Electric Vehicle Charger Market Building the Infrastructure for the Electric Mobility Era

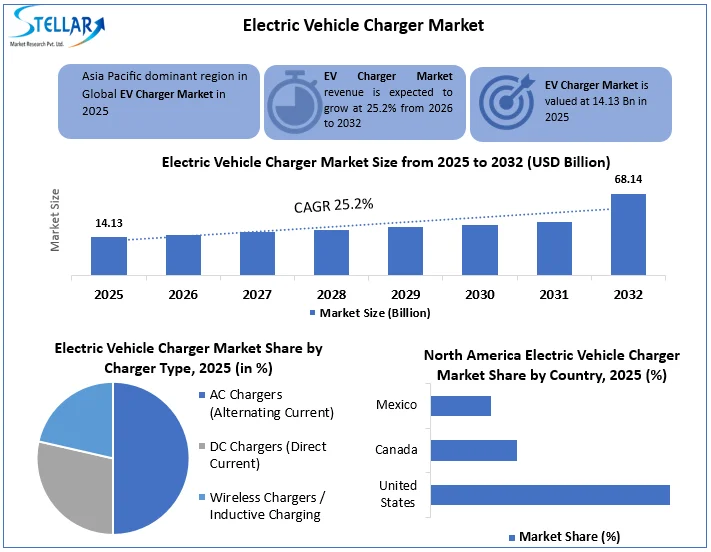

Electric Vehicle Charger Market Size is expected to reach USD 68.14 Bn by 2032 from USD 14.13 Bn. in 2025 at a CAGR of 25.2%

Format : PDF | Report ID : SMR_1152

Electric Vehicle Charger Market: Overview

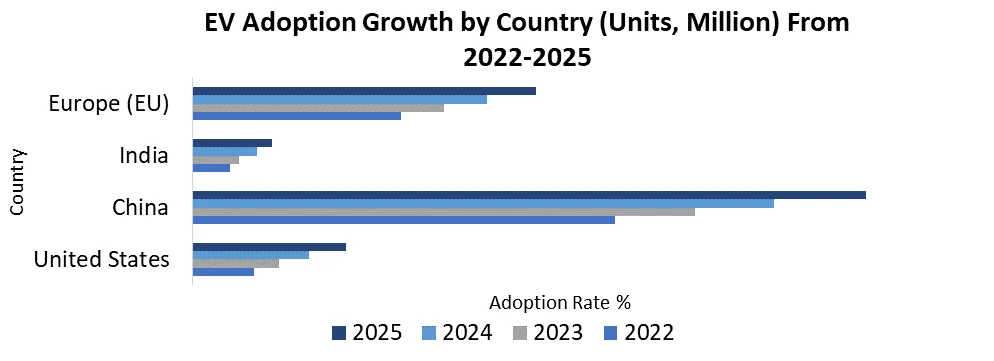

The global EV charger has evolved rapidly alongside the surge in electric vehicle (EV) adoption worldwide. Driven by advancements in AC Level 1 and Level 2 chargers, and DC fast charging infrastructure, the market has witnessed accelerated deployment along urban corridors, highways, and residential complexes. As of 2025, countries like the U.S., China, Germany, and India have significantly expanded their charging networks. For example, India’s public EV charging infrastructure rose from 5,151 units in 2022 to 29,277 by mid-2025, marking a 72% CAGR, reflecting global trends of rapid scaling. DC fast chargers represent over 20% of public ports in the U.S., while Level 2 chargers account for nearly 80%. With increasing demand from private, commercial, and fleet operators, the market is transitioning toward higher-power and multi-standard connectors such as CCS, CHAdeMO, and NACS.

Key Highlights

- Rapid EV Adoption: Rising electric vehicle sales globally, including 16.9% growth in India FY25, drive strong charger demand.

- Infrastructure Expansion: Over 12,000 chargers in the U.S., 29,277 in India, and growing networks in China, Europe, and the Middle East.

- High-Power Charging: Deployment of DC fast chargers up to 500 kW and modular solutions for heavy-duty vehicles.

- Government Support: Policies, subsidies, and programs like the U.S. NEVI Formula Program and India’s FAME scheme accelerate infrastructure growth.

- Fleet Electrification: Increasing electrification of commercial fleets fuels demand for durable, high-utilization charging solutions.

- Technological Innovation: Companies focus on interoperable connectors (CCS, CHAdeMO, NACS), wireless/inductive charging, and IoT-enabled networks.

- Key Players: Tesla, ChargePoint, ABB, Siemens, Electrify America, BP Pulse/Shell Recharge, Blink Charging, and others driving global market competition.

- Investment Focus: Major investments in charging infrastructure, including VinFast’s overseas plant in India (~US$1.83 Bn) and Tamil Nadu’s Rs. 50,000 crore (~US$5.84 Bn) EV projects.

To get more Insights: Request Free Sample Report

Electric Vehicle Charger Market Dynamics:

Driver: Rapid EV Adoption and Government Incentives

The global Electric Vehicle Charger Market is driven by the rapid adoption of electric vehicles, supported by government incentives, subsidies, and regulatory mandates to reduce carbon emissions. Countries such as the U.S., China, and India are expanding public and private charging infrastructure through strategic investments. Technological advancements in fast charging, such as DC chargers up to 500 kW, and standardization of connectors such as CCS, CHAdeMO, and NACS accelerate market penetration and consumer adoption.

Restraint: High Installation and Operational Costs

Despite growing demand, the deployment of DC fast charging stations faces high installation and operational costs, making large-scale infrastructure development challenging. Additional barriers include power grid limitations, extreme weather conditions, and inconsistent electrical infrastructure in emerging markets. Supply chain constraints for critical minerals such as lithium and cobalt also disrupt timely deployment, while regional variations in standards and connector types hinder universal compatibility and adoption rates.

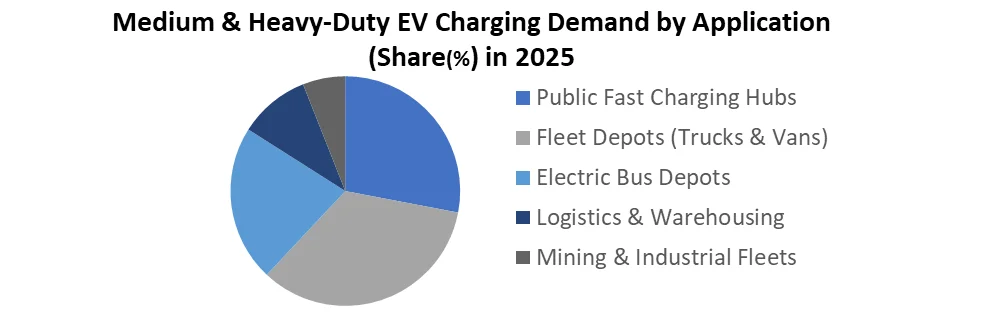

Opportunity: Expansion in Fleet and Heavy-Duty EV Charging

The rising adoption of medium- and heavy-duty EVs, including buses, trucks, and commercial fleets, presents significant market opportunities. Megawatt Charging Systems (MCS) capable of delivering up to 3.75 MW are being developed for high-throughput and overnight charging. Coupled with investments in workplace and public chargers, as well as innovative wireless/inductive charging solutions, this segment allows manufacturers and infrastructure providers to tap into emerging, high-demand markets globally, especially in regions with ambitious EV targets.

Electric Vehicle Charger Market Segment Analysis

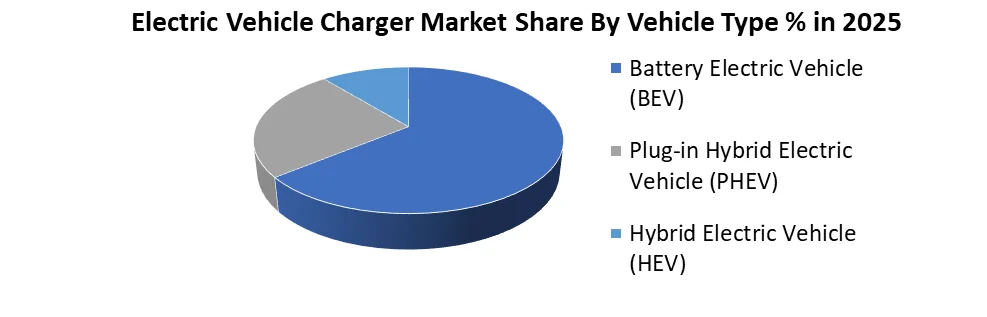

Battery Electric Vehicles (BEVs) dominated EV charger demand in 2025. As they rely entirely on external charging, driving strong deployment of home, public, and DC fast chargers. Plug-in Hybrid Electric Vehicles (PHEVs) support moderate charger demands due to partial electric operation and flexible charging needs. Hybrid Electric Vehicles (HEVs) have minimal impact, as they primarily use internal charging without external infrastructure dependency.

Electric Vehicle Charger Market Regional Analysis

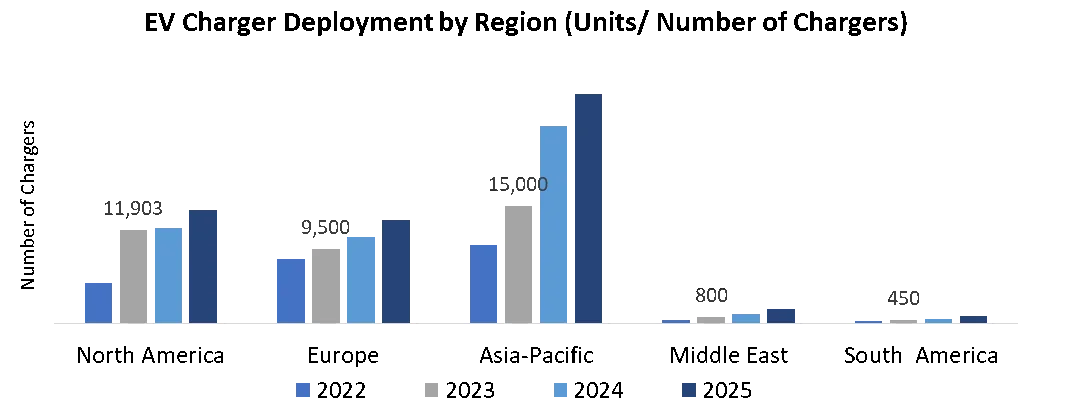

Asia Pacific region dominated the market in 2025. The global Electric Vehicle Charger Market is witnessing robust growth across regions, driven by government policies, strategic investments, and increasing EV adoption in passenger, commercial, and fleet segments. In North America, over 12,146 charging stations were operational in the U.S. as of February 2024, supported by federal initiatives such as the National Electric Vehicle Infrastructure (NEVI) Formula Program, with DC fast chargers expanding along highways and urban centers.

Europe is led by Germany and Norway in high-power DC charger deployment, while the adoption of the Open Charge Point Interface (OCPI) ensures interoperability across networks. In Asia-Pacific, India’s EV sales grew 16.9% in FY25, with public chargers reaching 29,277 by July 2025, and Tamil Nadu set to receive Nearly US$ 5.84 billion in EV investments. China is rapidly expanding AC Level 2 and DC fast charging infrastructure, Vietnam’s VinFast established its first overseas plant in India with a phased investment of USD 1.83 billion. The Middle East and South America focus on commercial and fleet electrification solutions.

Electric Vehicle Charger Market Competitive Landscape

The global Electric Vehicle Charger Market is competitive, with key players focusing on network expansion, technological innovation, and strategic partnerships. Tesla, Inc. leads with over 45,000 Superchargers globally and recently opened its network to non-Tesla vehicles through NACS adoption. ChargePoint Holdings, Inc. operates 115,000+ charging outlets across 14 countries, serving 1.2 million subscribers, offering AC Level 2 and DC fast chargers for residential, commercial, and public use. Electrify America has deployed 950+ stations with 4,250 DC fast connectors in the U.S., while ABB Ltd. and Siemens AG focus on modular ultra-fast and commercial solutions. BP Pulse / Shell Recharge plans 1,000+ ultra-fast hubs in the UK, and Blink Charging manages 78,000+ ports worldwide. Other notable players include Hyundai, Ather Energy, VinFast, EVBox, Schneider Electric, Delta Electronics, and Enel X. Strategic investments in IoT-enabled chargers, 400+kW fast charging, and fleet-focused infrastructure are driving market growth, supported by increasing EV adoption, public-private partnerships, and government incentives globally.

Global Electric Vehicle Charger Market Scope

|

Global Electric Vehicle Charger Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 14.13 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

25.2% |

Market Size in 2032: |

USD 68.14 Billion |

|

Electric Vehicle Charger Market Segment Analysis |

By Vehicle Type |

Battery Electric Vehicle (BEV) Plug-in Hybrid Electric Vehicle (PHEV) Hybrid Electric Vehicle (HEV) |

|

|

By Charging Type |

AC Chargers (Alternating Current) DC Chargers (Direct Current) Wireless Chargers / Inductive Charging |

||

|

By Charging Level / Speed |

Level 1 Chargers Level 2 Chargers Level 3 / DC Fast Chargers Ultra-Fast Chargers (>50 kW) |

||

|

By End User |

Residential Commercial |

||

Electric Vehicle Charger Market Key Players

- Tesla, Inc.

- ChargePoint Holdings, Inc.

- ABB Ltd.

- Siemens AG

- BP Pulse / Shell Recharge

- Electrify America

- Blink Charging Co.

- Wallbox

- Pod Point

- IONITY

- Star Charge

- EVBox

- EO Charging

- Nabtesco Technologies

- SolarPower EV

- FastChargingSolution

- EvoMotive

- Invenia

- GreenLime Chargers

- Lithium EV Systems

- BESEN Group

- BYD Co., Ltd.

- Panasonic

- Webasto

- Nichicon

- Leviton

- Eaton

- Schneider Electric

- DBT-CEV

- ClipperCreek

Frequently Asked Questions

AC Level 2 chargers dominate in residential and workplace settings, while DC fast chargers are witnessing faster growth due to demand from highways, urban hubs, and commercial fleet applications.

Asia-Pacific leads due to large-scale deployments in China and India, followed by Europe and North America, where strong policy support and infrastructure funding programs accelerate charger installations.

Major end users include residential consumers, commercial facilities, fleet operators, public charging network providers, municipalities, and logistics and public transport operators.

High installation costs, grid capacity constraints, interoperability issues, climate-related performance challenges, and supply chain disruptions for key components remain key market challenges

1. Electric Vehicle Charger Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Electric Vehicle Charger Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Headquarter

2.3.3. Product Portfolio

2.3.4. End-User

2.3.5. Total Company Revenue (2025)

2.3.6. Certifications

2.3.7. Global Presence

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

2.6. Recent Developments

2.7. Market Positioning & Share Analysis

2.7.1. Company Revenue, EV Charger Revenue, and Market Share (%)

2.7.2. SMR Competitive Positioning

2.8. Strategic Developments & Partnerships

2.8.1. Mergers, acquisitions, and joint ventures

2.8.2. Expansion into emerging markets

2.8.3. Strategic alliances with OEMs or system integrators

2.8.4. Investments in new production facilities

2.8.5. Sustainability initiatives and green product launches

3. Electric Vehicle Charger Market: Dynamics

3.1. Electric Vehicle Charger Market Trends

3.2. Electric Vehicle Charger Market Dynamics

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Middle East and Africa

3.2.5. South America

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulation By Region

4. Technology Trends

4.1.1. Smart Charging Solutions

4.1.2. IoT Integration

4.1.3. Wireless Charging

4.1.4. Vehicle-to-Grid (V2G)

4.1.5. Fast & Ultra-Fast Charging

4.1.6. Battery Swapping Integration

5. Government Policies & Incentives

5.1.1. Subsidies & Tax Benefits

5.1.2. EV Adoption Targets

5.1.3. Charging Infrastructure Regulations

5.1.4. Safety Standards

5.1.5. Import/Export Policies

5.1.6. Regional Policy Comparison

6. Strategic Initiatives by Companies

6.1.1. Partnerships & Collaborations

6.1.2. Mergers & Acquisitions

6.1.3. R&D Initiatives

6.1.4. New Product Launches

6.1.5. Geographic Expansion

6.1.6. Sustainability Initiatives

7. Investment Analysis

7.1.1. Investment Trends

7.1.2. Funding & VC Insights

7.1.3. Public vs Private Investments

7.1.4. Startup Opportunities

7.1.5. ROI Analysis

7.1.6. Key Investment Risks

7.1.7. Challenges & Risks

8. Infrastructure Bottlenecks

8.1.1. High Capital Costs

8.1.2. Standardization Issues

8.1.3. Cybersecurity & Data Privacy

8.1.4. Technological Barriers

8.1.5. Regional Market Risks

9. Electric Vehicle Charger Market: Global Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

9.1. Electric Vehicle Charger Market Size and Forecast, By Vehicle Type (2025-2032)

9.1.1. Battery Electric Vehicle (BEV)

9.1.2. Plug-in Hybrid Electric Vehicle (PHEV)

9.1.3. Hybrid Electric Vehicle (HEV)

9.2. Electric Vehicle Charger Market Size and Forecast, By Charging Type (2025-2032)

9.2.1. AC Chargers (Alternating Current)

9.2.2. DC Chargers (Direct Current)

9.2.3. Wireless Chargers / Inductive Charging

9.3. Electric Vehicle Charger Market Size and Forecast, By Charging Level / Speed (2025-2032)

9.3.1. Level 1 Chargers

9.3.2. Level 2 Chargers

9.3.3. Level 3 / DC Fast Chargers

9.3.4. Ultra-Fast Chargers (>50 kW)

9.4. Electric Vehicle Charger Market Size and Forecast, by End-use Industry (2025-2032)

9.4.1. Residential

9.4.2. Commercial

9.5. Electric Vehicle Charger Market Size and Forecast, by Region (2025-2032)

9.5.1. North America

9.5.2. Europe

9.5.3. Asia Pacific

9.5.4. Middle East and Africa

9.5.5. South America

10. North America Electric Vehicle Charger Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

10.1. North America Electric Vehicle Charger Market Size and Forecast, By Vehicle Type (2025-2032)

10.2. North America Electric Vehicle Charger Market Size and Forecast, By Charging Type (2025-2032)

10.3. North America Electric Vehicle Charger Market Size and Forecast, By Charging Level / Speed (2025-2032)

10.4. North America Electric Vehicle Charger Market Size and Forecast, by End-use Industry (2025-2032)

10.5. North America Electric Vehicle Charger Market Size and Forecast, by Country (2025-2032)

10.5.1. United States

10.5.2. Canada

10.5.3. Mexico

11. Europe Electric Vehicle Charger Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

11.1. Europe Electric Vehicle Charger Market Size and Forecast, By Vehicle Type (2025-2032)

11.2. Europe Electric Vehicle Charger Market Size and Forecast, By Charging Type (2025-2032)

11.3. Europe Electric Vehicle Charger Market Size and Forecast, By Charging Level / Speed (2025-2032)

11.4. Europe Electric Vehicle Charger Market Size and Forecast, by End-use Industry (2025-2032)

11.5. Europe Electric Vehicle Charger Market Size and Forecast, by Country (2025-2032)

11.5.1. United Kingdom

11.5.2. France

11.5.3. Germany

11.5.4. Italy

11.5.5. Spain

11.5.6. Sweden

11.5.7. Austria

11.5.8. Rest of Europe

12. Asia Pacific Electric Vehicle Charger Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

12.1. Asia Pacific Electric Vehicle Charger Market Size and Forecast, By Vehicle Type (2025-2032)

12.2. Asia Pacific Electric Vehicle Charger Market Size and Forecast, By Charging Type (2025-2032)

12.3. Asia Pacific Electric Vehicle Charger Market Size and Forecast, By Charging Level / Speed (2025-2032)

12.4. Asia Pacific Electric Vehicle Charger Market Size and Forecast, by End-use Industry (2025-2032)

12.5. Asia Pacific Electric Vehicle Charger Market Size and Forecast, by Country (2025-2032)

12.5.1. China

12.5.2. S Korea

12.5.3. Japan

12.5.4. India

12.5.5. Australia

12.5.6. Indonesia

12.5.7. Malaysia

12.5.8. Vietnam

12.5.9. Taiwan

12.5.10. Rest of Asia Pacific

13. Middle East and Africa Electric Vehicle Charger Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

13.1. Middle East and Africa Electric Vehicle Charger Market Size and Forecast, By Vehicle Type (2025-2032)

13.2. Middle East and Africa Electric Vehicle Charger Market Size and Forecast, By Charging Type (2025-2032)

13.3. Middle East and Africa Electric Vehicle Charger Market Size and Forecast, By Charging Level / Speed (2025-2032)

13.4. Middle East and Africa Electric Vehicle Charger Market Size and Forecast, by End-use Industry (2025-2032)

13.5. Middle East and Africa Electric Vehicle Charger Market Size and Forecast, by Country (2025-2032)

13.5.1. South Africa

13.5.2. GCC

13.5.3. Egypt

13.5.4. Nigeria

13.5.5. Rest of ME&A

14. South America Electric Vehicle Charger Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

14.1. South America Electric Vehicle Charger Market Size and Forecast, By Vehicle Type (2025-2032)

14.2. South America Electric Vehicle Charger Market Size and Forecast, By Charging Type (2025-2032)

14.3. South America Electric Vehicle Charger Market Size and Forecast, By Charging Level / Speed (2025-2032)

14.4. South America Electric Vehicle Charger Market Size and Forecast, by End-use Industry (2025-2032)

14.5. South America Electric Vehicle Charger Market Size and Forecast, by Country (2025-2032)

14.5.1. Brazil

14.5.2. Argentina

14.5.3. Chile

14.5.4. Colombia

14.5.5. Rest Of South America

15. Company Profile: Key Players

15.1. Tesla, Inc.

15.1.1. Company Overview

15.1.2. Business Portfolio

15.1.3. Financial Overview

15.1.4. SWOT Analysis

15.1.5. Strategic Analysis

15.1.6. Recent Developments

15.2. ChargePoint Holdings, Inc.

15.3. ABB Ltd.

15.4. Siemens AG

15.5. BP Pulse / Shell Recharge

15.6. Electrify America

15.7. Blink Charging Co.

15.8. Wallbox

15.9. Pod Point

15.10. IONITY

15.11. Star Charge

15.12. EVBox

15.13. EO Charging

15.14. Nabtesco Technologies

15.15. SolarPower EV

15.16. FastChargingSolution

15.17. EvoMotive

15.18. Invenia

15.19. GreenLime Chargers

15.20. Lithium EV Systems

15.21. BESEN Group

15.22. BYD Co., Ltd.

15.23. Panasonic

15.24. Webasto

15.25. Nichicon

15.26. Leviton

15.27. Eaton

15.28. Schneider Electric

15.29. DBT-CEV

15.30. ClipperCreek

16. Key Findings

17. Industry Recommendations

18. Electric Vehicle Charger Market: Research Methodology