Heparin Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

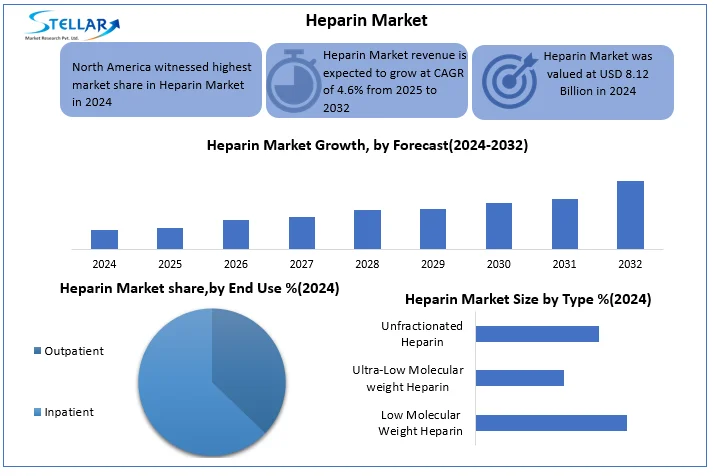

Heparin Market was valued at USD 8.12 Billion in 2024. The Total Heparin Market revenue is expected to grow by CAGR 4.6% from 2025 to 2032 and reach nearly USD 11.64 Billion in 2032.

Format : PDF | Report ID : SMR_2763

Heparin Market Overview

Heparin is an anticoagulant used to prevent and treat blood clots. It is mainly taken from the pig intestines and works by increasing the antithrombin III activity to disrupt blood clotting factors. Heparin is widely used for surgery, dialysis, and conditions such as DVT and PE. It is available in two types: unfractionated heparin and low molecular weight heparin.

Global heparin market has been experiencing significant growth which is inspired by the increasing proliferation of chronic health conditions such as venous thromboembolism, atrial fibrillation and chronic kidney disease. Heparin Market demand for dialysis and kidney remedies, which require anticoagulants to avoid blood clots inspired the custom of heparin particularly low molecular load heparin due to its better protection, prolonged life and comfort of administration. Technological progresses as well as the development of synthetic and bio engineer heparin are addressing the supply chain concerns associated with animal-rich sources and refining product safety and stability.

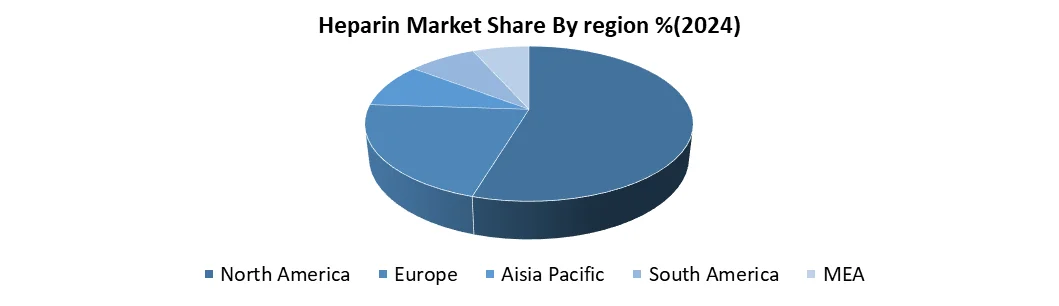

These innovations are opening new opportunities in both established and emerging markets. In 2024, North America dominated the global heparin market with about 38% market share maintained by the presence of high disease burden well established healthcare infrastructure and the presence of major pharmaceutical companies such as Pfizer and Amphastar Pharmaceuticals Inc. These factors collectively strengthen the market strong growth approach during the forecast period.

Trade and tariffs impact the heparin market by affecting raw Type supply mainly from China. Import restrictions or higher tariffs raise production costs and limit global availability. Geopolitical tensions and disease outbreaks in source countries disrupt the supply chain leading to price volatility and shortages in the global heparin market.

To get more Insights: Request Free Sample Report

Heparin Market Dynamics

Increasing Use of Dialysis and Renal Therapies is to Drive the Heparin Market Growth

Heparin is necessary in dialysis and kidney remedies to prevent the formation of blood clots during extracorporeal circulation. During haemodialysis blood flows through an external circuit and dialyser which increases the risk of clots. particularly low molecular load heparin is usually administered to maintain smooth blood flow and prevent complications. With increasing global proliferation of chronic kidney disease and end stage renal disease the number of patients needful regular dialysis is steadily increasing. This boom directly increases the demand for anticoagulants such as heparin. expansion of dialysis centres better healthcare access in developing areas and progress in kidney care is supporting the development of Heparin market making renal treatments a major application section.

Advancements in Biotech and Synthetic Heparin to Give the Market Opportunity

The development of synthetic and bio engineer heparin represents a significant advancement in the anticoagulant market addressing important challenges related to traditional animal rich sources. Traditional heparin is mainly extracted from porcine intestinal mucosa which exposes the supply chain for risks such as outbreaks and regulatory barriers. According to recent studies published in the Journal of Thrombosis and Haemostasis in 2023, synthetic heparin analogues reduce better batch stability increased safety profiles and contamination risks. recourse DNA enabling scalable production of the advance bioorganizer heparin in Application and chemical synthesis which reduce the lack of supplies related to animal sourcing and moral concerns. Heparin Market analysts estimate that these innovations will not only ensure stable supply but will also open new medical applications through sewn molecular amendments. Biotech powered heparin options offer an attractive opportunity globally to bring revolution in anticoagulant treatments.

Risk of Contamination and Adverse Reactions to Limit Heparin Market Growth

Heparin's dependence on animal-oriented sources exposes the market for potential contamination risks historically affecting its reputation and use. A notable event was contamination with the oversalted Chondroitin sulphate of 2007–2008, leading to serious adverse reactions and many fatal deadly globally. Such contamination concerns increased the demand for regulatory investigation and stringent quality control increasing production costs. heparin administration cause complications of bleeding and side effects such as heparin inspired thrombocytopenia a serious immune reaction that limit the patient eligibility. These security concerns prohibit adoption widely especially in outpatient settings. the need for safe options and better manufacturing practices is a challenge for the market. Addressing contamination risks and adverse reactions is important to maintain heparin market growth and achieve healthcare provider and patient confidence.

Heparin Market Segment Analysis

Based on Type, the market is segmented into Low Molecular Weight Heparin, Ultra Low Molecular Weight Heparin, and Unfractionated Heparin. The Low Molecular Weight segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. The global heparin market its favourable safety profile and other heparin types related to the administration are relaxed. Low molecular loads are related to low incidence of adverse effects such as heparin inspired thrombocytopenia and bleeding complications which are more prevalent with unfamiliar heparin. Low molecular weight predicts anticoagulant activity and administered provides leather injections eliminating the necessary for regular laboratory monitoring. Its long half life enables the low dose frequency which increases the patient compliance and convenience. These advantages strengthen dark vein thrombosis and pulmonary embolism low molecular loads in combination with its widespread use in thrombotic disorders and its widespread use in treatment.

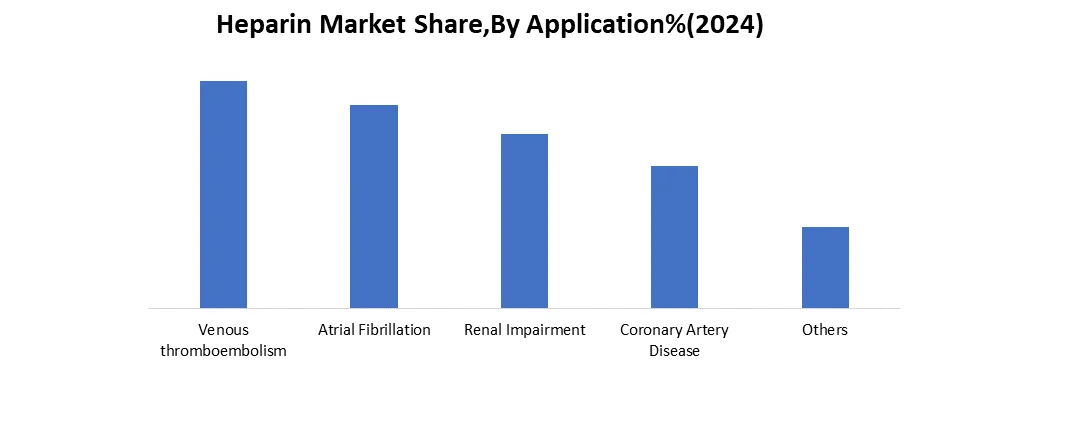

Based on Application, the market is segmented into venous thromboembolism, atrial fibrillation, renal impairment, coronary artery disease and others. The venous thromboembolism segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. venous thromboembolism including deep vein thrombosis and pulmonary embolism remains a key reason of heart sickness and mortality worldwide. venous thromboembolism high prevalence especially hospitalized surgical cancer and immobile patients greatly increased the demand for real anticoagulation therapy. low molecular load is commonly used as the first-row treatment and preventive agent which is caused by rapid onset of action predicted pharmacokinetics and installed clinical efficacy. strong references from global healthcare organizations and clinical guidelines support the training of heparin in venous thromboembolism management. Its cost effectiveness and reliability as well as frequent use of heparin in mutually inpatient and outpatient attention settings heparin checks the dominance of the venous thromboembolism segment in the heparin industry.

Based on End Users, the market is segmented into Outpatient, Inpatient. The inpatient segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. Heparin is mainly used in hospital settings where immediate and controlled anticoagulation is required. It plays an important role in managing acute conditions during major surgery such as venous thrombosis pulmonary embolism atrial fibrillation and orthopaedic or heart processes. In these scenarios unaffected heparin and low molecular load heparin are preferred due to their rapid start and ease of dose adjustment under medical supervision. procedures such as dialysis and post operative prophylaxis depend on heparin in heavy care. Needs immediate feedback for close monitoring risk management and adverse effects takes care of the leading environment for heparin administration.

Based on Region North America dominated the heparin market in 2024 and is expected to hold largest share during the forecast period. This leadership is driven by the region high prevalence of conditions requiring anticoagulant therapy such as venous thromboembolism atrial fibrillation and chronic kidney disease. venous thromboembolism affects nearly 900,000 people annually in the U.S. while atrial fibrillation impacts over 6 million Americans. The advanced healthcare infrastructure, high surgical volumes and strict adherence to clinical guidelines in North America further support the extensive use of heparin. The presence of major pharmaceutical companies like Pfizer, Baxter International and Fresenius Kabi ensures consistent supply and innovation. Together these factors solidify North America position as the leading heparin industry.

Heparin Market Competitive Landscape

Pfizer Inc. And Amphastar Pharmaceuticals, Inc. Heparin is a major player in the heparin market. Physics a strong global appearance with a comprehensive product range and regulatory approval. It focuses on innovation biosimilars and broad international distribution. Amphastar specializes in cost effective injection especially in the US market. Its major strength is in house API production and vertical integration. While Fizer is globally Amphastar dominates the American hospital area. The advantage of the physic is on the global scale, while the Amphastar provides pricing efficiency. Both contribute significantly to the development of the market through various strategies.

Heparin Market Key Developments

In February 22, 2024, Leo Pharma (Denmark) launched a prefilled syringe version of tinzaparin to improve outpatient care. The new format enhances ease of use supports home administration and boosts patient compliance strengthening Leo Pharma’s position in the global LMWH market.

In March 18, 2024, Bharat Serums and Vaccines Ltd. (India) launched its new Low Molecular Weight Heparin product line targeted at Indian hospitals. This launch aims to strengthen local supply lessen import necessity and support India's "Make in India" healthcare initiative.

In January 25, 2024, Pfizer Inc. (USA) signed a long-term agreement with Chinese suppliers to secure porcine mucosa-based API for heparin production. This strategic move aims to strengthen Pfizer’s supply chain resilience against potential disruptions produced by geopolitical tensions and animal disease outbreaks ensuring consistent global availability of its heparin products industry.

|

Heparin Market Scope |

|

|

Market Size in 2024 |

USD 8.12 Billion |

|

Market Size in 2032 |

USD 11.64 Billion |

|

CAGR (2025-2032) |

4.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Low Molecular Weight Heparin Ultra-Low Molecular Weight Heparin Unfractionated Heparin |

|

By Application venous thromboembolism Atrial fibrillation Renal impairment Coronary artery disease Others |

|

|

By End User Inpatient Outpatient |

|

|

Regional Scope |

North America- US, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in the Heparin Market

North America

- Pfizer Inc. (USA)

