Asia pacific duty-free retail Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

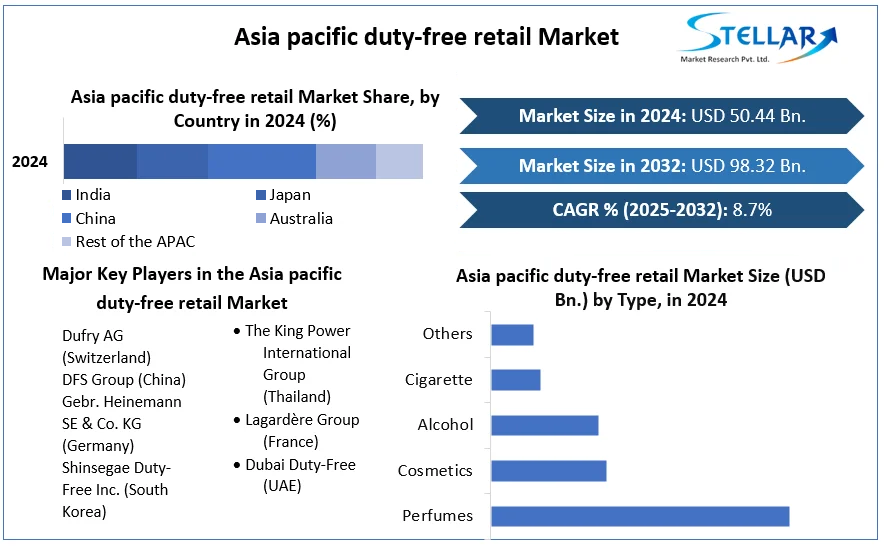

Asia pacific duty-free retail Market was valued at USD 50.44 billion in 2024.Global market size is estimated to grow at a CAGR of 8.7.

Format : PDF | Report ID : SMR_994

Asia pacific duty-free retail Market Definition:

The items sold in a duty-free shop (or store) are exempt from paying certain local or national taxes and tariffs, provided that the customers are travelers who would be taking the goods outside of the country. Each jurisdiction has different rules on whether goods can be sold duty-free, how they can be sold, and how the duty is calculated or refunded.

Further, the Asia pacific duty-free retail market is segmented by Type, Sales Channel, and geography. Based on Type, the Asia pacific duty-free retail market is segmented into Perfumes, Cosmetics, Alcohol, Cigarettes, and Others. Based on the Sales Channel, the Asia pacific duty-free retail market is segmented under the channels of Airports, Onboard aircraft, seaports, train stations, and others. Based on the Distribution Channel, the Asia pacific duty-free retail market is segmented under the channels Online and Offline. By geography, the market covers the following regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. For each segment, the market sizing and forecasts have been done based on (USD Billion).

To get more Insights: Request Free Sample Report

Asia pacific duty-free retail COVID 19 Insights:

The COVID-19 pandemic has damaged the growth of the Asia pacific duty-free retail business. The sudden decline in air traffic, most notably in 2021, hampered both aeronautical and non-aeronautical revenue as carriers reduced their capacity and customers postponed foreign trips. a Canadian-based international platform for promoting airport standards and market practices, total airport revenues fell by 35% to USD 14 billion in the first quarter of 2021 and by 90% to USD 39 billion in the second quarter. Due to trade tensions and trade protectionism between China and Australia, the United States, and other trading partners, duty-free sales between these countries are likely to suffer soon. To reduce social tensions or any unrest caused by the COVID-19 pandemic's effects on employment and social inequality, governments are likely to adopt a protectionist trade policy. The COVID-19 crisis has had a particularly negative impact on the tourism market. In the first three months of 2021, China International Travel Service (CITS), a Chinese travel agency business, reported a decrease of % to USD 1.08 billion (7.63 billion yuan), going from a profit of USD 0.36 to a net loss of USD 18.89 million (120.14 million yuan).

Asia pacific duty-free retail Market Dynamics:

new international airports are being constructed, creating considerable economic prospects for people who work in the market. For instance, the first phase of an international airport dubbed "Dholera" in Gujarat will cost USD 135.07 million, according to building clearance granted in February 2021 by the Airport Authority of India (AAI), a governmental entity in India that oversees 125 airports (INR 987 crore). Delhi and Mumbai will each have three international airports, compared to two operational airports for each of the top 31 Indian cities, and India would have 190–200 operational airports by the year 2040, as stated in the Civil Aviation Ministry's "Indian Aviation's Vision 2040."

An increase in new air routes in Asian countries will encourage the entry of new players.

Multiple airlines from numerous countries are expanding their international networks and opening new airports as the COVID-19 situation leads the world's borders to progressively reopen. This feature will probably accelerate the arrival of new players shortly, especially those from Asia. According to the International Times, a Chinese English-language journal, China will begin a fresh round of airport construction projects in 2022. Both new airport development and airport growth are part of the projects. For instance, Shanghai Pudong International Airport's fourth phase of its growth project began in earnest in January 2022. The airport is expected to serve 130 million people a year by 2029.

