Interest Rate Swaps Market: Size, Share, Growth Drivers and Emerging Trends (2025-2032)

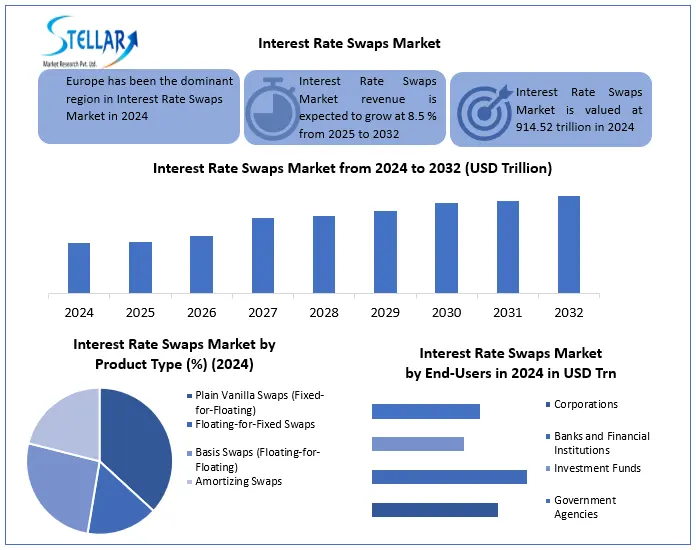

Interest Rate Swaps Market was valued at USD 469.2 trillion in 2024 and is expected to reach USD 967.15 trillion by 2032, at a CAGR of 8.7% during the forecast period 2025-2032.

Format : PDF | Report ID : SMR_2849

Interest Rate Swaps Market Overview:

An interest rate swap (IRS) is a type of derivative contract through which two counterparties agree to exchange one stream of future interest payments for another, based on a specified principal amount. Interest rate swaps usually involve the exchange of a fixed interest rate payment for a floating rate payment, or vice versa, to reduce or increase exposure to fluctuations in interest rates, or to obtain a marginally lower interest rate than would have been possible without the swap.

The Interest Rate Swaps (IRS) market is a lighting fast, multi-dimensional environment driven by global macroeconomic forces, central bank intervention and the tactical maneuvering of select financial participants. Its fundamental use is to enable market participants to either manage, or take exposure to interest rate risk, and it provides considerable flexibility compared with standardized exchange traded products, given its Over-the-Counter (OTC) status.

In 2023, USD-denominated contracts accounted for 41.7% of the total IRD traded notional, by mid-2024 the percentage of IRS notional outstanding denominated in US dollars had fallen to $169.3 trillion (29.3% of total IRD notional outstanding), whilst Euro-denominated notional had increased to $206.1 trillion (35.6% of total), showing the currency dominance to be a dynamic concept. The biggest market share still uses hedging as the main objective, to reduce the financial risk of unfavourable changes in interest rates, to achieve certainty in cash flows.

This landscape is further reduced by mergers, with the example of UBS taking over Credit Suisse, concentrating market activity. This structure facilitates the effective organisation of a huge, centrally cleared market, with 81.7 percentage of interest rate derivatives being traded notional centrally cleared in 2024.

To get more Insights: Request Free Sample Report

Interest Rate Swaps Market Dynamics:

Monetary Policy Divergence helps to drive the Interest Rate Swaps Market

Monetary policy divergence Monetary policy divergence describes when the major central banks take different approaches to interest rate policy, as occurred in early 2025 when the US Fed remained steady whereas the ECB and others lowered rates. This brings about different costs of funding and returns on investments among currencies. This discrepancy is the driver of demand in IRS market to hedge against currency-specific interest rate risks, or to transform exposure to one rate regime into the other, or to speculate on the widening or narrowing of interest rate differentials between economic blocs. This causes greater cross-currency swap action and may affect basis spreads.

Enhanced Hedging Flexibility creates opportunities in Interest Rate Swaps Market

The Interest Rate Swaps (IRS) market provides greater hedging flexibility because it is an OTC market and can be customized unlike the standardized exchange-traded products. Notional amounts, maturities, payment frequencies (e.g. quarterly versus semi-annually), and reference rates can be precisely matched by the participants This allows a greater degree of precision in addressing interest rate risk than is possible with more inflexible structures.

Interest Rate Swaps Market Segment Analysis:

Based on Product Type Interest Rate Swaps Market, segmented into Plain Vanilla Swaps (Fixed-for-Floating), Floating-for-Fixed Swaps, Basis Swaps (Floating-for-Floating), Amortizing Swaps. Vanilla Swaps (Fixed-for-Floating) are segment-dominated the market in 2024 and are expected to hold the largest market share over the forecast period. Tthe simplest and most basic Interest Rate Swaps Market structure is the fixed-for-floating plain vanilla swap. It is simply terminable, at clear terms (fixed rate versus a benchmark floating rate, such as SOFR or EURIBOR, constant notional), making it easy to understand, price and trade. This uniformity encourages profound liquidity and enables lucrative market making. plain vanilla fixed-for-floating swaps constitute a large fraction of the total number of interest rate derivative transactions. As an illustration, there are certain analyses that suggest that plain vanilla swaps represent approximately 60-75% of the total interest rate swaps outstanding at different points in time. With the move to Risk-Free Rates (RFRs) such as SOFR, SOFR-linked plain vanilla swaps have rapidly become the USD markets standard, demonstrating the inherent resilience and flexibility of this product type.

Based on Currency Interest Rate Swaps Market, segmented into USD-denominated Swaps, EUR-denominated Swaps, GBP-denominated Swaps, Other Currencies Swaps, USD-denominated Swaps are expected to dominate the market in 2024 and are expected to hold the largest market share over the forecast period. IRD contracts dollar-denominated IRD traded notional and trade count were 41.7 and 35.5% respectively. More recently, by mid-2024, the proportion of IRS notional outstanding denominated in US dollars dropped to 169.3 trillion (29.3 percent of the total IRD notional outstanding), and the portion denominated in Euro increased. This means that it is a dynamic market and relative shares can change, yet USD is a beast.

Based on Purpose Interest Rate Swaps Market, segmented into Hedging, Speculation, Arbitrag, Hedging are expected to dominate the market in 2024 and are expected to hold the largest market share over the forecast period. To reduce or eliminate financial risk arising from adverse movements in interest rates. Hedgers seek to achieve predictability and stability in their cash flows or asset/liability valuations. Banks extensively utilize IRS to help them manage the duration -mismatch between their assets (e.g. fixed-rate loans) and liabilities (e.g. floating-rate deposits) so that their balance sheet is not sensitive to rate changes.

Based on End-Users Interest Rate Swaps Market, segmented Corporations, Banks and Financial Institutions, Investment Funds, Banks and Financial Institutions, are expected to dominate the market in 2024 and are expected to hold the largest market share over the forecast period. Banks acquire deposits (generally floating-rate debt) and provide loans (generally fixed-rate assets, such as mortgages, long-term corporate loans). IRS are necessary instruments to help them manage the interest rate risk that would accrue because of this asset-liability mismatch. They employ swaps to turn fixed-rate assets to floating or floating-rate liabilities to fixed and thus match their interest rate exposure.

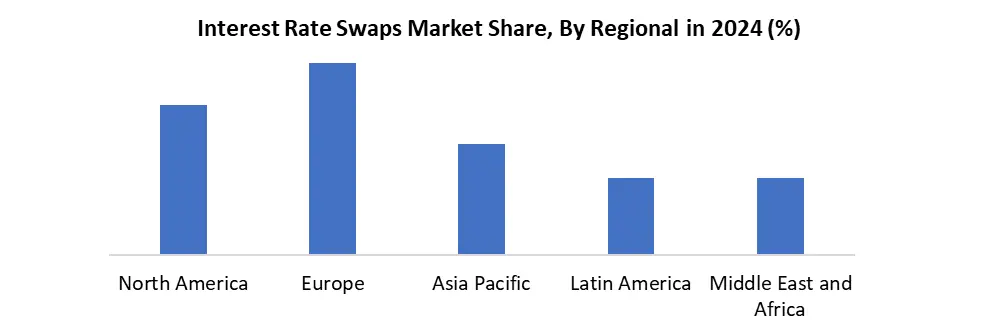

Interest Rate Swaps Market Regional Analysis:

Confluence of Historical, Structural, and Economic Factors makes Europe dominated Interest Rate Swaps Market

The European domination of the IRS market is based on the fact that it has a large integrated economy that uses Euro. The major financial centres such as London, Frankfurt and Paris are characterised by deep liquidity. The benchmark currency status of the Euro and the deep interbank rates (such as EURIBOR and 0STR) make banks and corporates that have to manage huge amounts of assets and liabilities in Euros engage in widespread hedging. Tough central clearing requirements (e.g. EMIR) also boost market stability and activity.

Interest Rate Swaps Market competitive landscape:

The Interest Rate Swaps Market is really concentrated, with a small number of global financial powerhouses, such as J.P. Morgan and Goldman Sachs Group, Inc. taking the lead. These banks are the main market makers and play a key role in making the market by offering much needed liquidity and transacting on behalf of a variety of clients. This landscape is further consolidated through mergers, as in the case of UBS taking over Credit Suisse which narrows the independent dealers and concentrates the market activity. This centralised framework allows the effective organisation of a large, centrally cleared market; e.g., in 2024, 81.7% of interest rate derivatives traded notional was centrally cleared. The extent of their operations is indicative of the dominance of these players in the global finance; the global notional outstanding of OTC interest rate derivatives is almost $579 trillion.

Interest Rate Swaps Market Key Development

- Mar 22, 2024 – RFR Transition Matures: By Feb 2025, 90.6% of fixed-for-floating IRS notional was cleared, with SOFR becoming the USD market standard, showing strong liquidity and adoption.

- Jul 24, 2023 – Policy Divergence: ECB began cutting rates mid-2024, by June 6, 2025, RBI cut repo rate to 5.50% (third in a row), while the Fed held steady, widening global rate differentials and impacting cross-currency swap pricing.

|

Interest Rate Swaps Market |

|

|

Market by Size in 2024 |

USD 469.2 Trillion |

|

Market by Size in 2032 |

USD 967.15 Trillion |

|

CAGR (2025-2032) |

8.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Plain Vanilla Swaps (Fixed-for-Floating) Floating-for-Fixed Swaps Basis Swaps (Floating-for-Floating) Amortizing Swaps |

|

By Currency USD-denominated Swaps EUR-denominated Swaps GBP-denominated Swaps Other Currencies |

|

|

By Purpose Hedging Speculation Arbitrage |

|

|

By End-Users Corporations Banks and Financial Institutions Investment Funds Government Agencies |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Taiwan, Philippines, Indonesia, Vietnam, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of Interest Rate Swaps Market

North America

- J.P. Morgan (United States)

- Citigroup (United States)

- Goldman Sachs (United States)

- Morgan Stanley (United States)

- Bank of America (United States)

- Wells Fargo (United States)

- TrueEX (United States)

- CME Group (United States)

- BGC Group / FMX (United States)

- TradeWeb (United States)

Europe

- Deutsche Bank (Germany)

- Barclays (United Kingdom)

- HSBC (United Kingdom)

- BNP Paribas (France)

- Société Générale (France)

- UBS (Switzerland)

- Credit Suisse (Switzerland)

- NatWest Group (United Kingdom)

- Danske Bank (Denmark)

- Crédit Agricole CIB (France)

Asia-Pacific

- Nomura Holdings (Japan)

- Mizuho Financial Group (Japan)

- Sumitomo Mitsui Financial Group (Japan)

- Agricultural Bank of China (China)

- Bank of China (China)

- Industrial and Commercial Bank of China (China)

- China Construction Bank (China)

- DBS Bank (Singapore)

Middle East & Africa

- Standard Chartered (MEA)

South America

- Banco Santander Brasil (Brazil)

Frequently Asked Questions

The major players profiled in the report include J.P. Morgan, Deutsche, Bank AG, Barclays And Others

Upcoming trends in the Interest Rate Swaps Market include increasing electronification and automation, continued volatility in swap spreads driven by sovereign issuance and central bank balance sheet normalization, and evolving regulatory impacts on capital requirements.

Europe is the largest regional market for Interest Rate Swaps Market

Banks and Financial Institutions the dominant application is the Interest Rate Swaps Market is conferences and seminars.

1. Global Interest Rate Swaps Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Interest Rate Swaps Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. Purpose Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Global Interest Rate Swaps Market: Dynamics

3.1. Global Interest Rate Swaps Market Trends

3.2. Global Interest Rate Swaps Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Global Interest Rate Swaps Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Plain Vanilla Swaps (Fixed-for-Floating)

4.1.2. Floating-for-Fixed Swaps

4.1.3. Basis Swaps (Floating-for-Floating)

4.1.4. Amortizing Swaps

4.2. Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

4.2.1. USD-denominated Swaps

4.2.2. EUR-denominated Swaps

4.2.3. GBP-denominated Swaps

4.2.4. Other Currencies

4.3. Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

4.3.1. Hedging

4.3.2. Speculation

4.3.3. Arbitrage

4.4. Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

4.4.1. Corporations

4.4.2. Banks and Financial Institutions

4.4.3. Investment Funds

4.4.4. Government Agencies

4.5. Global Interest Rate Swaps Market Size and Forecast, By Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Interest Rate Swaps Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Plain Vanilla Swaps (Fixed-for-Floating)

5.1.2. Floating-for-Fixed Swaps

5.1.3. Basis Swaps (Floating-for-Floating)

5.1.4. Amortizing Swaps

5.2. North America Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

5.2.1. USD-denominated Swaps

5.2.2. EUR-denominated Swaps

5.2.3. GBP-denominated Swaps

5.2.4. Other Currencies

5.3. North America Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

5.3.1. Hedging

5.3.2. Speculation

5.3.3. Arbitrage

5.4. North America Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

5.4.1. Corporations

5.4.2. Banks and Financial Institutions

5.4.3. Investment Funds

5.4.4. Government Agencies

5.5. North America Interest Rate Swaps Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

5.5.1.1.1. Plain Vanilla Swaps (Fixed-for-Floating)

5.5.1.1.2. Floating-for-Fixed Swaps

5.5.1.1.3. Basis Swaps (Floating-for-Floating)

5.5.1.1.4. Amortizing Swaps

5.5.1.2. United States Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

5.5.1.2.1. USD-denominated Swaps

5.5.1.2.2. EUR-denominated Swaps

5.5.1.2.3. GBP-denominated Swaps

5.5.1.2.4. Other Currencies

5.5.1.3. United States Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

5.5.1.3.1. Hedging

5.5.1.3.2. Speculation

5.5.1.3.3. Arbitrage

5.5.1.4. United States Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

5.5.1.4.1. Corporations

5.5.1.4.2. Banks and Financial Institutions

5.5.1.4.3. Investment Funds

5.5.1.4.4. Government Agencies

5.5.2. Canada

5.5.2.1. Canada Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

5.5.2.1.1. Plain Vanilla Swaps (Fixed-for-Floating)

5.5.2.1.2. Floating-for-Fixed Swaps

5.5.2.1.3. Basis Swaps (Floating-for-Floating)

5.5.2.1.4. Amortizing Swaps

5.5.2.2. Canada Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

5.5.2.2.1. USD-denominated Swaps

5.5.2.2.2. EUR-denominated Swaps

5.5.2.2.3. GBP-denominated Swaps

5.5.2.2.4. Other Currencies

5.5.2.3. Canada Interest Rate Swaps Market Size and Forecast, Purpose (2024-2032)

5.5.2.3.1. Hedging

5.5.2.3.2. Speculation

5.5.2.3.3. Arbitrage

5.5.2.4. Canada Interest Rate Swaps Market Size and Forecast, End-Users (2024-2032)

5.5.2.4.1. Corporations

5.5.2.4.2. Banks and Financial Institutions

5.5.2.4.3. Investment Funds

5.5.2.4.4. Government Agencies

5.5.3. Mexico

5.5.3.1. Mexico Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

5.5.3.1.1. Plain Vanilla Swaps (Fixed-for-Floating)

5.5.3.1.2. Floating-for-Fixed Swaps

5.5.3.1.3. Basis Swaps (Floating-for-Floating)

5.5.3.1.4. Amortizing Swaps

5.5.3.2. Mexico Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

5.5.3.2.1. USD-denominated Swaps

5.5.3.2.2. EUR-denominated Swaps

5.5.3.2.3. GBP-denominated Swaps

5.5.3.2.4. Other Currencies

5.5.3.3. Mexico Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

5.5.3.3.1. Hedging

5.5.3.3.2. Speculation

5.5.3.3.3. Arbitrage

5.5.3.4. Mexico Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

5.5.3.4.1. Corporations

5.5.3.4.2. Banks and Financial Institutions

5.5.3.4.3. Investment Funds

5.5.3.4.4. Government Agencies

6. Europe Interest Rate Swaps Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.2. Europe Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.3. Europe Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.4. Europe Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5. Europe Interest Rate Swaps Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.1.2. United Kingdom Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.1.3. United Kingdom Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.1.4. United Kingdom Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5.2. France

6.5.2.1. France Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.2.2. France Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.2.3. France Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.2.4. France Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.3.2. Germany Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.3.3. Germany Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.3.4. Germany Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.4.2. Italy Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.4.3. Italy Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.4.4. Italy Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.5.2. Spain Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.5.3. Spain Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.5.4. Spain Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.6.2. Sweden Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.6.3. Sweden Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.6.4. Sweden Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.7.2. Russia Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.7.3. Russia Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.7.4. Russia Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

6.5.8.2. Rest of Europe Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

6.5.8.3. Rest of Europe Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

6.5.8.4. Rest of Europe Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7. Asia Pacific Global Interest Rate Swaps Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.2. Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.3. Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.4. Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5. Asia Pacific Global Interest Rate Swaps Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.1.2. China Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.1.3. China Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.1.4. China Global Interest Rate Swaps Market Size and Forecast, By China Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.2.2. S Korea Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.2.3. S Korea Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.2.4. S Korea Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.3.2. Japan Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.3.3. Japan Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.3.4. Japan Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.4. India

7.5.4.1. India Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.4.2. India Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.4.3. India Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.4.4. India Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.5.2. Australia Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.5.3. Australia Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.5.4. Australia Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.6.2. Indonesia Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.6.3. Indonesia Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.6.4. Indonesia Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.7.2. Malaysia Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.7.3. Malaysia Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.7.4. Malaysia Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.8. Philippines

7.5.8.1. Philippines Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.8.2. Philippines Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.8.3. Philippines Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.8.4. Philippines Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.9. Thailand

7.5.9.1. Thailand Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.9.2. Thailand Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.9.3. Thailand Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.9.4. Thailand Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.10.2. Vietnam Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.10.3. Vietnam Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.10.4. Vietnam Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

