Australia Esports Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

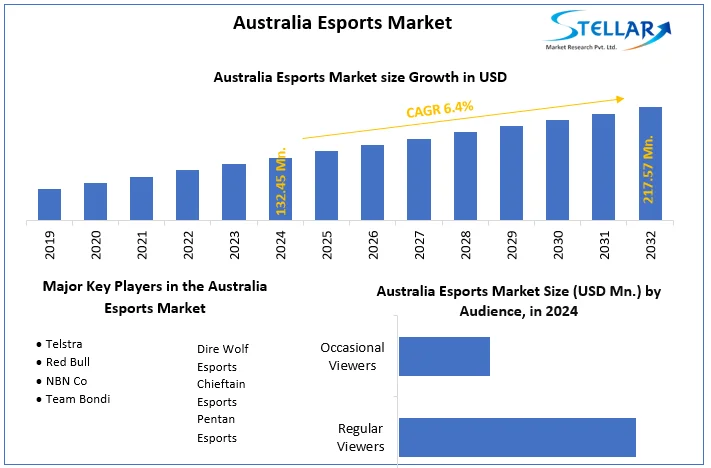

The Australia Esports Market size was valued at USD 132.45 Mn. in 2024. The total Australian Esports Market revenue is expected to grow at a CAGR of 6.40% from 2025 to 2032, reaching nearly USD 217.57 Mn. in 2032.

Format : PDF | Report ID : SMR_1586

Australia Esports Market Overview

The Report covers key facts impacting the industry's growth, including market trends, challenges, opportunities, and potential strategies for stakeholders. Also, the report covered several Challenges including constraints such as insufficient internet connection that hamper growing insights. Exploration of development prospects and innovative market segments presents opportunities. The infrastructure study includes dedicated esports venues and international comparisons. The technical assessment evaluates readiness, with a focus on internet speed and hardware limits. Market dynamics take into account travel implications and regulatory frameworks to provide an integrated view of growth barriers and opportunities. Investing in established leagues such as the OPL or in new projects can generate revenue through sponsorships, broadcast rights, and product sales.

Supporting Australian game creators with esports-focused products provides financial opportunities. Investing in streaming networks and content providers helps to capitalize on the growing esports audience. Resolving internet connection and infrastructure restrictions offers new investment opportunities. Companies that provide data analytics, player performance analysis, and esports coaching services address the demand for professionalism and performance enhancement.

The Esports audience in Australia is expected to reach XX million by 2030, with mobile esports driving the growth. Professionalization, through established leagues and larger prize pools, draws sponsorships and improves market legitimacy. Esports organizations receive financial help from the government through programs such as the Digital Media and Games Industry Strategy Grant Program. Robust grassroots systems and academies develop potential, establishing Australia as a global talent pool. Technological developments, such as enhanced internet infrastructure and VR/AR integration, will increase accessibility. Diversification into mobile esports, women's esports, and casual gaming will bring in new fans and sponsors.

To get more Insights: Request Free Sample Report

Professional Leagues and Tournaments

Australia has seen the establishment of professional esports leagues and tournaments across various games. Games such as League of Legends, Counter-Strike-Global Offensive (CS: GO), and Dota 2 have active competitive scenes. The spike in professional leagues and investments has had a huge impact on the Australian esports sector. Professionalization raises production standards, improves infrastructure, and provides consistent pay, attracting top personnel and cultivating competitiveness.

This trend drives market growth since higher investment increases prize pools, broadens marketing efforts, and attracts a varied audience. Simultaneously, it increases worldwide competitiveness by providing Australian teams with platforms for international competition, thus raising the country's position in the global esports market. Also, the developing professional landscape creates job possibilities, including positions for coaches, analysts, administrators, and event organizers, which strengthens the wider esports ecosystem.

- Investment in Australian esports organizations reached $10 million in 2024.

- Sponsorship deals between esports organizations and brands such as Intel, Red Bull, and Telstra are on the rise.

- The number of professional esports players and staff in Australia has doubled since 2018.

Infrastructure and Connectivity Issues

Limited internet access decreases player involvement, hinders talent development, and creates an unequal playing field for urban and rural gamers. Frequent latency and disconnections annoy gamers, thereby reducing market interest. Insufficient bandwidth stifles esports technology adoption, limiting industry innovation. Australia lacks dedicated esports arenas that are similar to foreign counterparts, which is expected to influence big tournament experiences. Existing venues do not have high-speed internet or specialized gear to host top-tier esports events. The lack of distributed venues entails significant travel, rising expenses, and logistical challenges for players and fans.

Key Highlights of the Esports market in Australia covered in the Report

- According to Stellar reports, xx% of Australian homes still use low-speed internet, with rural areas disproportionately affected.

- In 2024 Research found that xx% of Australian esports players experienced lag and disconnects during online competitions.

- Australia is expected to miss out on up to $xx billion in potential economic benefits by not fully capitalizing on the esports market.

Australia Esports Market Segment Analysis

By Gender, Male and female segments hold the largest share of the Australian esports market, estimated at around 70% for males and 30% for females. Male consumers, the most frequent spenders in esports, create cash through in-game purchases and event participation. Influential male esports figures wield significant power, obtaining sponsorships and commercial partnerships. The competitive landscape, driven by a large male player population, drives skill development and raises professional esports standards in Australia. The increase in female participation represents a significant unfulfilled growth opportunity for the Australian esports business.

Diverse viewpoints from female gamers and spectators demand content and product diversification to accommodate diverse tastes. Gender balance, inclusion, and a friendly environment for female participation are essential for guaranteeing long-term market sustainability.

|

Australia Esports Market Scope |

|

|

Market Size in 2024 |

USD 132.45 Mn. |

|

Market Size in 2032 |

USD 217.57 Mn. |

|

CAGR (2025-2032) |

6.40 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Gender

|

|

By Audience

|

|

|

By Revenue Model

|

|

Key Players in the Australian Esports Market

- Telstra

- Red Bull

- NBN Co

- Team Bondi

- Dire Wolf Esports

- Chieftain Esports

- Pentan Esports

Frequently Asked Questions

There are opportunities for the establishment of esports education programs and training facilities. Collaboration with educational institutions to foster talent development is on the rise.

The Australia Esports Market size was valued at USD 132.45 Million in 2024. The total Australian digital payment market revenue is expected to grow at a CAGR of 6.40 % from 2025 to 2032, reaching nearly USD 217.57 Million by 2032.

1. Australia Esports Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Trends and Innovations

2. Australia Esports Market: Dynamics

2.1. Australia Esports Market Trends

2.2. PORTER’s Five Forces Analysis

2.3. PESTLE Analysis

2.4. Evolution of Esports in Australia

2.5. Statistical Data on the Size of the Australian Esports Market

2.6. Profile of Esports Enthusiasts in Australia

2.7. Overview of Financial Backing and Investments

2.8. Technological Advancements Supporting Esports Events

2.9. Television and Online Streaming Platforms Covering Esports

2.10. Opportunities for Growth and Development

2.11. Key Opinion Leader Analysis for the Australian Digital Payment Industry

3. Australia Esports Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032)

3.1. Germany Esports Market Size and Forecast, by Gender (2024-2032)

3.1.1. Male

3.1.2. Female

3.2. Germany Esports Market Size and Forecast, by Audience (2024-2032)

3.2.1. Regular Viewers

3.2.2. Occasional Viewers

3.3. Germany Esports Market Size and Forecast, by Revenue Model (2024-2032)

3.3.1. Sponsorship & advertising

3.3.2. Esports betting & and fantasy site

3.3.3. Prize pool

3.3.4. Amateur & and micro tournament

3.3.5. Merchandising

3.3.6. Ticket sale

4. Australia Esports Market: Competitive Landscape

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.3.1. Company Name

4.3.2. Product Segment

4.3.3. End-user Segment

4.3.4. Revenue (2024)

4.4. Market Analysis by Organized Players vs. Unorganized Players

4.4.1. Organized Players

4.4.2. Unorganized Players

4.5. Leading German Digital Payment Market Companies, by market capitalization

4.6. Market Trends and Challenges in Australia

4.6.1. Technological Advancements

4.6.2. Affordability and Accessibility

4.6.3. Shortage of Skilled Professionals

4.7. Market Structure

4.7.1. Market Leaders

4.7.2. Market Followers

4.7.3. Emerging Players in the Market

4.7.4. Challenges

4.7.5. Mergers and Acquisitions Details

5. Company Profile: Key Players

5.1. Telstra

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Details on Partnership

5.1.7. Potential Impact of Emerging Technologies

5.1.8. Regulatory Accreditations and Certifications Received by Them

5.1.9. Strategies Adopted by Key Players

5.1.10. Recent Developments

5.2. Red Bull

5.3. NBN Co

5.4. Team Bondi

5.5. Dire Wolf Esports

5.6. Chieftain Esports

5.7. Pentan Esports

6. Key Findings

7. Industry Recommendations

8. Australia Esports Market: Research Methodology