Sulfuric Acid Market: Global Industry Analysis and Forecast (2025-2032)

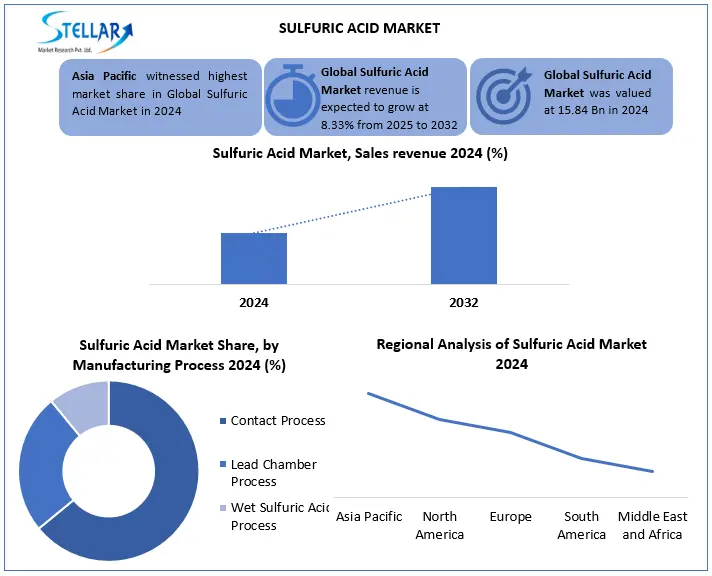

The Sulfuric Acid Market size was valued at USD 15.84 Bn in 2024 and the total Global Sulfuric Acid Market revenue is expected to grow at a CAGR of 8.33% from 2025 to 2032, reaching nearly USD 30.04 Bn by 2032.

Format : PDF | Report ID : SMR_2806

Sulfuric Acid Market Overview

Sulfuric acid (H2SO4) is a highly corrosive, dense, and oily strong mineral acid that is colourless to slightly yellow in its pure form. It is one of the most industrially important chemicals due to its wide-ranging applications, including fertilizer production (phosphate processing), metal refining (copper, zinc), petroleum refining, chemical synthesis (detergents, dyes), and battery manufacturing (lead-acid batteries).

The major driving force inside the sulfuric acid market is the growing global call for phosphate-based fully fertilizers, which is responsible for the consumption of more than 50% sulfuric acid, seeks to help in fuel growing population and food protection through increasing agriculture. Increase in steel processing (especially copper, zinc, and nickel leaching for EVS and electronics) and growing battery manufacturing (lead-acid and lithium-ion) further for propel calls for sulphuric acid. Technical improvements in recycling and sulfur restoration strategies additionally increase sulfuric acid market performance, ensuring that sulfuric acid remains fundamental for the duration of essential industries.

Many fundamental chemical and mining corporations have initiated a green sulfuric acid initiative in 2024 to reduce carbon emissions with traditional manufacturing techniques. BASF (Germany) and Yara International (Norway) are leading hydrogen-based sulfuric acid flora, the use of renewable power to divide water for hydrogen instead of burning fossil-rich sulfur.

To get more Insights: Request Free Sample Report

Sulfuric Acid Market Dynamics

Expansion of the Energy Sector to Boost the Sulfuric Acid Market

The expansion of the energy zone, particularly in battery production and recycling, is extensively driving the demand for sulfuric acid. Sulfuric acid performs a critical role in the manufacturing and recycling of lead-acid batteries, that are widely used in strength garage systems. As the worldwide shift in the direction of renewable power resources intensifies, the want for green energy storage solutions has led to an increase in battery production.

Complex Production for High Purity Applications to restrain the Sulfuric Acid Market

The manufacturing of high-purity sulfuric acid affords giant challenges that restrain its broader market adoption. Achieving the extremely-low impurity levels required for programs in semiconductors, prescription drugs, and electronics necessitates superior purification strategies, such as multi-stage distillation, ion trade, and membrane filtration. These processes demand large capital funding in specialized equipment and infrastructure, main to better production charges. For instance, the manufacturing of electronic-grade high-purity sulfuric acid involves stringent excellent manage measures to satisfy the exacting standards of the semiconductor enterprise, where even hint contaminants can compromise product integrity.

Biofuel and Renewable Energy Production to create Opportunity in the Sulfuric Acid Market

Sulfuric acid gives an important feature in the biofuel enterprise, especially in the manufacture of biodiesel and bioethanol. In biodiesel production, it acts as a powerful catalyst in the estimation of fatty acids, which receives high conversion capacity as 96–99% under customized conditions. As the global emphasis on renewable power is intensified, biofuels manufacturing strategies predict the upstanding emphasis on the decision for sulfuric acid, supplying considerable growth possibilities within the sulfuric acid marketplace.

Sulfuric Acid Market Segment Analysis

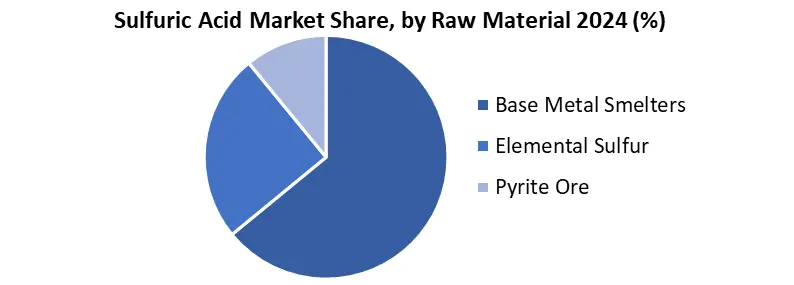

Based on Raw Material, the sulfuric acid market is segmented into elemental sulfur, base metal smelters and pyrite ore. The base metal smelter segment dominates the sulfuric acid marketplace through raw materials, usually because a part of sulfuric acid is produced as a sub -board of copper, zinc and nickel smelting. This method is responsible for more than 50% of the world sulfuric acid delivery, as smelters get high sulfur dioxide (so,) emissions from metal ore processing and are converted into sulfuric acid, which leads to cost -effective and environmentally regulated.

Based on Manufacturing Process, the sulfuric acid market is segmented into contact process, lead chamber process and wet sulfuric acid process. The contact process dominates the sulfuric acid market with the assistance of the production approach due to the ability to supply more than 90% of the world sulfuric acid manufacturing. The excessive performance, scalability and the ability to supply focused sulfuric acid (98–99% purity) further demands sulphuric acid growth.

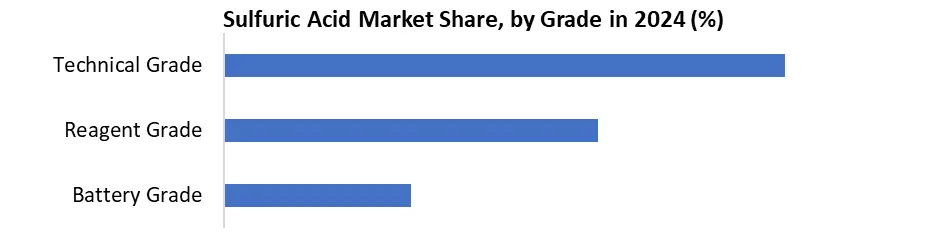

Based on Grade, the sulfuric acid market is segmented into technical grade, reagent grade and battery grade. The technical grade phase dominates the sulfuric acid market, accounting for the largest part of global production and consumption. This dominance is pushed with fertilizer production (phosphate-based fertilizers), steel processing (copper, zinc leaching), and its large resources in petroleum refining, which together form a majority of sulfuric acid development.

Based on Application, the sulfuric acid market is segmented into fertilizers, automotives, chemical manufacturing, metal processing, textile industry, petroleum refining, etc. The fertilizer section dominates the sulfuric acid market through utility, accounting for more than 50% of the world intake, as sulfuric acid is used in phosphate-based fertilizers. This dominance operates using increasing agricultural demand, especially in Asia-Pacific and South America, where countries like China, India and Brazil depend on phosphate fertilizers to beautify crop yields.

Sulfuric Acid Market Regional Analysis

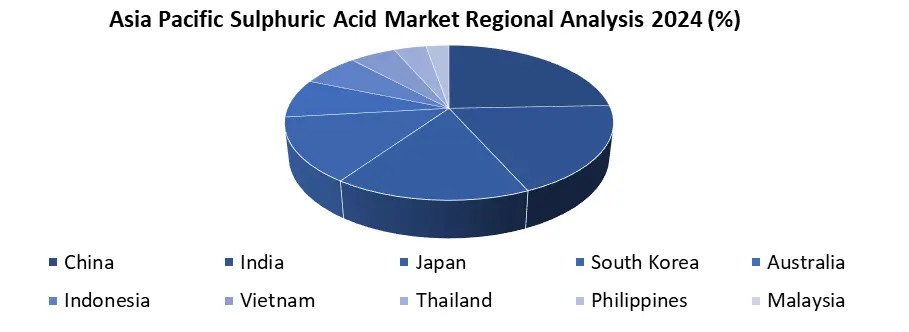

Asia Pacific dominates in the Sulfuric Acid Market

The Asia Pacific (APAC) region dominates the sulfuric acid marketplace because of its main role in key demand-using industries. China, the arena’s pinnacle producer, contributes over 35% of worldwide sulfuric acid output, largely from smelter-based totally byproduct manufacturing and phosphate fertilizer manufacturing, with over 50% of its sulfuric acid used in agriculture. India follows as a chief country, with 70% of its sulfuric acid call for tied to fertilizers, even as speedy industrialization boosts utilization in chemical compounds and metals.

Sulfuric Acid Market Competitive Landscape

In 2024, BASF maintained a major feature inside the sulfuric acid market worldwide, taking advantage of control in its integrated chemical production community and experienced sulfuric acid functions. The aggressive part of the BASF stems from its hydrogen-based pilot vegetation in Ludwigshafen, which aligns with the decarbonization mandate of the European Union, and its strategic partnership in battery-grade sulfuric acid for lithium mining.

Key Developments in the Sulfuric Acid Market

- In March 2025, the Mosaic Company launched a $200M AI-powered sulfuric acid plant in Louisiana, boosting production efficiency by 22%.

- In Januray 2025, Honeywell International debuted its Ultra-SRU technology, achieving 99.97% sulfur recovery for refinery applications.

- In October 2024, PCS Nitrogen commissioned North America's first modular sulfuric acid unit, reducing construction timelines by 40%.

- IN February 2025, Chemtrade Logistics began supplying battery-grade sulfuric acid to 3 major EV manufacturers.

- In May 2025, Peñoles partnered with Sumitomo to develop low-carbon sulfuric acid production from copper smelting byproducts.

|

Sulfuric Acid Market Scope |

||

|

Market Size in 2024 |

15.84 Bn. |

|

|

Market Size in 2032 |

30.04 Bn. |

|

|

CAGR (2025-2032) |

8.33% |

|

|

Historic Data |

2019-2024 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments Analysis |

By Raw Material Elemental Sulfur Base Metal Smelters Pyrite Ore |

|

|

By Manufacturing Process Contact Process Lead Chamber Process Wet Sulfuric Acid Process |

||

|

By Grade Technical Grade Reagent Grade Battery Grade |

||

|

By Application Fertilizers Chemical Manufacturing Automotive Textile Industry Metal Processing Petroleum Refining Others |

||

|

Regional Scope |

North America: United States, Canada, Mexico Europe: United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe Asia Pacific (APAC): China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC Middle East & Africa (MEA): South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA South America: Brazil, Argentina, Colombia, Chile, Peru, Rest of South America |

|

Key players of Sulfuric Acid Market

North America

- The Mosaic Company (US)

- Honeywell International (US)

- PCS Nitrogen (US)

- Chemtrade Logistics (Canada)

- Peñoles (Mexico)

Europe

- Johnson Matthey (UK)

- BASF SE (Germany)

- Arkema (France)

- Italmatch Chemicals (Italy)

- Fertiberia (Spain)

Asia Pacific

- China Petrochemical Corporation (China)

- Yunnan Copper Co., Ltd. (China)

- Sumitomo Chemical Co., Ltd. (Japan)

- Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) (India)

- Hindustan Zinc (Vedanta Group) (India)

- Incitec Pivot Limited (Australia)

Middle East and Africa

- Sasol (South Africa)

- Omnia Group (South Africa)

- Saudi Arabian Mining Company (Ma’aden) (GCC)

- Notore Chemical Industries (Nigeria)

- Abu Qir Fertilizers and Chemicals (Egypt)

South America

- Vale S.A. (Brazil)

- Unigel (Brazil)

- Profertil S.A. (Argentina)

- Ecopetrol (Colombia)

- Codelco (Chile)

Frequently Asked Questions

Asia Pacific is the leading region in Sulfuric Acid Market in 2024.

Primary driver for the Sulfuric Acid Market is the expansion of sulphuric acid into the energy sector.

A significant challenge in the Sulfuric Acid Market is complex production of sulphuric acid for the high purity applications.

BASF, China Petrochemical Corporation, Yunnan Copper Co., Ltd., Sumitomo Chemical Co., Ltd., Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) are the leading companies in the Sulfuric acid market.

1. Sulfuric Acid Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Sulfuric Acid Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. Application Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Sulfuric Acid Market: Dynamics

3.1. Sulfuric Acid Market Trends

3.2. Sulfuric Acid Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Sulfuric Acid Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

4.1.1. Elemental Sulfur

4.1.2. Base Metal Smelters

4.1.3. Pyrite Ore

4.2. Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

4.2.1. Contact Process

4.2.2. Lead Chamber Process

4.2.3. Wet Sulfuric Acid Process

4.3. Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

4.3.1. Technical Grade

4.3.2. Reagent Grade

4.3.3. Battery Grade

4.4. Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

4.4.1. Fertilizers

4.4.2. Chemical Manufacturing

4.4.3. Automotive

4.4.4. Textile Industry

4.4.5. Metal Processing

4.4.6. Petroleum Refining

4.4.7. Others

4.5. Sulfuric Acid Market Size and Forecast, By Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

5.1.1. Elemental Sulfur

5.1.2. Base Metal Smelters

5.1.3. Pyrite Ore

5.2. North America Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

5.2.1. Contact Process

5.2.2. Lead Chamber Process

5.2.3. Wet Sulfuric Acid Process

5.3. North America Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

5.3.1. Technical Grade

5.3.2. Reagent Grade

5.3.3. Battery Grade

5.4. North America Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

5.4.1. Fertilizers

5.4.2. Chemical Manufacturing

5.4.3. Automotive

5.4.4. Textile Industry

5.4.5. Metal Processing

5.4.6. Petroleum Refining

5.4.7. Others

5.5. North America Sulfuric Acid Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

5.5.1.1.1. Elemental Sulfur

5.5.1.1.2. Base Metal Smelters

5.5.1.1.3. Pyrite Ore

5.5.1.2. United States Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

5.5.1.2.1. Contact Process

5.5.1.2.2. Lead Chamber Process

5.5.1.2.3. Wet Sulfuric Acid Process

5.5.1.3. United States Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

5.5.1.3.1. Technical Grade

5.5.1.3.2. Reagent Grade

5.5.1.3.3. Battery Grade

5.5.1.4. United States Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

5.5.1.4.1. Fertilizers

5.5.1.4.2. Chemical Manufacturing

5.5.1.4.3. Automotive

5.5.1.4.4. Textile Industry

5.5.1.4.5. Metal Processing

5.5.1.4.6. Petroleum Refining

5.5.1.4.7. Others

5.5.2. Canada

5.5.2.1. Canada Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

5.5.2.1.1. Elemental Sulfur

5.5.2.1.2. Base Metal Smelters

5.5.2.1.3. Pyrite Ore

5.5.2.2. Canada Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

5.5.2.2.1. Contact Process

5.5.2.2.2. Lead Chamber Process

5.5.2.2.3. Wet Sulfuric Acid Process

5.5.2.3. Canada Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

5.5.2.3.1. Technical Grade

5.5.2.3.2. Reagent Grade

5.5.2.3.3. Battery Grade

5.5.2.4. Canada Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

5.5.2.4.1. Fertilizers

5.5.2.4.2. Chemical Manufacturing

5.5.2.4.3. Automotive

5.5.2.4.4. Textile Industry

5.5.2.4.5. Metal Processing

5.5.2.4.6. Petroleum Refining

5.5.2.4.7. Others

5.5.3. Mexico

5.5.3.1. Mexico Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

5.5.3.1.1. Elemental Sulfur

5.5.3.1.2. Base Metal Smelters

5.5.3.1.3. Pyrite Ore

5.5.3.2. Mexico Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

5.5.3.2.1. Contact Process

5.5.3.2.2. Lead Chamber Process

5.5.3.2.3. Wet Sulfuric Acid Process

5.5.3.3. Mexico Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

5.5.3.3.1. Technical Grade

5.5.3.3.2. Reagent Grade

5.5.3.3.3. Battery Grade

5.5.3.4. Mexico Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

5.5.3.4.1. Fertilizers

5.5.3.4.2. Chemical Manufacturing

5.5.3.4.3. Automotive

5.5.3.4.4. Textile Industry

5.5.3.4.5. Metal Processing

5.5.3.4.6. Petroleum Refining

5.5.3.4.7. Others

6. Europe Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

6.1. Europe Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.2. Europe Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.3. Europe Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.4. Europe Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5. Europe Sulfuric Acid Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.1.2. United Kingdom Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.1.3. United Kingdom Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.1.4. United Kingdom Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5.2. France

6.5.2.1. France Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.2.2. France Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.2.3. France Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.2.4. France Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.3.2. Germany Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.3.3. Germany Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.3.4. Germany Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.4.2. Italy Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.4.3. Italy Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.4.4. Italy Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.5.2. Spain Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.5.3. Spain Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.5.4. Spain Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.6.2. Sweden Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.6.3. Sweden Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.6.4. Sweden Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.7.2. Russia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.7.3. Russia Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.7.4. Russia Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

6.5.8.2. Rest of Europe Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

6.5.8.3. Rest of Europe Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

6.5.8.4. Rest of Europe Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

7.1. Asia Pacific Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.2. Asia Pacific Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.3. Asia Pacific Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.4. Asia Pacific Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5. Asia Pacific Sulfuric Acid Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.1.2. China Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.1.3. China Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.1.4. China Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.2.2. S Korea Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.2.3. S Korea Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.2.4. S Korea Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.3.2. Japan Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.3.3. Japan Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.3.4. Japan Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.4. India

7.5.4.1. India Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.4.2. India Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.4.3. India Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.4.4. India Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.5.2. Australia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.5.3. Australia Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.5.4. Australia Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.6.2. Indonesia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.6.3. Indonesia Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.6.4. Indonesia Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.7.2. Malaysia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.7.3. Malaysia Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.7.4. Malaysia Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.8. Philippines

7.5.8.1. Philippines Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.8.2. Philippines Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.8.3. Philippines Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.8.4. Philippines Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.9. Thailand

7.5.9.1. Thailand Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.9.2. Thailand Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.9.3. Thailand Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.9.4. Thailand Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.10.2. Vietnam Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.10.3. Vietnam Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.10.4. Vietnam Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

7.5.11.2. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

7.5.11.3. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

7.5.11.4. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Sulfuric Acid Market Size and Forecast (by Value in USD Bn) (2024-2032)

8.1. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

8.2. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

8.3. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

8.4. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

8.5. Middle East and Africa Sulfuric Acid Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

8.5.1.2. South Africa Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

8.5.1.3. South Africa Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

8.5.1.4. South Africa Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

8.5.2.2. GCC Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

8.5.2.3. GCC Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

8.5.2.4. GCC Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

8.5.3. Egypt

8.5.3.1. Egypt Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

8.5.3.2. Egypt Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

8.5.3.3. Egypt Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

8.5.3.4. Egypt Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

8.5.4.2. Nigeria Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

8.5.4.3. Nigeria Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

8.5.4.4. Nigeria Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

8.5.5.2. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

8.5.5.3. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

8.5.5.4. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

9. South America Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

9.1. South America Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

9.2. South America Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

9.3. South America Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

9.4. South America Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

9.5. South America Sulfuric Acid Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

9.5.1.2. Brazil Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

9.5.1.3. Brazil Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

9.5.1.4. Brazil Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

9.5.2.2. Argentina Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

9.5.2.3. Argentina Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

9.5.2.4. Argentina Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

9.5.3. Colombia

9.5.3.1. Colombia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

9.5.3.2. Colombia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

9.5.3.3. Colombia Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

9.5.3.4. Colombia Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

9.5.4. Chile

9.5.4.1. Chile Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

9.5.4.2. Chile Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

9.5.4.3. Chile Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

9.5.4.4. Chile Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

9.5.5. Rest Of South America

9.5.5.1. Rest Of South America Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032)

9.5.5.2. Rest Of South America Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032)

9.5.5.3. Rest Of South America Sulfuric Acid Market Size and Forecast, By Grade (2024-2032)

9.5.5.4. Rest Of South America Sulfuric Acid Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. The Mosaic Company

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Honeywell International

10.3. PCS Nitrogen

10.4. Chemtrade Logistics

10.5. Peñoles

10.6. Johnson Matthey

10.7. BASF SE

10.8. Arkema

10.9. Italmatch Chemicals

10.10. Fertiberia

10.11. China Petrochemical Corporation

10.12. Yunnan Copper Co., Ltd.

10.13. Sumitomo Chemical Co., Ltd.

10.14. Gujarat Narmada Valley Fertilizers & Chemicals (GNFC)

10.15. Hindustan Zinc (Vedanta Group)

10.16. Incitec Pivot Limited

10.17. Sasol

10.18. Omnia Group

10.19. Saudi Arabian Mining Company (Ma’aden)

10.20. Notore Chemical Industries

10.21. Abu Qir Fertilizers and Chemicals

10.22. Vale S.A.

10.23. Unigel

10.24. Profertil S.A.

10.25. Ecopetrol

10.26. Codelco

11. Key Findings & Analyst Recommendations

12. Sulfuric Acid Market: Research Methodology