Building Insulation Materials Market 2025–2032: Energy Efficiency Regulations, Sustainable Construction, and Advanced Thermal Insulation Solutions

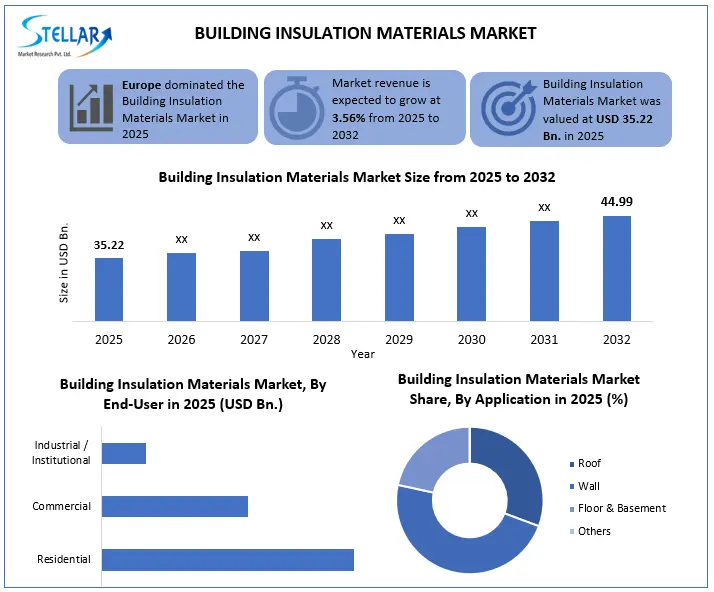

The Building Insulation Materials Market is expected to grow from USD 35.22 Bn. in 2025 to USD 44.99 Bn. by 2032 at a CAGR of 3.56%, driven by energy-efficiency regulations, sustainable construction demand, thermal insulation adoption, and renovation activities.

Format : PDF | Report ID : SMR_919

Building Insulation Materials Market Overview

The Building Insulation Materials Market operates under strong regulatory influence, driven by energy-efficiency mandates, renovation activity, and demand for advanced thermal insulation solutions across global construction markets. Insulation has increasingly transitioned from a discretionary material to a core compliance component in residential, commercial, and public infrastructure projects, as governments tighten building energy codes and emission-reduction standards. Sustainable construction practices and lifecycle energy optimization are reinforcing demand for high-performance insulation materials, supporting portfolio premiumization and performance-led differentiation. The global sustainable construction and green building market was valued at USD 618.58 billion in 2025, reflecting the scale at which sustainability-aligned materials, including insulation, are being embedded into construction decision-making. Leading companies such as Saint-Gobain, Owens Corning, and Rockwool International maintain strong market positions through extensive product portfolios, regulatory-aligned innovation, and strategic capacity expansion. In 2025, Europe commanded regulation-driven market strength, while Asia-Pacific exhibited rapid growth dynamics across urban and industrial construction hubs.

For manufacturers and investors, value creation aligns with enhancing thermal efficiency, ensuring fire safety compliance, and integrating solutions within sustainability and regulatory frameworks. Strategic focus on advanced insulation systems, low-emission materials, and retrofit-ready solutions strengthens competitive positioning and drives market leadership.

To get more Insights: Request Free Sample Report

Building Insulation Materials Market Dynamics

Regulatory Alignment to Drive Building Insulation Materials Market Growth

The building insulation materials sector is shaped by sustained regulatory alignment with energy efficiency and emission reduction objectives across global construction markets. Government authorities continue tightening building energy codes and thermal performance norms, raising compliance thresholds by XX% across residential, commercial, and public infrastructure projects. Public expenditure on affordable housing, urban renewal, and climate-resilient infrastructure expanded at approximately 2% in 2024, directly increasing insulation intensity per building. Escalating electricity and cooling tariffs further strengthened insulation adoption as a lifecycle cost optimization lever, positioning thermal efficiency as a baseline compliance requirement within project planning and approvals.

Renovation and Retrofit to Create Opportunities in the Building Insulation Materials Market

Renovation and retrofit activity continue to represent a structurally attractive growth avenue. Government-backed energy efficiency incentive programs recorded close to 2% growth in 2024, particularly across aging residential and institutional building stock. Energy performance targets linked to long-term operating cost reduction, accelerated insulation replacement, and system upgrades. At the same time, broader adoption of sustainable construction practices increased preference for advanced insulation materials offering higher thermal efficiency, improved fire performance, and lower lifecycle emissions, supporting portfolio premiumization and performance-led differentiation across the value chain. Industry surveys indicate that over two-thirds of global construction stakeholders now recognize sustainable construction as a priority, reinforcing insulation’s role as a core performance-enabling material.

Cost and Compliance Pressures to Restrain the Building Insulation Materials Market

Cost sensitivity remains a key restraint, especially in price-driven construction markets. Advanced and sustainable insulation materials reflected XX% higher upfront cost levels in 2024 compared with conventional alternatives, constraining penetration across small and mid-scale projects. Raw material price volatility and rising compliance expenditure linked to fire safety and emissions standards continued to pressure manufacturer margins. Increasingly stringent health, safety, and certification requirements further elevated operational complexity, reinforcing the need for disciplined cost management and regulatory alignment across the sector.

Building Insulation Materials Market Regional Analysis

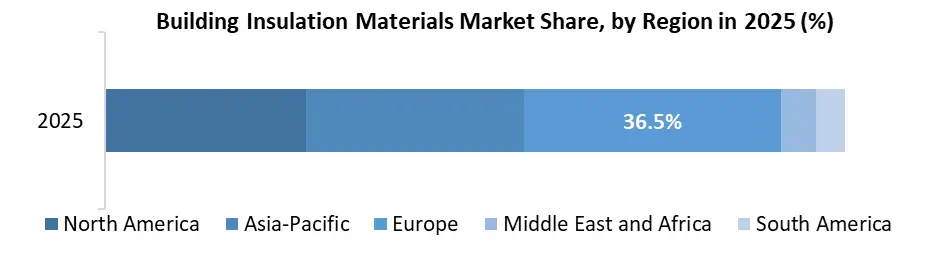

The building insulation materials market is divided into Europe, Asia-Pacific, North America, the Middle East & Africa, and South America. In 2025, Europe dominated 36.5% of the Building Insulation Materials Market share, while Asia-Pacific was the fastest-growing region with 31% share.

Why Europe Dominated the Building Insulation Materials Market in 2025?

- Stringent Energy Efficiency Regulations:

Europe enforced high building energy standards through the EU Energy Performance of Buildings Directive (EPBD) and national codes. These rules mandated advanced insulation in new and renovated buildings, creating steady demand.

- Renovation & Sustainability Focus:

Large-scale renovation of aging building stock and climate goals, like net-zero by 2050, drove the adoption of high-performance insulation. This trend ensured Europe remained the leader in energy-efficient construction.

- Government Policies & Incentives:

- Programs such as the EU Green Deal integrated insulation compliance into building approvals and renovation funding frameworks. With over 81 countries having implemented mandatory or voluntary building codes for energy efficiency, insulation adoption was further catalyzed across both developed and emerging construction markets.

Building Insulation Materials Market Segment Analysis

The Building Insulation Materials Market is segmented based on material type, application, technology, and end-user.

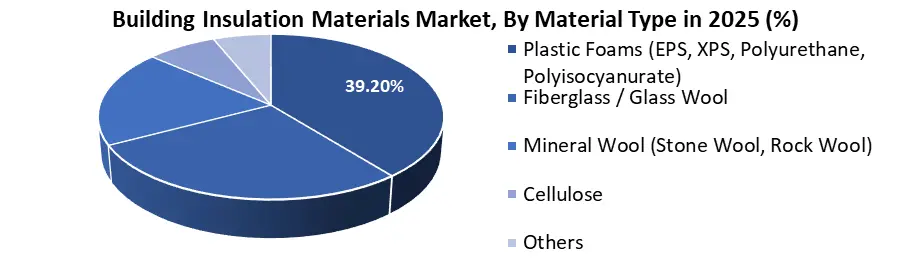

Based on material type, the building insulation materials market is segmented into fiberglass/glass wool, mineral wool, plastic foams, cellulose, and other insulation materials. The plastic foams segment (EPS, XPS, polyurethane, and polyisocyanurate) dominated the market, accounting for 39.2% of total consumption in 2025. This leadership was driven by superior thermal resistance, moisture durability, and lightweight properties, enabling wide adoption across residential and commercial buildings. Moreover, growing emphasis on energy-efficient construction and stringent building energy codes continued to support strong demand for plastic foam insulation materials.

Building Insulation Materials Market Competitive Landscape

In 2025, the building insulation materials market remained moderately concentrated, with several global players commanding significant market shares through broad product portfolios, strong distribution networks, and continuous innovation. The leading companies included Owens Corning, Saint-Gobain, Rockwool International, Knauf Insulation, and Kingspan Group, which collectively accounted for a substantial share of market volume across fiberglass, mineral wool, and high-performance plastic foam insulation segments.

Saint?Gobain began construction of a new float glass and fifth mineral wool insulation line at its Oragadam, Chennai facility on August 13, 2025, marking its largest insulation investment in the Asia?Pacific region and reinforcing local manufacturing capacity for high?performance insulation solutions in India.

BASF SE expanded its product portfolio with the launch of WALLTITE® RSB spray polyurethane foam insulation on December 12, 2025, which integrates recycled and renewable raw materials to lower carbon footprint and support sustainable construction demand.

Advanced green building technologies have demonstrated up to 25% reduction in operational energy consumption compared with conventional buildings, further reinforcing premium insulation adoption in performance-led construction projects.

These companies are expected to lead due to technological differentiation, sustainability commitments, strategic partnerships, and aggressive capacity expansion, positioning them strongly in global construction markets.

|

Building Insulation Materials Market Scope |

|

|

Market Size in 2025 |

USD 35.22 Bn.. |

|

Market Size in 2032 |

USD 44.99 Bn.. |

|

CAGR (2026-2032) |

3.56% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Material Type Fiberglass / Glass Wool Mineral Wool (Stone Wool, Rock Wool) Plastic Foams (EPS, XPS, Polyurethane, Polyisocyanurate) Cellulose Others |

|

By Application Roof Wall Floor and Basement Others |

|

|

By Technology New Construction Renovation / Retrofit |

|

|

By End-User Residential Commercial Industrial / Institutional |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the Building Insulation Materials Market

North America

- Owens Corning (USA)

- Johns Manville (USA)

- Dow Inc. (USA)

- DuPont de Nemours, Inc. (USA)

- Huntsman Corporation (USA)

- Carlisle Companies Inc. (USA)

- GAF Materials Corporation (USA)

- Atlas Roofing Corporation (USA)

- Cellofoam North America Inc. (USA)

- IKO Group (Canada)

Europe

- Saint-Gobain (France)

- Rockwool International A/S (Denmark)

- Knauf Insulation (Germany)

- Kingspan Group plc (Ireland)

- BASF SE (Germany)

- Covestro AG (Germany)

- Armacell International (Germany)

- Recticel NV/SA (Belgium)

- URSA Insulation (Spain)

- Celotex Ltd. (United Kingdom)

- Gyvlon Ltd. (United Kingdom)

Asia-Pacific

- Anhui Sunval International Co., Ltd. (China)

- Hangzhou Qiyao New Material Co., Ltd. (China)

- Hainan Fuwang Industrial Co., Ltd. (China)

- Xuchang Zhufeng Insulation Material Co., Ltd. (China)

- Others

Frequently Asked Questions

The market size of the Building Insulation Materials Market by 2032 is expected to reach at US$ 44.99 Bn.

What is the forecast period for the Building Insulation Materials Market is 2026-2032

The market size of the Building Insulation Materials Market in 2024 was valued at US$ 35.22 Bn.

1. Building Insulation Materials Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Building Insulation Materials Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. Distribution Channel Segment

2.4.4. Revenue (2025)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Building Insulation Materials Market: Dynamics

3.1. Building Insulation Materials Market Trends

3.2. Building Insulation Materials Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Insulation Materials vs Alternative Energy Efficiency Solutions

4.1. Comparison with HVAC Efficiency Upgrades and Retrofits

4.2. Insulation versus Reflective Coatings and Glazing Solutions

4.3. Cost Effectiveness and Payback Period Comparison

4.4. Suitability across New Construction versus Renovation Projects

4.5. Strategic Implications for Building Owners and Developers

5. Pricing & Cost Benchmarking Analysis by Region

5.1. Historical Price Trend Analysis (2020–2025)

5.2. Regional Pricing Differentials

5.3. Impact of Raw Material and Labor Costs on Final Pricing

5.4. Channel-Wise Price Variation Analysis

5.5. Price Elasticity and Demand Sensitivity Assessment

5.6. Forward-Looking Pricing Outlook

5.7. Scenario-Based Cost Sensitivity Analysis

6. Demand–Supply Balance and Capacity Utilization Analysis

6.1. Global and Regional Insulation Material Demand Assessment

6.2. Installed Manufacturing Capacity by Material Type

6.3. Capacity Utilization and Supply Bottlenecks

6.4. Import Dependence and Regional Supply Gaps

6.5. Long-Term Demand–Supply Outlook

7. Installation Practices, Skill Availability, and Quality Assurance

7.1. Installation Quality Impact on Insulation Performance

7.2. Availability of Trained Installers and Labor Constraints

7.3. Certification, Training, and Best Practice Standards

7.4. Quality Assurance and Inspection Mechanisms

7.5. Performance Degradation due to Poor Installation

8. Investment & Financial Attractiveness Analysis

8.1. Capital Intensity and Investment Requirements

8.2. Return on Investment Benchmarking

8.3. Payback Period Analysis

8.4. M&A and Capacity Expansion Rationale

8.5. Investment Risk–Reward Assessment

8.6. Long-Term Value Creation Potential

9. Technology & Innovation Analysis

9.1. Emerging Insulation Material Technologies and Formulations

9.2. R&D Intensity and Innovation Focus Areas

9.3. Performance Benchmarking across Insulation Types

9.4. Durability, Lifecycle, and Thermal Efficiency Assessment

9.5. Cost–Performance Trade-Off Analysis

9.6. Technology Adoption Barriers and Acceleration Factors

9.7. Role of Sustainable and Bio-Based Innovations

10. Go-To-Market & Distribution Effectiveness

10.1. Distribution Channel Structure and Reach

10.2. Channel Efficiency and Cost Economics

10.3. Role of Distributors, Contractors, and Direct Sales

10.4. Key Account Penetration Strategies

10.5. Digitalization and Online Sales Impact

10.6. Channel Disruption and Consolidation Risks

10.7. Partnership and Alliance Effectiveness Analysis

11. Import & Export Analysis (2025)

11.1. Global Trade Flows Overview (Volume & Value)

11.2. Major Exporting Countries and Market Share

11.3. Leading Importing Regions and Demand Drivers

11.4. Trade Barriers, Tariffs, and Duty Structures

11.5. Trade Balance Analysis by Region

11.6. Impact of Currency Fluctuations on Trade Economics

11.7. 2024 Trade Trend Forecasts and Disruptions

12. Supply Chain Analysis

12.1. Raw Material Supply Sources and Concentration Risks

12.2. Supplier Landscape and Bargaining Power

12.3. Manufacturing Footprint and Regional Capacity Distribution

12.4. Logistics and Distribution Network Efficiency

12.5. Input Cost Drivers and Volatility Impact

12.6. Supply Chain Disruption Risks and Mitigation Strategies

12.7. Digitalization and Technology in Supply Chain Optimization

13. Sustainability Analysis

13.1. Carbon Footprint and Lifecycle Emissions Assessment

13.2. Energy Efficiency Contribution to Building Sustainability

13.3. Use of Recycled and Bio-Based Insulation Materials

13.4. Sustainability Certifications and Market Impact (LEED/BREEAM)

13.5. ESG Compliance Metrics for Manufacturers

13.6. Cost–Benefit Analysis of Sustainable Materials

13.7. Future Sustainability Trends and Adoption Drivers

14. Regulatory Landscape by Region

14.1. Building Energy Codes and Insulation Regulations across Regions

14.2. Certification, Testing, and Compliance Standards

14.3. Government Incentives and Subsidy Frameworks

14.4. Environmental Regulations and Carbon Compliance Impact

14.5. Trade, Import, and Regulatory Barriers

14.6. Regional Regulatory Risk and Policy Outlook

15. Building Insulation Materials Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2026-2032)

15.1. Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

15.1.1. Fiberglass / Glass Wool

15.1.2. Mineral Wool (Stone Wool, Rock Wool)

15.1.3. Plastic Foams (EPS, XPS, Polyurethane, Polyisocyanurate)

15.1.4. Cellulose

15.1.5. Others

15.2. Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

15.2.1. Roof

15.2.2. Wall

15.2.3. Floor and Basement

15.2.4. Others

15.3. Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

15.3.1. New Construction

15.3.2. Renovation / Retrofit

15.4. Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

15.4.1. Residential

15.4.2. Commercial

15.4.3. Industrial / Institutional

15.5. Building Insulation Materials Market Size and Forecast, by region (2026-2032)

15.5.1. North America

15.5.2. Europe

15.5.3. Asia Pacific

15.5.4. Middle East and Africa

15.5.5. South America

16. North America Building Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Billion) (2026-2032)

16.1. North America Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

16.1.1. Fiberglass / Glass Wool

16.1.2. Mineral Wool (Stone Wool, Rock Wool)

16.1.3. Plastic Foams (EPS, XPS, Polyurethane, Polyisocyanurate)

16.1.4. Cellulose

16.1.5. Others

16.2. Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

16.2.1. Roof

16.2.2. Wall

16.2.3. Floor and Basement

16.2.4. Others

16.3. North America Building Insulation Materials Market Size and Forecast, By Technology (2024-2032

16.3.1. New Construction

16.3.2. Renovation / Retrofit

16.4. North America Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

16.4.1. Residential

16.4.2. Commercial

16.4.3. Industrial / Institutional

16.5. North America Building Insulation Materials Market Size and Forecast, by Country (2026-2032)

16.5.1. United States

16.5.1.1. United States Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

16.5.1.1.1. Fiberglass / Glass Wool

16.5.1.1.2. Mineral Wool (Stone Wool, Rock Wool)

16.5.1.1.3. Plastic Foams (EPS, XPS, Polyurethane, Polyisocyanurate)

16.5.1.1.4. Cellulose

16.5.1.1.5. Others

16.5.1.2. Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

16.5.1.2.1. Roof

16.5.1.2.2. Wall

16.5.1.2.3. Floor and Basement

16.5.1.2.4. Others

16.5.1.3. United States Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

16.5.1.3.1. New Construction

16.5.1.3.2. Renovation / Retrofit

16.5.1.4. United States Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

16.5.1.4.1. Residential

16.5.1.4.2. Commercial

16.5.1.4.3. Industrial / Institutional

16.5.2. Canada

16.5.2.1. Canada Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

16.5.2.1.1. Fiberglass / Glass Wool

16.5.2.1.2. Mineral Wool (Stone Wool, Rock Wool)

16.5.2.1.3. Plastic Foams (EPS, XPS, Polyurethane, Polyisocyanurate)

16.5.2.1.4. Cellulose

16.5.2.1.5. Others

16.5.2.2. Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

16.5.2.2.1. Roof

16.5.2.2.2. Wall

16.5.2.2.3. Floor and Basement

16.5.2.2.4. Others

16.5.2.3. Canada Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

16.5.2.3.1. New Construction

16.5.2.3.2. Renovation / Retrofit

16.5.2.4. Canada Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

16.5.2.4.1. Residential

16.5.2.4.2. Commercial

16.5.2.4.3. Industrial / Institutional

16.5.3. Mexico

16.5.3.1. Mexico Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

16.5.3.1.1. Fiberglass / Glass Wool

16.5.3.1.2. Mineral Wool (Stone Wool, Rock Wool)

16.5.3.1.3. Plastic Foams (EPS, XPS, Polyurethane, Polyisocyanurate)

16.5.3.1.4. Cellulose

16.5.3.1.5. Others

16.5.3.2. Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

16.5.3.2.1. Roof

16.5.3.2.2. Wall

16.5.3.2.3. Floor and Basement

16.5.3.2.4. Others

16.5.3.3. Mexico Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

16.5.3.3.1. New Construction

16.5.3.3.2. Renovation / Retrofit

16.5.3.4. Mexico Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

16.5.3.4.1. Residential

16.5.3.4.2. Commercial

16.5.3.4.3. Industrial / Institutional

17. Europe Building Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Billion) (2026-2032)

17.1. Europe Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.2. Europe Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.3. Europe Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.4. Europe Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5. Europe Building Insulation Materials Market Size and Forecast, by Country (2026-2032)

17.5.1. United Kingdom

17.5.1.1. United Kingdom Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.1.2. United Kingdom Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.1.3. United Kingdom Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.1.4. United Kingdom Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5.2. France

17.5.2.1. France Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.2.2. France Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.2.3. France Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.2.4. France Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5.3. Germany

17.5.3.1. Germany Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.3.2. Germany Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.3.3. Germany Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.3.4. Germany Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5.4. Italy

17.5.4.1. Italy Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.4.2. Italy Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.4.3. Italy Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.4.4. Italy Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5.5. Spain

17.5.5.1. Spain Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.5.2. Spain Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.5.3. Spain Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.5.4. Spain Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5.6. Sweden

17.5.6.1. Sweden Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.6.2. Sweden Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.6.3. Sweden Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.6.4. Sweden Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5.7. Austria

17.5.7.1. Austria Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.7.2. Austria Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.7.3. Austria Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.7.4. Austria Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

17.5.8. Rest of Europe

17.5.8.1. Rest of Europe Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

17.5.8.2. Rest of Europe Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

17.5.8.3. Rest of Europe Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

17.5.8.4. Rest of Europe Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18. Asia Pacific Building Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Billion) (2026-2032)

18.1. Asia Pacific Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.2. Asia Pacific Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.3. Asia Pacific Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.4. Asia Pacific Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5. Asia Pacific Building Insulation Materials Market Size and Forecast, by Country (2026-2032)

18.5.1. China

18.5.1.1. China Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.1.2. China Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.1.3. China Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.1.4. China Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.2. S Korea

18.5.2.1. S Korea Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.2.2. S Korea Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.2.3. S Korea Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.2.4. S Korea Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.3. Japan

18.5.3.1. Japan Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.3.2. Japan Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.3.3. Japan Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.3.4. Japan Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.4. India

18.5.4.1. India Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.4.2. India Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.4.3. India Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.4.4. India Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.5. Australia

18.5.5.1. Australia Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.5.2. Australia Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.5.3. Australia Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.5.4. Australia Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.6. Indonesia

18.5.6.1. Indonesia Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.6.2. Indonesia Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.6.3. Indonesia Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.6.4. Indonesia Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.7. Malaysia

18.5.7.1. Malaysia Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.7.2. Malaysia Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.7.3. Malaysia Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.7.4. Malaysia Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.8. Vietnam

18.5.8.1. Vietnam Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.8.2. Vietnam Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.8.3. Vietnam Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.8.4. Vietnam Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.9. Philippines

18.5.9.1. Philippines Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.9.2. Philippines Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.9.3. Philippines Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.9.4. Philippines Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

18.5.10. Rest of Asia Pacific

18.5.10.1. Rest of Asia Pacific Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

18.5.10.2. Rest of Asia Pacific Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

18.5.10.3. Rest of Asia Pacific Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

18.5.10.4. Rest of Asia Pacific Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

19. Middle East and Africa Building Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Billion) (2026-2032)

19.1. Middle East and Africa Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

19.2. Middle East and Africa Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

19.3. Middle East and Africa Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

19.4. Middle East and Africa Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

19.5. Middle East and Africa Building Insulation Materials Market Size and Forecast, by Country (2026-2032)

19.5.1. South Africa

19.5.1.1. South Africa Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

19.5.1.2. South Africa Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

19.5.1.3. South Africa Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

19.5.1.4. South Africa Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

19.5.2. GCC

19.5.2.1. GCC Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

19.5.2.2. GCC Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

19.5.2.3. GCC Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

19.5.2.4. GCC Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

19.5.3. Nigeria

19.5.3.1. Nigeria Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

19.5.3.2. Nigeria Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

19.5.3.3. Nigeria Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

19.5.3.4. Nigeria Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

19.5.4. Rest of ME&A

19.5.4.1. Rest of ME&A Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

19.5.4.2. Rest of ME&A Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

19.5.4.3. Rest of ME&A Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

19.5.4.4. Rest of ME&A Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

20. South America Building Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Billion) (2026-2032)

20.1. South America Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

20.2. South America Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

20.3. South America Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

20.4. South America Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

20.5. South America Building Insulation Materials Market Size and Forecast, by Country (2026-2032)

20.5.1. Brazil

20.5.1.1. Brazil Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

20.5.1.2. Brazil Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

20.5.1.3. Brazil Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

20.5.1.4. Brazil Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

20.5.2. Argentina

20.5.2.1. Argentina Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

20.5.2.2. Argentina Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

20.5.2.3. Argentina Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

20.5.2.4. Argentina Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

20.5.3. Rest Of South America

20.5.3.1. Rest Of South America Building Insulation Materials Market Size and Forecast, By Material Type (2026-2032)

20.5.3.2. Rest Of South America Building Insulation Materials Market Size and Forecast, By Application (2026-2032)

20.5.3.3. Rest Of South America Building Insulation Materials Market Size and Forecast, By Technology (2026-2032)

20.5.3.4. Rest Of South America Building Insulation Materials Market Size and Forecast, By End-User (2026-2032)

21. Company Profile: Key Players

21.1. Owens Corning (USA)

21.1.1. Company Overview

21.1.2. Business Portfolio

21.1.3. Financial Overview

21.1.4. SWOT Analysis

21.1.5. Strategic Analysis

21.1.6. Recent Developments

21.2. Johns Manville (USA)

21.3. Dow Inc. (USA)

21.4. DuPont de Nemours, Inc. (USA)

21.5. Huntsman Corporation (USA)

21.6. Carlisle Companies Inc. (USA)

21.7. GAF Materials Corporation (USA)

21.8. Atlas Roofing Corporation (USA)

21.9. Cellofoam North America Inc. (USA)

21.10. IKO Group (Canada)

21.11. Saint-Gobain (France)

21.12. Rockwool International A/S (Denmark)

21.13. Knauf Insulation (Germany)

21.14. Kingspan Group plc (Ireland)

21.15. BASF SE (Germany)

21.16. Covestro AG (Germany)

21.17. Armacell International (Germany)

21.18. Recticel NV/SA (Belgium)

21.19. URSA Insulation (Spain)

21.20. Celotex Ltd. (United Kingdom)

21.21. Gyvlon Ltd. (United Kingdom)

21.22. Anhui Sunval International Co., Ltd. (China)

21.23. Hangzhou Qiyao New Material Co., Ltd. (China)

21.24. Hainan Fuwang Industrial Co., Ltd. (China)

21.25. Xuchang Zhufeng Insulation Material Co., Ltd. (China)

21.26. Others

22. Key Findings

23. Analyst Recommendations

24. Building Insulation Materials Market: Research Methodology