Healthcare Analytics Market - Global Industry Analysis and Forecast (2025-2032)

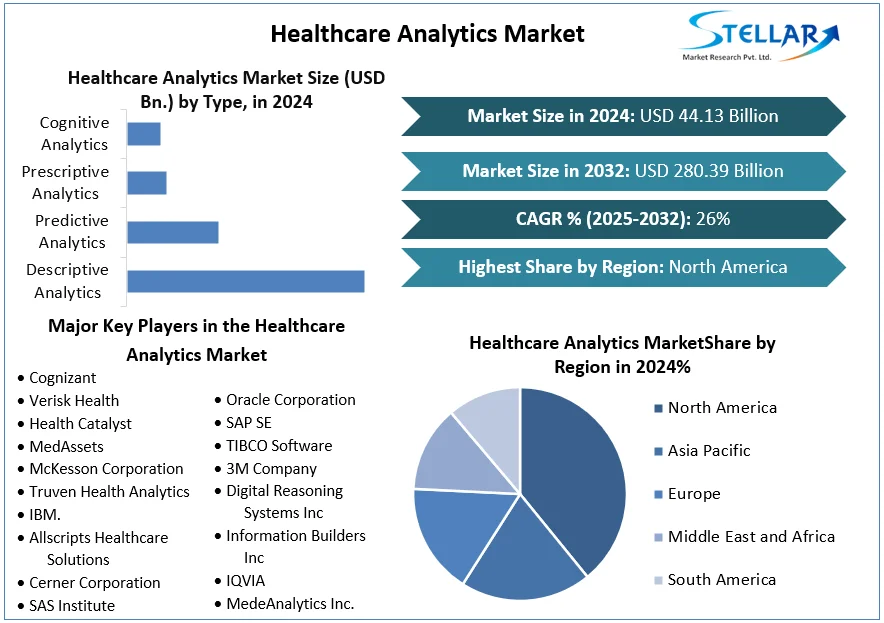

Healthcare Analytics Market size was valued at USD 44.13 Bn in 2024 and is expected to reach USD 280.39 Bn by 2032, at a CAGR of 26%.

Format : PDF | Report ID : SMR_2261

Healthcare Analytics Market Overview

Healthcare analytics is the process of collecting, managing, and analyzing healthcare data to uncover insights, trends, and patterns that are used to make informed decisions and improve patient outcomes. This involves the use of various quantitative and qualitative techniques to transform raw data into meaningful information that is used to enhance healthcare delivery, reduce costs, and optimize patient care. By leveraging health data analytics, healthcare organizations are able to better understand patient populations, identify high-risk individuals, optimize resource allocation, and develop personalized treatment plans. This approach leads to improved patient outcomes, reduced healthcare costs, and enhanced overall efficiency which drives healthcare market growth.

Healthcare fraud (HCF) is a significant financial burden on the healthcare system in the United States, accounting for an estimated $68 billion annually. Healthcare analytics help analyze claim patterns of different insurance policies or insurers and detect duplicate and phantom billing. The average cost of a healthcare data breach was $10.10 million in 2020, 9.4% higher than in 2021. This is the highest average cost across all industries, due to increased applications in detecting fraud and prevention of data healthcare analytics market is growing worldwide.

North America region dominates the healthcare analytics market, this is due to various factors such as increased spending, and better infrastructure. There are over 173,000 clinical laboratories in the United States. And over 7,300 active hospitals as of April 2024, these are major areas where healthcare analytics is used. increased numbers of labs and hospitals create demand for healthcare analytics tools which helps the market grow.

To get more Insights: Request Free Sample Report

Healthcare Analytics Market Dynamics

Big data analytics in healthcare reduces costs, enhances electronic health records, and boosts patient engagement, benefiting the healthcare analytics market.

Big data analytics is part of healthcare analytics which helps to detect the emergence of infectious disease outbreaks by sourcing data from public health records, social media reports, and internet searches. This allows for real-time tracking and mapping of outbreaks which helps the healthcare analytics market grow. The Centers for Medicare and Medicaid Services prevented over $210 million in healthcare fraud in one year using predictive analytics. Digitizing medical records through EHRs helps in substantial cost savings. An integrated EHR system has already saved an estimated $1 billion from reduced office visits and lab tests. Connected devices and wearables collect patient information such as heart rates and sleep habits which are used with other medical records for faster, more accurate diagnoses. big data analytics in healthcare help significant cost savings, improving EHRs, and engaging patients which has a positive impact on the market.

Technological Innovations and Investments Drive Healthcare Analytics Market Growth

Technological advancements significantly transform the healthcare analytics market and drive growth in this area.

- Microsoft introduced new healthcare-specific data solutions in its Fabric analytics platform to help healthcare organizations unify data across silos and generate insights.

- SAS launched a new enterprise analytics platform for healthcare that simplifies data management, improves governance, and accelerates patient insights.

- Microsoft introduced new healthcare-focused AI capabilities in Azure, including Generative AI models to summarize patient timelines, simplify clinical reports, and provide radiology insights. Customizable healthcare chatbots and virtual assistants that leverage AI models and credible data sources.

The use of technology resulted in increased productivity, as healthcare professionals are able to access relevant information more quickly and make more efficient use of their time, this drives healthcare analytics market growth. Investments and government spending on the healthcare industry are growing in many developing countries. DocPlix, a health-tech startup, raised Rs 1.2 crore (US$ 0.14 million) aiming to digitize health records for India's 1.4 billion population and enhance healthcare accessibility. IIT Bombay has partnered with Blockchain for Impact (BFI) to receive a $900,000 investment over three years. This funding will allow IIT Bombay to leverage its expertise in creating accessible and affordable healthcare technologies. Such investments and government spending help the market grow.

Dealing with Data Complexity, Privacy Issues, and Cost Control slows down the market growth.

In the healthcare Industry, the majority of data is unstructured. This data is typically fragmented, dispersed, and lacks standardization, making it challenging to aggregate and analyze even within the same organization. healthcare analytics market poses significant privacy concerns due to HIPAA legislation and the sensitive nature of the data, which is highly susceptible to cyber-attacks when centrally stored. Ensuring the privacy and security of healthcare data is crucial when implementing data analytics solutions. the expenses involved in securing, storing, and moving it from one location to another, as well as the costs of analyzing the data, remain high. These costs can quickly add up and become a significant burden for organizations that generate large amounts of data. The irregularity of EMR data, caused by patients' records being captured only during hospital visits, creates a "longitudinal patient matrix" structure. This uneven distribution of medical features and periods between visits makes it challenging to analyze and extract meaningful insights from the data effectively.

Healthcare Analytics Market Segment Analysis

Based on type Descriptive analytics held the highest market in 2024. The Healthcare Analytics Market is driven primarily by rising demand to improve patient outcomes in the healthcare sector. Descriptive analytics plays a crucial role in evaluating patient demographic information, healthcare facilities are able to better understand the needs of diverse populations and tailor their services accordingly. descriptive analytics help optimize resource allocation, reduce waste, and identify cost-saving opportunities by examining patterns in equipment, supply, and financial data. Descriptive analysis of claims data helps identify fraudulent or abusive billing patterns. By understanding typical utilization patterns, insurers are able to detect anomalies for further investigation.

Based on the end-user Life science companies dominated the healthcare analytics market in 2024, accounting for a revenue share of XX%. These companies are the largest users of analytical tools and platforms, leveraging them to reduce product costs, increase profit margins, improve product quality, and drive faster adoption and growth in the segment. Life science companies are constantly investing in enhancing their product portfolios and offerings to meet the demands of a wider population, which has led to an increased need for analytical tools to better understand and predict the market, and drive value-based decisions. Meanwhile, healthcare providers are anticipated to register the fastest growth rate of xx% through 2032, as the burden of delivering cost-effective care and better patient management is crucial for hospitals and healthcare professionals, especially during and after the COVID-19 pandemic. The need to manage patient records, disease surveillance, and provide cost-effective care to patients have been key factors in healthcare analytics market.

Healthcare Analytics Market Regional Insights

North America held the largest market share healthcare analytics market. This is due to region's cutting-edge healthcare facilities, widespread adoption of advanced platforms, and robust technological infrastructure. The increasing prevalence of chronic diseases and the aging population in North America have created a need for hospitals and other organizations to adopt healthcare analytics solutions to lower operational costs, promote innovations, and enhance the quality of care delivered. More than two-thirds of all deaths in the US are caused by chronic diseases. Chronic diseases account for 75% of the country's healthcare spending or an estimated $5,300 per person annually. Technological advancements in data analytics and the high density of prominent players operating in the regional market are further driving the expansion of the North America healthcare analytics market.

Healthcare Analytics Market Scope

|

Healthcare Analytics Market Scope |

|

|

Market Size in 2024 |

USD 44.13 Bn. |

|

Market Size in 2032 |

USD 280.39 Bn. |

|

CAGR (2025-2032) |

26% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments Analysis |

By Type Descriptive Analytics Predictive Analytics Prescriptive Analytics Cognitive Analytics |

|

By Component Services Hardware Software |

|

|

By Application Clinical Analytics Financial Analytics Operational & Administrative Analytics Population Health Analytics |

|

|

By End-User- Healthcare Payers Healthcare Providers Life Science Companies |

|

|

Regional Scope |

North America (United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa ( South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Healthcare Analytics Market Key Players

-

- Cognizant

- Verisk Health

- Health Catalyst

- MedAssets

- McKesson Corporation

- Truven Health Analytics

- IBM.

- Allscripts Healthcare Solutions

- Cerner Corporation

- SAS Institute

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- TIBCO Software

- 3M Company

- Digital Reasoning Systems Inc

- Information Builders Inc

- IQVIA

- MedeAnalytics Inc.

Frequently Asked Questions

Ans. North America is expected to dominate the Healthcare Analytics Market during the forecast period.

Ans. The Healthcare Analytics Market size is expected to reach USD 280.39 Billion by 2032.

Ans. The drivers of the healthcare analytics market include the increasing adoption of electronic health records (EHRs), the demand for improved patient outcomes and cost efficiency, and advancements in big data analytics technologies.

Ans The segments covered in the Healthcare Analytics Market report are based on Type, End-User, Component and Application, and region.

- Healthcare Analytics Market: Research Methodology

- Healthcare Analytics Market Introduction

- Study Assumption and Market Definition

- Scope of the Study

- Executive Summary

- Global Healthcare Analytics Market: Competitive Landscape

- SMR Competition Matrix

- Competitive Landscape

- Key Players Benchmarking

- Company Name

- Product Segment

- End-user Segment

- Revenue (2024)

- Company Headquarter

- Leading Healthcare Analytics Market Companies, by Market Capitalization

- Market Structure

- Market Leaders

- Market Followers

- Emerging Players

- Mergers and Acquisitions Details

- Healthcare Analytics Market: Dynamics

- Healthcare Analytics Market Trends

- Healthcare Analytics Market Dynamics

-

- Drivers

- Restraints

- Opportunities

- Challenges

-

- PORTER’s Five Forces Analysis

- PESTLE Analysis

- Regulatory Landscape by Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Healthcare Analytics Market: Global Market Size and Forecast (Value in USD Million) (2024-2032)

- Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Cognitive Analytics

- Healthcare Analytics Market Size and Forecast, By End-user (2024-2032)

- Healthcare Payers

- Healthcare Providers

- Life Sciences Companies

- Healthcare Analytics Market Size and Forecast, By Application (2024-2032)

- Clinical Analytics

- Financial Analytics

- Operational & Administrative Analytics

- Population Health Analytics

- Healthcare Analytics Market Size and Forecast, By Component (2024-2032)

- Services

- Hardware

- Software

- Healthcare Analytics Market Size and Forecast, by Region (2024-2032)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- North America Healthcare Analytics Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

- North America Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Cognitive Analytics

- North America Healthcare Analytics Market Size and Forecast, By End-user (2024-2032)

- Healthcare Payers

- Healthcare Providers

- Life Sciences Companies

- North America Healthcare Analytics Market Size and Forecast, By Application (2024-2032)

- Clinical Analytics

- Financial Analytics

- Operational & Administrative Analytics

- Population Health Analytics

- North America Healthcare Analytics Market Size and Forecast, By Component (2024-2032)

- Services

- Hardware

- Software

- North America Healthcare Analytics Market Size and Forecast, by Country (2024-2032)

- United States

- Canada

- Mexico

- North America Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- Europe Healthcare Analytics Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

- Europe Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- Europe Healthcare Analytics Market Size and Forecast, By End-user (2024-2032)

- Europe Healthcare Analytics Market Size and Forecast, By Application (2024-2032)

- Europe Healthcare Analytics Market Size and Forecast, By Component (2024-2032)

- Europe Healthcare Analytics Market Size and Forecast, by Country (2024-2032)

- United Kingdom

- France

- Germany

- Italy

- Spain

- Sweden

- Russia

- Rest of Europe

- Asia Pacific Healthcare Analytics Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

- Asia Pacific Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- Asia Pacific Healthcare Analytics Market Size and Forecast, By End-user (2024-2032)

- Asia Pacific Healthcare Analytics Market Size and Forecast, By Application (2024-2032)

- Asia Pacific Healthcare Analytics Market Size and Forecast, By Component (2024-2032)

-

- Asia Pacific Healthcare Analytics Market Size and Forecast, by Country (2024-2032)

- China

- S Korea

- Japan

- India

- Australia

- ASEAN

- Rest of Asia Pacific

- Asia Pacific Healthcare Analytics Market Size and Forecast, by Country (2024-2032)

- Middle East and Africa Healthcare Analytics Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

- Middle East and Africa Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- Middle East and Africa Healthcare Analytics Market Size and Forecast, By End-user (2024-2032)

- Middle East and Africa Healthcare Analytics Market Size and Forecast, By Application (2024-2032)

- Middle East and Africa Healthcare Analytics Market Size and Forecast, By Component (2024-2032)

- Middle East and Africa Healthcare Analytics Market Size and Forecast, by Country (2024-2032)

- South Africa

- GCC

- Nigeria

- Rest of ME&A

- South America Healthcare Analytics Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

- South America Healthcare Analytics Market Size and Forecast, By Type (2024-2032)

- South America Healthcare Analytics Market Size and Forecast, By End-user (2024-2032)

- South America Healthcare Analytics Market Size and Forecast, By Application (2024-2032)

- South America Healthcare Analytics Market Size and Forecast, By Component (2024-2032)

- South America Healthcare Analytics Market Size and Forecast, by Country (2024-2032)

- Brazil

- Argentina

- Rest Of South America

- Company Profile: Key Players

- Cognizant

- Company Overview

- Business Portfolio

- Financial Overview

- SWOT Analysis

- Strategic Analysis

- Recent Developments

- Verisk Health

- Health Catalyst

- MedAssets

- McKesson Corporation

- Truven Health Analytics

- IBM.

- Allscripts Healthcare Solutions

- Cerner Corporation

- SAS Institute

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- TIBCO Software

- 3M Company

- Digital Reasoning Systems Inc

- Information Builders Inc

- IQVIA

- MedeAnalytics Inc.

- Cognizant

- Key Findings

- Industry Recommendations