Japan Digital Payment Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

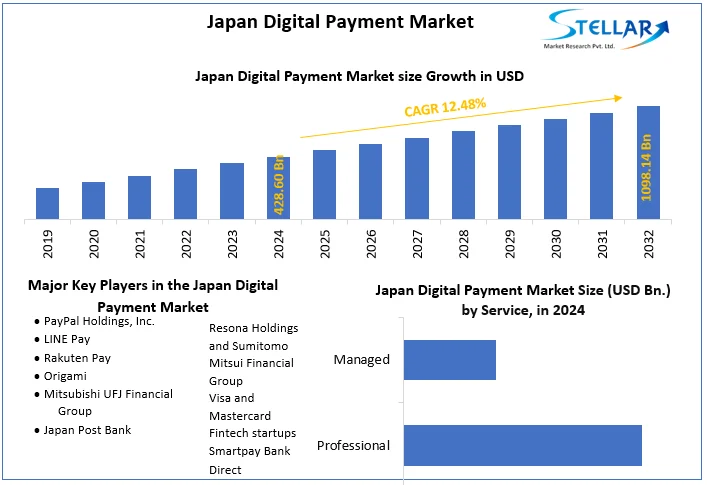

The Japan Digital Payment Market size was valued at USD 428.60 Bn. in 2024 and the total Japan Digital Payment revenue is expected to grow at a CAGR of 12.48% from 2025 to 2032, reaching nearly USD 1098.14 Bn.

Format : PDF | Report ID : SMR_1579

Japan Digital Payment Market Overview

The comprehensive report serves as a beacon for understanding the intricate landscape of the Japan digital payment market. With a primary objective to dissect the current scenario and future trajectories of digital payments in Japan, the scope of the analysis spans key market players, emerging trends, and the dynamic interplay of factors molding the industry. Employing a robust methodology blending primary and secondary research, the report ensures accuracy and reliability by directly engaging with industry experts, market participants, and consumers. The thorough review of existing literature, industry reports, and reputable data sources further enhances the credibility of the analysis.

Delving into the market overview, the report scrutinizes the current state of Japan's digital payment landscape, unravelling key growth drivers, challenges, and opportunities that define the industry. Through a meticulous analysis of market trends and dynamics, the report provides valuable insights into the growth prospects of the digital payment market in Japan, laying the groundwork for informed decision-making by industry players and stakeholders alike.

- Percentage of Japanese consumers who used cashless payments in 2023: 82.4%.

To get more Insights: Request Free Sample Report

Japan Digital Payment Market Dynamics

Government Initiatives Propel Digital Payment Market Soar

In the dynamic landscape of Japan's digital payment market, the government's visionary initiatives and robust regulatory support have emerged as pivotal catalysts, driving a cashless revolution across the nation. Under the ambitious "Cashless Vision," authorities have strategically incentivized businesses and consumers to embrace digital transactions, fostering an environment conducive to innovation and efficiency. The proactive stance has not only enhanced transparency and curtailed tax evasion but has also driven unprecedented growth in the digital payment sector. As a result, businesses are witnessing a seismic shift in consumer behavior, with an increasing reliance on convenient and fast payment options.

The government's unwavering commitment to advancing financial technology aligns with global trends, positioning Japan at the forefront of the digital payment evolution. The collaborative effort between regulatory bodies and industry stakeholders underscores a transformative era, signaling a bright future for Japan's digital payment ecosystem.

Japan's Consumers Ride High on Cashless Convenience

In the heart of Japan's dynamic digital payment market, a seismic shift in consumer behavior is reshaping the financial landscape. The younger generation's increasing tech-savviness coupled with a growing appetite for seamless transactions has fuelled a surge in demand for digital payment methods. As smartphones become ubiquitous, Japanese consumers are rapidly adopting innovative payment solutions that offer speed, convenience, and security. The changing behavior is not just a trend; it's a fundamental transformation in the way transactions are conducted.

Businesses quick to adapt to this evolution are witnessing a surge in digital transactions, underlining the significance of understanding and catering to the preferences of a consumer base that values efficiency and a frictionless payment experience. The wave of cashless convenience is not just a choice; it's becoming the norm as Japan's consumers embrace the future of finance.

Japan Digital Payment Market Segment Analysis

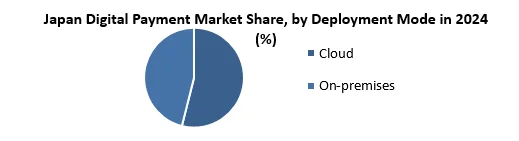

Based on Deployment Mode, the On-Premises segment held the largest market share of about 62% in the Japan Digital Payment Market in 2024. According to the MMR analysis, the segment is expected to grow at a CAGR of 13.5% during the forecast period. The rising demand for security, data privacy, control over integrations, and customization is boosting the japan digital payment market. Certain businesses, particularly in healthcare and finance, might prefer the perceived greater control and security of on-premises solutions over cloud environments.

- Number of electronic money transactions in Japan in 2023: 5.88 billion (up 2.5% from 2022)

The Cloud segment of The Japan Digital Payment Market through cloud technology improves competition and innovation in Fintech. Startups and smaller entities now access powerful AI tools without hefty upfront investments, leveling the playing field. Cloud platforms enable faster innovation, scalability, and flexibility, reducing costs. Collaboration and knowledge sharing boom, fostering quicker problem-solving. Access to cutting-edge AI technologies, coupled with improved security and compliance, encourages wider adoption in the financial sector.

- Projected value of the Japanese contactless payment market in 2030: US$172.3 billion.

The major key players in the Japan Digital Payment Market are LINE Pay, Rakuten Pay, Origami, and Mitsubishi UFJ Financial Group. Thus, increasing demand for the Japan Digital Payment market supports the segment growth.

|

Japan Digital Payment Market Scope |

|

|

Market Size in 2024 |

USD 428.60 billion |

|

Market Size in 2032 |

USD 1098.14 billion |

|

CAGR (2025-2032) |

12.48% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Service

|

|

By Solution

|

|

|

By Mode of Payment

|

|

|

By Organization Size

|

|

|

By Deployment Mode

|

|

|

By Industry

|

|

Leading Key Players in the Japan Digital Payment Market

- PayPal Holdings, Inc.

- LINE Pay

- Rakuten Pay

- Origami

- Mitsubishi UFJ Financial Group

- Japan Post Bank

- Resona Holdings and Sumitomo Mitsui Financial Group

- Visa and Mastercard

- Fintech startups

- Smartpay Bank Direct

Frequently Asked Questions

Data Privacy and Security Concerns and Explain ability and Trust Issues are expected to be the major restraining factors for Japan’s Digital Payment market growth.

The Japan Digital Payment Market size was valued at USD 428.60 Billion in 2024. The total Japan Digital Payment revenue is expected to grow at a CAGR of 12.48% from 2025 to 2032, reaching nearly USD 1098.14 Billion by 2032.

1. Japan Digital Payment Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Japan Digital Payment Market Consumer Adoption and Behaviour

2.1 Consumer Preferences

2.2 Factors Influencing Adoption

2.3 Challenges in Consumer Adoption

3. Japan Digital Payment Market: Dynamics

3.1.1 Market Driver

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Value Chain Analysis

3.5 Regulatory Landscape

3.6 Analysis of Government Schemes and Initiatives for the Japan Digital Payment Industry

3.7 The Pandemic and Redefining of The Japan Digital Payment Industry Landscape

4. JAPAN Digital Payment Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 Japan Digital Payment Market Size and Forecast, by Service (2024-2032)

4.1.1 Professional

4.1.2 Managed

4.2 Japan Digital Payment Market Size and Forecast, Solution (2024-2032)

4.2.1 Payment Gateway

4.2.2 Payment Processing

4.2.3 Payment Security & Fraud Management

4.3 Japan Digital Payment Market Size and Forecast, by Mode of Payment (2024-2032)

4.3.1 Bank Cards

4.3.2 Digital Wallets

4.3.3 Point of Sales

4.3.4 Net Banking

4.4 Japan Digital Payment Market Size and Forecast, by Organization Size (2024-2032)

4.4.1 SMEs

4.4.2 Large Enterprises

4.5 Japan Digital Payment Market Size and Forecast, by Deployment Mode (2024-2032)

4.5.1 Cloud

4.5.2 On-premises

4.6 Japan Digital Payment Market Size and Forecast, by Industry (2024-2032)

4.6.1 BFSI

4.6.2 Healthcare

4.6.3 IT & Telecom

4.6.4 Retail & E-commerce

4.6.5 Transportation

5. Japan Digital Payment Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading Japan Digital Payment Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 PayPal Holdings, Inc.

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 LINE Pay

6.3 Rakuten Pay

6.4 Origami

6.5 Mitsubishi UFJ Financial Group

6.6 Japan Post Bank

6.7 Resona Holdings and Sumitomo Mitsui Financial Group

6.8 Visa and Mastercard

6.9 Fintech startups

6.10 Smartpay Bank Direct

7. Key Findings

8. Industry Recommendations

9. Japan Digital Payment Market: Research Methodology