate the shutdown within milliseconds. These smart systems also provide integration with remote diagnostics, cloud-based compliance reporting and building or plant-wide safety platforms. As the U.S. And Canadian industries accelerate their transition towards digital changes and industry 4.0, increasing demand for connected arch flash solutions, especially in utilities, oil and gas and smart manufacturing sectors.

North America Arc Flash Protection Market Segment Analysis:

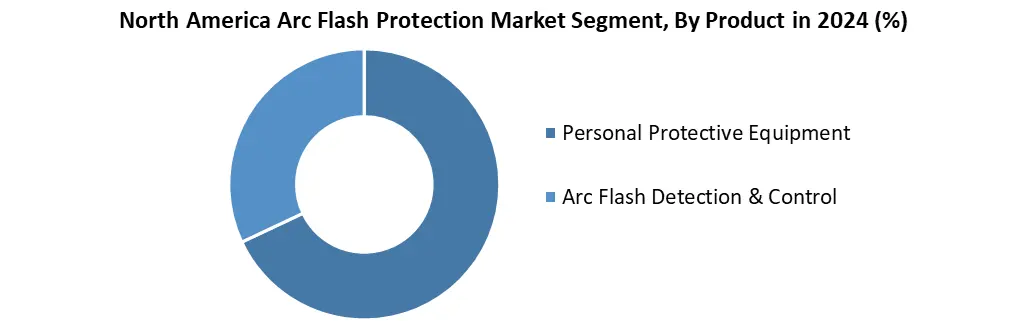

Based on Product, the North America arc flash Protection Market is segmented into Personal Protective Equipment (PPE) and Arc Flash Detection & Control. the Personal Protective Equipment (PPE) segment is dominant in the North America arc flash protection market. Due to the mandatory use of PPE in almost all industries where electrical threats exist, including manufacturing, utilities, oil and gas manufacturing and data centers. Arc-rated PPE, such as flame-resistant clothes, face shields, gloves and suits, is the first and most immediate line of defense for workers against flash injuries. PPE is easier to apply compared to relatively cost-effective and complex identification and control systems, which is also widely adopted in developing areas where awareness and infrastructure for advanced ARC mitigation technologies are limited.

Based on End-Use, the North America arc Flash Protection Market is segmented into Utilities, Manufacturing & Processing Industries, Oil & Gas, Transportation & Infrastructure and others. The utility is dominant in the North America arc flash protection market in 2024 due to their high-risk, high-voltage operations, strict regulatory requirements and the role of important infrastructure. Although the manufacturing and processing sector holds the largest market share, its dominance exceeds the scale and volume compared to the severity of risk or regulatory enforcement. Utilities maintain significant infrastructure and they often perform live work during maintenance and upgrades, which increases the need for strong security. Utilities are also initial adopt advanced arc flash technology, which invest heavily in both PPE and engineer security solutions to ensure uninterrupted service and activities.

North America Arc Flash Protection Market Regional Analysis

The United States is dominant in the North America Arc Flash Protection Market in 2024.

The Arc Flash Protection Market is accounting for about 76% of the regional market share in 2024. This dominance is roughly powered by a strict enforcement of OSHA standards and power safety rules such as NFPA 70E, requiring Arc flash hazardous analysis, labeling and use of certified individual safety equipment (PPE). In the U.S., there is a large basis of aging utility and industrial infrastructure, resulting in retrofit and modernization projects that demand advanced ARC flash detection and mitigation technologies. In addition, by increasing the strong attention of the country on workplace security and ESG-powered security initiatives, companies have encouraged companies to invest in both PPE and Arc control systems.

North America Arc Flash Protection Market Competitive Landscape

The North America Arc Flash Protection Market key players such as ABB, Schneider Electric, Eaton, General Electric (GE) and Honeywell. These companies dominate because of their strong regional presence, comprehensive product portfolio and advanced security technologies. ABB and Schneider provide electric integrated arc flash detection and control systems, while Eaton goes with the arc-resistant switchgear. GE is focused on electrical safety through GE Smart Grid Solutions, and Honeywell specializes in innovative arc-rated PPEs and wearable safety techniques. Their continuous investment in smart and obedient solutions keeps them at the forefront of the market.

Recent Developments:

- In December 2024, Honeywell launched its Pro-Wear® Plus High-visibility Arc Flash Cover (25 cal/cm²), for utility and industrial workers in compliance with NFPA 70E and CSA Z462 standards and offering safety and comfort for industrial workers.

- In February 2024, Eaton introduced its AFDD+ device, in which a compact unit was combined with MCB, RCD and Arch Fault Detection in one compact unit to reduce fire risk and increase circuit security protection in buildings.

- In 10 April 2023, U.S.-based Pyramex Safety introduced the GL3000 series, a new line of arc-rated gloves offering ergonomic fit and NFPA 70E compliance, targeting electrical workers across North America.

|

The North America Arc Flash Protection Market Scope |

|

|

Market Size in 2024 |

USD 1.38 Bn. |

|

Market Size in 2032 |

USD 1.94 Bn. |

|

CAGR (2025-2032) |

4.38% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product, Personal Protective Equipment (PPE) Arc Flash Detection & Control |

|

By End-Use, Utilities Manufacturing & Processing Industries Oil & Gas Transportation & Infrastructure Others |

|

North America Arc Flash Protection Market Key players:

- Honeywell International Inc. (USA)

- Eaton Corporation (USA)

- Pyramex Safety (USA)

- DuPont de Nemours, Inc. (USA)

- 3M Company (USA)

- National Safety Apparel (NSA) (USA)

- Oberon Company (USA)

- Lakeland Industries, Inc. (USA)

- Westex: A Milliken Brand (USA)

Frequently Asked Questions

Rising Electrical Safety Regulations and Retrofit Demand in U.S. Electrical Utilities are driving the North America Arc Flash Protection Market.

The North America Arc Flash Protection Market key players such as ABB, Schneider Electric, Eaton, General Electric (GE), and Honeywell.

1. North America Arc Flash Protection Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Arc Flash Protection Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Service Segment

2.2.4. End-User Segment

2.2.5. Revenue (2024)

2.2.6. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Arc Flash Protection Market: Dynamics

3.1. North America Arc Flash Protection Market Trends

3.2. North America Arc Flash Protection Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Arc Flash Protection Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. North America Arc Flash Protection Market Size and Forecast, By Product (2024-2032)

4.1.1. Personal Protective Equipment (PPE)

4.1.2. Arc Flash Detection & Control

4.2. North America Arc Flash Protection Market Size and Forecast, By End-Use (2024-2032)

4.2.1. Utilities

4.2.2. Manufacturing & Processing Industries

4.2.3. Oil & Gas

4.2.4. Transportation & Infrastructure

4.2.5. Others

4.3. North America Arc Flash Protection Market Size and Forecast, By Country (2024-2032)

4.3.1. United States

4.3.1.1. United States Arc Flash Protection Market Size and Forecast, By Product (2024-2032)

4.3.1.1.1. Personal Protective Equipment (PPE)

4.3.1.1.2. Arc Flash Detection & Control

4.3.1.2. United States Arc Flash Protection Market Size and Forecast, By End-Use (2024-2032)

4.3.1.2.1. Utilities

4.3.1.2.2. Manufacturing & Processing Industries

4.3.1.2.3. Oil & Gas

4.3.1.2.4. Transportation & Infrastructure

4.3.1.2.5. Others

4.3.2. Canada

4.3.2.1. Canada Arc Flash Protection Market Size and Forecast, By Product (2024-2032)

4.3.2.1.1. Personal Protective Equipment (PPE)

4.3.2.1.2. Arc Flash Detection & Control

4.3.2.2. Canada Arc Flash Protection Market Size and Forecast, By End-Use (2024-2032)

4.3.2.2.1. Utilities

4.3.2.2.2. Manufacturing & Processing Industries

4.3.2.2.3. Oil & Gas

4.3.2.2.4. Transportation & Infrastructure

4.3.2.2.5. Others

4.3.3. Mexico

4.3.3.1. Mexico Arc Flash Protection Market Size and Forecast, By Product (2024-2032)

4.3.3.1.1. Personal Protective Equipment (PPE)

4.3.3.1.2. Arc Flash Detection & Control

4.3.3.2. Mexico Arc Flash Protection Market Size and Forecast, By End-Use (2024-2032)

4.3.3.2.1. Utilities

4.3.3.2.2. Manufacturing & Processing Industries

4.3.3.2.3. Oil & Gas

4.3.3.2.4. Transportation & Infrastructure

4.3.3.2.5. Others

5. Company Profile: Key Players

5.1. Honeywell International Inc. (USA)

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. Eaton Corporation (USA)

5.3. Pyramex Safety (USA)

5.4. DuPont de Nemours, Inc. (USA)

5.5. 3M Company (USA)

5.6. National Safety Apparel (NSA) (USA)

5.7. Oberon Company (USA)

5.8. Lakeland Industries, Inc. (USA)

5.9. Westex: A Milliken Brand (USA)

6. Key Findings

7. Analyst Recommendations