- Amphastar Pharmaceuticals, Inc. (USA)

- B. Braun Medical Inc. (USA)

- Fresenius Kabi USA, LLC (USA)

- Teva Pharmaceuticals USA, Inc. (USA)

- Apotex Inc. – Canada

Europe

- Sanofi S.A. (France)

- Aspen Pharmacare Holdings Limited (Ireland)

- Leo Pharma A/S (Denmark)

- Rovi Pharma Industrial Services S.A. (Spain)

- Sandoz (Switzerland)

- Techdow Pharma (Europe) (Germany)

- Laboratorios Farmacéuticos Rovi, S.A. (Spain)

- STADA Arzneimittel AG (Germany)

Asia-Pacific

- Shenzhen Hepalink Pharmaceutical Co., Ltd. (China)

- Qianhong Bio-pharma Co., Ltd. (China)

- Nanjing King-friend Biochemical Pharmaceutical Co., Ltd. (China)

- Changzhou Qianhong Biopharma Co., Ltd. (China)

- Daewoong Pharmaceutical Co., Ltd. (South Korea)

- Bharat Serums and Vaccines Ltd. (India)

- Biocon Ltd. (India)

- Samarth Life Sciences Pvt. Ltd. (India)

South America

- Blau Farmacêutica S.A. (Brazil)

- Eurofarma Laboratórios S.A. (Brazil)

- Laboratorios Richmond S.A.C.I.F. (Argentina)

- Grupo Biotoscana (now Knight Therapeutics) (Colombia/Brazil)

Middle East & Africa

- Julphar (Gulf Pharmaceutical Industries) (UAE)

- Tabuk Pharmaceuticals (Saudi Arabia)

- Aspen Pharmacare (South Africa)

- Pharco Pharmaceuticals (Egypt)

Frequently Asked Questions

North America dominated the market in 2024, holding about 38% of the total market share.

Low Molecular Weight Heparin (LOW MOLECULAR WEIGHT) is leading the market due to its safety, ease of use, and better clinical outcomes.

The market is expected to grow at a CAGR of 4.6% during the forecast period.

Key players include Pfizer Inc., Amphastar Pharmaceuticals, B. Braun Medical, Fresenius Kabi USA, and Teva Pharmaceuticals.

1. Heparin Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Heparin Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Heparin Market: Dynamics

3.1. Heparin Market Trends by Region

3.1.1. North America Heparin Market Trends

3.1.2. Europe Heparin Market Trends

3.1.3. Asia Pacific Heparin Market Trends

3.1.4. Middle East and Africa Heparin Market Trends

3.1.5. South America Heparin Market Trends

3.2. Heparin Market Dynamics

3.2.1. Global Heparin Market Drivers

3.2.2. Global Heparin Market Restraints

3.2.3. Global Heparin Market Opportunities

3.2.4. Global Heparin Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Heparin Industry

4. Heparin Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Heparin Market Size and Forecast, By Type (2024-2032)

4.1.1. Low Molecular Weight Heparin

4.1.2. Ultra-low Molecular Weight Heparin

4.1.3. Unfractionated Heparin

4.2. Heparin Market Size and Forecast, By Application (2024-2032)

4.2.1. Venous thromboembolism

4.2.2. Atrial Fibrillation

4.2.3. Renal Impairment

4.2.4. Coronary Artery Disease

4.2.5. others

4.3. Heparin Market Size and Forecast, By End-Use (2024-2032)

4.3.1. Inpatient

4.3.2. Outpatient

4.4. Heparin Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Heparin Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Heparin Market Size and Forecast, By Type (2024-2032)

5.1.1. Low Molecular Weight Heparin

5.1.2. Ultra-low Molecular Heparin

5.1.3. Unfractionated Heparin

5.2. North America Heparin Market Size and Forecast, By Application (2024-2032)

5.2.1. Venous thromboembolism

5.2.2. Atrial fibrillation

5.2.3. Renal impairment

5.2.4. Coronary artery disease

5.2.5. Others

5.3. North America Heparin Market Size and Forecast, By End-User (2024-2032)

5.3.1. Inpatient

5.3.2. Outpatient

5.4. North America Heparin Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Heparin Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Low Molecular Weight Heparin

5.4.1.1.2. Ultra-low Molecular Weight Heparin

5.4.1.1.3. Unfractionated Heparin

5.4.1.2. United States Heparin Market Size and Forecast, By Application (2024-2032)

5.4.1.2.1. Venous thromboembolism

5.4.1.2.2. Atrial fibrillation

5.4.1.2.3. Renal impairment

5.4.1.2.4. Coronary artery disease

5.4.1.2.5. others

5.4.1.3. United States Heparin Market Size and Forecast, By End-User (2024-2032)

5.4.1.3.1. Inpatient

5.4.1.3.2. Outpatient

5.4.2. Canada

5.4.2.1. Canada Heparin Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Low Molecular Weight Heparin

5.4.2.1.2. Ultra-low Molecular Weight Heparin

5.4.2.1.3. Unfractionated Heparin

5.4.2.2. Canada Heparin Market Size and Forecast, By Application (2024-2032)

5.4.2.2.1. Venous thromboembolism

5.4.2.2.2. Atrial fibrillation

5.4.2.2.3. Renal impairment

5.4.2.2.4. Coronary artery disease

5.4.2.2.5. others

5.4.2.3. Canada Heparin Market Size and Forecast, By End-User (2024-2032)

5.4.2.3.1. Inpatient

5.4.2.3.2. Outpatient

5.4.2.4. Mexico Heparin Market Size and Forecast, By Type (2024-2032)

5.4.2.4.1. Low Molecular Weight Heparin

5.4.2.4.2. Ultra-low Molecular Weight Heparin

5.4.2.4.3. Unfractionated Heparin

5.4.2.5. Mexico Heparin Market Size and Forecast, By Application (2024-2032)

5.4.2.5.1. Venous thromboembolism

5.4.2.5.2. Atrial fibrillation

5.4.2.5.3. Renal impairment

5.4.2.5.4. Coronary artery disease

5.4.2.5.5. others

5.4.2.6. Mexico Heparin Market Size and Forecast, By End-User (2024-2032)

5.4.2.6.1. Inpatient

5.4.2.6.2. Outpatient

6. Europe Heparin Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Heparin Market Size and Forecast, By Type (2024-2032)

6.2. Europe Heparin Market Size and Forecast, By Application (2024-2032)

6.3. Europe Heparin Market Size and Forecast, By End-User (2024-2032)

6.4. Europe Heparin Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Heparin Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Heparin Market Size and Forecast, By Application (2024-2032)

6.4.1.3. United Kingdom Heparin Market Size and Forecast, End-User (2024-2032)

6.4.2. France

6.4.2.1. France Heparin Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Heparin Market Size and Forecast, By Application (2024-2032)

6.4.2.3. France Heparin Market Size and Forecast, By End-User (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Heparin Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Heparin Market Size and Forecast, By Application (2024-2032)

6.4.3.3. Germany Heparin Market Size and Forecast, End-User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Heparin Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Heparin Market Size and Forecast, By Application (2024-2032)

6.4.4.3. Italy Heparin Market Size and Forecast, End-User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Heparin Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Heparin Market Size and Forecast, By Application (2024-2032)

6.4.5.3. Spain Heparin Market Size and Forecast, End-User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Heparin Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Heparin Market Size and Forecast, By Application (2024-2032)

6.4.6.3. Sweden Heparin Market Size and Forecast, By End-User (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Heparin Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Heparin Market Size and Forecast, By Application (2024-2032)

6.4.7.3. Austria Heparin Market Size and Forecast, By End-User (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Heparin Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Heparin Market Size and Forecast, By Application (2024-2032)

6.4.8.3. Rest of Europe Heparin Market Size and Forecast, By End-User (2024-2032)

7. Asia Pacific Heparin Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Heparin Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Heparin Market Size and Forecast, By Application (2024-2032)

7.3. Asia Pacific Heparin Market Size and Forecast, By End-User (2024-2032)

7.4. Asia Pacific Heparin Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Heparin Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Heparin Market Size and Forecast, By Application (2024-2032)

7.4.1.3. China Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Heparin Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Heparin Market Size and Forecast, By Application (2024-2032)

7.4.2.3. S Korea Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Heparin Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Heparin Market Size and Forecast, By Application (2024-2032)

7.4.3.3. Japan Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.4. India

7.4.4.1. India Heparin Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Heparin Market Size and Forecast, By Application (2024-2032)

7.4.4.3. India Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Heparin Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Heparin Market Size and Forecast, By Application (2024-2032)

7.4.5.3. Australia Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Heparin Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Heparin Market Size and Forecast, By Application (2024-2032)

7.4.6.3. Indonesia Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Heparin Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Heparin Market Size and Forecast, By Application (2024-2032)

7.4.7.3. Philippines Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Heparin Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Heparin Market Size and Forecast, By Application (2024-2032)

7.4.8.3. Malaysia Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Heparin Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Heparin Market Size and Forecast, By Application (2024-2032)

7.4.9.3. Vietnam Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Heparin Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Heparin Market Size and Forecast, By Application (2024-2032)

7.4.10.3. Thailand Heparin Market Size and Forecast, By End-User (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Heparin Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Heparin Market Size and Forecast, By Application (2024-2032)

7.4.11.3. Rest of Asia Pacific Heparin Market Size and Forecast, By End-User (2024-2032)

8. Middle East and Africa Heparin Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Heparin Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Heparin Market Size and Forecast, By Application (2024-2032)

8.3. Middle East and Africa Heparin Market Size and Forecast, By End-User (2024-2032)

8.4. Middle East and Africa Heparin Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Heparin Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Heparin Market Size and Forecast, By Application (2024-2032)

8.4.1.3. South Africa Heparin Market Size and Forecast, By End-User (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Heparin Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Heparin Market Size and Forecast, By Application (2024-2032)

8.4.2.3. GCC Heparin Market Size and Forecast, By End-User (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Heparin Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Heparin Market Size and Forecast, By Application (2024-2032)

8.4.3.3. Nigeria Heparin Market Size and Forecast, By End-User (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Heparin Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Heparin Market Size and Forecast, By Application (2024-2032)

8.4.4.3. Rest of ME&A Heparin Market Size and Forecast, By End-User (2024-2032)

9. South America Heparin Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Heparin Market Size and Forecast, By Type (2024-2032)

9.2. South America Heparin Market Size and Forecast, By Application (2024-2032)

9.3. South America Heparin Market Size and Forecast, By End-User (2024-2032)

9.4. South America Heparin Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Heparin Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Heparin Market Size and Forecast, By Application (2024-2032)

9.4.1.3. Brazil Heparin Market Size and Forecast, End-User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Heparin Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Heparin Market Size and Forecast, By Application (2024-2032)

9.4.2.3. Argentina Heparin Market Size and Forecast, By End-User (2024-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Heparin Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest of South America Heparin Market Size and Forecast, By Application (2024-2032)

9.4.3.3. Rest of South America Heparin Market Size and Forecast, By End-User (2024-2032)

10. Company Profile: Key Players

10.1. Pfizer Inc.

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Development

10.2. Amphastar Pharmaceuticals, Inc.

10.3. B. Braun Medical Inc.

10.4. Fresenius Kabi USA, LLC

10.5. Teva Pharmaceuticals USA, Inc.

10.6. Apotex Inc. – CSanofi S.A.

10.7. Aspen Pharmacare Holdings Limited

10.8. Rovi Pharma Industrial Services S.A.

10.9. Sandoz

10.10. Techdow Pharma

10.11. Laboratorios Farmacéuticos Rovi, S.A.

10.12. STADA Arzneimittel AG

10.13. Shenzhen Hepalink Pharmaceutical Co., Ltd.

10.14. Qianhong Bio-pharma Co., Ltd.

10.15. Nanjing King-friend Biochemical Pharmaceutical Co., Ltd.

10.16. Changzhou Qianhong Biopharma Co., Ltd.

10.17. Daewoong Pharmaceutical Co., Ltd.

10.18. Bharat Serums and Vaccines Ltd.

10.19. Biocon Ltd.

10.20. Samarth Life Sciences Pvt. Ltd.

10.21. Blau Farmacêutica S.A.

10.22. Eurofarma Laboratórios S.A.

10.23. Laboratorios Richmond S.A.C.I.F.

10.24. Grupo Biotoscana

10.25. Julphar

10.26. Tabuk Pharmaceuticals

10.27. Aspen Pharmacare

10.28. Pharco Pharmaceuticals

10.29. Leo Pharma A/S

10.30. Sanofi S.A.

11. Key Findings

12. Analyst Recommendations

13. Heparin Market: Research Methodology