Digital Health Market- Global Industry Analysis and Forecast (2025-2032) by Component, Categories, End User, and region

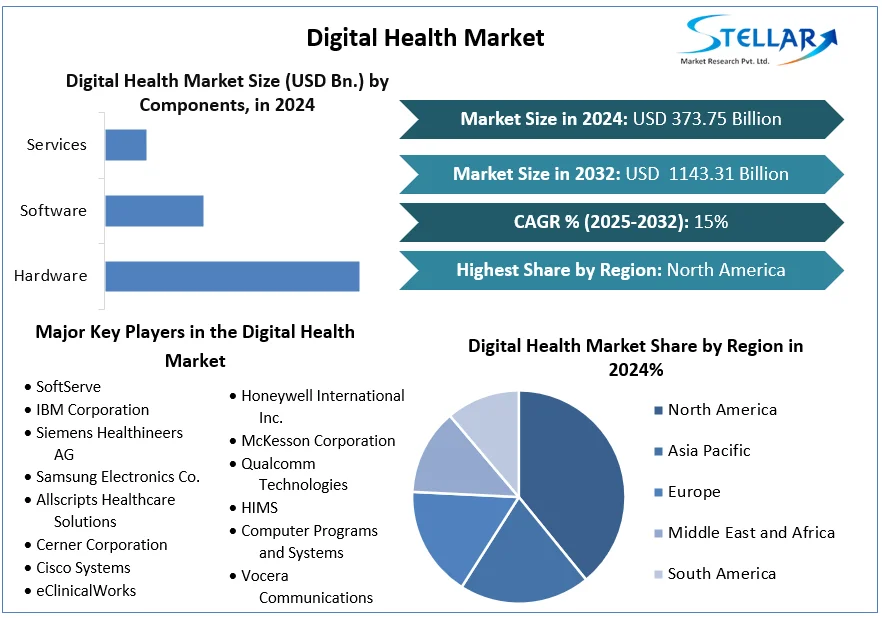

Digital Health Market size was valued at USD 373.75 Billion in 2024 and is expected to grow at a CAGR of 15 % from 2025 to 2032, reaching nearly USD 1143.31 Billion.

Format : PDF | Report ID : SMR_1598

Digital Health Market Objective

Stellar Market Research conducted brief analysis on Global Digital Health Market. The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Global Digital Health Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Global Digital Health Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Digital Health Market Overview

Digital health is the application of information and communication technology, along with digital technologies, to improve healthcare delivery, increase system efficiency, and give people more control over their health.

The key driving factors for Digital health market such as aging population, regulatory support, rise in consumer demands, and many others are analysed in the report. Recent technologies, like IoT and Wearables for observing and tracking patients' health status Virtual and Augmented Reality for enhancing telehealth systems and Cloud-Based Patient Records to improve accessibility to medical data and streamlining healthcare processes, are applied to cater the rising demand for Digital health Market.

Use of artificial intelligence in Digital Health is surging as for data analysis, personalized medicine, and bettering patient outcomes, AI has created huge opportunity for Digital health market players to enhance their sales. Recent trends in Digital health market, such as, Telemedicine to deliver clinical medical treatment remotely, Remote Patient Monitoring to gather and send patient data in order to provide individualized treatment and real-time monitoring, and many others are analysed thoroughly in the report.

Stellar market research conducted the analysis of for Digital health market over past 5 years and by using the data, came to a conclusion that North America dominated the global Digital health market with around 42% market share and is expected to continue its dominance during the forecast period. The dominance is majorly supported by United States and Canada. United States, with a CAGR of 17%, has dominated the Digital health market in North America. Companies like Allscripts Healthcare Solution, Cerner Corporation, Cisco Systems, GE HealthCare, and others are few major companies operating in North America region analysed in the report. APAC and Europe are also contributing significantly to the Global Digital health market.

To get more Insights: Request Free Sample Report

Digital Health Market Dynamics

Aging Population

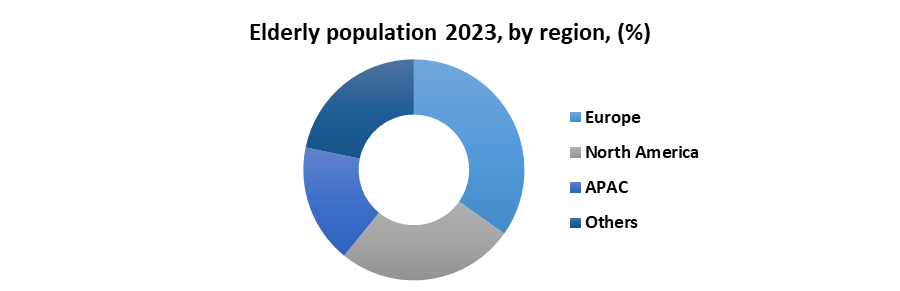

The global surge in the aging population is emerging as a key factor for the global digital health market. As with increase in elderly populations, there is rise in the occurrence of chronic diseases and healthcare demands. Globally, the elderly population in Europe is highest, as SMR estimates that the proportion of people aged 65 and above in the European Union rise to 28% by 2030. Countries such as Germany, the United Kingdom, and France are witnessing this demographic trend which led companies like Siemens Healthineers and InHealth to invest in digital health innovations, ranging from diagnostic tools to telemedicine platforms.

In North America, the aging population has led to a surge in digital health utilization and major companies like Teladoc Health and Philips Healthcare are investing to capitalize on this demographic shift by offering telehealth services and remote patient monitoring solutions, catering the healthcare requirements of the elderly population. Asia-Pacific is seeing significant growth in the digital health market due to its increasingly aging population in nations like China and Japan. According to SMR, the use of digital health solutions has expanded in Japan, where more than 32% of the population is 65 years of age or older. Prominent corporations such as Sony Corporation and M3, Inc. are actively engaged, providing technology that address the healthcare requirements of the senior population.

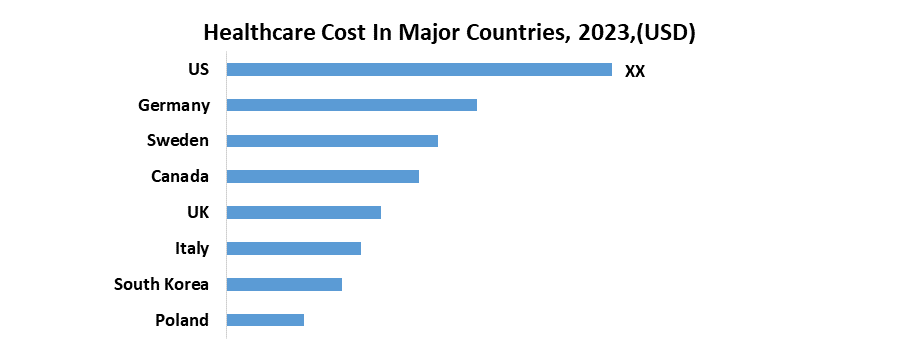

Rise in Healthcare costs

The need for digital health solutions that seek for novel ways to save costs, enhance patient outcomes, and optimize operational efficiencies has increased as a result of the rising costs in the global digital health market. The annual growth rate of healthcare expenditures has continuously surpassed the growth of the US GDP in the US, a nation known for its high healthcare spending. SMR estimates that national health spending in the United States total around $4.5 trillion in 2023, or 17% of GDP. This has caused customers to look into more affordable options, which is what's causing digital health technologies to become more integrated. During the COVID-19 pandemic, telemedicine saw a significant uptick, with virtual visits making up more than 35% of Medicare primary care visits in April 2020.

Growing investments and funding for start-ups providing digital healthcare services

The growing digital health market has attracted new starts-ups to contribute in the growing demand. With the help of its machine learning algorithms, Dascena has successfully raised $50.4 million in a Series B fundraising round in 2020 to improve patient outcomes by preventing sickness at an early stage, raising the standard of care. PatientPop, California based company, raised USD 125 million from investors, like HLM Venture Partners, Leerink Transformation Partners, Toba Capital to deliver recent digital facilities which are HIPAA-compliant.

Kindbody's consistent recognition in prestigious lists like CB Insights Digital Health 150 and the New York Digital Health 100 highlights its position among the most promising and innovative digital health companies, with $180 million revenue in 2023 and raising $315 million in debt and equity in 2023. The growing investment in these various prominent start-ups showcase the growing demand in digital health market.

|

Company Name |

Funding |

Year |

|

Vault Health |

$30 million |

2020 |

|

Medable |

$304 million |

2021 |

|

H1 |

$123 million |

2022 |

|

Odyssey |

$386 million |

2023 |

Regulation impact on digital health market

The United States' digital health business is regulated by an extensive legal and regulatory framework. In charge of regulating digital health technology is the Food and Drug Administration (FDA), whose regulatory environment is always changing to make room for new and exciting innovations to enter the market. Upholding the FDA's criteria for the safety and effectiveness of digital health technologies, the Digital Health Center of Excellence is committed to provide a simplified and least onerous regulatory procedure. The Federal Food, Drug, and Cosmetic Act (FDCA) compliance is one of the regulatory framework's components for producers of digital health applications.

The proposed European Health Data Space (EHDS) Regulation outlines the requirements for the mandatory sharing of electronic health data, which the European Union is now formalizing. The purpose of this legal framework is to enable people to take control of their health data and make it easier to use it for improved research, innovation, and policymaking as well as improved healthcare delivery.

Digital Health Market Segment Analysis

By categories, the digital health market is categorized into distinct segments, including Telemedicine, Data Analytics, mobile Health (health) apps, Clinical Decision Support, Wearable Sensors, and Others. Mobile Health has emerged as the dominant segment, capturing the largest market share of around 32% in 2024. This substantial market presence is attributed to the escalating incidence of cardiovascular diseases and the widespread adoption of mobile devices for disease management, thereby propelling overall market expansion.

According to SMR, mhealth is expected to grow at a CAGR of 5.2% for mHealth throughout the forecast period. This expected growth is underpinned by a heightened demand for remote monitoring devices, a substantial increase in the user base of smartphones, and the prevalence of hypertension. These factors collectively contribute to the sustained expansion of the mHealth segment, positioning it as a key driver of digital health market over the forecast period.

Digital Health Market Competitive Landscape

- Holmusk and Veradigm Announced New Phase of Strategic Investment to Fuel Innovation and Close the Evidence Gap in Behavioral Health.

- Oracle completed the acquisition of Cerner for $28.3 billion in 2022, marking a significant transformation in healthcare delivery.

- In Dec 2023, GE HealthCare and AirStrip Forge Exclusive Partnership to Revolutionize Patient Monitoring Technology.

- Code BGP is a privately held BGP monitoring company based in Greece. The Code BGP team consists of renowned BGP experts who enable Cisco ThousandEyes to grow its BGP monitoring capabilities and global, authoritative view of Internet health.

In 2021, Quartet Health, a mental health-focused start up, recently secured $60 million in funding in a round led by Independence Health Group.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Digital health Market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as expected market size and trends. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers.

The research includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favourable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry.

The research also aids in comprehending the Digital health Market dynamics and structure by studying market segments and forecasting market size.

The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Digital health Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

|

Digital health Market Scope |

|

|

Market Size in 2024 |

USD 373.75 Bn. |

|

Market Size in 2032 |

USD 1143.31 Bn. |

|

CAGR (2025-2032) |

15% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Categories

|

|

By Components

|

|

|

By End User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Digital Health Market Players

- SoftServe

- IBM Corporation

- Siemens Healthineers AG

- Samsung Electronics Co.

- Allscripts Healthcare Solutions

- Cerner Corporation

- Cisco Systems

- eClinicalWorks

- GE healthcare

- Honeywell International Inc.

- McKesson Corporation

- Qualcomm Technologies

- HIMS

- Computer Programs and Systems

- Vocera Communications

- Koninklijke Philips N.V

- Orange

- MQure

Frequently Asked Questions

North America is expected to hold the largest share in the Digital Health Market.

The expected Digital Health Market size by 2032 is US $ 1143.31 Bn.

Allscripts Healthcare Solution, Inc., Cerner Corporation, Cisco systems, eCLINICALWORKS, General Electric Company, Koninklijke Philips N.V, Honeywell International Inc., Mckesson Corporation, Siemans Healthcare AG, Qualcomm technologies, Inc., Samsung Electronics Co., Ltd., HiMS, Orange, Qualcomm Technologies, Inc., Softserve, MQure, Computer Programs and Systems, Inc., Vocera Communications, IBM Corporation.

The Digital Health Market size in 2024 was US $ 373.75 Bn.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Digital Health Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Digital Health Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

3.5. Digital Health Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Digital Health Market: Dynamics

4.1. Digital Health Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Digital Health Market Drivers

4.3. Digital Health Market Restraints

4.4. Digital Health Market Opportunities

4.5. Digital Health Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Healthcare Analytics

4.8.2. Cloud Healthcare

4.8.3. Patient Engagement

4.8.4. Home Healthcare

4.8.5. Digital Biomarkers

4.8.6. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Global Digital Health Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Global Digital Health Market Size and Forecast, by Categories (2024-2032)

5.1.1. Telemedicine

5.1.2. Data Analytics

5.1.3. mHealth apps

5.1.4. Clinical decision support

5.1.5. Wearable Sensors

5.1.6. Others

5.2. Global Digital Health Market Size and Forecast, by Components (2024-2032)

5.2.1. Hardware

5.2.2. Software

5.2.3. Services

5.3. Global Digital Health Market Size and Forecast, by End-User (2024-2032)

5.3.1. Healthcare Providers

5.3.2. Payers

5.3.3. Healthcare Consumers

5.3.4. Others

5.4. Global Digital Health Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Digital Health Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Digital Health Market Size and Forecast, by Categories (2024-2032)

6.1.1. Telemedicine

6.1.2. Data Analytics

6.1.3. mHealth apps

6.1.4. Clinical decision support

6.1.5. Wearable Sensors

6.1.6. Others

6.2. North America Digital Health Market Size and Forecast, by Components (2024-2032)

6.2.1. Hardware

6.2.2. Software

6.2.3. Services

6.3. North America Digital Health Market Size and Forecast, by End-User (2024-2032)

6.3.1. Healthcare Providers

6.3.2. Payers

6.3.3. Healthcare Consumers

6.3.4. Others

6.4. North America Digital Health Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Digital Health Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Digital Health Market Size and Forecast, by Categories (2024-2032)

7.2. Europe Digital Health Market Size and Forecast, by Components (2024-2032)

7.3. Europe Digital Health Market Size and Forecast, by End-User (2024-2032)

7.4. Europe Digital Health Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Digital Health Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Digital Health Market Size and Forecast, by Categories (2024-2032)

8.2. Asia Pacific Digital Health Market Size and Forecast, by Components (2024-2032)

8.3. Asia Pacific Digital Health Market Size and Forecast, by End-User (2024-2032)

8.4. Asia Pacific Digital Health Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Digital Health Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Digital Health Market Size and Forecast, by Categories (2024-2032)

9.2. Middle East and Africa Digital Health Market Size and Forecast, by Components (2024-2032)

9.3. Middle East and Africa Digital Health Market Size and Forecast, by End-User (2024-2032)

9.4. Middle East and Africa Digital Health Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Digital Health Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Digital Health Market Size and Forecast, by Categories (2024-2032)

10.2. South America Digital Health Market Size and Forecast, by Components (2024-2032)

10.3. South America Digital Health Market Size and Forecast, by End-User (2024-2032)

10.4. South America Digital Health Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. SoftServe

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. IBM Corporation

11.3. Siemens Healthineers AG

11.4. Samsung Electronics Co.

11.5. Allscripts Healthcare Solutions

11.6. Cerner Corporation

11.7. Cisco Systems

11.8. eClinicalWorks

11.9. GE healthcare

11.10. Honeywell International Inc.

11.11. McKesson Corporation

11.12. Qualcomm Technologies

11.13. HIMS

11.14. Computer Programs and Systems

11.15. Vocera Communications

11.16. Koninklijke Philips N.V

11.17. Orange

11.18. MQure

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook