Dysmenorrhea Treatment Market: Global Industry Analysis and Forecast (2025-2032)

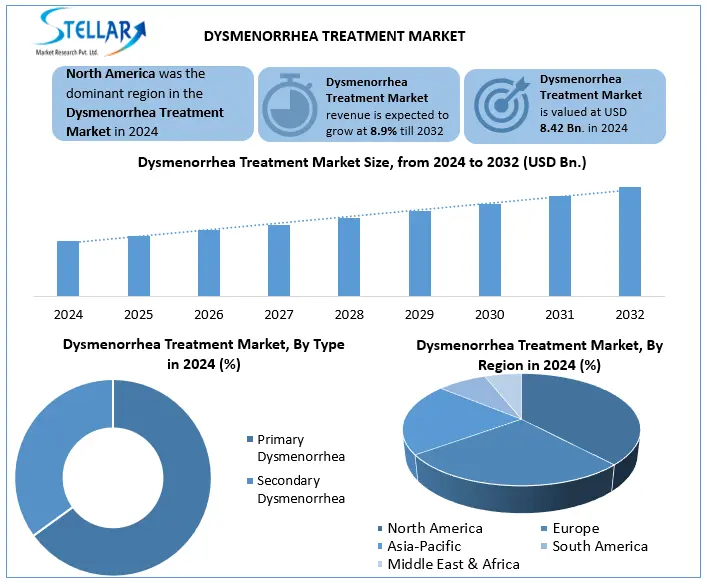

The Dysmenorrhea Treatment Market was valued at USD 8.42 Bn. in 2024. The Total Dysmenorrhea Treatment Market revenue is expected to grow by CAGR 8.9% from 2025 to 2032 and reach nearly USD 16.65 Bn. in 2032.

Format : PDF | Report ID : SMR_2782

Dysmenorrhea Treatment Market Overview:

Dysmenorrhea treatment is a process of managing and relieving menstrual pain due to uterine contractions, which are usually experienced during menstruation. It includes medical, hormonal, physical and sometimes surgical intervention, it depends on whether the condition is primary or secondary.

The dysmenorrhea treatment market has been increasing due to growing menstrual health awareness, increasing prevalence of menstrual pain and widespread access to both medicinal and non-drug remedies. Increase in cases of menstrual pain and awareness for the Dysmenorrhea treatment market. The dysmenorrhea treatment market is moving towards natural, non-hormonal therapy, tracking apps such as digital health equipment and telemedicine-based care. This change reflects the increasing demand for individual, technology-competent and safe treatment options on traditional drugs.

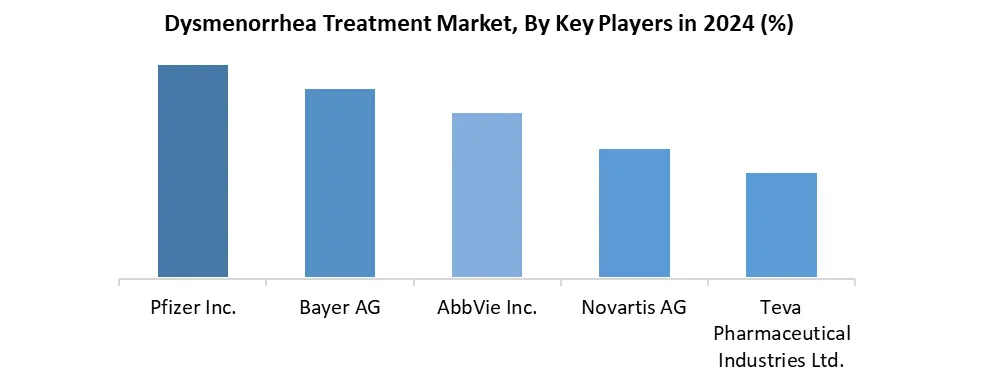

North America, especially the United States, is the largest consumer of Dysmenorrhea treatment due to access to high awareness and healthcare. North America dominated the Dysmenorrhea Treatment Market in 2024. Dysmenorrhea Treatment Market Key players are Pfizer Inc., Bayer AG, AbbVie Inc., Novartis AG and Teva Pharmaceutical Industries Ltd. On January 4, 2024, Merc uncontrolled the next generation of oral contraceptive targeting, indicating rapid investment in the harmon side relaying.

To get more Insights: Request Free Sample Report

Dysmenorrhea Treatment Market Dynamics:

Rising Menstrual Pain Cases and Awareness to Boost the Dysmenorrhea Treatment Market

As more women experience menstrual pain (dysmenorrhea), mainly in of young age groups, required effective treatment options. At the same time, awareness about menstruation is increasing due to education, media and public health initiatives. This combination is encouraging more women to receive medical treatments, which drives dysmenorrhea treatment and increases growth in the market. About 45% of individuals need medical care, and up to 50% miss school or work during menstruation, which disrupts the quality of life and contributes to anxiety or depression. Health campaigns, school programs and media efforts have reduced the stigma and encouraged women to seek medical help. Also, progress in treatment, like NSAIDs and hormonal contraceptives, are extended options for non-pharmacological options such as acupuncture and supplements. This is accelerating market growth, with support for assistant healthcare policies and women's health priorities.

R&D in Non-Hormonal & Herbal Therapies to Boost the Dysmenorrhea Treatment Market Growth

Many women are rapidly hesitant to depend on the long-term use of NSAIDs or hormonal contraceptives due to concerns about gastrointestinal, heart, or reproductive side effects. As a result, research institutes and pharmaceutical manufacturers are investing in non-hormonal and herbal remedies, such as ginger, fennel, cinnamon, chamomile and traditional East Asian formulas, which are gaining momentum because research values their therapeutic ability for dysmenorrhea. For example, ginger and fennel reduced menstrual pain, with ginger, comparable effectiveness appears for NSAIDs such as herbal extracts. These innovations not only diversify the treatment scenario, but also open the market for a few areas, such as women or traditional measures in areas with limited access to pharmaceuticals. Clinical testing and integrated medical studies make the efficacy of these treatments more valid, which helps them to obtain approval in mainstream gynaecological care.

Normalization of Menstrual Pain to Retrain the Dysmenorrhea Treatment Market Growth

Still nowadays, menstrual cramps are considered a natural or unavoidable aspect of womanhood rather than a medical condition that requires treatment of dysmenorrhea. Globally, dysmenorrhea affects 50–90% of women of reproductive age, also it is often dismissed as a "normal" part of a woman's life, causing significant underdiagnosis and broader self-management without medical guidance. Only 30% of the affected individuals take medical advice and more than half rely on informal copy strategies. Even within healthcare settings, symptoms are often downplayed or misattributed, resulting in delays or misdiagnosis of disease. Also, despite the availability of effective remedies and a big part of the affected population remains untreated, which limits the capacity of the market and slows down the adoption of both medicines and alternative treatment options.

Commercialization of Personalized Products to Create Opportunity in the Dysmenorrhea Treatment Market

The growing scientific evidence and rising government-endorsed research into personalized, non-hormonal therapies represent a major opportunity in the dysmenorrhea treatment market. Many women experience side effects or differences with hormonal contraceptives and NSAIDs, leading to a change towards natural and tailored options. Scientific research has valued many non-hormonal options, such as ginger, heat therapy, dietary change and the effectiveness of acupuncture, which are rapidly favored to their low-risk profiles. For example, ginger (750 2,000mg daily during menstruation) reduces menstrual pain more effectively than a placebo (mean difference –1.85, p=0.0003), with comparable results of NSAIDs and low side effects. By taking advantage of digital health equipment and biomarkers, companies personalize these treatments based on menstrual patterns, severity of pain and hormone sensitivity, which makes treatment more effective and accessible.

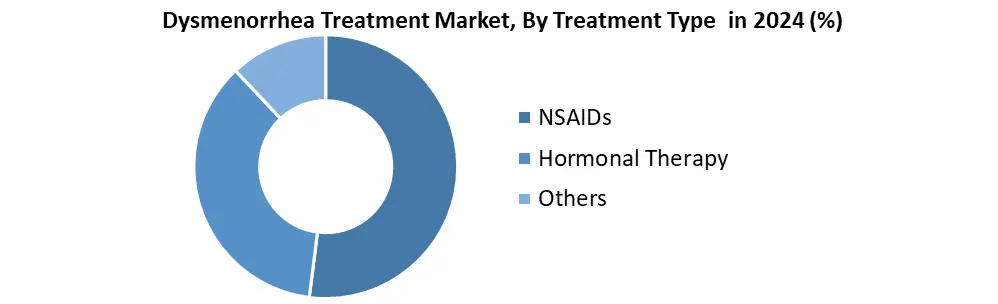

Dysmenorrhea Treatment Market Segment Analysis:

based on the treatment type, the market is divided into non-steroidal anti-inflammatory drugs (NSAIDs), hormonal therapy and others. Non-steroidal anti-inflammatory drugs (NSAIDs) dominated the Dysmenorrhea treatment market in 2024 and are expected to dominate the forecast period (2025–2032). 70% of women use NSAIDs with primary Dysmenorrhea conditions, which apply NSAIDs as the primary method of pain relief due to the rapid effectiveness of menstrual pain, comprehensive availability, and relatively cheap cost compared to others. NSAIDs work by preventing prostaglandin synthesis, substances such as hormones responsible for uterine contractions and pain during menstruation. As a result, they are often the first aid recommended by healthcare providers. Their over-the-counter access in most areas also contribute to their widespread use, especially among individuals who manage Dysmenorrhea without formal medical consultation.

Based on type, the dysmenorrhea treatment market is segmented into primary dysmenorrhea and secondary dysmenorrhea. The primary dysmenorrhea dominated the dysmenorrhea treatment market in 2024 and is expected to dominate the forecast period (2025–2032). This form of menstrual pain, which occurs without any underlying pelvic pathology in both women and girls, is more common than secondary dysmenorrhea and usually begins during adolescence. More than 90% of adolescent girls and more than 50% of women of reproductive age experience primary dysmenorrhea. Its high circulation is the main driver of market dominance, as it produces adequate demand for both over-the-counter and prescribed pain relief treatment.

Dysmenorrhea Treatment Market Regional Analysis

North America dominated the Dysmenorrhea Treatment Market in 2024 and is expected to dominate during forecast period (2025-2032)

In North America, mainly United States is a significant contributor in Dysmenorrhea Treatment Market. Because of the high frequency of menstrual syndromes in women of reproductive age, there is strong community awareness and access to human healthcare. The U.S. benefits from a well-established pharmaceutical industry for both over-the-counter NSAIDs and comprehensive availability of advanced prescription hormonal therapy and favorable compensation policies. The Current FDA approval of new medications such as Myfembree (relugolix combination therapy) has expanded the range of effective options.

The North America Challenge has limited access to special gynecological care in the rural and underserved regions, causing underdiagnosis and dependence on self-medication. This gap is driven by the short-term waiting time for OB-GYNs deficiency and expert appointments in non-urban areas.

Dysmenorrhea Treatment Market Competitive Landscape

Dysmenorrhea Treatment Market key players are Pfizer Inc., Bayer AG, AbbVie Inc., Novartis AG and Teva Pharmaceutical Industries Ltd., which are all focusing on innovation, drug approval and expansion of medical portfolio. Fizer Inc. reported a full year 2024 revenue of $ 63.6 billion, which increased by 7% year-on-year and demonstrated strong operating development in its portfolio, led by a comprehensive pain relief portfolio and strong global access. Bayer dominates the OTC section with reliable brands such as Midol. Dysmenorrhea treatment market trends include increasing attention on non-hormonal and individual remedies, an increase in OTC products, digital health partnerships, and an increase in competition from generic and natural remedies.

Recent Developments

- On December 1, 2022, Pfizer in the United state submitted a new application for primary dysmenorrhea for an extended-release NSAID, offering a 12-hour relief with low doses, enhanced compliance and expanding the pain management portfolio of their non-opioid women.

- On 15 June 2023, AbbVie in the United States launched a major awareness campaign for Mirena (levonorgestrel IUD), which promotes its off-labeled use to dysmenorrhea and emphasizes its hormonal, long-term solutions in women's reproductive health.

- On March 30, 2024, Novartis in Switzerland announced a new hormonal therapy, providing double benefits: contraceptive and dysmenorrhea relief. This product focuses on fewer side effects and long-term cycle control in women.

- On March 30, 2024, Novartis in Switzerland announced a new hormonal therapy, providing double benefits: contraceptive and dysmenorrhea relief. This product focuses on fewer side effects and long- term life cycle control in women.

|

Dysmenorrhea Treatment Market Scope |

|

|

Market Size in 2024 |

USD 8.42 Bn. |

|

Market Size in 2032 |

USD 16.65 Bn. |

|

CAGR (2025-2032) |

8.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Treatment Type Non-steroidal Anti-inflammatory Drugs (NSAIDs) Hormonal Therapy |

|

By Type Primary Dysmenorrhea Secondary Dysmenorrhea |

|

|

By Sales Channel Hospitals Clinics retail pharmacy Online pharmacy |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Dysmenorrhea Treatment Market Key players:

North America

- Pfizer Inc. (USA)

- AbbVie Inc. (USA)

- Johnson & Johnson (USA)

- Merck & Co., Inc. (USA)

- Teva Pharmaceuticals (Israel)

- Bayer AG (Germany)

Europe

- Novartis AG (Switzerland)

- Sanofi S.A. (France)

- GlaxoSmithKline plc (GSK) (UK)

- Grünenthal GmbH (Germany)

- Actavis Generics (now part of Teva) (Ireland)

Asia Pacific

- Zydus Lifesciences Ltd. (India)

- Daiichi Sankyo Co., Ltd. (Japan)

- Sun Pharmaceutical Industries Ltd. (India)

- Lupin Limited (India)

- Hisamitsu Pharmaceutical Co., Inc. (Japan)

- Takeda Pharmaceutical Company Ltd. (Japan)

Middle East and Africa

- Aspen Pharmacare (South Africa)

- Julphar (Gulf Pharmaceutical Industries) (UAE)

- Tabuk Pharmaceuticals (Saudi Arabia)

- Pharco Pharmaceuticals (Egypt)

- SAJA Pharmaceuticals (Saudi Arabia)

South America

- EMS Pharma (Brazil)

- Aché Laboratórios Farmacêuticos S.A. (Brazil)

- Laboratorios Bagó (Argentina)

- Laboratorios Richmond (Argentina)

- Eurofarma Laboratórios S.A. (Brazil)

Frequently Asked Questions

North America dominated the Dysmenorrhea Treatment Market in 2024, because of the high frequency of menstrual syndromes in women and there is strong community awareness and access to human healthcare.

Rising menstrual pain cases and awareness and R&D in Non-Hormonal & Herbal Therapies are driving the Dysmenorrhea Treatment Market.

The Pfizer Inc., Bayer AG, AbbVie Inc., Novartis AG and Teva Pharmaceutical Industries Ltd. are the Key Players in the global Dysmenorrhea Treatment Market.

1. Dysmenorrhea Treatment Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Dysmenorrhea Treatment Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. Sales Channel Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Dysmenorrhea Treatment Market: Dynamics

3.1. Dysmenorrhea Treatment Market Trends

3.2. Dysmenorrhea Treatment Market Dynamics

3.2.1. Dysmenorrhea Treatment Market Drivers

3.2.2. Dysmenorrhea Treatment Market Restraints

3.2.3. Dysmenorrhea Treatment Market Opportunities

3.2.4. Dysmenorrhea Treatment Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Dysmenorrhea Treatment Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

4.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

4.1.2. Hormonal Therapy

4.2. Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

4.2.1. Primary Dysmenorrhea

4.2.2. Secondary Dysmenorrhea

4.3. Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

4.3.1. Hospitals

4.3.2. Clinics retail pharmacy

4.3.3. Online pharmacy

4.4. Dysmenorrhea Treatment Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Dysmenorrhea Treatment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.1.2. Hormonal Therapy

5.2. North America Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.2.1. Primary Dysmenorrhea

5.2.2. Secondary Dysmenorrhea

5.3. North America Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.3.1. Hospitals

5.3.2. Clinics retail pharmacy

5.3.3. Online pharmacy

5.4. North America Dysmenorrhea Treatment Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.4.1.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.4.1.1.2. Hormonal Therapy

5.4.1.2. United States Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.4.1.2.1. Primary Dysmenorrhea

5.4.1.2.2. Secondary Dysmenorrhea

5.4.1.3. United States Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.4.1.3.1. Hospitals

5.4.1.3.2. Clinics retail pharmacy

5.4.1.3.3. Online pharmacy

5.4.2. Canada

5.4.2.1. Canada Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.4.2.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.4.2.1.2. Hormonal Therapy

5.4.2.2. Canada Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.4.2.2.1. Primary Dysmenorrhea

5.4.2.2.2. Secondary Dysmenorrhea

5.4.2.3. Canada Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.4.2.3.1. Hospitals

5.4.2.3.2. Clinics retail pharmacy

5.4.2.3.3. Online pharmacy

5.4.3. Mexico

5.4.3.1. Mexico Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.4.3.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.4.3.1.2. Hormonal Therapy

5.4.3.2. Mexico Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.4.3.2.1. Primary Dysmenorrhea

5.4.3.2.2. Secondary Dysmenorrhea

5.4.3.3. Mexico Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.4.3.3.1. Hospitals

5.4.3.3.2. Clinics retail pharmacy

5.4.3.3.3. Online pharmacy

6. Europe Dysmenorrhea Treatment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.2. Europe Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.3. Europe Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4. Europe Dysmenorrhea Treatment Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.1.2. United Kingdom Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.4.1.3. United Kingdom Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4.2. France

6.4.2.1. France Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.2.2. France Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.4.2.3. France Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.3.2. Germany Dysmenorrhea Treatment Market Size and Forecast, By Type 2025-2032)

6.4.3.3. Germany Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.4.2. Italy Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.4.4.3. Italy Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.5.2. Spain Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.4.5.3. Spain Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.6.2. Sweden Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.4.6.3. Sweden Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.7.2. Russia Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.4.7.3. Russia Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.4.8.2. Rest of Europe Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

6.4.8.3. Rest of Europe Dysmenorrhea Treatment Market Size and Forecast By Sales Channel (2024-2032)

7. Asia Pacific Dysmenorrhea Treatment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.2. Asia Pacific Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.3. Asia Pacific Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4. Asia Pacific Dysmenorrhea Treatment Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.1.2. China Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.1.3. China Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.2.2. S Korea Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.2.3. S Korea Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.3.2. Japan Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.3.3. Japan Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.4. India

7.4.4.1. India Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.4.2. India Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.4.3. India Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.5.2. Australia Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.5.3. Australia Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.6.2. Indonesia Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.6.3. Indonesia Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.7.2. Malaysia Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.7.3. Malaysia Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.8.2. Philippines Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.8.3. Philippines Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.9.2. Thailand Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.9.3. Thailand Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.10.2. Vietnam Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.10.3. Vietnam Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

7.4.11.3. Rest of Asia Pacific Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

8. Middle East and Africa Dysmenorrhea Treatment Market Size and Forecast (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

8.2. Middle East and Africa Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

8.3. Middle East and Africa Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

8.4. Middle East and Africa Dysmenorrhea Treatment Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

8.4.1.2. South Africa Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

8.4.1.3. South Africa Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

8.4.2.2. GCC Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

8.4.2.3. GCC Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

8.4.3.2. Egypt Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

8.4.3.3. Egypt Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

8.4.4.2. Nigeria Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

8.4.4.3. Nigeria Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

8.4.5.2. Rest of ME&A Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

8.4.5.3. Rest of ME&A Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

9. South America Dysmenorrhea Treatment Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

9.2. South America Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

9.3. South America Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

9.4. South America Dysmenorrhea Treatment Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

9.4.1.2. Brazil Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

9.4.1.3. Brazil Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

9.4.2.2. Argentina Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

9.4.2.3. Argentina Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

9.4.3.2. Colombia Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

9.4.3.3. Colombia Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

9.4.4.2. Chile Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

9.4.4.3. Chile Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

9.4.5. Rest of South America

9.4.5.1. Rest of South America Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

9.4.5.2. Rest of South America Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

9.4.5.3. Rest of South America Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

10. Company Profile: Key Players

10.1. Pfizer Inc. (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. AbbVie Inc. (USA)

10.3. Johnson & Johnson (USA)

10.4. Merck & Co., Inc. (USA)

10.5. Teva Pharmaceuticals (Israel)

10.6. Bayer AG (Germany)

10.7. Novartis AG (Switzerland)

10.8. Sanofi S.A. (France)

10.9. GlaxoSmithKline plc (GSK) (UK)

10.10. Grünenthal GmbH (Germany)

10.11. Actavis Generics (now part of Teva) (Ireland)

10.12. Zydus Lifesciences Ltd. (India)

10.13. Daiichi Sankyo Co., Ltd. (Japan)

10.14. Sun Pharmaceutical Industries Ltd. (India)

10.15. Lupin Limited (India)

10.16. Hisamitsu Pharmaceutical Co., Inc. (Japan)

10.17. Takeda Pharmaceutical Company Ltd. (Japan)

10.18. EMS Pharma (Brazil)

10.19. Aché Laboratórios Farmacêuticos S.A. (Brazil)

10.20. Laboratorios Bagó (Argentina)

10.21. Laboratorios Richmond (Argentina)

10.22. Eurofarma Laboratórios S.A. (Brazil)

10.23. Aspen Pharmacare (South Africa)

10.24. Julphar (Gulf Pharmaceutical Industries) (UAE)

10.25. Tabuk Pharmaceuticals (Saudi Arabia)

10.26. Pharco Pharmaceuticals (Egypt)

10.27. SAJA Pharmaceuticals (Saudi Arabia)

11. Key Findings

12. Industry Recommendations

13. Dysmenorrhea Treatment Market: Research Methodology