Elderly Walker Market Growth of Market Size, Market Dynamics, Trends, Segments and Forecast Period (2026-2032)

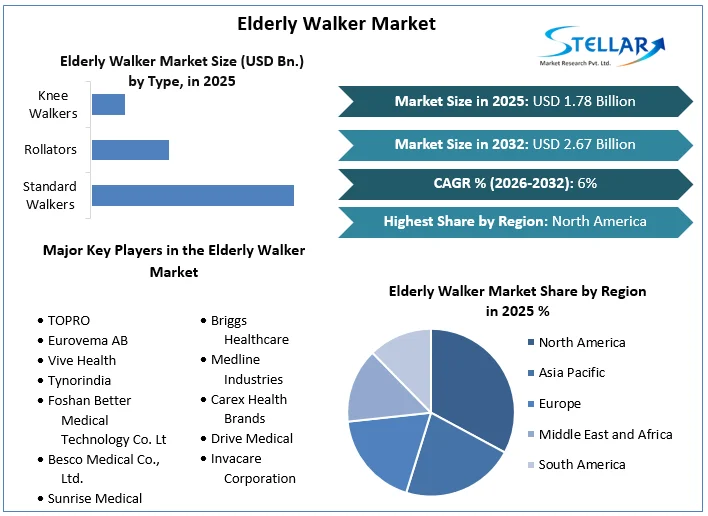

The Elderly Walker Market Size is valued at 1.78 billion in 2025 and is expected to reach 2.67 billion by the year 2032 at a 6 % CAGR during the forecast period for 2026-2032.

Format : PDF | Report ID : SMR_1398

Elderly Walker Market Overview

The ageing population and rising rates of chronic disorders that impair mobility are driving the growth of the elderly walker market. Type, end-use, and geography are used to segment the geriatric walker market. The market is divided into rollators, knee walkers, and normal walkers based on kind. The most popular kind of walker is a standard walker, followed by a rollator. People who temporarily have a condition or injury that impairs one leg use knee walkers. The market is divided into segments for hospitals, home care, and other end uses. Due to the rise in geriatric patients in hospitals, the hospital segment is anticipated to dominate the market throughout the forecasted period. Due to the increasing number of older individuals choosing to remain at home and get care from their relatives, the home care market is also anticipated to expand dramatically. During the projected period, the North American area is anticipated to lead the market, followed by the European and Asia Pacific regions. The dominance of the North American region is linked to the region's high prevalence of chronic diseases and growing elderly population. The market for geriatric walkers is expanding and has enormous potential. The primary factors driving market expansion are the increased prevalence of chronic diseases and the growing elderly population.

To get more Insights: Request Free Sample Report

market for elderly walkers is increasing. Mobility issues brought on by chronic conditions including Parkinson's, arthritis, and stroke may necessitate the use of geriatric walkers. An increasing number of people are becoming aware of the advantages of mobility aids, such as geriatric walkers, in preserving older individuals' independence and quality of life. The demand for these products is rising as a result. Governments all over the world are putting assistance and initiatives in place to assist senior citizens in maintaining their independence and leading active, healthy lives. Included in this is offering financial support for the purchase of mobility equipment. Companies that produce walkers for the elderly are continuously coming up with new ideas and creating new products with enhanced features and functionality. As a result, older walkers are more desirable to users, which is promoting market expansion.

Elderly Walker Market Opportunities

There is a chance for firms to create walker models that are more aesthetically pleasing, useful, and comfortable for the elderly. For instance, walkers with integrated seats, storage spaces, and braking systems are becoming more and more common. Companies can also provide walker solutions that are tailored to the specific requirements of older consumers. This can entail altering the walker's height, width, and other specifications to achieve a secure fit. Affordable walkers are required, and they must be available to all elderly users, regardless of their level of income. By employing less expensive materials or reducing the design, businesses can provide walkers that are more reasonably priced. Companies can promote their elderly walkers to carers, who frequently play a significant part in the choice to purchase. Walkers that are simple to travel, fold, and store may be what carers are looking for. Additionally, walkers with extra amenities like seats and storage spaces can be of appeal to them. To better understand the needs and preferences of geriatric people, market research must be done prior to designing or launching any new products. By doing this, you can be sure that your products are actually filling market demands. Promoting and selling geriatric walkers can benefit from the expertise of healthcare professionals like physicians, nurses, and physical therapists. Businesses can collaborate with healthcare professionals by offering them instructional materials and product information, as well as discounts or other rewards. Attending trade shows is an excellent method to network with other companies and find out about the newest trends in the elderly walker sector. By doing this, you may keep one step ahead of the competition and create new goods and services that cater to the changing needs of senior users.

Elderly Walker Market Challenges

The expense of healthcare is increasing globally, which is straining the finances of senior people and their families. As a result, it could be difficult for them to afford to buy pricey elderly walkers. In many nations, insurance companies do not pay for elderly walkers. Because of this, elderly people must pay for them out of pocket, which can be very expensive. In some regions of the world, senior citizens lack access to high-quality medical care. They could find it challenging to get fitted for an older walker or to get the right instruction on how to use it securely as a result. The shame attached to using mobility aids can deter elderly people from utilising geriatric walkers. In cultures where older people are supposed to be independent, this is particularly true. Many seniors are unaware of the advantages of utilising geriatric walkers. Additionally, they might not be knowledgeable about the various kinds of geriatric walkers that are offered or how to pick the best one for their requirements. Along with these difficulties, various mobility aids like wheelchairs and scooters are posing a growing threat to the elderly walker business. Although this competition is bringing down costs, it is also making it more challenging for makers of geriatric walkers to distinguish their goods from one another. The geriatric walker market is anticipated to expand over the next few years despite these obstacles. This is brought on by the ageing population and the rising prevalence of chronic illnesses that can impair mobility, such as Parkinson's disease and arthritis.

Elderly Walker Market Restraints

Elderly walkers, particularly those with cutting-edge technology, can be pricey. For some older people and their families, especially in underdeveloped nations, this can be a hurdle. Some older people might not be aware of the advantages of using a walker, or they could be hesitant to use one out of fear of embarrassment or losing their independence. Because elderly walkers are frequently mass-produced, not all users' specific demands may be met. For instance, due to height or weight limits, some older people might find it difficult to use a regular walker. If used improperly, elderly walkers might pose a threat to personal safety. For instance, the user may be at risk of falling if the walker is not set to the proper height or if they lack sufficient upper body strength. Medicare and other insurance companies could not fully cover the cost of geriatric walkers, which may make them more expensive for some users. In rural locations or impoverished nations, elderly walkers are not always easily accessible. Canes, crutches, and wheelchairs are just a few of the numerous mobility aids that are readily available. Depending on their particular needs and preferences, some older people may favour these alternatives to walkers.

Elderly Walker Market Trends

By 2050, there will be 1.6 billion people in the world who are 65 years of age or older, which will be a double of the current figure. The demand for goods and services that support the elderly, such as walkers and other mobility aids, is rising as a result. Ageing adults may find it challenging to walk freely if they have conditions like Parkinson's disease, arthritis, or a stroke. Walkers can offer the stability and assistance required to preserve mobility and independence. For senior people to preserve their health and wellbeing, exercise is crucial. Even if they have mobility issues, elderly people can benefit from increased exercise by using walkers. Foldable, lightweight walkers are more portable and convenient to store than regular walkers. The elderly can now utilise them more easily, especially when travelling or going out. There are now several older walkers available with extra amenities like chairs, baskets, and storage areas. These elements may increase the walker's adaptability and ease of use in daily life. Rollators are a four-wheeled type of walker. For older people with more severe mobility issues, they provide more stability and support than conventional walkers.

Elderly Walker Market Regional Analysis

North America: North America is expected to dominate the elderly walker market during the forecast period. The dominance of the region is attributed to the rising geriatric population, increasing prevalence of chronic diseases and favourable reimbursement policies.

Europe: Europe is expected to be the second-largest market for elderly walkers during the forecast period. The growth of the market in the region is attributed to the rising geriatric population, increasing prevalence of chronic diseases and growing awareness about the benefits of using elderly walkers.

Asia-Pacific: Asia-Pacific is expected to be the fastest-growing market for the elderly walkers during the forecast period. The growth of the market in the region is attributed to the rapidly increasing geriatric population, rising prevalence of chronic diseases and growing disposable incomes.

Latin America and the Middle East & Africa: Latin America and the Middle East & Africa are expected to be smaller markets for elderly walkers during the forecast period. However, the markets in these regions are expected to witness significant growth during the forecast period.

Elderly Walker Market Segment Analysis

By Type: Seniors with minor mobility impairments frequently utilise standard walkers, the most basic sort of walker. Rollators are more sophisticated walkers with wheels and brakes, which make them stable and easier to manoeuvre. Seniors who must keep one leg off the ground due to an accident or surgery utilise knee walkers.

By End-User: For their patients and residents, hospitals and home care organisations buy walkers. Walkers can also be purchased from retail establishments like pharmacies and medical supply shops.

Elderly Walker Market Competitive Landscape

In the upcoming years, the market for elderly walkers is anticipated to expand rapidly as a result of the ageing population and rising incidence of chronic illnesses that can impair mobility. The major market players, who are spending money on developing new products and increasing their distribution networks, are anticipated to be the main drivers of this expansion. The elderly walker market also includes a number of smaller businesses in addition to the major players mentioned above. These businesses often have a smaller selection of products, but they might be able to give more individualised service. It's crucial to take the person's demands and requirements into account while selecting an elderly walker. The individual's height, weight, strength, and degree of mobility should all be taken into account. It's crucial to pick a walker that is both comfortable and simple to use.

Besco Medical Co. Ltd.: The Company had a revenue of $5 million in 2022. Besco Medical, founded in 2009 and certified by ISO 13485 and CE, is one of the world's fastest-growing manufacturers and exporters of durable medical equipment from China, including wheelchairs, hospital beds, bathroom safety products, walking aids, oxygen concentrators, and PPE (protective cover all, KN95 masks, face shields, and goggles). Customers can be found all over the world, including in North America, Europe, Central America, South America, the Middle East, Asia, and Africa. BESCO manufactures and sells its goods.

TOPRP: TOPRO is a Norwegian manufacturer of mobility products for people with limited mobility.

Their products are particularly known for their design, user-friendliness and first-class quality. The Company had a revenue of $5 million in 2022.

Elderly Walker Market Scope Table

|

Elderly Walker Market |

|

|

Market Size in 2025 |

USD 1.78 Bn. |

|

Market Size in 2032 |

USD 2.67 Bn. |

|

CAGR (2026-2032) |

6 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

By End-User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Elderly Walker Market Key Players

- TOPRO

- Eurovema AB

- Vive Health

- Tynorindia

- Foshan Better Medical Technology Co. Ltd

- Besco Medical Co., Ltd.

- Sunrise Medical

- Briggs Healthcare

- Medline Industries

- Carex Health Brands

- Drive Medical

- Invacare Corporation

Frequently Asked Questions

The Elderly Walker Market CAGR in 2025 was US$ 1.78 billion.

The Elderly Walker Market CAGR in 2032 is expected to US$ 2.67 billion.

The segments of Type are Standard Walkers, Rollators and Knee Walkers.

6 percentage is the CAGR for the forecast period (2026-2032) of Elderly Walker Market.

1. Elderly Walker Market: Research Methodology

2. Elderly Walker Market: Executive Summary

3. Elderly Walker Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Elderly Walker Market: Dynamics

5.1. Market Trends

5.2. Market Drivers

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Technology Roadmap

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Elderly Walker Market Size and Forecast by Segments (by Value USD Billion)

6.1. Elderly Walker Market Size and Forecast, by Type (2025-2032)

6.1.1. Standard Walkers

6.1.2. Rollators

6.1.3. Knee Walkers

6.2. Elderly Walker Market Size and Forecast, by End User (2025-2032)

6.2.1. Hospital

6.2.2. Retail

6.2.3. Home Care

6.3. Elderly Walker Market Size and Forecast, by Region (2025-2032)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Elderly Walker Market Size and Forecast (by Value USD Billion)

7.1. North America Elderly Walker Market Size and Forecast, by Type (2025-2032)

7.1.1. Standard Walkers

7.1.2. Rollators

7.1.3. Knee Walkers

7.2. North America Elderly Walker Market Size and Forecast, by End User (2025-2032)

7.2.1. Hospital

7.2.2. Retail

7.2.3. Home Care

7.3. North America Elderly Walker Market Size and Forecast, by Country (2025-2032)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. Europe Elderly Walker Market Size and Forecast (by Value USD Billion)

8.1. Europe Elderly Walker Market Size and Forecast, by Type (2025-2032)

8.1.1. Standard Walkers

8.1.2. Rollators

8.1.3. Knee Walkers

8.2. Europe Elderly Walker Market Size and Forecast, by End User (2025-2032)

8.2.1. Hospital

8.2.2. Retail

8.2.3. Home Care

8.3. Europe Elderly Walker Market Size and Forecast, by Country (2025-2032)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. Austria

8.3.8. Rest of Europe

9. Asia Pacific Elderly Walker Market Size and Forecast (by Value USD Billion)

9.1. Asia Pacific Elderly Walker Market Size and Forecast, by Type (2025-2032)

9.1.1. Standard Walkers

9.1.2. Rollators

9.1.3. Knee Walkers

9.2. Asia Pacific Elderly Walker Market Size and Forecast, by End User (2025-2032)

9.2.1. Hospital

9.2.2. Retail

9.2.3. Home Care

9.3. Asia Pacific Elderly Walker Market Size and Forecast, by Country (2025-2032)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Elderly Walker Market Size and Forecast (by Value USD Billion)

10.1. Middle East and Africa Elderly Walker Market Size and Forecast, by Type (2025-2032)

10.1.1. Standard Walkers

10.1.2. Rollators

10.1.3. Knee Walkers

10.2. Middle East and Africa Elderly Walker Market Size and Forecast, by End User (2025-2032)

10.2.1. Hospital

10.2.2. Retail

10.2.3. Home Care

10.3. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, by Country (2025-2032)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Elderly Walker Market Size and Forecast (by Value USD Billion)

11.1. South America Elderly Walker Market Size and Forecast, by Type (2025-2032)

11.1.1. Standard Walkers

11.1.2. Rollators

11.1.3. Knee Walkers

11.2. South America Elderly Walker Market Size and Forecast, by End User (2025-2032)

11.2.1. Hospital

11.2.2. Retail

11.2.3. Home Care

11.3. South America Elderly Walker Market Size and Forecast, by Country (2025-2032)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. TOPRO

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Eurovema AB

12.3. Vive Health

12.4. Tynorindia

12.5. Foshan Better Medical Technology Co. Ltd

12.6. Besco Medical Co., Ltd.

12.7. Sunrise Medical

12.8. Briggs Healthcare

12.9. Medline Industries

12.10. Carex Health Brands

12.11. Drive Medical

12.12. Invacare Corporation

13. Key Findings

14. Industry Recommendations