7.5.11.2. Rest of Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

7.5.11.3. Rest of Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

7.5.11.4. Rest of Asia Pacific Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

8. Middle East and Africa Global Interest Rate Swaps Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

8.2. Middle East and Africa Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

8.3. Middle East and Africa Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

8.4. Middle East and Africa Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

8.5. Middle East and Africa Global Interest Rate Swaps Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

8.5.1.2. South Africa Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

8.5.1.3. South Africa Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

8.5.1.4. South Africa Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

8.5.2.2. GCC Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

8.5.2.3. GCC Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

8.5.2.4. GCC Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

8.5.3. Egypt

8.5.3.1. Egypt Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

8.5.3.2. Egypt Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

8.5.3.3. Egypt Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

8.5.3.4. Egypt Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

8.5.4.2. Nigeria Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

8.5.4.3. Nigeria Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

8.5.4.4. Nigeria Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

8.5.5.2. Rest of ME&A Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

8.5.5.3. Rest of ME&A Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

8.5.5.4. Rest of ME&A Global Interest Rate Swaps Market Size and Forecast, By END Users (2024-2032)

9. South America Global Interest Rate Swaps Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

9.2. South America Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

9.3. South America Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

9.4. South America Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

9.5. South America Global Interest Rate Swaps Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

9.5.1.2. Brazil Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

9.5.1.3. Brazil Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

9.5.1.4. Brazil Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

9.5.2.2. Argentina Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

9.5.2.3. Argentina Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

9.5.2.4. Argentina Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

9.5.3. Colombia

9.5.3.1. Colombia Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

9.5.3.2. Colombia Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

9.5.3.3. Colombia Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

9.5.3.4. Colombia Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

9.5.4. Chile

9.5.4.1. Chile Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

9.5.4.2. Chile Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

9.5.4.3. Chile Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

9.5.4.4. Chile Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

9.5.5. Rest of South America

9.5.5.1. Rest of South America Global Interest Rate Swaps Market Size and Forecast, By Product Type (2024-2032)

9.5.5.2. Rest of South America Global Interest Rate Swaps Market Size and Forecast, By Currency (2024-2032)

9.5.5.3. Rest of South America Global Interest Rate Swaps Market Size and Forecast, By Purpose (2024-2032)

9.5.5.4. Rest of South America Global Interest Rate Swaps Market Size and Forecast, By End-Users (2024-2032)

10. Company Profile: Key Players

10.1. J.P. Morgan (United States)

10.1.1. Overview

10.1.2. Business Portfolio

10.1.3. Financial Strategic Analysis

10.1.4. Recent Developments

10.2. Citigroup (United States)

10.3. Goldman Sachs (United States)

10.4. Morgan Stanley (United States)

10.5. Bank of America (United States)

10.6. Wells Fargo (United States)

10.7. TrueEX (United States)

10.8. CME Group (United States)

10.9. BGC Group / FMX (United States)

10.10. TradeWeb (United States)

10.11. Deutsche Bank (Germany)

10.12. Barclays (United Kingdom)

10.13. HSBC (United Kingdom)

10.14. BNP Paribas (France)

10.15. BS (Switzerland)

10.16. Credit Suisse (Switzerland)

10.17. NatWest Group (United Kingdom)

10.18. Danske Bank (Denmark)

10.19. Crédit Agricole CIB (France)

10.20. Nomura Holdings (Japan)

10.21. Mizuho Financial Group (Japan)

10.22. Sumitomo Mitsui Financial Group (Japan)

10.23. Agricultural Bank of China (China)

10.24. Bank of China (China)

10.25. Industrial and Commercial Bank of China (China)

10.26. China Construction Bank (China)

10.27. DBS Bank (Singapore)

10.28. Standard Chartered (MEA)

10.29. Banco Santander Brasil (Brazil)

11. Key Findings & Analyst Recommendations

12. Interest Rate Swaps Market: Research Methodology