International Product Demand is Affected by Currency Fluctuations

Asia pacific Duty-free markets are impacted by international exchange rates. Even though they operate in several countries and routinely transact in different currencies, including the precise exchange rates for the Euro, Dollar, and British Pound, they are nevertheless impacted by market fluctuations. The exchange rate of the day is used to convert these currencies. Asia pacific duty-free retail businesses, particularly retail chains that sell luxury goods, may experience favorable or negative effects from market currency exchange movements depending on the fluctuating exchange rate. The COVID-19 pandemic's unpredictable currency rates are one of the main external factors fueling economic inflation.

Asia pacific duty-free retail Market Segment Analysis:

By Type, With increased customer taste for high-end and luxury goods, there will be a growth in the demand for perfumes.

Cigarettes, alcohol, cosmetics, and perfumes are just a few of the types of products that are categorized on the market. The category for fragrances is likely to control the majority of the market share over the time frame. Asia pacific duty-free retailers all categorized under the world receive luxury fragrances through well-known international distribution networks. Affluent foreign travelers commonly go to Asia pacific duty-free retail chains to buy perfumes from internationally recognized brands including Giorgio Armani, Al Haramain Dazzle Intense, Belle, Signature Rose, Signature Silver, and Khulasat Al Oud. Major distribution channels offer all perfume varieties, including Perfume or De Perfume, Eau De Perfume (EDP), Eau De Toilette (EDT), and Eau De Cologne (EDC).

By Sales Channel, Increasing Number of Stores at Airports Around the World to Speed Up Product Sales

According to the sales channel, the market is segmented by airports, ships, seaports, train stations, and other places. Airports account for the majority of total product sales. The growing number of local and international airports across all countries favor product sales through this distribution channel. Several developments under the "airports" category illustrate the rising number of duty-free stores in airports around the world. A duty-free shop would be established at Thiruvananthapuram International Airport by the middle of May 2022, according to a statement made in April 2022 by the Adani Group, an Indian integrated corporate conglomerate, and Flemingo, a Dubai-based operator. to establish duty-free shops in all significant seaports by the year 2024.

Asia pacific duty-free retail Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the Europe market key players in the market, particularly in this region, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Asia pacific duty-free retail market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia pacific duty-free retail market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia pacific duty-free retail Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia pacific duty-free retail market report is to help understand which market segments, rand, and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia pacific duty-free retail market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia pacific duty-free retail market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Asia pacific duty-free retail market. The report also analyses if the Asia pacific duty-free retail market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia pacific duty-free retail market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia pacific duty-free retail market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia pacific duty-free retail market is aided by legal factors.

Asia Pacific Duty-Free Retail Market Scope:

|

Asia Pacific Duty-Free Retail Market |

|

|

Market Size in 2024 |

USD 50.44 Bn. |

|

Market Size in 2032 |

USD 98.32 Bn. |

|

CAGR (2025-2032) |

8.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Type

|

|

by Sales Channel

|

|

|

Country Scope |

|

Asia pacific duty-free retail Market Key Players:

- Dufry AG (Switzerland)

- DFS Group (China)

- Gebr. Heinemann SE & Co. KG (Germany)

- Shinsegae Duty-Free Inc. (South Korea)

- The King Power International Group (Thailand)

- Lagardère Group (France)

- Dubai Duty-Free (UAE)

Frequently Asked Questions

The market size of the Asia pacific duty-free retail Market by 2032 is expected to reach USD 98.32 Billion.

The forecast period for the Asia pacific duty-free retail Market is 2025-2032.

The market size of the Asia pacific duty-free retail Market in 2024 was valued at USD 50.44 Billion.

Asia Pacific region held the highest share in 2024.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia Pacific duty-free retail Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. Asia Pacific duty-free retail Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Asia Pacific duty-free retail Market: Dynamics

4.1. Asia pacific duty-free retail Market Trends

4.2. Asia pacific duty-free retail Market Drivers

4.3. Asia pacific duty-free retail Market Restraints

4.4. Asia pacific duty-free retail Market Opportunities

4.5. Asia pacific duty-free retail Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Asia Pacific duty-free retail Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific duty-free retail Market Size and Forecast, by Type (2024-2032)

5.1.1. Perfumes

5.1.2. Cosmetics

5.1.3. Alcohol

5.1.4. Cigarette

5.1.5. Others

5.2. Asia Pacific duty-free retail Market Size and Forecast, by Sales Channel (2024-2032)

5.2.1. Airport

5.2.2. Onboard aircraft

5.2.3. seaport

5.2.4. Train stations

5.2.5. Others

5.3. Asia Pacific duty-free retail Market Size and Forecast, by Country (2024-2032)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia

5.3.6. ASEAN

5.3.7. Rest of APAC

6. Company Profile: Key Players

6.1. Dufry AG (Switzerland)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. DFS Group (China)

6.3. Gebr. Heinemann SE & Co. KG (Germany)

6.4. Shinsegae Duty-Free Inc. (South Korea)

6.5. The King Power International Group (Thailand)

6.6. Lagardère Group (France)

6.7. Dubai Duty-Free (UAE)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook