Australia Digital Payment Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

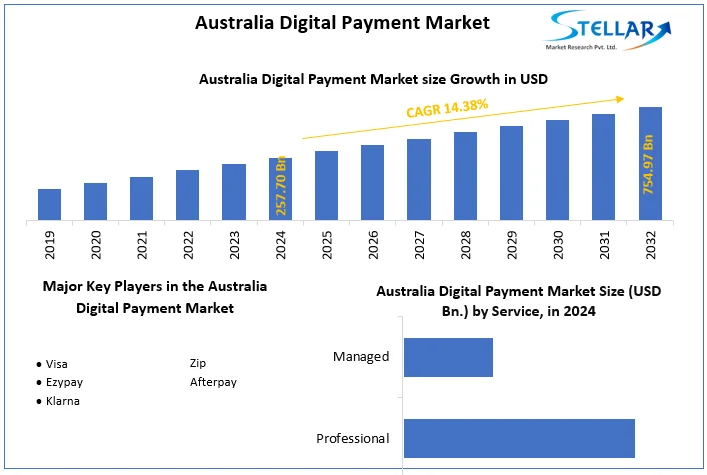

The Australia Digital Payment Market size was valued at USD 257.70 Billion in 2024. The total Australia Digital Payment Market revenue is expected to grow at a CAGR of 14.38% from 2025 to 2032, reaching nearly USD 754.97 Billion in 2032.

Format : PDF | Report ID : SMR_1577

Australian Digital Payment Market Overview

The Stellar research highlights the significant growth of the Australian digital payment market, which is driven by technology advancements and shifting consumer preferences. The in-depth research delves into the dynamic market factors, upcoming trends, and important players influencing the current landscape. Australians prefer cashless transactions because of the convenience and security of digital payments. The mobile-first economy, which is powered by increased smartphone penetration, is increasing the use of mobile wallets and contactless payments. The growing e-commerce industry necessitates efficient digital payment market. Buy Now, Pay Later (BNPL) suppliers are gaining popularity for their flexible payment alternatives.

Open Banking regulations make it easier to create new payment solutions and integrate banking apps. Companies offering user-friendly mobile wallet technologies and smooth connections are well-positioned to benefit from the growing trend of mobile payments. In the mature BNPL sector, there are numerous potentials for businesses that offer new features and responsible lending. Fintech businesses that use Open Banking to provide new payment solutions have enormous development potential. With the increase in digital transactions, there is a greater need for cybersecurity systems to protect online payments and consumer data. Australian payment solution businesses pursuing regional development in Southeast Asia can leverage their knowledge and technology for success.

To get more Insights: Request Free Sample Report

Government Initiatives for a Cashless Economy

Government initiatives have had a significant impact on Australia's digital payment market. Awareness campaigns and incentives have accelerated adoption among consumers and businesses. Strategic investments in secure payment infrastructure, particularly contactless systems, have increased accessibility while also encouraging widespread adoption. In addition, initiatives such as tax breaks for cashless transactions have substantially reduced entry barriers, making digital payments a greater attraction to businesses and contributing significantly to the overall growth and development of the market.

Several government initiatives in Australia have actively encouraged the transition towards a cashless economy, promoting the adoption of digital payment methods.

These initiatives focus on three key objectives:

- Cashless transactions are faster, reduce administrative costs, and streamline financial processes for businesses and individuals.

- Replacing cash with digital payments minimizes opportunities for tax evasion, money laundering, and other illicit activities.

- Digital transactions leave a clear audit trail, improving financial oversight and transparency in the system.

In February 2023, the government announced the creation of a National Coordinator for Cyber Security, which is going to be supported by a National Office for Cyber Security inside the Department of Home Affairs, to guarantee a centrally coordinated approach to meeting the government's cyber security duties. The government also announced the establishment of the 2023-2030 Cyber Security Strategy, which would support a nationally coordinated strategy to make Australia the most cyber-secure nation in the world by 2030.

Dependency on Card Payments

The dependence on traditional card payments hinders the development of digital payment options. It is essential for advancing the use of alternative payment methods including mobile wallets and QR codes. The widespread adoption of card payments restricts the introduction of alternative means, slowing total industry growth. Merchants frequently face higher transaction costs from card networks, which influences consumer prices. Depending extensively on cards restricts access to benefits offered by alternate means such as loyalty programs, fast transfers, and improved transaction tracking.

Australia Digital Payment Market Segment Analysis

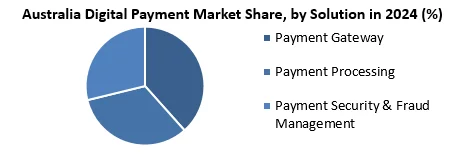

By Solution, Payment gateway segments hold the largest share of the Australian Digital Payment market, estimated at around 55%. Gateways play an essential role in increasing Australia's flourishing e-commerce sector, These gateways enable businesses to prosper in online sales by providing safe, user-friendly checkout experiences, regardless of technological expertise. The increased market accessibility has expanded customer options, accelerating the adoption of e-commerce. Gateways offer smooth mobile payments by integrating with popular wallets such as Apple Pay and Google Pay, corresponding with Australia's widespread smartphone penetration (more than 90%) and growing preference for mobile purchasing. Diversified mobile payment options enabled by gateways improve ease and transaction speed, accelerating the pace of online commerce.

Gateways enable businesses to respond to the different tastes of Australian consumers by accepting several payment methods such as credit cards, debit cards, digital wallets, and Buy Now, Pay Later (BNPL) options. It offers a customized and seamless checkout experience, increasing customer happiness and strengthening business loyalty with a fast and convenient payment process.

|

Australia Digital Payment Market Scope |

|

|

Market Size in 2024 |

USD 257.70 Bn. |

|

Market Size in 2032 |

USD 754.97 Bn. |

|

CAGR (2025-2032) |

14.38% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Service

|

|

By Solution

|

|

|

By Mode of Payment

|

|

|

By Organization Size

|

|

|

By Deployment Mode

|

|

|

By Industry

|

|

Key Players in the Australia Digital Payment Market

Frequently Asked Questions

BNPL services, including popular options like Afterpay and Zip Pay, have gained significant traction in Australia. They offer consumers flexibility in making payments for online and offline purchases.

The Australian digital payment Market size was valued at USD 257.70 billion in 2024. The total Australian digital payment market revenue is expected to grow at a CAGR of 14.38% from 2025 to 2032, reaching nearly USD 754.97 billion by 2032.

1. Australia Digital Payment Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Australia Digital Payment Market: Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Australia Digital Payment Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Service Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Australia Digital Payment Market: Dynamics

4.1. Australia Digital Payment Market Trends

4.2. Australia Digital Payment Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Australia Digital Payment Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Australia Digital Payment Market Size and Forecast, by Service (2024-2032)

5.1.1. Professional

5.1.2. Managed

5.2. Australia Digital Payment Market Size and Forecast, by Solution (2024-2032)

5.2.1. Payment Gateway

5.2.2. Payment Processing

5.2.3. Payment Security & Fraud Management

5.3. Australia Digital Payment Market Size and Forecast, by Mode of Payment (2024-2032)

5.3.1. Bank Cards

5.3.2. Digital Wallets

5.3.3. Point of Sales

5.3.4. Net Banking

5.4. Australia Digital Payment Market Size and Forecast, by Organization Size (2024-2032)

5.4.1. SMEs

5.4.2. Large Enterprises

5.5. Australia Digital Payment Market Size and Forecast, by Deployment Mode (2024-2032)

5.5.1. Cloud

5.5.2. On-premises

5.6. Australia Digital Payment Market Size and Forecast, by Industry (2024-2032)

5.6.1. BFSI

5.6.2. Healthcare

5.6.3. IT & Telecom

5.6.4. Retail & E-commerce

5.6.5. Transportation

6. Company Profile: Key Players

6.1. Visa

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Ezypay

6.3. Klarna

6.4. Zip

6.5. Afterpay

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook