Home Infusion Therapy Market - Global Industry Analysis and Forecast (2025-2032)

The Home Infusion Therapy Market size was valued at USD 27.92 Billion in 2024 and the total Home Infusion Therapy Market size is expected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 51.80 Billion by 2032.

Format : PDF | Report ID : SMR_2268

Home Infusion Therapy Market Overview

Home infusion therapy is a specialized medical treatment that involves administering medication, fluids, or nutrients to patients at home using equipment like pumps, catheters, and vials. The problem of chronic diseases is rapidly increasing globally, with chronic immune deficiencies, cancer, diabetes, and congestive heart failure affecting approximately 133 million of Americans, representing 45% of the total population.

The geriatric population is also boosting market growth, as they are more prone to chronic diseases and prefer to remain in their homes for as long as possible. Over 80% of patients in the U.S. wish to avoid hospitalization and intensive care during the terminal phase of their lives and prefer to be treated at home. The trend of medical care at home is expected to persist and gain momentum in the forecast period. Key factors driving this trend include the rising prevalence of chronic diseases, expanding reimbursement codes for remote patient monitoring, and the expensive nature of hospital stays.

The cases of chronic diseases are continue to increase in the future because of the rising geriatric population and high prevalence of these diseases among children and younger adults. Growing awareness about the benefits of home treatment modality and rapid technological advancements in home-use devices are additional factors likely to fuel the demand for home infusion therapy industry globally during the forecast period.

For Instance, CVS Health Specialty Infusion Services, a division of the company, offers high-quality home infusion therapy services to over 50,000 patients annually. With over 85 branch locations, CVS Health serves 97% of the US population and administers over 1.2 million infusion treatments. The company provides treatments for chronic diseases, antibiotic therapy, parenteral nutrition, and enteral nutrition. With high patient satisfaction rates, CVS Health invests in digital health tools like telehealth services and remote monitoring. CVS Health is a leading Player of home infusion therapy in the US, offering coordinated, patient-centred care.

To get more Insights: Request Free Sample Report

Home Infusion Therapy Market Dynamics:

Home Infusion Therapy Market Driven by Chronic Illnesses, Aging Population, and Personalized Medical Solutions

The global home infusion therapy market is driven by the increasing prevalence of chronic illnesses such as osteoarthritis, HIV, diabetes, and cancer. The growing elderly population, who are more prone to life-threatening disorders, requires regular medical attention, such as infusion therapy, which includes IV therapy and IV hydration therapy, plays a crucial role in addressing conditions like congestive heart failure, immune deficiencies, and cancer. The integration of IV therapy and IV hydration therapy enhances access to effective and personalized medical solutions at home. Cost-benefits treatments and improved patient outcomes are driving market growth. The increasing demographic of baby boomers struggling with flexibility because of conditions like osteoarthritis and paralysis is pushing home infusion therapy upscale. The emergence of continuous subcutaneous apomorphine infusion is an exceptional treatment for Parkinson's disease, escalating demand for subcutaneous infusion therapy.

- Technological advancements in infusion pumps, disposable supplies, and remote patient monitoring devices have made home infusion therapy more accessible and safer. Government initiatives and insurance coverage have also increased patient access to these services. The United States currently dominates the market because of major Leading Players, well-established healthcare infrastructure, and favourable reimbursement policies.

Key Drivers Fuelling the Rapid Growth of the Home Infusion Therapy Market

The rising prevalence of chronic diseases, government initiatives, favourable reimbursement policies, and rising costs of extended hospital stays are driving patients to choose home infusion therapy. The shifting Customer preferences for home healthcare services because of their convenience and cost-benefits, along with the growing need for hospital space and beds, are also driving market growth. The rising prevalence of hospital-acquired infections (HAIs) because of prolonged exposure to contaminated equipment, bed linens, and air droplets is also contributing to home infusion therapy market growth. The widespread demand for specialty drugs requiring specialized administration is another significant growth-inducing factor. Innovative technological advancements, such as lightweight, portable, and easy-to-use infusion pumps equipped with advanced drip systems, present remunerative growth opportunities for the market.

The home infusion therapy market faces challenges and risks associated with infections & high costs.

Infusion therapy patients face significant Challenges of infections because of the potential for bloodstream infections, which lead to serious health complications and even death. Maintaining hygiene and safety standards at home is challenging, as patients and their families fear that common home settings do not fully limit the risk of contamination in IV lines, catheters, or infusion pumps. This fear makes them hesitant to accept long-term infusion regimens involving frequent visits by nursing staff. The global home infusion therapy market faces significant challenges because of the high upfront costs associated with infusion pumps and equipment procurement, which pose financial barriers for those with limited resources or inadequate insurance coverage. Also, patients managing chronic illnesses face additional out-of-pocket costs, hindering market growth during the forecast period.

The home infusion therapy market is witnessing promising opportunities driven by several key factors.

The Home Infusion Therapy industry is witnessing promising opportunities driven by several factors. There is a growing aging populace globally, growing the demand for domestic-primarily based healthcare answers that offer convenience and price-effectiveness. This demographic shift underscores the want for cures that are administered accurately outdoors in conventional sanatorium settings. Also, advancements in clinical generation have enhanced the feasibility of administering complicated remedies at home, thereby expanding the market potential. Moreover, the superiority of continual diseases together with autoimmune issues and most cancers necessitates long-term infusion treatments, similarly fuelling market increase.

Also, healthcare reforms emphasizing outpatient care and favourable compensation regulations are boosting the adoption of home infusion cures. These factors collectively create a good environment for stakeholders, such as healthcare vendors, pharmaceutical groups, and generation innovators, to put money into and increase their presence within the dynamic Home Infusion Therapy market. Manufacturers and healthcare carriers are capitalizing on those possibilities using innovating in drug transport structures and imparting complete home infusion services. Prominent producers along with BD, Baxter International Inc., and Fresenius Kabi are actively investing in this marketplace phase, developing advanced infusion pumps and expanding their provider offerings to satisfy growing demand. These traits underscore a robust outlook for the Home Infusion Therapy market, offering lucrative opportunities for stakeholders throughout the healthcare spectrum.

Home Infusion Therapy Market Segment Analysis:

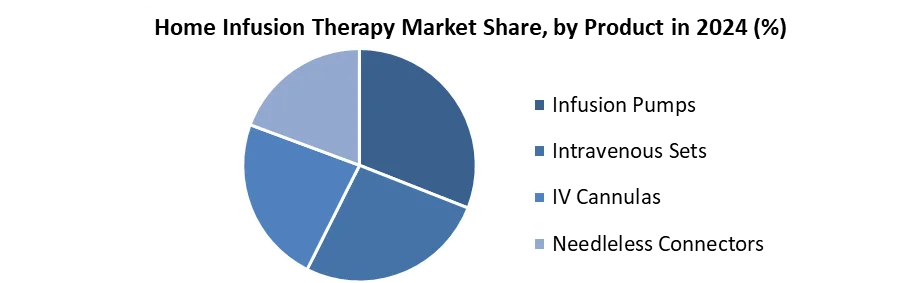

Based on Product, the infusion pumps segment is expected to dominate the global home infusion therapy market with XX% share in 2023. These pumps offer precision in drug delivery via an IV, providing patients with greater control over their treatment. They are particularly popular in chemotherapy and diabetes treatment, where they provide convenient home-based administration of drugs over extended periods, reducing hospital visits and regulating drug dosage more accurately. Insulin-dependent diabetes patients also rely on infusion pumps to maintain steady glucose levels outside of hospital settings. Advanced pump features like customizable basal rate programs and integrated glucose monitors facilitate remote monitoring.

Miniaturized infusion pump technology has increased acceptance among patients seeking discreet, wearable devices. Mems's sensor-based smart pumps are gaining traction because they integrate connectivity options, allowing two-way data transmission to cloud-based patient portals for better therapeutic management. The growing need for convenient, precise home-based therapies continues to enhance the role of infusion pumps in home infusion services.

Based on Indication, the anti-infective segment dominated the market in 2024 because of the increasing prevalence of infectious diseases, ease of setup, and low cost of treatment. This segment is expected to grow significantly because of the use of catheters, antifungal and anti-toxin drugs. The chemotherapy segment is expected to experience the highest growth because of the increasing global cancer prevalence and awareness of the benefits of home-based chemotherapy. The demand for pressure pumps for home-based chemotherapy is expected to increase because of the increasing frequency of malignant growth. These non-battery, continuous-pressure pumps help manage chemotherapy medications at the right speed and in the right amounts, making them a rapidly growing segment of the market.

Home Infusion Therapy Market Regional Insight:

North America is a major market for home infusion therapy because of factors such as chronic diseases, treatment costs, technological advancements, and products launches. The most prevalent cancers in the US include breast, lung, prostate, colorectal, bladder, and skin cancer. The shift from acute care to home care settings is driven by cost savings and improved patient mobility. The demand for regional goods is also boosted by healthcare industry improvements and the use of advanced medical items. Home healthcare has growth prospects because of insurance coverage for home infusion services. Companies like Option Care Enterprises and CHI Health offer infusion therapy services in home healthcare settings, with insurance coverage covering costs. Home infusion therapy is commonly prescribed for pulmonary hypertension, and the pressure on healthcare facilities in the US has increased the demand for home nutritional infusion therapies.

Home Infusion Therapy Market Competitive Landscape:

The competitive landscape of the market is determined by intense competition among global and regional players such as Option Care Health, Inc, Coram LLC, Medix Infusion, CVS Health and JMS Co. Ltd these companies leverage their extensive R&D experiences for development. Option Care Health, Inc. and Coram LLC are significant players in the home infusion therapy market in North America because of a combination of industry trends, demographic factors, and healthcare advancements. These companies are growing and the home infusion therapy market is growing in North America.

Option Care Health, Inc., headquartered in the USA, is a leading provider of home infusion therapy services, offering a comprehensive range of therapies to patients across the country. As of the latest data, Option Care Health reported robust growth in their home infusion therapy segment, with significant expansions in service offerings and geographical coverage. Their strategic focus on patient-centric care and advanced clinical solutions has positioned them strongly in the competitive landscape. Coram LLC, also based in the USA, is another prominent player in the home infusion therapy market. Acquired by CVS Health, Coram LLC operates under the CVS Health umbrella and provides extensive home infusion services.

With a broad network and integration into CVS Health's pharmacy and healthcare services, Coram LLC leverages its scale to enhance patient access and service efficiency. In terms of sales in the home infusion therapy market, Option Care Health, Inc. reported approximately $2.5 billion in revenue for the latest fiscal year, reflecting steady growth driven by their expanded service offerings and patient base. On the other hand, Coram LLC, integrated within CVS Health, contributes significantly to CVS's healthcare services revenue, although specific revenue figures for Coram LLC alone are not separately disclosed. Both Option Care Health, Inc. and Coram LLC exemplify strong contenders in the competitive landscape of home infusion therapy, with each leveraging unique strengths in service provision and market reach to enhance patient outcomes and operational excellence.

|

Home Infusion Therapy Market Scope |

|

|

Market Size in 2024 |

USD 27.92 Bn. |

|

Market Size in 2032 |

USD 51.80 Bn. |

|

CAGR (2025-2032) |

8.03 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Analysis |

By Product Infusion Pumps Elastomeric Electromechanical Gravity Others Intravenous Sets IV Cannulas Needleless Connectors |

|

By Indication Anti-Infective Chemotherapy Hydration Therapy Enteral Nutrition Total Parenteral Nutrition Immunoglobulin Therapy Others |

|

|

By End User Patients Nurse Hospitals Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Home Infusion Therapy Market

- Option Care Health, Inc - USA

- Coram LLC - USA

- Medix Infusion - USA

- PharMerica - USA

- Fresenius Kabi - Germany

- Prochant - USA

- ICU Medical, Inc. - USA

- B. Braun Melsungen AG - Germany

- Baxter International Inc - USA

- BD - USA

- Caesarea Medical Electronics - Israel

- Terumo Corporation - Japan

- JMS Co. Ltd. - Japan

- Optum - USA

- CareCentrix, Inc. - USA

- CVS Health - USA

- KabaFusion - USA

- PromptCare - USA

- Infusystem - USA

- Cardinal Health Inc. - USA

- CHI Health – USA

- XX.inc

Frequently Asked Questions

Ans. North America is expected to lead the Home Infusion Therapy Market during the forecast period.

Ans. An analysis of profit trends and projections for companies in the Home Infusion Therapy Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

Ans. The Home Infusion Therapy Market size was valued at USD 27.92 Billion in 2024 and the total Home Infusion Therapy Market size is expected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 51.80 Billion by 2032.

Ans. The segments covered in the market report are by Product, by Indication and by End User.

- Home Infusion Therapy Market: Research Methodology

- Home Infusion Therapy Market: Executive Summary

- Home Infusion Therapy Market: Competitive Landscape

- Potential Areas for Investment

- Stellar Competition Matrix

- Competitive Landscape

- Key Players Benchmarking

- Market Structure

- Market Leaders

- Market Followers

- Emerging Players

- Consolidation of the Market

- Import and export of Home Infusion Therapy Market

- Home Infusion Therapy Market : Dynamics

- Market Driver

- Increasing Consumer Awareness

- Innovation in Product Offerings

- Market Trends by Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Market Drivers by Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Market Restraints

- Market Opportunities

- Market Challenges

- PORTER’s Five Forces Analysis

- PESTLE Analysis

- Strategies for New Entrants to Penetrate the Market

- Regulatory Landscape by Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Market Driver

- Home Infusion Therapy Market Size and Forecast by Segments (by value Units)

- Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Home Infusion Therapy Market Size and Forecast, by Indication (2024-2032)

- Anti-Infective

- Chemotherapy

- Hydration Therapy

- Enteral Nutrition

- Total Parenteral Nutrition

- Immunoglobulin Therapy

- Others

- Home Infusion Therapy Market Size and Forecast, by End User (2024-2032)

- Patients

- Nurse

- Hospitals

- Others

- Home Infusion Therapy Market Size and Forecast, by Region (2024-2032)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- North America Home Infusion Therapy Market Size and Forecast (by value Units)

- North America Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- North America Home Infusion Therapy Market Size and Forecast, by Indication (2024-2032)

- Anti-Infective

- Chemotherapy

- Hydration Therapy

- Enteral Nutrition

- Total Parenteral Nutrition

- Immunoglobulin Therapy

- Others

- North America Home Infusion Therapy Market Size and Forecast, by End User (2024-2032)

- Patients

- Nurse

- Hospitals

- Others

- North America Home Infusion Therapy Market Size and Forecast, by Country (2024-2032)

- United States

- Canada

- Mexico

- North America Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Europe Home Infusion Therapy Market Size and Forecast (by Value Units)

- Europe Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Europe Home Infusion Therapy Market Size and Forecast, by Indication (2024-2032)

- Anti-Infective

- Chemotherapy

- Hydration Therapy

- Enteral Nutrition

- Total Parenteral Nutrition

- Immunoglobulin Therapy

- Others

- Europe Home Infusion Therapy Market Size and Forecast, by End User (2024-2032)

- Patients

- Nurse

- Hospitals

- Others

- Europe Home Infusion Therapy Market Size and Forecast, by Country (2024-2032)

- UK

- France

- Germany

- Italy

- Spain

- Sweden

- Austria

- Rest of Europe

- Europe Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Asia Pacific Home Infusion Therapy Market Size and Forecast (by Value Units)

- Asia Pacific Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Asia Pacific Home Infusion Therapy Market Size and Forecast, by Indication (2024-2032)

- Anti-Infective

- Chemotherapy

- Hydration Therapy

- Enteral Nutrition

- Total Parenteral Nutrition

- Immunoglobulin Therapy

- Others

- Asia Pacific Home Infusion Therapy Market Size and Forecast, by End User (2024-2032)

- Patients

- Nurse

- Hospitals

- Others

- Asia Pacific Home Infusion Therapy Market Size and Forecast, by Country (2024-2032)

- China

- S Korea

- Japan

- India

- Australia

- Asean

- Rest of Asia Pacific

- Asia Pacific Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Middle East and Africa Home Infusion Therapy Market Size and Forecast (by Value Units)

- Middle East and Africa Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Middle East and Africa Home Infusion Therapy Market Size and Forecast, by Indication (2024-2032)

- Anti-Infective

- Chemotherapy

- Hydration Therapy

- Enteral Nutrition

- Total Parenteral Nutrition

- Immunoglobulin Therapy

- Others

- Middle East and Africa Home Infusion Therapy Market Size and Forecast, by End User (2024-2032)

- Patients

- Nurse

- Hospitals

- Others

- Middle East and Africa Home Infusion Therapy Market Size and Forecast, by Country (2024-2032)

- South Africa

- GCC

- Rest of ME&A

- Middle East and Africa Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- South America Home Infusion Therapy Market Size and Forecast (by Value Units)

- South America Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- South America Home Infusion Therapy Market Size and Forecast, by Indication (2024-2032)

- Anti-Infective

- Chemotherapy

- Hydration Therapy

- Enteral Nutrition

- Total Parenteral Nutrition

- Immunoglobulin Therapy

- Others

- South America Home Infusion Therapy Market Size and Forecast, by End User (2024-2032)

- Patients

- Nurse

- Hospitals

- Others

- South America Home Infusion Therapy Market Size and Forecast, by Country (2024-2032)

- Brazil

- Argentina

- Rest of South America

- South America Home Infusion Therapy Market Size and Forecast, by Product (2024-2032)

- Company Profile: Key players

- Option Care Health, Inc

- Company Overview

- Financial Overview

- Business Portfolio

- SWOT Analysis

- Business Strategy

- Recent Developments

- Coram LLC

- Medix Infusion,

- PharMerica

- Fresenius Kabi

- Prochant

- ICU Medical, Inc. --

- B. Braun Melsungen AG

- Baxter International Inc

- BD

- Caesarea Medical Electronics

- Terumo Corporation

- JMS Co. Ltd.

- Optum

- CareCentrix, Inc.

- CVS Health

- KabaFusion

- PromptCare

- Infusystem

- Cardinal Health Inc.

- CHI Health

- XX.inc

- Option Care Health, Inc

- Key Findings

- Industry Recommendation