Hydrogen Peroxide Market: Growth Driving Factors and Opportunities (2024-2032)

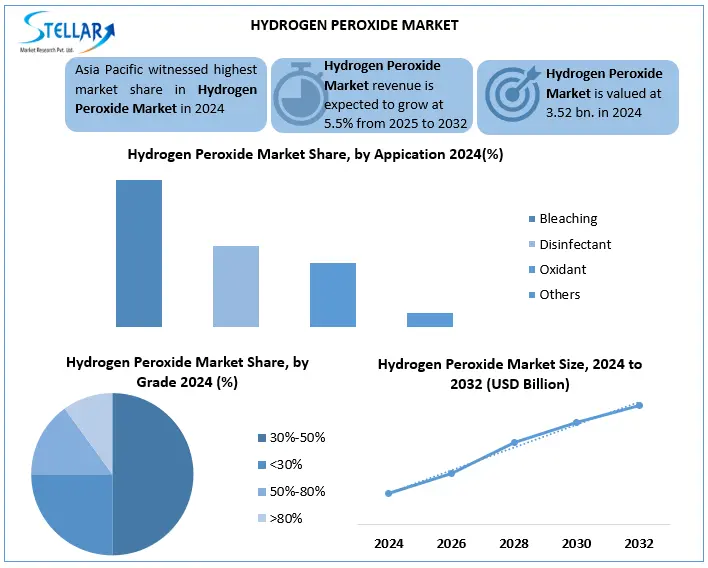

The Hydrogen Peroxide Market was valued at USD 3.52 billion in 2024. Its total industry revenue is expected to grow by 5.5% from 2025 to 2032, reaching nearly USD 5.40 billion in 2032.

Format : PDF | Report ID : SMR_2821

Hydrogen Peroxide Market Overview

Hydrogen peroxide (H2O2) is a powerful yet eco-friendly oxidizing agent that breaks down into just water and oxygen. Used across industries, it serves as a disinfectant (3-6% solutions), industrial bleach (30-50% for paper/textiles), and high-tech cleaner (>50% for electronics).

Key applications include pulp bleaching, water treatment, chemical synthesis, and wound care. While low concentrations are safe, high-grade H2O2 requires careful handling due to its corrosive nature and decomposition risks. Its clean breakdown makes it a sustainable choice for replacing harsher chemicals in manufacturing and sanitation.

Hydrogen peroxide market is experiencing strong growth by the increasing demand for environmentally friendly industrial solutions. Pulp and paper industry remains the largest consumer, which adopts H2O2 as a sustainable bleaching option for rapid chlorine-based chemicals. Asia-Pacific dominates global consumption by expanding manufacturing areas in major markets like China and India. Water treatment applications are growing rapidly as municipalities and industries implement advanced oxidation processes. High-purity grade semiconductors are gaining importance in high-tech areas, including manufacturing and electronics. Leading manufacturers are investing in capacity expansions and sustainable production technologies to meet the needs of developed industry.

To get more Insights: Request Free Sample Report

Hydrogen Peroxide Market Dynamics

Eco-Friendly Bleaching to Drive the Hydrogen Peroxide Market

Pulp & paper industry is the largest consumer of hydrogen peroxide, also using it eco-friendly bleaching agent to replace chlorine-based chemicals. H2O2's key advantages include non-toxic decomposition (into water/oxygen) and compliance with strict environmental regulations (ECF/TCF standards). It brightens pulp for the high-quality paper, enables recycled fiber deinking, and removes lignin without damaging fibers. Growing demand for sustainable packaging and recycled paper boosts consumption, mainly in Asia-Pacific markets. While alternatives like ozone exist, H2O2 remains dominant due to superior paper quality and recycling compatibility. With 5-6% annual growth, its use will expand further as environmental standards tighten globally.

High-Concentration Hydrogen Peroxide Handling to Restrain the Hydrogen Peroxide Market

High-concentration hydrogen peroxide (>50%) poses serious safety risks, including violent decomposition when exposed to contaminants or heat. Also, the grades require stainless steel/aluminum storage with temperature control (<30°C) and pressure-relief systems. Even trace metals or organics can trigger dangerous exothermic reactions, releasing oxygen. Strict handling protocols mandate stabilizers, full PPE, and water-based fire suppression. Transportation is heavily regulated, with air shipment banned for >52% solutions. Industries like electronics and aerospace face extra challenges with ultra-pure or rocket-grade H?O? (90-98%), requiring cleanrooms and refrigeration. Proper management is critical to prevent accidents in industrial and laboratory settings.

The Green Oxidizer Revolutionizing Clean Chemistry to Boost the Hydrogen Peroxide Market

Hydrogen peroxide is becoming oxidizer of choice in green chemistry by its clean decomposition into water and oxygen. It replaces toxic alternatives like chromates in pharmaceutical synthesis and chlorine in pulp bleaching, aligning with global sustainability goals. HPPO process for propylene oxide production showcases its industrial green potential, reducing wastewater by 70-80%. Also, emerging bio-based production methods, including enzymatic and photocatalytic routes, promise even cleaner H?O? synthesis. While cost and stability challenges remain, tightening environmental regulations are accelerating adoption. Major chemical firms like Solvay and Evonik are investing heavily in peroxide-based green technologies, driving market growth.

Hydrogen Peroxide Market Segment Analysis

Based on Application, hydrogen peroxide market is segmented in disinfectant, bleaching, oxidant, and others. Bleaching segment dominates hydrogen peroxide market, by its widespread use in paper & pulp and textile industries. Also, eco-friendly alternative to chlorine-based bleaches, hydrogen peroxide is essential for whitening paper pulp and fabrics while meeting strict environmental regulations. Although disinfectant applications grew during the pandemic, their demand is more variable, while oxidant uses (like wastewater treatment) and niche applications (e.g., electronics) remain smaller in scale. Also, steady, large-scale consumption in bleaching, along with rising textile production in emerging markets, ensures its continued market leadership.

Based on Grade, hydrogen peroxide market is segmented in <30%, 30%-50%, 50%-80%, and >80%. 30%-50% hydrogen peroxide grade leads the global market, due ro its widespread use in paper/pulp bleaching and textile processing, two largest application sectors. This mid-range concentration offers the optimal balance between bleaching effectiveness and safe handling, making it more practical than higher grades that require specialized storage. It's also a preferred choice for chemical manufacturing and water treatment by its strong yet controllable oxidizing properties. While <30% solutions serve disinfectant needs and >50% grades cater to niche applications like electronics, the 30%-50% segment delivers best cost-to-performance ratio for bulk industrial use. Its dominance is further reinforced by environmental regulations favoring this concentration for eco-friendly bleaching processes. Also grade's versatility across multiple industries ensures its continued market leadership in hydrogen peroxide applications.

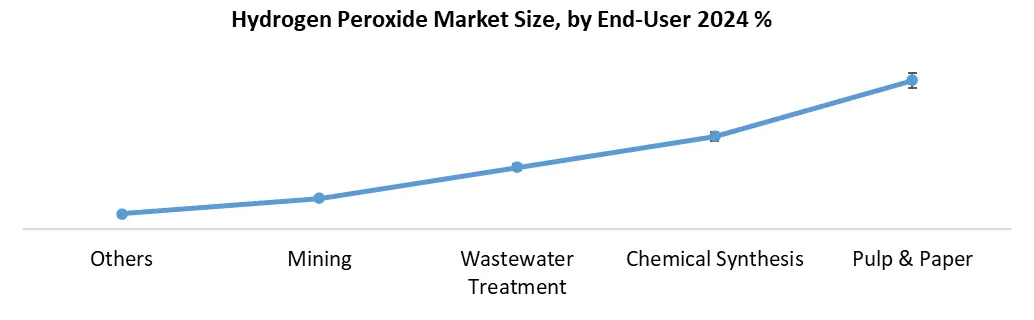

Based on End-user, hydrogen peroxide market is segmented in pulp & paper, chemical synthesis, wastewater treatment, mining, and others. Pulp & paper industry dominates the hydrogen peroxide market, consuming 40-50% of global production. This dominance stems from hydrogen peroxide's essential role also an eco-friendly bleaching agent, replacing chlorine-based chemicals in paper manufacturing. Strict environmental regulations favor its use since it decomposes into just water and oxygen. The textile industry's parallel demand for fabric bleaching further boosts consumption. While wastewater treatment and chemical synthesis are growing segments, their volumes remain smaller than pulp/paper's massive-scale usage. The industry's structural dependence on hydrogen peroxide for quality and compliance ensures its continued market leadership. Emerging economies' expanding paper production further reinforces this dominance.

Hydrogen Peroxide Market Regional Analysis

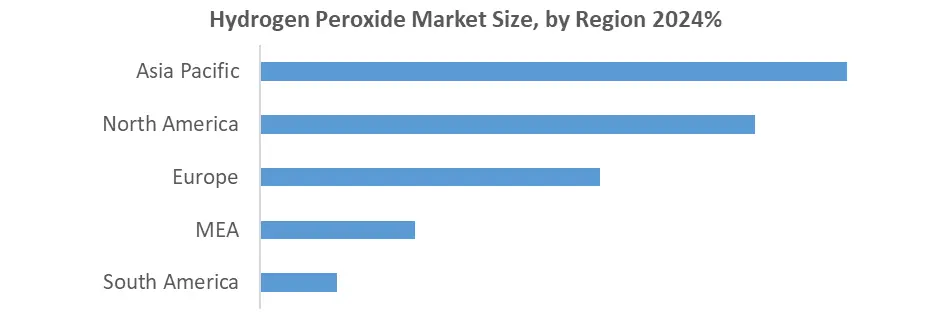

The region leads global hydrogen peroxide market, capturing over 40% of worldwide demand, by its booming pulp/paper and textile industries that heavily rely on H?O? for eco-friendly bleaching. Also world manufacturing hub, APAC's rapid industrialization in chemicals, electronics, and water treatment further accelerates consumption. China and India dominate as both major producers and consumers, supported by local manufacturing capabilities and favorable environmental policies phasing out chlorine-based alternatives. While North America and Europe maintain steady demand for sustainable applications, APAC's expanding industrial base and cost-competitive production ensure its continued market dominance, with growth outpacing other regions.

Hydrogen Peroxide Market Competitive Landscape

The hydrogen peroxide market is fiercely competitive, with giants like Solvay and Evonik leading large-scale production while specialists like Mitsubishi Gas Chemical focus on high-purity grades. Competition revolves around production efficiency (traditional vs green methods), application expertise (paper, electronics, pharma), and regional dominance. Emerging players target niches like semiconductor-grade H?O? (Santoku Chemical) and sustainable solutions (PeroxyChem). Key differentiators include concentration grades (industrial to medical), stabilization tech, and strategic partnerships with paper mills, water plants, and chipmakers. The market is evolving with tighter regulations and demand for eco-friendly alternatives.

Recent Development in the Hydrogen Peroxide Market

1. Solvay

- June 2024: Launched "HighStable™ 50", a stabilized H?O? formulation for pulp bleaching, reducing decomposition losses by 20%.

- March 2024: Expanded production in Brazil to serve Latin American paper and water treatment markets.

2. Evonik

- May 2024: Partnered with Intel to supply ultra-high-purity H?O? for advanced semiconductor node manufacturing.

|

Hydrogen Peroxide Market Scope |

|

|

Market Size in 2024 |

USD 3.52 Bn. |

|

Market Size in 2032 |

USD 5.40 Bn. |

|

CAGR (2024-2032) |

5.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Segments

|

By Application Disinfectant Bleaching Oxidant Others |

|

By Grade <30% 30%-50% 50%-80% >80% |

|

|

By End-User Pulp & Paper Chemical Synthesis Wastewater Treatment Mining Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Hydrogen Peroxide Market

North America

- Solvay SA (Belgium) - US operations

- Evonik Industries AG (Germany) - North American HQ

- Arkema Group (France)

- Ecolab Inc. (USA)

- Auro Hydrogen Peroxide (Canada)

Europe

- Solvay SA (Belgium)

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Arkema Group (France)

- PeroxyChem (UK) - now part of Evonik

- Perstorp Holding AB (Sweden)

Asia-Pacific

- Sinopec Shanghai Petrochemical (China)

- Luxi Chemical Group (China)

- Mitsubishi Gas Chemical Company (Japan)

- Nouryon (Netherlands) - Japan operations

- OCI Company Ltd. (South Korea)

- National Peroxide Limited (India)

- Gujarat Alkalies & Chemicals Ltd. (India)

- Aditya Birla Chemicals (Thailand)

- Arkema Asia Pacific (Singapore)

Middle East & Africa

- SABIC (Saudi Arabia)

- Afrox Limited (South Africa)

- Emirates Peroxide Company (UAE)

South America

- Solvay Brazil (Brazil)

- Arkema Argentina (Argentina)

- Quimica Meroquim (Chile)

- Industrias Químicas Oxígeno (Colombia)

Frequently Asked Questions

Safety risks with high-concentration H?O? (>50%), requiring specialized storage/transport, and raw material price volatility.

30%-50% concentration, ideal for industrial bleaching (paper/textiles) and chemical synthesis, balancing efficiency and safety.

Solvay, Evonik (large-scale); Mitsubishi Gas (high-purity); Santoku (semiconductors).

Better production, specialty grades (electronics/medical), and regional expansion.

1. Hydrogen Peroxide Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Hydrogen Peroxide Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Hydrogen Peroxide Market: Dynamics

3.1. Hydrogen Peroxide Market Trends

3.2. Hydrogen Peroxide Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis For the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Hydrogen Peroxide Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

4.1.1. Disinfectant

4.1.2. Bleaching

4.1.3. Oxidant

4.1.4. Others

4.2. Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

4.2.1. <30%

4.2.2. 30%-50%

4.2.3. 50%-80%

4.2.4. >80%

4.3. Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

4.3.1. Pulp & Paper

4.3.2. Chemical Synthesis

4.3.3. Wastewater Treatment

4.3.4. Mining

4.3.5. Others

4.4. Hydrogen Peroxide Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Hydrogen Peroxide Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

5.1.1. Disinfectant

5.1.2. Bleaching

5.1.3. Oxidant

5.1.4. Others

5.2. North America Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

5.2.1. <30%

5.2.2. 30%-50%

5.2.3. 50%-80%

5.2.4. >80%

5.3. North America Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

5.3.1. Pulp & Paper

5.3.2. Chemical Synthesis

5.3.3. Wastewater Treatment

5.3.4. Mining

5.3.5. Others

5.4. North America Hydrogen Peroxide Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

5.4.1.1.1. Disinfectant

5.4.1.1.2. Bleaching

5.4.1.1.3. Oxidant

5.4.1.1.4. Others

5.4.1.2. United States Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

5.4.1.2.1. <30%

5.4.1.2.2. 30%-50%

5.4.1.2.3. 50%-80%

5.4.1.2.4. >80%

5.4.1.3. United States Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

5.4.1.3.1. Pulp & Paper

5.4.1.3.2. Chemical Synthesis

5.4.1.3.3. Wastewater Treatment

5.4.1.3.4. Mining

5.4.1.3.5. Others

5.4.2. Canada

5.4.2.1. Canada Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

5.4.2.1.1. Disinfectant

5.4.2.1.2. Bleaching

5.4.2.1.3. Oxidant

5.4.2.1.4. Others

5.4.2.2. Canada Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

5.4.2.2.1. <30%

5.4.2.2.2. 30%-50%

5.4.2.2.3. 50%-80%

5.4.2.2.4. >80%

5.4.2.3. Canada Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

5.4.2.3.1. Pulp & Paper

5.4.2.3.2. Chemical Synthesis

5.4.2.3.3. Wastewater Treatment

5.4.2.3.4. Mining

5.4.2.3.5. Others

5.4.3. Mexico

5.4.3.1. Mexico Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

5.4.3.1.1. Disinfectant

5.4.3.1.2. Bleaching

5.4.3.1.3. Oxidant

5.4.3.1.4. Others

5.4.3.2. Mexico Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

5.4.3.2.1. <30%

5.4.3.2.2. 30%-50%

5.4.3.2.3. 50%-80%

5.4.3.2.4. >80%

5.4.3.3. Mexico Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

5.4.3.3.1. Pulp & Paper

5.4.3.3.2. Chemical Synthesis

5.4.3.3.3. Wastewater Treatment

5.4.3.3.4. Mining

5.4.3.3.5. Others

6. Europe Hydrogen Peroxide Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.2. Europe Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.3. Europe Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4. Europe Hydrogen Peroxide Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.1.2. United Kingdom Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.1.3. United Kingdom Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4.2. France

6.4.2.1. France Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.2.2. France Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.2.3. France Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.3.2. Germany Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.3.3. Germany Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.4.2. Italy Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.4.3. Italy Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.5.2. Spain Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.5.3. Spain Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.6.2. Sweden Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.6.3. Sweden Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.7.2. Russia Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.7.3. Russia Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

6.4.8.2. Rest of Europe Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

6.4.8.3. Rest of Europe Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7. Asia Pacific Hydrogen Peroxide Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.2. Asia Pacific Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.3. Asia Pacific Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4. Asia Pacific Hydrogen Peroxide Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.1.2. China Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.1.3. China Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.2.2. S Korea Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.2.3. S Korea Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.3.2. Japan Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.3.3. Japan Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.4. India

7.4.4.1. India Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.4.2. India Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.4.3. India Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.5.2. Australia Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.5.3. Australia Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.6.2. Indonesia Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.6.3. Indonesia Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.7.2. Malaysia Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.7.3. Malaysia Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.8.2. Philippines Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.8.3. Philippines Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.9.2. Thailand Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.9.3. Thailand Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.10.2. Vietnam Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.10.3. Vietnam Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

7.4.11.2. Rest of Asia Pacific Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

7.4.11.3. Rest of Asia Pacific Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

8. Middle East and Africa Hydrogen Peroxide Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

8.2. Middle East and Africa Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

8.3. Middle East and Africa Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

8.4. Middle East and Africa Hydrogen Peroxide Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

8.4.1.2. South Africa Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

8.4.1.3. South Africa Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

8.4.2.2. GCC Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

8.4.2.3. GCC Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

8.4.3.2. Egypt Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

8.4.3.3. Egypt Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

8.4.4.2. Nigeria Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

8.4.4.3. Nigeria Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

8.4.5.2. Rest of ME&A Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

8.4.5.3. Rest of ME&A Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

9. South America Hydrogen Peroxide Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032

9.1. South America Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

9.2. South America Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

9.3. South America Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

9.4. South America Hydrogen Peroxide Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

9.4.1.2. Brazil Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

9.4.1.3. Brazil Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

9.4.2.2. Argentina Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

9.4.2.3. Argentina Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

9.4.3.2. Colombia Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

9.4.3.3. Colombia Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

9.4.4.2. Chile Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

9.4.4.3. Chile Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Hydrogen Peroxide Market Size and Forecast, By Application (2024-2032)

9.4.5.2. Rest Of South America Hydrogen Peroxide Market Size and Forecast, By Grade (2024-2032)

9.4.5.3. Rest Of South America Hydrogen Peroxide Market Size and Forecast, By End-User (2024-2032)

10. Company Profile: Key Players

10.1. Solvay SA (Belgium) - US operations

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Strategic Analysis

10.1.4. Recent Developments

10.2. Evonik Industries AG (Germany)

10.3. Arkema Group (France)

10.4. Ecolab Inc. (USA)

10.5. Auro Hydrogen Peroxide (Canada)

10.6. Solvay SA (Belgium)

10.7. Evonik Industries AG (Germany)

10.8. BASF SE (Germany)

10.9. Arkema Group (France)

10.10. PeroxyChem (UK) - now part of Evonik

10.11. Perstorp Holding AB (Sweden)

10.12. Sinopec Shanghai Petrochemical (China)

10.13. Luxi Chemical Group (China)

10.14. Mitsubishi Gas Chemical Company (Japan)

10.15. Nouryon (Netherlands) - Japan operations

10.16. OCI Company Ltd. (South Korea)

10.17. National Peroxide Limited (India)

10.18. Gujarat Alkalies & Chemicals Ltd. (India)

10.19. Aditya Birla Chemicals (Thailand)

10.20. Arkema Asia Pacific (Singapore)

10.21. SABIC (Saudi Arabia)

10.22. Afrox Limited (South Africa)

10.23. Emirates Peroxide Company (UAE)

10.24. Solvay Brazil (Brazil)

10.25. Arkema Argentina (Argentina)

10.26. Quimica Meroquim (Chile)

10.27. Industrias Químicas Oxígeno (Colombia)

11. Key Findings

12. Industry Recommendations

13. Hydrogen Peroxide Market: Research Methodology