AI Fintech Market in Malaysia: Industry Analysis and Forecast (2024-2030)

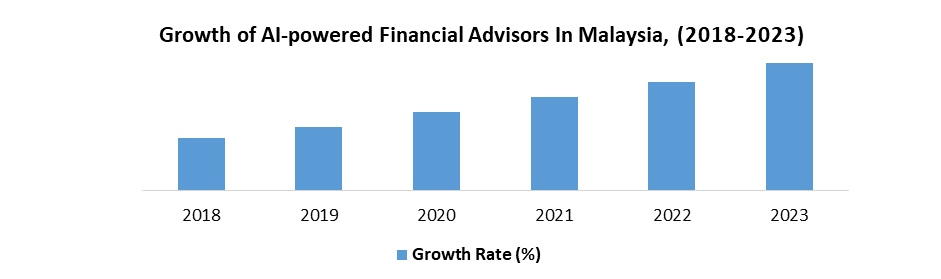

AI in Fintech Market size in Malaysia was valued at USD 1.9 Bn. in 2023 and the total AI in Fintech revenue is expected to grow at a CAGR of 7.30% from 2024 to 2030, reaching nearly USD 3.11 Bn. in 2030.

Format : PDF | Report ID : SMR_1690

AI Fintech Market Overview in Malaysia

The AI Fintech Market in Malaysia report offers comprehensive insights into the industry, leveraging AI to manage vast data and derive consumer insights. The report has covered the industry trends like automated wealth management and personalized financial advice. The growth of automated wealth management and personal finance is expected to be driven by AI in fintech and the impact of the growth is analysed and given in the numbers in Malaysian market. The report also has covered Competitive intelligence, which is improved through data analysis and is helping in market trend identification. Also, market segmentation becomes more precise with AI and enables personalized categorization based on financial behavior. The report serves as a valuable tool for market intelligence and helping investors in strategic decision-making. Through qualitative and quantitative research, it interprets data patterns and extracts meaningful insights.

Additionally, it also focuses on research methodologies and objectives and ensuring accuracy. The report shows Fintech companies influence AI to understand consumer behavior and target markets effectively. Enhanced product positioning, pricing strategies, and brand awareness are crucial in seizing market opportunities and driving growth through effective market penetration strategies.

To get more Insights: Request Free Sample Report

AI Fintech Market in Malaysia Dynamics:

Increasing digital economy for individuals and domestic firms alike: The Government of Malaysia and Google collaborate to boost Malaysia's digital economy and leverage AI in fintech. Aimed at fostering growth and competitiveness as well as the initiative includes educational programs, infrastructure investment, and cloud-first policies. It aligns with Malaysia's MADANI Economy Framework and NIMP 2030 and focuses on job creation and innovation that creates an employment rate. Through joint AI projects and cybersecurity efforts, they aim to empower local companies globally. Additionally, it foresees benefits for talent development and small businesses, aligning with NIMP 2030 objectives.

Development of eKYC and digital identity: The development of eKYC and digital identity In Malaysia AI in the fintech sector, AI innovations revolutionize operations. Facial Recognition, exemplified by WISE AI, streamlines eKYC with a selfie or video verification. Data Security receives a boost as AI analyzes user data, thwarting fraudulent activities in eKYC. This fortifies against identity theft, safeguarding financial systems.

Scaling with a security-first mindset while navigating compliance: In Malaysia AI in fintech drives innovation and digital transformation, transitioning to the heart of the financial services industry. In hybrid cloud and AI adoption, managing data influx across cloud and on-premises is crucial. Safety and agreement remain dominant within evolving fears and regulations. Third- and fourth-party dependencies amplify risk, necessitating vigilant management.

AI Fintech Market in Malaysia Segment Analysis

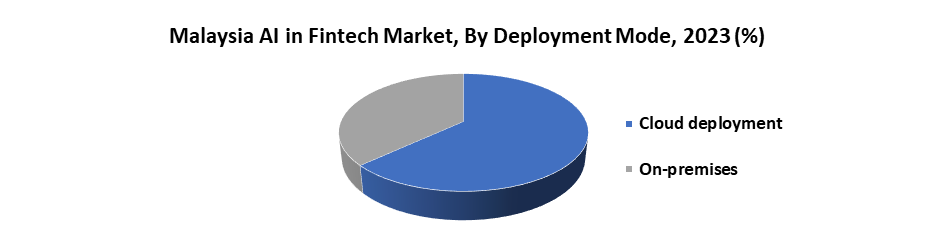

Based on Deployment Mode, the Cloud segment held the largest market share of about 60% in the Malaysia AI Fintech Market in 2023. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 7.33% during the forecast period. Malaysia excels in Fintech AI thanks to swift tech advancements and seamless device integration, positioning it as a leader in the market.

In the AI Fintech Market in Malaysia , the Cloud deployment model is composed of significant growth this trend reflects businesses increasing reliance on cloud solutions to address challenges traditionally tackled by conventional IT infrastructure. Cloud adoption improves agility, and efficiency, and offers rapid access to cost-effective IT resources. It facilitates scalable application and infrastructure expansion, ensuring high-speed performance and reliability for users. Additionally, integration with IoT, Data and Intelligence, and Intelligent Automation fuels continuous enhancement of cloud-based business operations.

In AI Fintech Market in Malaysia , AI scalability and agility are empowered by the cloud. Firms effortlessly adjust AI infrastructure to match demand, vital for tasks like fraud detection and credit scoring. Cloud's pay-as-you-go model enhances cost-effectiveness, liberating capital for essential business growth. With robust security measures and regulatory compliance tailored to Malaysia's financial standards, data privacy and adherence are assured. Cloud platforms provide pre-built AI tools, accelerating solution development and deployment. This fosters a severely competitive landscape, where fintech firms innovate swiftly, driving progress and meeting evolving market demands effectively.

In Malaysia AI in fintech scope, Public Cloud stands as the top choice, embraced by companies for its versatility. Leading providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) furnish a plethora of AI and data analytics services and empower innovation. For those with stringent data security prerequisites, the Private Cloud emerges as a fitting solution, furnishing dedicated infrastructure within a public cloud realm. Meanwhile, Hybrid Cloud amalgamates the strengths of both and offers flexibility. Here, fintech enterprises uphold sensitive data integrity via a private cloud, while harnessing the processing of public cloud resources, fostering a balanced and adaptable infrastructure.

|

AI Fintech Market in Malaysia Scope |

|

|

Market Size in 2023 |

USD 1.9 Bn. |

|

Market Size in 2030 |

USD 3.11 Bn. |

|

CAGR (2024-2030) |

7.30 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Component

|

|

By Deployment Mode

|

|

Leading Key Players in the AI Fintech Market in Malaysia

Frequently Asked Questions

Data Privacy and Security Concerns and Explainability and Trust Issues are expected to be the major restraining factors for AI Fintech Market in Malaysia growth.

The AI Fintech Market in Malaysia size was valued at USD 1.9 Billion in 2023 and the total Malaysia AI in Fintech revenue is expected to grow at a CAGR of 7.30% from 2024 to 2030, reaching nearly USD 3.11 Billion By 2030.

1. AI Fintech Market in Malaysia: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. AI Fintech Market in Malaysia: Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024 – 2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. AI Fintech Market in Malaysia: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. AI Fintech Market in Malaysia: Dynamics

4.1. AI Fintech Market in Malaysia Trends

4.2. AI Fintech Market in Malaysia Drivers

4.3. AI Fintech Market in Malaysia Restraints

4.4. AI Fintech Market in Malaysia Opportunities

4.5. AI Fintech Market in Malaysia Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. AI Fintech Market in Malaysia: Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. AI Fintech Market in Malaysia Size and Forecast, by Component (2023-2030)

5.1.1. Solutions

5.1.2. Services

5.2. AI Fintech Market in Malaysia Size and Forecast, by Deployment Mode (2023-2030)

5.2.1. Cloud

5.2.2. On-premises

6. Company Profile: Key Players

6.1. Google

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Microsoft

6.3. IBM

6.4. Amazon

6.5. Fusionex

6.6. Genaxis

6.7. Symprio

6.8. Virtual Spirit Technology

6.9. Workspez

6.10. SAP

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook