Global EV Charging Market Size, Share & Industry Forecast (2026–2032) Residential, Commercial & Public Charging Infrastructure

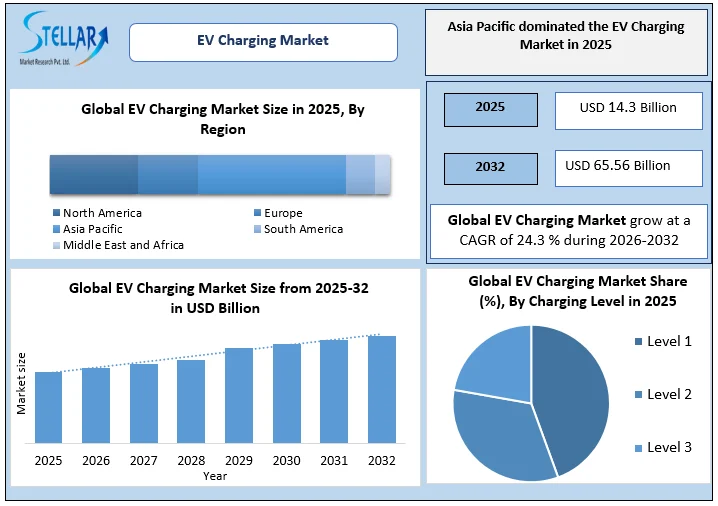

The Global EV Charging Market was valued at USD 14.3 billion in 2025 and is projected to reach USD 65.56 billion by 2032, growing at a CAGR of 24.3 % during the forecast period. Market growth is driven by rapid electric vehicle adoption, expansion of public fast and ultra-fast charging networks, supportive government policies, and rising investments in residential, commercial, and highway charging infrastructure.

Format : PDF | Report ID : SMR_2901

EV Charging Market Overview

The global EV charging market in 2025 continues to grow as electric vehicle adoption accelerates across passenger and commercial fleets. Demand is particularly strong for medium- and heavy-duty EV charging infrastructure, driven by urban logistics, last-mile delivery, and regional freight operations.

- In China, nearly 450 electric heavy-duty vehicle models were available in 2025, with more than half being buses and fleet vehicles. Battery swapping trials in concrete and freight sectors have accelerated EV adoption.

- The United States offered over 140 electric heavy-duty models, with around 50% medium-duty trucks, reflecting fleet operators’ focus on predictable, high-mileage routes. Yard tractors and drayage fleets in California are among early adopters of electric trucks.

- Europe had approximately 150 electric heavy-duty models, evenly split between buses, medium-, and heavy-duty trucks. Orders such as Amazon’s 200 Mercedes eActros-600 trucks and DHL’s Mercedes eActros 300s in Germany and the UK highlight the shift toward decarbonized logistics.

To get more Insights: Request Free Sample Report

Market Highlights

- High EV satisfaction: 91% of EV drivers would not return to petrol/diesel.

- Cost advantage: 86% find EVs cheaper to run; over half of new EV drivers switch for cost reasons.

- Improved charging network: 64% of drivers report better public charging over the past year.

- Home vs public charging divide: Drivers with home chargers (9/10) find EVs cheaper; only 5/10 for public-only users.

- Public charging availability: EV-to-public-charger ratio in Europe is 13:1, improving ~10% since 2023.

- Fast & ultra-fast charger growth: Ultra-fast chargers (150 kW+) rose 50% to 71,000, representing ~10% of all public fast chargers; 20% support 350 kW+.

- Policy support: EU regulations like AFIR and the Building Directive drive network expansion along major roads, improving convenience for EV users.

- Global public charging points exceed 3.7 million units, while private residential chargers surpass 14 million globally in 2025.

- High-speed DC chargers are being deployed for fleets covering 400+ km daily routes, including projects in India (UltraTech Cement ordering 100 electric trucks) and the U.S. (Tesla Semi pilot tested by DHL).

Market Dynamics

Government Incentives & Subsidies to drive the EV Charging Market

Government incentives and subsidies are pivotal in driving EV adoption in 2025. China’s EV100 program and commercial vehicle subsidies cover up to 30% of purchase costs, supporting orders for over 180,000 electric trucks. In the U.S., the NEVI program has allocated $5 billion for corridor chargers, alongside $40,000 tax credits per medium-duty EV truck. Europe offers subsidies covering up to 50% of charging infrastructure costs, enabling fleets like DHL and Amazon to expand electric deployments efficiently.

|

Country/Region |

Purchase Subsidy / Tax Incentive |

Charging Infrastructure Support |

|

China |

Purchase tax exemption up to ~¥30,000 per EV (reducing from 2026) and historic NEV subsidies; various local perks (e.g., license privileges) |

Major public charging expansion subsidies; tax breaks support infrastructure deployment |

|

United States |

Up to $7,500 federal EV tax credit; additional ~$2,000–$5,000 state rebates possible |

$5 billion NEVI program for corridor chargers; tax credits up to ~$40,000 for commercial EVs (fleets) |

|

European Union (general) |

Varies by member state – e.g., France up to $7,000 for EV purchase; Germany discussing subsidies; VAT & tax reductions in several countries |

Subsidies up to 50% of charger installation costs in many regions; targets for chargers every ~60 km on major roads (AFIR) |

|

France |

Up to $5,000–$7,000 eco-bonus; registration tax exemptions also apply |

VAT reductions and other incentives for home chargers; public network expansion funding |

|

United Kingdom |

Grants: up to $3,750 on eligible EVs under $37,000; reduced company car tax rates |

Grants for home & workplace chargers (~£500); local authority funds for charging access |

|

Norway |

VAT & import duty exemptions; low road tax and toll/parking perks |

Government support for charger installation; frequent fast chargers on major routes |

|

India |

FAME-II & related schemes: subsidies up to $1,800 USD on EVs, plus GST reduction (5% on EV vs higher on ICE) |

$24 million planned for fast-charger rollouts; state incentives (e.g., Maharashtra $7.2 million) |

High Capital Expenditure Limits the Growth of EV Charging Market

The high upfront cost of EV charging infrastructure remains a key barrier in 2025. DC fast chargers cost between $50,000 and $150,000 per unit, with additional grid upgrades raising total installation expenses by 20–30%. This limits adoption, particularly for small and medium fleet operators, and slows deployment in emerging markets where financing and government support are less robust.

Opportunity in EV Charging: Enhancing Revenue Streams and Grid Efficiency

Integrated energy solutions, such as solar-powered charging stations and Vehicle-to-Grid (V2G) technology, are emerging as key opportunities for fleet operators. These solutions offer the potential to lower energy costs by up to 25% while simultaneously generating additional revenue through grid services. By 2025, regions such as India, the Middle East, and South America are set to pilot V2G-enabled infrastructure, creating significant growth potential in both public and commercial EV charging markets. This shift presents a strategic opportunity to enhance grid efficiency while driving the expansion of the EV charging sector.

EV Charging Market Segment Analysis

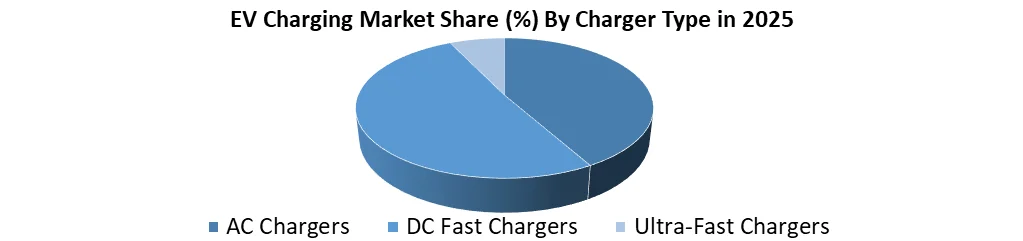

Based on Charger Type, The DC Fast Chargers segment dominated the EV Charging Market in 2025, due to their ability to charge EVs significantly faster than AC chargers, reducing downtime for users. Growing adoption of electric vehicles, especially in commercial and highway applications, and increasing government support for fast-charging infrastructure accelerated demand, making DC fast chargers the preferred choice over standard AC and emerging ultra-fast options.

Regional Analysis: EV Chagrining Market

Asia Pacific, led by China and India, dominated the global EV charging market in 2025. China installed over 450,000 new EV chargers, with medium- and heavy-duty trucks making up 55% of the commercial segment. Battery swapping initiatives and EV100 fleet programs accelerated adoption, particularly in logistics and concrete industries. India also gained traction, with UltraTech Cement ordering 100 electric trucks for 400 km routes, signaling strong fleet electrification.

North America: United States the U.S. added 140,000 chargers in 2025, driven by the $5 billion NEVI program. Medium-duty trucks lead adoption on predictable routes. California’s yard tractors and drayage fleets showcase early adoption, with Tesla Semi trials indicating growth in long-haul electrification.

Europe installed 150,000 chargers in 2025, distributed across buses, medium-, and heavy-duty trucks. Germany, France, and the UK are key markets, deploying models like Mercedes eActros and Amazon’s 200 electric trucks for high-mileage routes. EU alternative fuel directives support the expansion of public and private charging infrastructure.

Competitive Landscape: EV Charging Market 2025

The EV charging market in 2025 is highly competitive, driven by established automotive OEMs, energy companies, and specialised charging infrastructure providers. The market has seen rapid innovation in fast-charging technologies, interoperability solutions, and commercial fleet electrification strategies. Key players are focusing on expanding their global footprint, strategic partnerships, and scaling production to meet growing demand.

Top 5 Key Players & Strategic Outlook

- Tesla, Inc.

- Growth (2020–2025): Expanded Supercharger network to over 50,000 units globally, including medium- and heavy-duty fleet solutions.

- Strategies: Launching Tesla Semi for commercial fleets; integrating V2G technology and solar-powered charging solutions; expanding in North America, Europe, and Asia.

- ABB Ltd.

- Growth (2020–2025): Increased EV charger installations by 40% YoY, with DC fast chargers deployed across Europe, China, and North America.

- Strategies: Collaborating with fleet operators for large-scale deployments; focusing on interoperability and smart charging software; expanding into emerging markets.

- Siemens AG

- Growth (2020–2025): Installed over 30,000 charging units across Europe and Asia.

- Strategies: Developing high-capacity chargers for heavy-duty fleets; integrating AI-enabled charging management systems; targeting industrial and commercial sectors.

- ChargePoint Holdings, Inc.

- Growth (2020–2025): Added over 200,000 charging points globally, with strong presence in the U.S. and Canada.

- Strategies: Focus on cloud-based software for fleet management; partnerships with logistics companies; expanding into South America and Asia.

- ABB E-mobility / Shell Recharge Solutions

- Growth (2020–2025): Joint expansion of fast-charging corridors in Europe and North America; charging points exceeding 25,000.

- Strategies: Emphasizing public-private collaborations; integrating renewable energy sources; scaling high-power charging for medium- and heavy-duty trucks.

Market Trends & Developments by Countries

- China: Battery swapping trials and EV100 fleet programs boost commercial truck electrification.

- United States: NEVI program funds $5 billion for corridor chargers; Tesla Semi and yard tractors pilot adoption.

- Germany & UK: DHL and Amazon deploy high-mileage electric trucks; Mercedes eActros models expand regional fleet electrification.

- India: UltraTech Cement orders 100 trucks; Billion E-Mobility boosts production capacity for commercial EVs.

Recent Development:

|

Date |

Company |

Development Initiative |

Impact |

|

Apr-25 |

ChargePoint |

Announced new AC Level 2 charging technology |

Features bidirectional charging, V2X capability, ultra-fast speeds of 19.2 kW (NA) and 22 kW (EU); targets commercial, residential, and fleet applications |

|

Mar-25 |

BYD |

Launched Super e-Platform with megawatt flash charging technology |

Capable of 1,000 kW charging power & 2 km/second peak charging speed; includes all-liquid-cooled Megawatt Flash Charging terminal; plans 4,000+ MW flash charging stations in China |

|

Dec-24 |

ChargePoint & General Motors |

Collaboration to install up to 500 ultra-fast EV charging ports in the US |

GM Energy-branded stations with ChargePoint Express Plus (up to 500 kW) and Omni Port technology; supports CCS & NACS connectors for nationwide accessibility |

|

Feb-24 |

Tesla |

Supercharger network adopted as North America Charging Standard (NACS) |

Major automakers (GM US, Honda Japan, etc.) to transition to NACS by 2025, standardizing charging format across fleets |

|

Feb-24 |

Raizen Power & BYD |

Partnership to expand sustainable EV charging in Brazil |

Install ~600 new DC charge points, contributing 18 MW additional power; 100% clean energy; target 25% market share in Brazil's electromobility sector |

EV Charging Market Scope

|

Global EV Charging Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 14.3 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

24.3 % |

Market Size in 2032: |

USD 65.56 Billion |

|

EV Charging Market Segment Analysis |

By Charger Type |

AC Chargers DC Fast Chargers Ultra-Fast Chargers |

|

|

By Charging Level |

Level 1 Level 2 Level 3 |

||

|

By Power Rating |

<50 kW 50–150 kW >150 kW |

||

|

By Connector |

CHAdeMO CCS Type-2 / J1772 Others |

||

|

By End Use |

Passenger EVs Commercial EVs Heavy-Duty EVs Two-Wheelers |

||

EV Charging Market Key Players

- Tesla, Inc.

- ChargePoint Holdings, Inc.

- Shell Recharge

- BP Pulse

- Electrify America

- EVgo Services

- ABB Ltd.

- Siemens AG

- Schneider Electric

- Blink Charging Co.

- EVBox

- Eaton Corporation

- Alfen N.V.

- Allego N.V.

- Wallbox N.V.

- Tritium Pty Ltd

- Kempower

- Star Charge

- Delta Electronics

- Panasonic Corporation

- Bosch Automotive Service Solutions

- Enel X

- FLO

- Pod Point

- InstaVolt

- Beam Global

- Connected Kerb

- Toshiba Corporation

- Tata Power

- BYD Co., Ltd.

Frequently Asked Questions

Level 2 AC charging dominates in volume due to residential and workplace use, while DC fast charging leads in revenue growth due to highway and commercial deployment.

Asia-Pacific leads the market, supported by large-scale infrastructure deployment, strong policy support, and high EV penetration, particularly in China and emerging Asian economies.

High installation costs, grid capacity constraints, lack of interoperability standards, and uneven charging infrastructure distribution remain major challenges.

The EV charging market is expected to grow strongly, driven by ultra-fast charging, vehicle-to-grid (V2G) technology, smart charging systems, and increasing public-private investments.

1. EV Charging Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global EV Charging Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2025

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. EV Charging Market: Dynamics

3.1. EV Charging Market Trends

3.2. EV Charging Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Key Opinion Leader Analysis for the Global Industry

3.6. Analysis of Government Schemes and Initiatives for Industry

4. Regulatory and Policy Framework

4.1. Global EV Charging Regulations

4.2. Government Incentives and Subsidies

4.3. Emission Norms and Compliance

4.4. Grid and Energy Regulations

4.5. Standardization Initiatives

5. Technology Landscape

5.1. Smart Charging Technologies

5.2. Vehicle-to-Grid (V2G) Integration

5.3. AI-Based Load Management

5.4. Future Charging Innovations

6. Value Chain Analysis

6.1. Raw Material Suppliers

6.2. Charger Manufacturers

6.3. Software Providers

6.4. End-User Ecosystem

7. Pricing Analysis

7.1. Charger Cost Structure

7.2. Installation and Maintenance Costs

7.3. Regional Price Variations

7.4. Operating Cost Analysis

7.5. Pricing Trend Forecast

8. Investment and Funding Analysis

8.1. Public and Private Investments

8.2. Venture Capital and Strategic Funding

8.3. Government Funding Programs

8.4. Infrastructure Development Projects

8.5. ROI Analysis

9. Sustainability and Environmental Impact

9.1. Carbon Emission Reduction Impact

9.2. Renewable Energy-Powered Charging

9.3. Energy Efficiency Metrics

9.4. Lifecycle Environmental Assessment

9.5. ESG Considerations

10. EV Charging Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

10.1. EV Charging Market Size and Forecast, By Charger Type (2025-2032)

10.1.1. AC Chargers

10.1.2. DC Fast Chargers

10.1.3. Ultra-Fast Chargers

10.2. EV Charging Market Size and Forecast, By Charging Level (2025-2032)

10.2.1. Level 1

10.2.2. Level 2

10.2.3. Level 3

10.3. EV Charging Market Size and Forecast, By Power Rating (2025-2032)

10.3.1. <50 kW

10.3.2. 50–150 kW

10.3.3. >150 kW

10.4. EV Charging Market Size and Forecast, By Connector (2025-2032)

10.4.1. CHAdeMO

10.4.2. CCS

10.4.3. Type-2 / J1772

10.4.4. Others

10.5. EV Charging Market Size and Forecast, By End Use (2025-2032)

10.5.1. Passenger EVs

10.5.2. Commercial EVs

10.5.3. Heavy-Duty EVs

10.5.4. Two-Wheelers

10.6. EV Charging Market Size and Forecast, By Region (2025-2032)

10.6.1. North America

10.6.2. Europe

10.6.3. Asia Pacific

10.6.4. Middle East and Africa

10.6.5. South America

11. North America EV Charging Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

11.1. North America EV Charging Market Size and Forecast, By Charger Type (2025-2032)

11.2. North America EV Charging Market Size and Forecast, By Charging Level (2025-2032)

11.3. North America EV Charging Market Size and Forecast, By Power Rating (2025-2032)

11.4. North America EV Charging Market Size and Forecast, By Connector (2025-2032)

11.5. North America EV Charging Market Size and Forecast, By End Use (2025-2032)

11.6. North America EV Charging Market Size and Forecast, by Country (2025-2032)

11.6.1. United States

11.6.2. Canada

11.6.3. Mexico

12. Europe EV Charging Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

12.1. Europe EV Charging Market Size and Forecast, By Charger Type (2025-2032)

12.2. Europe EV Charging Market Size and Forecast, By Charging Level (2025-2032)

12.3. Europe EV Charging Market Size and Forecast, By Power Rating (2025-2032)

12.4. Europe EV Charging Market Size and Forecast, By Connector (2025-2032)

12.5. Europe EV Charging Market Size and Forecast, By End Use (2025-2032)

12.6. Europe EV Charging Market Size and Forecast, by Country (2025-2032)

12.6.1. United Kingdom

12.6.2. France

12.6.3. Germany

12.6.4. Italy

12.6.5. Spain

12.6.6. Sweden

12.6.7. Russia

12.6.8. Rest of Europe

13. Asia Pacific EV Charging Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

13.1. Asia Pacific EV Charging Market Size and Forecast, By Charger Type (2025-2032)

13.2. Asia Pacific EV Charging Market Size and Forecast, By Charging Level (2025-2032)

13.3. Asia Pacific EV Charging Market Size and Forecast, By Power Rating (2025-2032)

13.4. Asia Pacific EV Charging Market Size and Forecast, By Connector (2025-2032)

13.5. Asia Pacific EV Charging Market Size and Forecast, By End Use (2025-2032)

13.6. Asia Pacific EV Charging Market Size and Forecast, by Country (2025-2032)

13.6.1. China

13.6.2. S Korea

13.6.3. Japan

13.6.4. India

13.6.5. Australia

13.6.6. Indonesia

13.6.7. Malaysia

13.6.8. Philippines

13.6.9. Thailand

13.6.10. Vietnam

13.6.11. Rest of Asia Pacific

14. Middle East and Africa EV Charging Market Size and Forecast (by Value in USD Billion) (2025-2032)

14.1. Middle East and Africa EV Charging Market Size and Forecast, By Charger Type (2025-2032)

14.2. Middle East and Africa EV Charging Market Size and Forecast, By Charging Level (2025-2032)

14.3. Middle East and Africa EV Charging Market Size and Forecast, By Power Rating (2025-2032)

14.4. Middle East and Africa EV Charging Market Size and Forecast, By Connector (2025-2032)

14.5. Middle East and Africa EV Charging Market Size and Forecast, By End Use (2025-2032)

14.6. Middle East and Africa EV Charging Market Size and Forecast, by Country (2025-2032)

14.6.1. South Africa

14.6.2. GCC

14.6.3. Egypt

14.6.4. Nigeria

14.6.5. Rest of ME&A

15. South America EV Charging Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

15.1. South America EV Charging Market Size and Forecast, By Charger Type (2025-2032)

15.2. South America EV Charging Market Size and Forecast, By Charging Level (2025-2032)

15.3. South America EV Charging Market Size and Forecast, By Power Rating (2025-2032)

15.4. South America EV Charging Market Size and Forecast, By Connector (2025-2032)

15.5. South America EV Charging Market Size and Forecast, By End Use (2025-2032)

15.6. South America EV Charging Market Size and Forecast, by Country (2025-2032)

15.6.1. Brazil

15.6.2. Argentina

15.6.3. Colombia

15.6.4. Chile

15.6.5. Rest Of South America

16. Company Profile: Key Players

16.1. Tesla, Inc.

16.1.1. Company Overview

16.1.2. Business Portfolio

16.1.3. Financial Overview

16.1.4. SWOT Analysis

16.1.5. Strategic Analysis

16.1.6. Recent Developments

16.2. ChargePoint Holdings, Inc.

16.3. Shell Recharge

16.4. BP Pulse

16.5. Electrify America

16.6. EVgo Services

16.7. ABB Ltd.

16.8. Siemens AG

16.9. Schneider Electric

16.10. Blink Charging Co.

16.11. EVBox

16.12. Eaton Corporation

16.13. Alfen N.V.

16.14. Allego N.V.

16.15. Wallbox N.V.

16.16. Tritium Pty Ltd

16.17. Kempower

16.18. Star Charge

16.19. Delta Electronics

16.20. Panasonic Corporation

16.21. Bosch Automotive Service Solutions

16.22. Enel X

16.23. FLO

16.24. Pod Point

16.25. InstaVolt

16.26. Beam Global

16.27. Connected Kerb

16.28. Toshiba Corporation

16.29. Tata Power

16.30. BYD Co., Ltd.

17. Key Findings

18. Analyst Recommendations

19. EV Charging Market: Research Methodology