Duty-Free Retail Market Global Industry Analysis and Forecast (2026-2032)

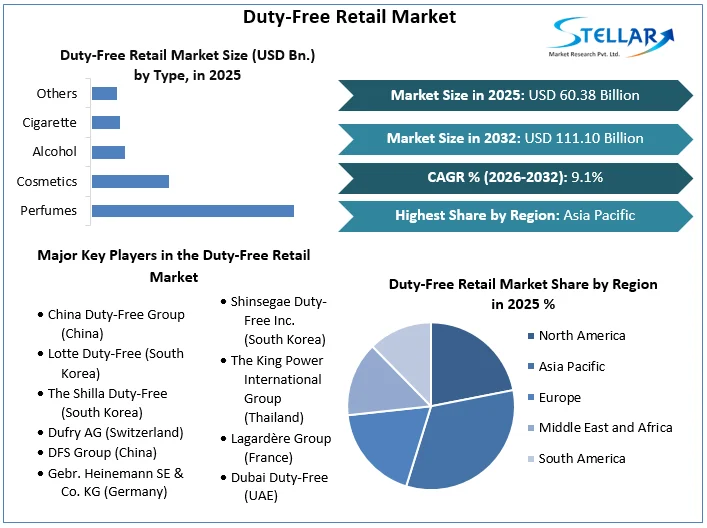

The duty-Free Retail Market was valued at USD 60.38 billion in 2025. Global Duty-Free Retail Market size is estimated to grow at a CAGR of 9.1 % over the forecast period.

Format : PDF | Report ID : SMR_1151

Duty-Free Retail Market Definition:

Duty-free retailing is the practice of making purchases at stores with no sales tax at airports, ferries, and cruise ports. To avoid paying taxes at foreign borders, visitors and tourists frequently shop at duty-free retail stores.

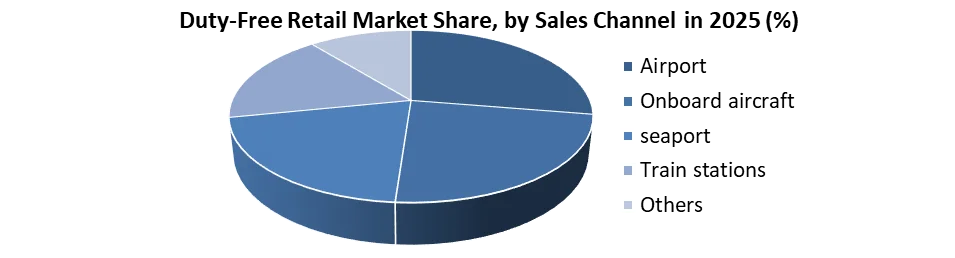

Further, the Duty-Free Retail market is segmented by Type, Sales Channel, and geography. Based on Type, the Duty-Free Retail market is segmented into Perfumes, Cosmetics, Alcohol, Cigarettes, and Others. Based on the Sales Channel, the Duty-Free Retail market is segmented under the channels of Airports, Onboard aircraft, seaports, train stations, and others. Based on the Distribution Channel, the Duty-Free Retail market is segmented under the channels Online and Offline. By geography, the market covers the following regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. For each segment, the market sizing and forecasts have been done based on (USD Billion).

To get more Insights: Request Free Sample Report

COVID-19 Impact: Significant Decline in Product Demand Observed Due to COVID-19 Pandemic

The international duty-free retail market growth has been adversely impacted by the COVID-19 pandemic. With airlines reducing their capacity and people avoiding travel internationally, the abrupt drop in air traffic, most notably in 2021, hindered both aeronautical and non-aeronautical revenue. Total airport revenues decreased by 35% to USD 14 billion in the first quarter of 2021 and by 90% to USD 39 billion in the second quarter of 2021, according to Airports Council International (ACI), a Canadian-based international platform for representing airport standards and market practices. Duty-free sales between these nations are likely to suffer shortly as a result of trade conflict and trade protectionism between China and Australia, the United States, and other trading partners. Governments are likely to implement a trade protectionist policy to ease social tensions or any unrest brought on by the COVID-19 pandemic's effects on employment and social inequality. One of the sectors most severely impacted by the COVID-19 situation is tourism. China International Travel Service (CITS), a Chinese travel agency company, reported a reduction of % to USD 1.08 billion (7.63 billion yuan) in the first quarter of 2021, moving from a profit of USD 0.36 to a net loss of USD 18.89 million (120.14 million yuan).

Duty-Free Retail Market Dynamics:

Rapidly Expanding International Tourism Market To favor market growth:

New international airports are being built all over the world, opening up significant economic opportunities for those working in the sector. For instance, the Airport Authority of India (AAI), a governmental organization in India that manages 125 airports, issued construction permission in February 2021 for the first phase of an international airport called "Dholera" in Gujarat for USD 135.07 million (INR 987 crore). According to the International Aviation Summit 2019, India would have 190–200 operational airports by the year 2040, as stated in the Civil Aviation Ministry's "Indian Aviation's Vision 2040." Delhi and Mumbai will each have three international airports, compared to two operational airports for each of the top 31 Indian cities. By March 2040, there should be 2,359 aircraft instead of the 622 that traveled over India in 2018.

Increased Number of New Air Routes in Asian Nations to Promote Entry of New Players

As the COVID-19 crisis causes the world's borders to gradually reopen, numerous airlines from various nations are growing their international networks and opening new airports. Shortly, this feature is likely to boost the entry of new players, particularly from Asia. China will start a new round of airport construction projects in 2022, according to the International Times, a Chinese English-language publication. The projects include both airport construction and airport growth. For instance, the fourth phase of the growth project for Shanghai Pudong International Airport officially started in January 2022. By 2029, the airport is likely to handle 130 million passengers annually.

Currency Fluctuations to Hamper Product Demand Internationally

The exchange rates between nations have an impact on duty-free markets. They are impacted by changes in the market even though they operate in various nations and frequently trade in a variety of currencies, including the specific exchange rates for the Euro, Dollar, and British Pound. These currencies are converted using the current day's exchange rate. Depending on the fluctuating exchange rate, duty-free retail firms, notably retail chains that sell luxury products, may be positively or negatively impacted by currency exchange changes in the market. One of the key external causes driving economic inflation is the unpredictability of currency rates amid the COVID-19 pandemic.

Duty-Free Retail Market Segment Analysis:

By Type, Demand for perfumes will increase due to consumers' growing preference for premium and luxury goods.

The international market is divided into categories according to kind, including cigarettes, alcohol, cosmetics, and perfumes. Throughout the projected period, the perfumes segment is likely to hold a majority of the market share. Luxury fragrances are distributed through well-known international networks to duty-free shops all around the world. To purchase perfumes from internationally renowned names like Giorgio Armani, Al Haramain Dazzle Intense, Belle, Signature Rose, Signature Silver, and Khulasat Al Oud, affluent international tourists frequently visit duty-free retail chains. All perfume types, including Perfume or De Perfume, Eau De Perfume (EDP), Eau De Toilette (EDT), and Eau De Cologne, are available through major distribution channels (EDC).

By Sales Channel,

Increasing Number of Stores at Airports Around the World to Speed Up Product Sales

Airports, shipboard, seaports, train stations, and other locations make up the market segmentation based on the sales channel. overall product sales are dominated by airports. Product sales through this distribution channel are favored by the expanding number of domestic and international airports throughout nations. The growing number of duty-free shops in airports around the world is highlighted by several advancements under the "airports" category. For instance, the Adani Group, an Indian integrated corporate conglomerate, and Flemingo, a Dubai-based operator, said in April 2022 that they intended to open a duty-free shop at Thiruvananthapuram International Airport by the middle of May 2022. This tactical step (new establishment) also draws attention to the escalating rivalry in the Indian market. Additionally, seaports play a significant role in the distribution of duty-free goods, particularly in Asian markets. Similar to airports, seaports help brands of different items become more visible on markets. Seaport-related recent developments offer attractive commercial opportunities for potential market participants For instance, the Ministry of Tourism's subsidiary India Tourism Development Corporation Ltd (ITDC) said in November 2017 that it intended to open duty-free stores in all major seaports by the year 2024.

Duty-Free Retail Market Regional Insights:

The Asia Pacific duty-free retail market is expected to expand significantly. Recent events in several Asian nations may present possibilities for current and future duty-free retailers to introduce a wide range of cutting-edge goods. To develop the Hainan Free Trade Port (Hainan FTP) on the nation's southern coast, for instance, the central government of China declared several initiatives in its master plan dated June 1, 2020. The government also disclosed its goal of elevating Hainan FTP to the status of a world-class free trade port by 2050. In the upcoming years, this strategic decision will likely benefit domestic retail chains that provide a broad range of Duty-Free Retail products.

In the future tremendous growth is expected in Europe. A major factor supporting the growth of the area market is rising tourist spending on luxury products. The relaxation of COVID-19 limitations has led to airports in European nations being set up to draw travelers and passengers to Duty-Free Retail stores on their route to the departure lounge, as is the case in other international markets. Such arrangements are likely to encourage passengers to make discretionary purchases, which will increase product sales in the ensuing years.

The North America Duty-Free retail sector, which is dominated by the United States, is primarily propelled by an influx of tourists and astronomically high U.S. travel spending. The U.S. Travel Association reports that with almost 2.3 billion trips made by people each year, domestic travel in the US increased by 1.7% in 2020 compared to 2021. One of the major contributors to the North American market in Canada. Duty-free shops are present in about 53 places across Canada, including international airports and locations near land borders, according to the Canada Border Services Agency (CBSA).

Middle Eastern duty-free retail sales are most popular in the UAE. The most popular tourist destinations in the globe right now include Dubai. Additionally, this nation is home to some of the largest Duty-Free Retail establishments in the globe. Due to the growing customer demand for high-end/luxury perfumes, product sales are expected to increase across the South American, Middle Eastern, and African markets over the period.

Duty-Free Retail Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Global Duty-Free Retail market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Duty-Free Retail market and how these trends will influence new business investments and market development throughout the period. The report also aids in the comprehension of the Global Duty-Free Retail Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Duty-Free Retail market report is to help understand which market segments, and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Duty-Free Retail market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Global Duty-free Retail market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Global Duty-Free Retail market. The report also analyses if the Global Duty-Free Retail market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Duty-Free Retail market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Global Duty-Free Retail market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Global Duty-Free Retail market is aided by legal factors.

Duty-Free Retail Market Scope:

|

Duty-Free Retail Market |

|

|

Market Size in 2025 |

USD 60.38 Bn. |

|

Market Size in 2032 |

USD 111.10 Bn. |

|

CAGR (2025-2032) |

9.1% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

By Sales Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Duty-Free Retail Market Key Players:

- China Duty-Free Group (China)

- Lotte Duty-Free (South Korea)

- The Shilla Duty-Free (South Korea)

- Dufry AG (Switzerland)

- DFS Group (China)

- Gebr. Heinemann SE & Co. KG (Germany)

- Shinsegae Duty-Free Inc. (South Korea)

- The King Power International Group (Thailand)

- Lagardère Group (France)

- Dubai Duty-Free (UAE)

Regional Breakdown:

Asia pacific duty-free retail Market: Industry Analysis and Forecast (2024-2030)

Europe Duty-free Retail Market: Industry Analysis and Forecast (2024-2030)

North America duty-free retail Market: Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

The Asia Pacific region is expected to hold the highest share in the Global Duty-Free Retail Market.

The market size of the Global Duty-Free Retail Market by 2032 is expected to reach USD 111.10 Billion.

The forecast period for the Global Duty-Free Retail Market is 2026-2032.

The market size of the Global Duty-Free Retail Market in 2025 was valued at USD 60.38 Billion.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Duty-Free Retail Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Duty-Free Retail Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. New Product Launches and Innovations

4. Duty-Free Retail Market: Dynamics

4.1. Duty-Free Retail Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Duty-Free Retail Market Drivers

4.3. Duty-Free Retail Market Restraints

4.4. Duty-Free Retail Market Opportunities

4.5. Duty-Free Retail Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Duty-Free Retail Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Duty-Free Retail Market Size and Forecast, by Type (2025-2032)

5.1.1. Perfumes

5.1.2. Cosmetics

5.1.3. Alcohol

5.1.4. Cigarette

5.1.5. Others

5.2. Duty-Free Retail Market Size and Forecast, by Sales Channel (2025-2032)

5.2.1. Airport

5.2.2. Onboard aircraft

5.2.3. seaport

5.2.4. Train stations

5.2.5. Others

5.3. Duty-Free Retail Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Duty-Free Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Duty-Free Retail Market Size and Forecast, by Type (2025-2032)

6.1.1. Perfumes

6.1.2. Cosmetics

6.1.3. Alcohol

6.1.4. Cigarette

6.1.5. Others

6.2. North America Duty-Free Retail Market Size and Forecast, by Sales Channel (2025-2032)

6.2.1. Airport

6.2.2. Onboard aircraft

6.2.3. seaport

6.2.4. Train stations

6.2.5. Others

6.3. North America Duty-Free Retail Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Duty-Free Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Duty-Free Retail Market Size and Forecast, by Type (2025-2032)

7.2. Europe Duty-Free Retail Market Size and Forecast, by Sales Channel (2025-2032)

7.3. Europe Duty-Free Retail Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Duty-Free Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Duty-Free Retail Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Duty-Free Retail Market Size and Forecast, by Sales Channel (2025-2032)

8.3. Asia Pacific Duty-Free Retail Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Duty-Free Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Duty-Free Retail Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Duty-Free Retail Market Size and Forecast, by Sales Channel (2025-2032)

9.3. Middle East and Africa Duty-Free Retail Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Duty-Free Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Duty-Free Retail Market Size and Forecast, by Type (2025-2032)

10.2. South America Duty-Free Retail Market Size and Forecast, by Sales Channel (2025-2032)

10.3. South America Duty-Free Retail Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. China Duty-Free Group (China)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Lotte Duty-Free (South Korea)

11.3. The Shilla Duty-Free (South Korea)

11.4. Dufry AG (Switzerland)

11.5. DFS Group (China)

11.6. Gebr. Heinemann SE & Co. KG (Germany)

11.7. Shinsegae Duty-Free Inc. (South Korea)

11.8. The King Power International Group (Thailand)

11.9. Lagardère Group (France)

11.10. Dubai Duty-Free (UAE)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook